PDP For Fleets - 3 Months Free

Bonnie is an Amazing Race superfan recently selected to participate in the upcoming season of the reality TV show. Contestants are required to have a valid U.S. passport and submit their passports to obtain visas for the countries that may be visited during filming. Our fictitious character, Bonnie, subsequently received IRS Notice CP508C informing her that the State Department had revoked her passport.

Bonnie's devastation is courtesy of the IRS and State Department implementing in January 2018 provisions of the 2015 Fixing America's Surface Transportation (FAST) Act to deny issuance or renewal of a passport to taxpayer’s owing more than $50,000 in delinquent taxes (adjusted for inflation). The law also allowed the State Department to revoke or limit a passport previously issued to a delinquent taxpayer living overseas allowing only for direct return to the United States.

"IRS collects $1.2 billion in less than two years from taxpayers with the passport revocation program who the IRS certified to the State Department as being seriously delinquent in their tax debt."

Internal Revenue Service

Note: The IRS will not reverse the passport certification just because you pay the debt below the threshold

The IRS certifies seriously delinquent tax debt to the State Department. Seriously delinquent tax debt is an individual's unpaid, legally enforceable federal tax debt (including interest and penalties) totaling more than $55,000 (adjusted yearly for inflation) for which a:

Some tax debt is not included in seriously delinquent tax debt such as:

In addition, the IRS will not certify anyone as owing a seriously delinquent tax debt:

No. The IRS will postpone certification only while an individual is serving in a designated combat zone or participating in a contingency operation.

The IRS may ask the State Department to exercise its authority to revoke your passport. For example, the IRS may recommend revocation if the IRS had reversed your certification because of your promise to pay, and you failed to pay. The IRS may also ask the State Department to revoke your passport if you could use offshore activities or interests to resolve your debt but choose not to.

Before the IRS sends a revocation referral to the State Department, the IRS will send you Letter 6152 asking you to call the IRS within 30 days to resolve your account to prevent this action.

The IRS will send a taxpayer Notice CP508R at the time it reverses certification. The IRS will reverse a certification when:

The IRS will make this reversal within 30 days and provide notification to the State Department as soon as practicable.

The IRS will not reverse certification if your request for a collection due process hearing or innocent spouse relief is on a debt that's not certified. Also, the IRS will not reverse the certification because you pay the debt below the threshold.

The State Department will notify you in writing, if the State Department denies your U.S. passport application or revokes your U.S. passport.

If you need your U.S. passport to keep your job, once the IRS certifies your seriously delinquent tax debt to the State Department, you must fully pay the balance or make an alternative payment arrangement to have your certification reversed.

Do not wait to resolve outstanding IRS issues! The FAST Act will wreak havoc on taxpayers owing the IRS at least $55,000 that need to apply for or renew their U.S. passport to keep their jobs or have imminent foreign travel planned.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He leads the Tax Controversy practice at Price Kong, CPAs & Consultants and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023-2025 Price Long, CPAs & Consultants, PC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] IRS Rev. Proc. 2011-47 (most recently superseded by 2017-42) & IRC 162(a)(2); Reg 1.162-2) A tax deduction is allowed for ordinary and necessary traveling expenses incurred by a taxpayer while away from home in the conduct of a trade or business. A truck driver is not away from home unless his or her duties require the individual to be away from the general area of his or her tax home for a period substantially longer than an ordinary workday and it is reasonable to need rest or sleep.

[ii] Rev. Ruling 75-432

[iii] HATEM ELSAYED, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. 8935-07S. Filed May 26, 2009

Are you a "Tax Turtle" if you live in your truck and still claim travel-related expenses like per diem?

There are frequent posts on trucker social media forums and even in trucking publications that suggest merely having a post office box will be sufficient to meet the IRS’ regulations for claiming travel-related expenses. However, if you are an over-the-road truck driver who lives in the truck when you are "home" you may be a classified a "tax turtle".

Sole-proprietorship trade or business expense deductions are the most litigated issue before the US Tax Court.

Taxpayer Advocate Service, "Most Litigated IRS Issues 2022"

Whether John had a tax home and whether his mother’s house was indeed his permanent residence were factual questions:

John was a “tax turtle” who was not entitled to claim per diem and travel-related expenses.As this case demonstrates the PO Box gambit will not survive scrutiny in a tax audit. For a self-employed truck who lives in their truck to claim travel-related expenses, like per diem, some amount of expenses must be incurred at your declared tax home. It would also be wise to spend some time there lest you risk being classified a “tax turtle”.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He leads the Tax Controversy practice at Price Kong, CPAs & Consultants and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023-2025 Price Kong, CPAs & Consultants, PC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] IRS Rev. Proc. 2011-47 (most recently superseded by 2017-42) & IRC 162(a)(2); Reg 1.162-2) A tax deduction is allowed for ordinary and necessary traveling expenses incurred by a taxpayer while away from home in the conduct of a trade or business. A truck driver is not away from home unless his or her duties require the individual to be away from the general area of his or her tax home for a period substantially longer than an ordinary workday and it is reasonable to need rest or sleep.

[ii] Rev. Ruling 75-432

[iii] HATEM ELSAYED, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. 8935-07S. Filed May 26, 2009

Trucker Per Diem & the 10% Ownership-Related Party Rule. Can an Owner-Operator claim trucker per diem under the related party rule if they own more than 10% of the company? Yes.

The 10% ownership - related party rule and per diem creates much confusion and is frequently misunderstood by both drivers and tax practitioners alike. Under the related party rule an Owner-Operator can claim substantiated meals & incidental expenses-only per diem even if they own 10% or more of the trucking company. Based on the foregoing the related party rule does not apply to the trucking industry.

Section 4.04 applies to:

Section 6.07 applies to:

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He leads the Tax Controversy practice at Price Kong, CPAs & Consultants and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023-2025 Price Kong, CPAs & Consultants, PC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

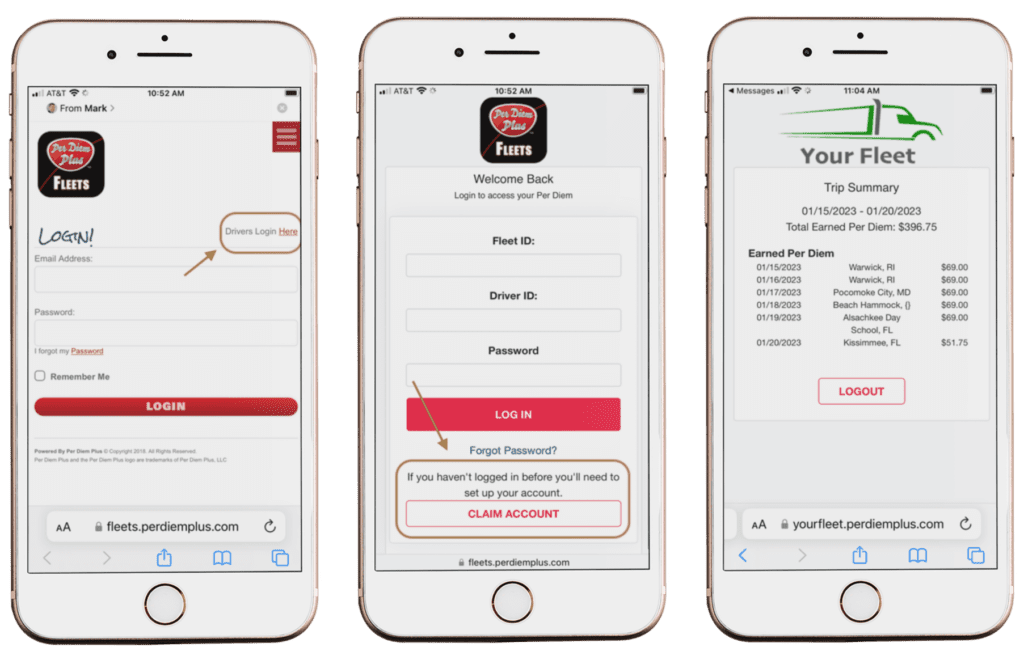

Per Diem Plus Releases Samsara Driver App. The leader in mobile-enabled transportation per diem solutions today announced the release of the Samsara Driver App. The web-based portal enables drivers to view per diem on their personal mobile device. This feature was developed in response to feedback from fleet managers to enhance per diem data visibility for drivers using Per Diem Plus Fleets API for Samsara, the pioneer of the Connected Operations Cloud. Per Diem Plus Fleets is available to all fleets on the Samsara App Marketplace.

Initial driver login steps:

You only must register once

The Trip Summary list earned per diem for the current payroll period and includes the date, place and amount of per diem.

The Per Diem Plus Fleets API adapter was developed in response to growing industry demand to build integrations and PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA. It is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

What is the IRS definition of a service dog? The IRS does not offer a definition of a service dog, but guidance can be gleaned from the Americans With Disability Act (ADA). Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability.

The dog must be trained to take a specific action when needed to assist the person with a disability. For example, a person with diabetes may have a dog that is trained to alert him when his blood sugar reaches high or low levels. A person with depression may have a dog that is trained to remind her to take her medication. Or, a person who has epilepsy may have a dog that is trained to detect the onset of a seizure and then help the person remain safe during the seizure.

No. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

Flying with a service dog? Here's everything you need to know (Becca Blond, The Points Guy, 9/12/23)

It depends. The ADA makes a distinction between psychiatric service animals and emotional support animals. If the dog has been trained to sense that an anxiety attack is about to happen and take a specific action to help avoid the attack or lessen its impact, that would qualify as a service animal. However, if the dog's mere presence provides comfort, that would not be considered a service animal under the ADA.

No. People with disabilities have the right to train the dog themselves and are not required to use a professional service dog training program.

Yes. The ADA does not restrict the type of dog breeds that can be service animals.

I found dozens of websites pitching “Service Animal” registration services while researching this article. All had variations on what disabilities qualified for the tax-deductible classification. My purpose is to analyze the tax implications and not to evaluate the merits of the service animal designation. Therefore, the below discussion (where applicable) uses definitions under the Americans With Disabilities Act (ADA).

Service Dog: Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability.

Emotional Support Dog: Emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. The types of emotional conditions that may require the assistance of an ESD are:

Guard Dog: There is scant guidance on the deductibility of guard dogs, however, it is clear they do not meet the statutory requirement to qualify under Internal Revenue Code 213.

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He leads the Tax Controversy practice at Price Kong, CPAs & Consultants and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023-2025 Price Kong, CPAs & Consultants, PC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i]https://esadoctors.com/esa-letter-service-dog-certification/

Can A Truck Driver Have Two Tax Homes? A driver claims Nevada as his residence, but his wife resides in Oregon.

"If a driver has two different home addresses, can he claim per diem while off duty at either location?"

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

IMark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He leads the Tax Controversy practice at Price Kong, CPAs & Consultants and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Thirty-eight states have noteworthy tax law changes taking effect on January 1, 2023. The good news is that most of the changes are lowering income tax bills for taxpayers. However, the end of temporary gas tax holidays and introduction of new excise and sales taxes will offset the income tax savings for residents in many states.

Use the Tax Foundation's interactive state-by-state analysis to explore the tax changes in your state.

Have a tax question? Contact Mark W. Sullivan, EA or request a free consultation HERE

Available as a $7.99 monthly subscription on Google Play and App Store

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

"Can I use my dog as a tax deduction" is a common questioned posed to tax professionals by long-haul truckers. Every pet owner claims their animal is a member of the family and they are an essential companion for thousands of truckers. The emergence of the "Emotional Support" registration industry reinforces this fact.

It understandable that taxpayers may want to recoup some of their pet expenses with a creative medical expense tax deduction[i]. To counter the urge to claim Fido as a tax deduction the IRS has promulgated guidance on what type of animals qualify.

A review of IRC § 213 is required to answer the question, "Can I use my dog as a tax deduction?". The costs of buying, training, and maintaining a service animal to assist an individual with mental disabilities may qualify as medical care if the taxpayer can establish that the taxpayer is using the service animal primarily for medical care to alleviate a mental defect or illness and that the taxpayer would not have paid the expenses but for the disease or illness.

IRS Chief Counsel Note: A taxpayer who claims that an expense of a peculiarly personal nature is primarily for medical care must establish that fact. The courts have looked toward objective factors to determine whether an otherwise personal expense is for medical care:

A personal expense is not deductible as medical care if the taxpayer would have paid the expense even in the absence of a medical condition. Commissioner v. Jacobs, 62 T.C. 813 (1974). [ii]

You can include in medical expenses:

In general, this includes any costs, such as food, grooming, and veterinary care, incurred in maintaining the health and vitality of the service animal so that it may perform its duties.

2024 Trucker Per Diem Rates Published (September 25, 2023)

Flying With A Service Dog? Here's Everything You Need To Know (Becca Bond, The Points Guy, 9/12/23)

What Is The IRS Definition Of A Service Dog?

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Generally, you can deduct on Schedule A, Itemized Deductions (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). However, with tax reform drastically increasing the Standard Deduction (2022: $12,950 Single, $25,900 Married) most taxpayers will not have sufficient itemized deductions to warrant pursuing a tax break for their pet expenses.

No, emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

"Prior to January 2021, the law allowed emotional support animals to fly with documentation from a medical doctor verifying the animal was necessary for comforting the passenger. ESAs did not have to be trained. But after rampant abuse of the system that included people taking everything from peacocks to snakes to untrained and aggressive dogs on flights, the DOT revised its regulations to allow airlines to ban ESAs from the skies. Although the ultimate decision was left up to the airlines themselves, all major U.S. and Canadian carriers quickly changed their policies to stop non-ESA pets from flying. You can still fly with a small dog (under 25 pounds), but the pup must be in a carrier and you will need to pay the airline pet fee to fly."

Becca Bond, The Points Guy (9/12/23)

Can I use my dog as a tax deduction if it guards my truck? The absence of specific guidance on guard dogs from IRS compels a taxpayer to evaluate the appropriateness of claiming a tax deduction for expenses related to a guard dog used to protect a truck that is constantly on the move as opposed to a drop-yard or terminal. Kay Bell writing for Bankrate.com provided a great analysis,

“That “Beware of dog” sign in your business’s window is no idle threat. Break-ins have stopped since you set up a place for your Rottweiler to stay overnight. In this case, the IRS would likely be amenable to business deduction claims of the animal’s work-related expenses.

Standard business deduction rules still apply, notably that the cost of keeping an animal on work premises is ordinary and necessary in your line of business. Once you show that, the dollars spent each year keeping your pooch in good guard condition — food, vet bills and training — would be deductible as a business expense.

As with all deductions, be prepared to provide full and accurate records of your animal’s hours on the job. You’ll also find your tax claim more acceptable when you demonstrate how the animal protects your livelihood inventory. In addition, as is often the case with business property, the dog must be depreciated, a way of allocating its cost over its useful life for IRS purposes.

Keep in mind, too, that your claims carry more weight when your pet is a breed that’s typically used for such jobs. So even though your Chihuahua has a loud bark, your tax claim is more credible if your guard dog is a German shepherd, Doberman pinscher or a similar imposing breed”.[iv]

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

Need assistance resolving a tax controversy issue? Contact Mark W. Sullivan, EA or request a free consultation HERE

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] 2014 American Pet Producers Association market study

[ii]https://www.irs.gov/pub/irs-wd/10-0129.pdf

[iii]https://www.irs.gov/pub/irs-pdf/p502.pdf

[iv]https://www.bankrate.com/finance/taxes/tax-write-offs-for-pet-owners-1.aspx#slide=3

Tax season is just around the corner and the airwaves will soon be awash with ads for tax services fighting for a piece of the $168 billion income tax preparation market.

Three factors to decide whether reliance on a professional was reasonable:

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

According to recent article in the New York Post by Glenn Reynolds a recent tweet says it all.

“Sam Bankman-Fried: I don’t know where $10 billion went. The Pentagon: We don’t know where $2.2 trillion went. The IRS: You just received $601.37 on Venmo don’t forget to report it.”

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®