PDP For Fleets - 3 Months Free

In this article we attempt to clear up the confusion on company-paid per diem caused by the recently passed Tax Reform and Jobs Act.

Under the 2017 Tax Reform and Jobs Act[i]:

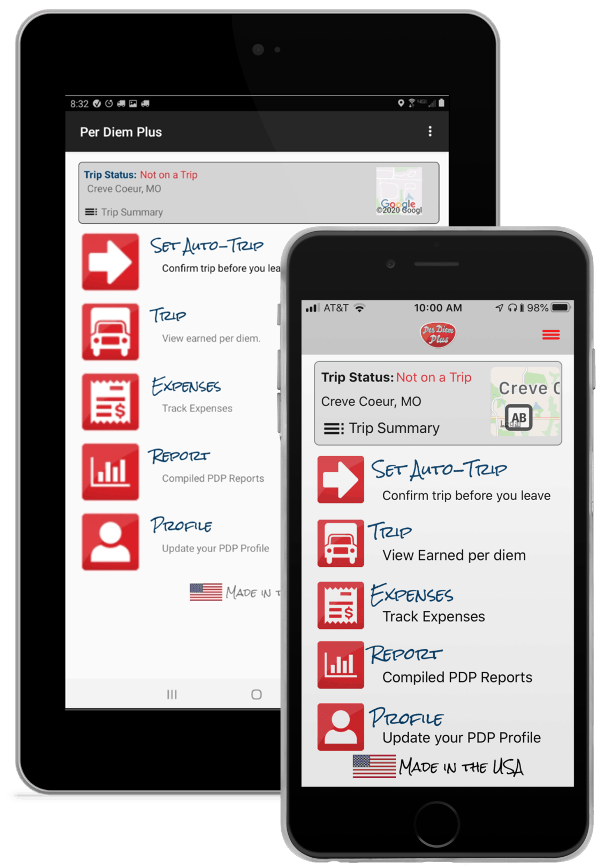

The good news is that motor carriers can implement an IRS-compliant accountable per diem program using the Per Diem Plus® FLEETS mobile application platform to offset the lost tax deductions for their drivers, while enhancing recruiting and retention[ii].

“Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

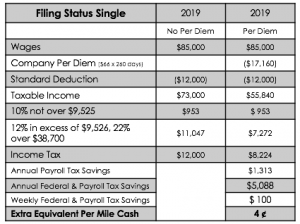

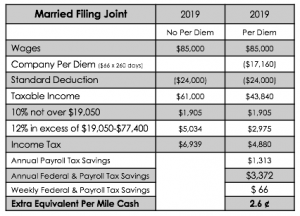

Yes. A motor carrier implementing a company-paid per diem plan can raise effective driver pay by 2.6¢ - 4¢ CPM. All per diem paid to a driver is treated as a non-taxable reimbursement and not reported on Form W-2.

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and miscellaneous expenses.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[3] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[i] All amounts paid under the arrangement are treated as paid under an accountable plan and are excluded from income and wages.

[ii] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and other job-related expenses.

The following article is summary of the impact of the 2017 Tax Cuts and Job Act (TCJA) on truckers The following is a list of common trucker tax deductions that were changed by the TCJA (except where noted).

The TCJA eliminated itemized deductions for employee drivers, which includes all unreimbursed employee business expenses. The following is a non-exhaustive list:

This provision does not apply to Owner Operators who claim travel-related and business expenses on Schedule C or Form 1120S.

IRC Section 199A generally provides a deduction of 20% of qualified business income (QBI) derived from a sole proprietorship, partnerships, or S corporation that is a qualified trade or business. The §199A deduction is taken from adjusted gross income (AGI) in determining taxable income and therefore does not reduce self-employment income. See my article titled "Understanding the 20% Passthrough Deduction" for a detailed discussion of the complicated deduction.

The §199A deduction is complicated and will require significant guidance from the IRS.

The deduction for alimony and separate maintenance payments by the payor is repealed. The payee (recipient) will not be required to include such payments in gross income for divorce or separation instruments executed after December 31, 2018.[i]

Medical expenses continue to be deductible to the extent they exceed 7.5% of adjusted gross income (AGI) for 2017 and 2018. For years after 2018 the threshold is 10% of AGI.

The moving expense deduction is repealed except for members of the Armed Forces. The exclusion from gross income and FICA wages for employer reimbursed moving expenses is repealed other than members of the Armed Forces.

This provision does not apply to Owner Operators who claim expenses related to moving a business operation on Schedule C or Form 1120S.

A taxpayer may claim an itemized deduction of up to $10,000 ($5,000 for married filing separately) for the aggregate of (1) state and local property taxes not paid or accrued in carrying on a trade or business (See IRC Sec. 212), and (2) state and local income taxes (or sales taxes in lieu of income taxes) paid or accrued in the tax year[ii].

This provision does not apply to Owner Operators who claim business-related taxes on Schedule C or Form 1120S.

The deduction for interest on home equity indebtedness is disallowed and applies to existing home equity loans. Home equity loans used for business or substantial improvement of a residence may still be deductible[iii]; any used for personal or investment purposes are not[iv].

The base for cash contributions is increased from 50% to 60%. No deduction is allowed for payments to colleges and universities in exchange for rights to purchase athletic seats.

All gambling expenses are now subject to the gambling winnings limitation and not just wagers. Schedule A filers can still deduct gambling losses to the extent of winnings but must have total itemized deductions exceeding the increased standard deductions.

The individual tax for failure to maintain minimum essential coverage is reduced to zero with respect to health coverage status for months beginning after December 31, 2018.

The standard deduction is increased to $24,000 for married filing jointly, $18,000 for head of household, and $12,000 for unmarried (single). The pre-2018 additional $1,250 standard deduction for taxpayers over age 65 or who are blind are retained.

Personal exemptions and dependency deductions are repealed. The IRS is examining how the definition of qualifying relative should be addressed.

Section 6695(g) of the internal Revenue Code requires paid return preparers to satisfy due diligence requirements to ensure clients qualify for the American opportunity credit, lifetime learning credit, earned income credit, and child tax credit.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] Notice 2018-37, 2018-18, I.R.B. 521

[ii] IRC § 164(b)(6) (flush language)

[iii] Temp. Reg. § 1.163-8T

[iv] Refer to Publication 936 (2017) Home Mortgage Interest Deduction for definitions of “substantial improvement”

First, and foremost, you want to make sure you have all expense receipts and documentation needed for any expenses you will be deducting on your tax return for 2016, especially major expense items like per diem and fuel. For your per diem expenses, be sure you have all 12 months of paper or electronic logs to substantiate time, date and place of the expense. Or, if you use Per Diem Plus®, all you need to do is run a report and send it to your accountant directly from the app. Unfortunately, per IRS Regulations, a calendar is not sufficient substantiation for per diem expenses.

If you are self-employed and have the ability to control when you invoice for end-of-year work, then delay invoicing for an end-of-year run until January, which will push the income into next year. This only makes sense if you expect to be in the same, or lower, tax bracket next year as this year.

If there are repairs that need to be made to your truck or supplies you need to purchase, etc. then make and pay for those purchases by year-end versus waiting until next year. Payment can be made using a credit card and still qualify for deduction in the current year even if you do not pay the credit card bill until next year.

Do you itemize your deductions rather than take the standard deduction? If so, then make some extra charitable contributions, cash or non-cash by the end of the year. However, be sure to obtain receipts for all charitable contributions regardless of the amount.

If you are on the borderline of being able to itemize, then aggregate deductions into one year or the other. This takes a little more planning. Examples include, paying an extra mortgage payment in one year to pay extra interest; paying two years of real estate taxes in one year, if you have control over the timing of payment (pay one on January 2nd to minimize interest and penalties and the other at the end of the year); and bunching charitable contributions into one year. Although the chance is slim, you do need to be cognizant of the Alternative Minimum Tax and whether this strategy could trigger it. You would want to discuss this with your tax professional before engaging in this strategy.

If you are self-employed, contributing to a retirement plan is a great way not only to save for retirement but to save taxes as well. There are several different plans to choose from. However, depending on which one you choose, governs when it needs to be set up. A SIMPLE plan would need to be set by October 31st of the first year of contributions; others need to be set up by December 31st. A SEP plan can be set up all the way up to the due date of the tax return, including extensions. Therefore, if you want to make a contribution but do not have the money by April 15th, you can extend your return in order to buy more time to make the contribution. Just remember, an extension to file the return is not an extension of time to pay the tax, just the SEP contribution.

IRA contributions must be made by April 15th even if you have filed for an extension. Generally, you can make a larger contribution to a plan other than an IRA, unless you plan to use the spousal IRA rules in order to double your contribution. This is another area where consulting with your tax professional may be beneficial to determine the best course of action.

Want to join the conversation? Drop us a line at info@perdiemplus.com

This article was written by Donna R. Sullivan, CPA of Per Diem Plus, LLC. Sullivan has over 25 years of tax consulting and preparation experience.

Please remember that everyone’s tax and financial situations are different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. Per Diem Plus® proprietary software is the trademark of Per Diem Plus, LLC.