Drivers have spoken! Based on user feedback Per Diem Plus introduces Small Fleets, which enables solo & team drivers to customize settings and automate features within the Per Diem Plus mobile app.

Step 1: Complete the Small Fleets registration HERE

What do you need to do to complete enrollment in Small Fleets?

That's it!

Per Diem Plus Fleets app requires your location to determine if you qualify for per diem. Learn how to adjust privacy settings in 4 easy steps HERE

Or scan the code with your smartphone camera

Select the SET AUTO-TRIP to start a trip.

The app will auto-activate 10 air miles from your tax home.

Drive through (transit) your tax home halo?

REFRESHING TRIP DATA

Cellular connectivity and network traffic volumes occasionally prevent the app from automatically updating per diem data. Select the Help menu then "Syncronize Data with Server" to refresh current trip.

Never-Lost Feature: Record per diem, expenses and receipts are stored on the secure PDP cloud and instantly accessible on your device for 4 years.

Select the TRIP tab to view:

Select TRIP SUMMARY to view recorded per diem and expenses for your current truck driving trip.

Select the EXPENSES tab to:

Select the REPORT tab to:

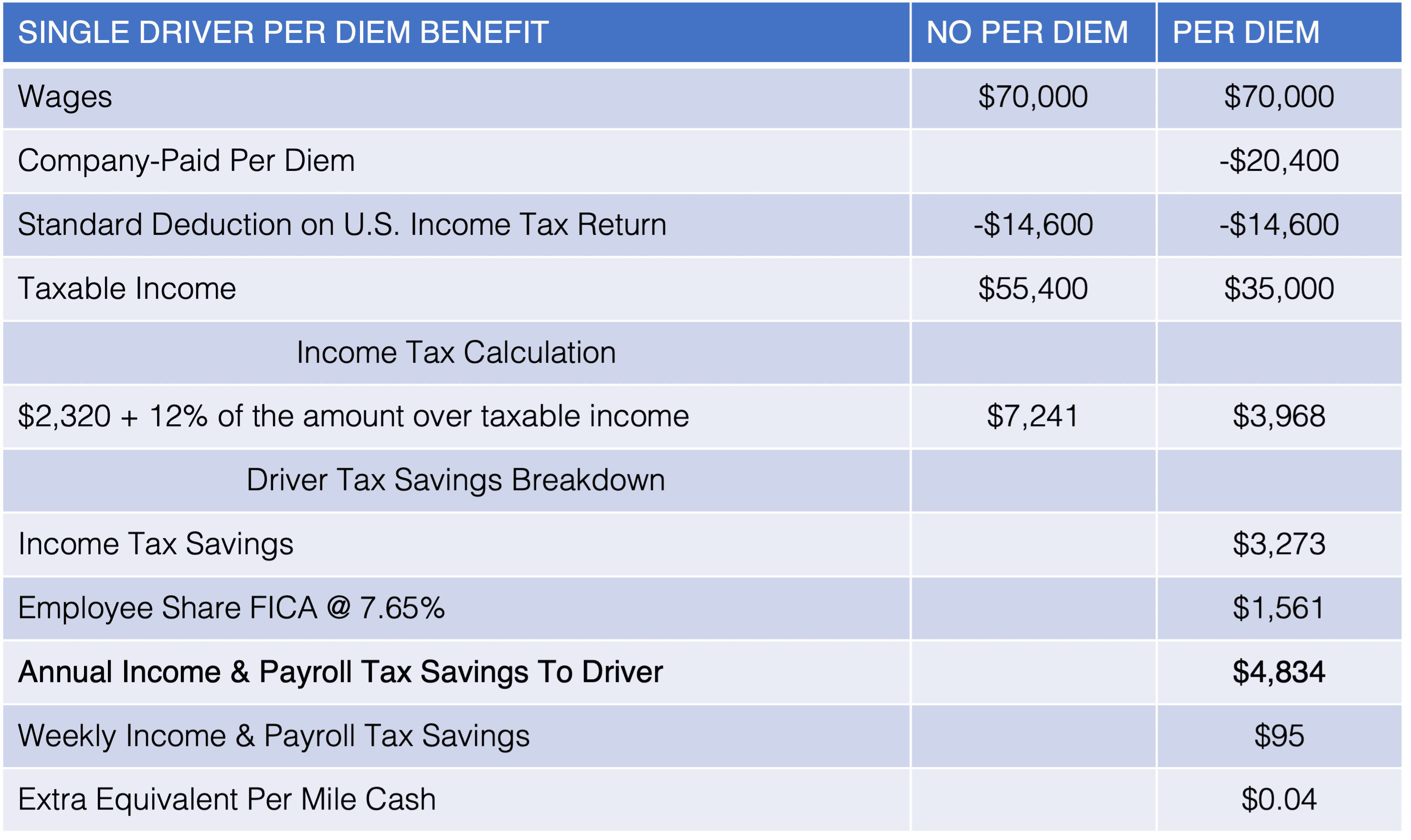

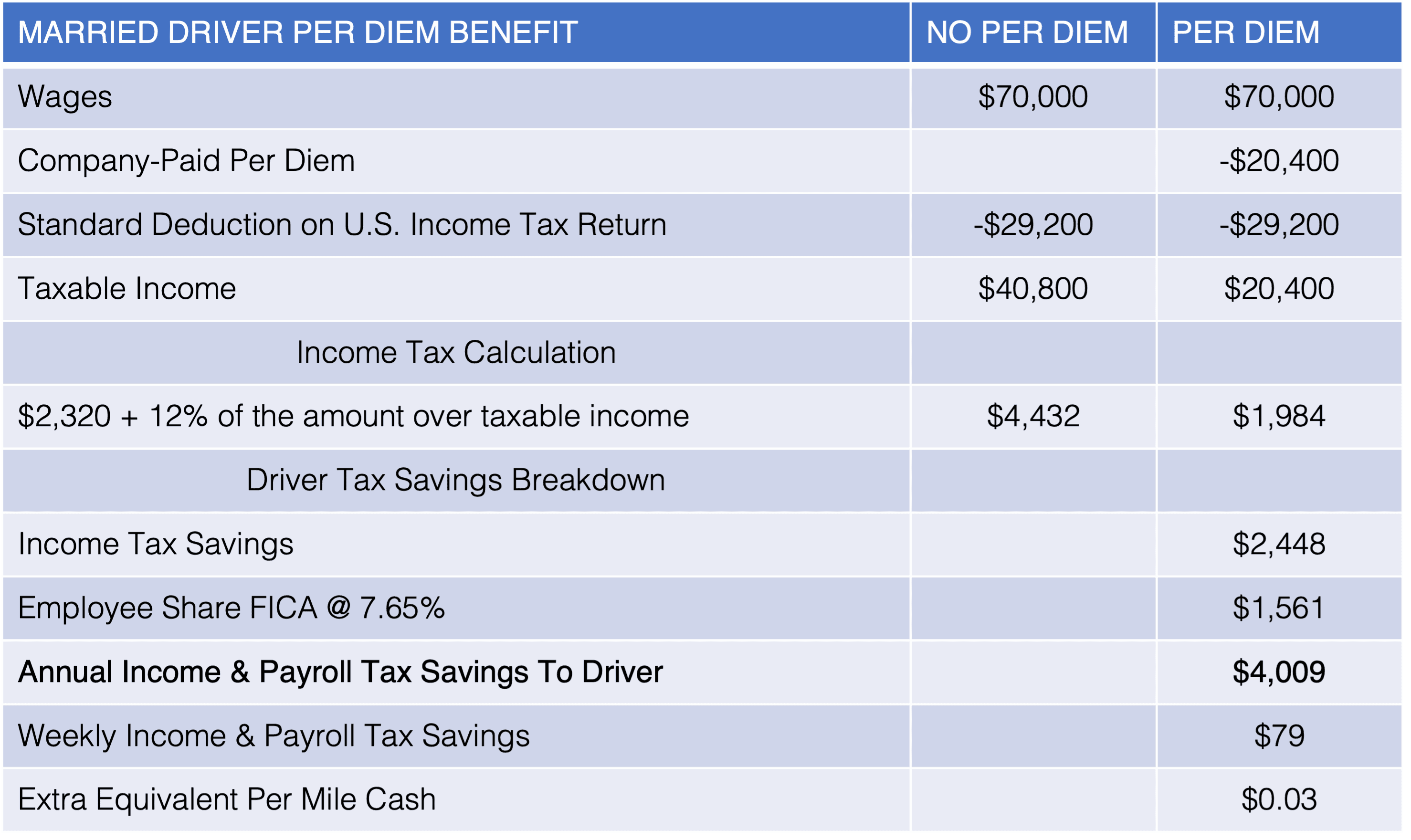

As of January 1, 2018, employee drivers are no longer allowed to claim unreimbursed employee business expenses, like meals per diem, as a tax deduction on their federal income tax return. Per Diem Plus is introducing an accountable, company-paid per diem plan for fleet client’s in response to this tax law change.

Which drivers receive per diem?

What is per diem?

A per day travel expense allowance paid to an employee as an expense reimbursement under an accountable per diem plan.

Is company-paid per diem taxable to a self-employed or employee driver?

No. It is considered a non-taxable reimbursement that is deducted from taxable wages.

How will per diem affect an employee driver's Social Security?

The per diem pay plan will reduce social security benefits. However, you still come out ahead because you could save thousands in taxes each year under the per diem program and only lose out on $4 to $11 per month in social security benefits. Speak with a tax advisor for more information about your situation.

How do I login to the app?

How do I track a truck driving trip?

How much per diem will I receive?

Does a driver have to spend all the per diem?

No.

How do I view my per diem in the app?

How often should I check my per diem?

I forgot my password, how do I reset it?

I changed devices, how do I login to the new device?

Do both team drivers have to login to the app when sharing a device?

No. Only one team driver needs to login to the app when using a shared device. Per diem will be automatically associated with the Co Driver's ID.

How do you change Co-Drivers when using a shared device with Per Diem Plus FLEETS?

Alert for AOL and Yahoo users: We recommend you create a free Gmail account due to older email providers, like AOL and Yahoo, blocking emails that include links or attachments.

Questions? Contact us at Support@Perdiemplus.com or (314) 488-1919