The IRS has released the tax brackets and special trucker per diem rates for 2022

Trucker Per Diem Rates

The 2022 trucker per diem rates and tax brackets have been released. For taxpayers in the transportation industry the per diem rate increased to $69 for for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

IRS Orders Immediate Stop To New Employee Retention Claims (September 14, 2023)

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

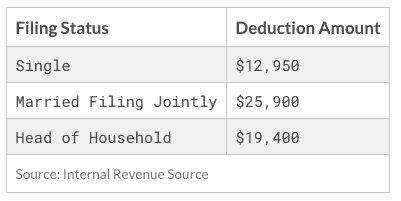

Standard Deduction & Personal Exemption

The standard deduction for single filers will increase to $12,950, $25,900 for married filing jointly, and $19,400 for head of household.

The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA)

Introducing Per Diem Plus Small Fleets, an affordable, customizable per diem solution for solo and team operators

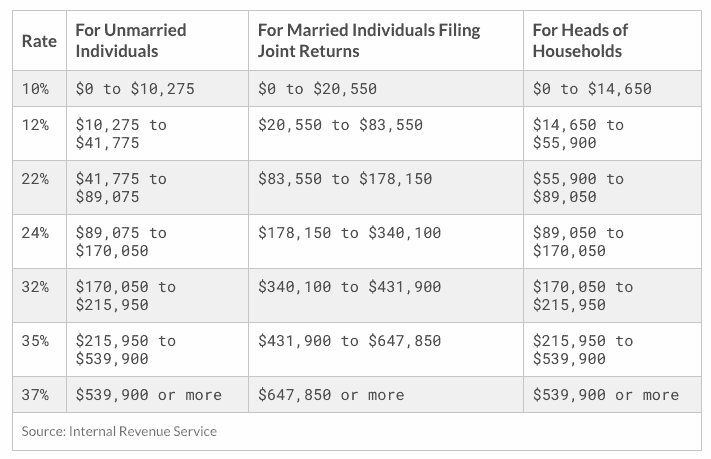

2022 Tax Brackets

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $539,900 and higher for single filers and $647,850 and higher for married couples filing jointly.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

- Open Settings>Privacy>Verify Location Services are ON

- Select Location Services>Per Diem Plus / Per Diem Plus Fleets

- Set to "Always Allow"

Android

- Open Settings>Privacy>Permission Manager

- Select Location>Per Diem Plus / Per Diem Plus Fleets

- Set to "Allow all the time"

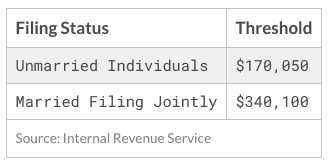

Qualified Business Income Deduction (Sec. 199A)

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses up to $170,050 and $340,100 for joint filers.

Child Tax Credit

The maximum Child Tax Credit is $2,000 per qualifying child and is not adjusted for inflation. The refundable portion of the Child Tax Credit is adjusted for inflation and will increase from $1,400 to $1,500 for 2022.

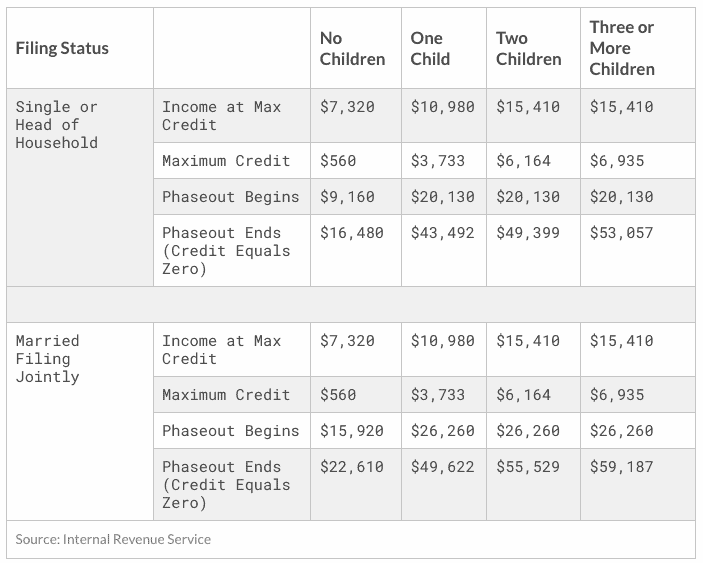

Earned Income Tax Credit

The maximum Earned Income Tax Credit (EITC) in 2022 for single and joint filers is $560 if the filer has no children (Table 5). The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children.

Drivers, try Per Diem Plus or Small Fleets absolutely free for 30 days!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

About Per Diem Plus

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Source: "2022 Tax Brackets", Erica York, Tax Foundation (11/10/21)