Designed by drivers, built by tax pros. The Per Diem Plus FLEETS mobile app automates an IRS-compliant, accountable record of trucker per diem for OTR drivers.

What do you need to do to enroll in the per diem plan for Bluegrass?

That's it!

Per Diem Plus Fleets app requires your location to determine if you qualify for per diem. Learn how to adjust privacy settings in 4 easy steps HERE

Or scan the code with your smartphone camera

Select the SET AUTO-TRIP to start a trip.

The app will auto-activate 10 air miles from your tax home.

Drive through (transit) your tax home halo?

REFRESHING TRIP DATA

Cellular connectivity and network traffic volumes occasionally prevent the app from automatically updating per diem data. Select the Help menu then "Syncronize Data with Server" to refresh current trip.

Never-Lost Feature: Record per diem, expenses and receipts are stored on the secure PDP cloud and instantly accessible on your device for 4 years.

Select the TRIP tab to view:

Select TRIP SUMMARY to view recorded per diem and expenses for your current truck driving trip.

Select the EXPENSES tab to:

Select the REPORT tab to:

As of January 1, 2018, employee drivers are no longer allowed to claim unreimbursed employee business expenses, like meals per diem, as a tax deduction on their federal income tax return. M&D Transportation is introducing a company-paid per diem plan for employee driver's in response to this tax law change.

Is participation in the per diem plan optional?

Yes.

What does it cost to participate in the per diem plan?

Per Diem Plus FLEETS is provided at no cost to the driver.

Which drivers receive per diem?

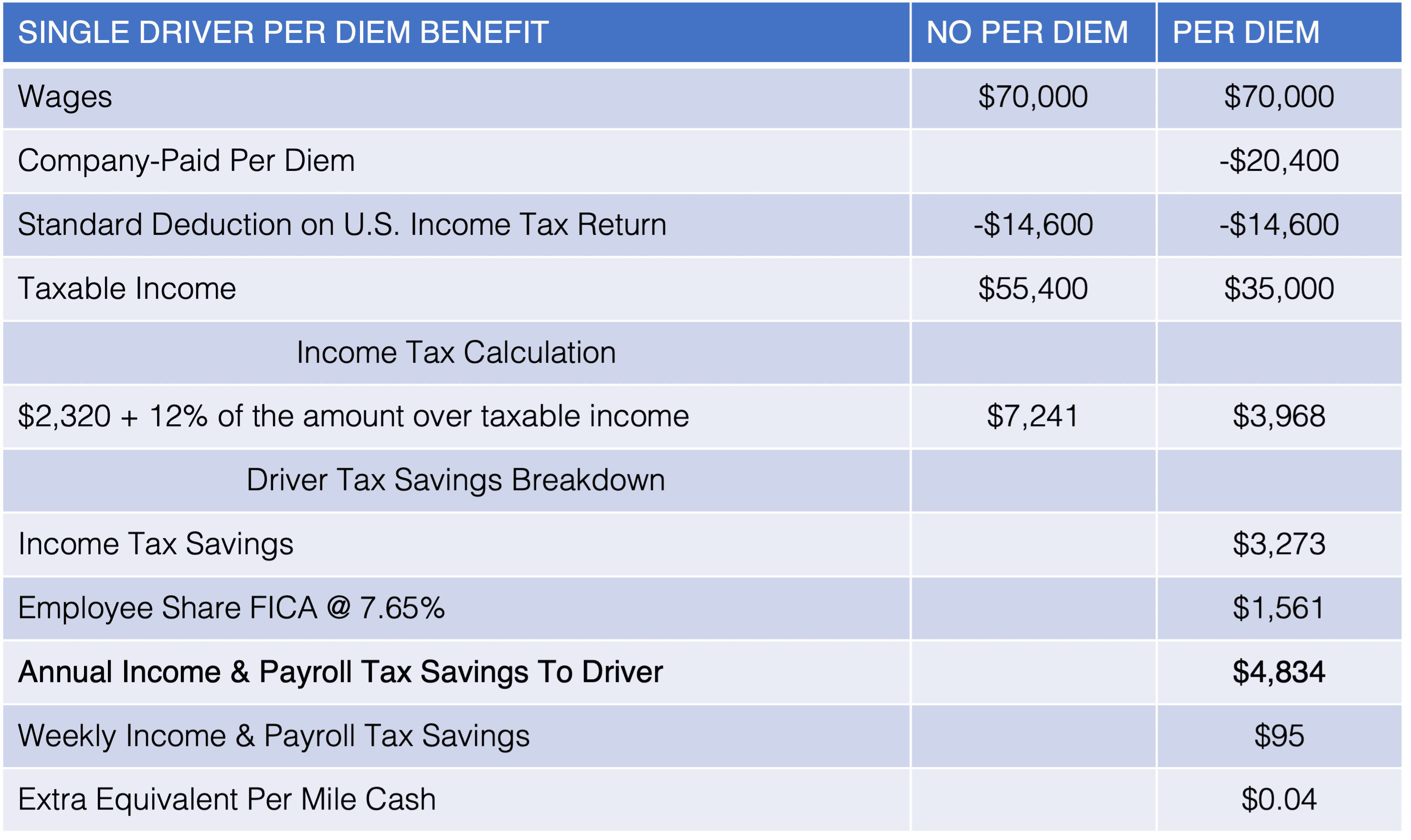

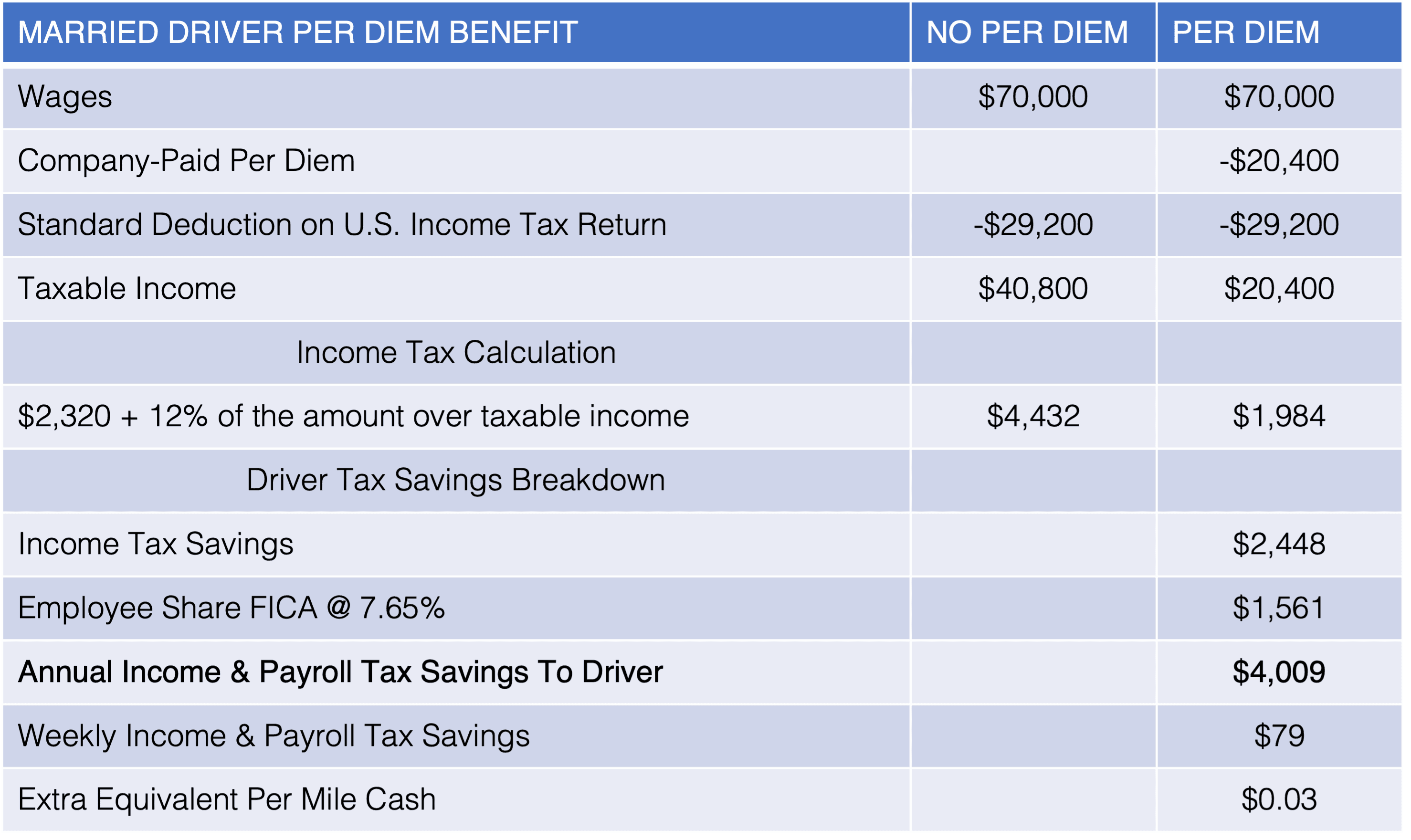

What are the typical tax savings to a driver receiving per diem?

The average long-haul driver will typically receive around $19,000 in nontaxable per diem under the Patriot Transport plan.

What is per diem?

A per day travel expense allowance paid to an employee as an expense reimbursement under an accountable per diem plan.

Is company-paid per diem taxable to an employee driver?

No. It is considered a non-taxable reimbursement that is excluded from taxable wages.

Who do I contact if the app did not record per diem correctly for my current truck driving trip?

How do I login to the app?

How do I track a truck driving trip?

How much per diem will I receive?

Does a driver have to spend all the per diem?

No.

How do I view my per diem in the app?

How often should I check my per diem?

I forgot my password, how do I reset it?

I changed trucks, how do I login to the new truck's device?

*This only applies to devices that are tethered to a vehicle*

Do both team drivers have to login to the app when sharing a device?

No. Only one team driver needs to login to the app when using a shared device. Per diem will be automatically associated with the Co Driver's ID.

How do you change Co-Drivers when using a shared device with Per Diem Plus FLEETS?

Questions? Contact us at Support@Perdiemplus.com or (314) 488-1919