2023 trucker per diem rates released by IRS

2023 trucker per diem rates and tax brackets were released by the IRS in an annual bulletin, Notice 2022-44, on September 26, 2022. For taxpayers in the transportation industry the per diem rate remains unchanged form 2022 to $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section Notice 2022-44

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

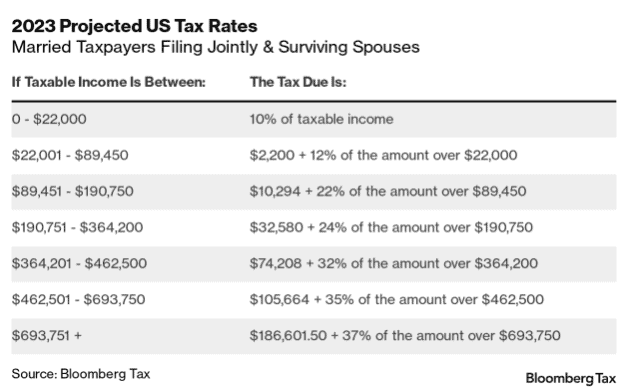

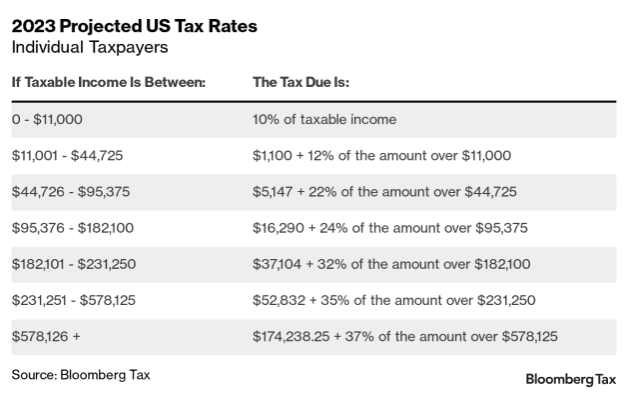

2023 Tax Brackets Announced

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

- Open Settings>Privacy>Verify Location Services are ON

- Select Location Services>Per Diem Plus / Per Diem Plus Fleets

- Set to "Always Allow"

Android

- Open Settings>Privacy>Permission Manager

- Select Location>Per Diem Plus / Per Diem Plus Fleets

- Set to "Allow all the time

Drivers, try Per Diem Plus or Small Fleets absolutely free for 30 days!

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

About Per Diem Plus

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®