PDP For Fleets - 3 Months Free

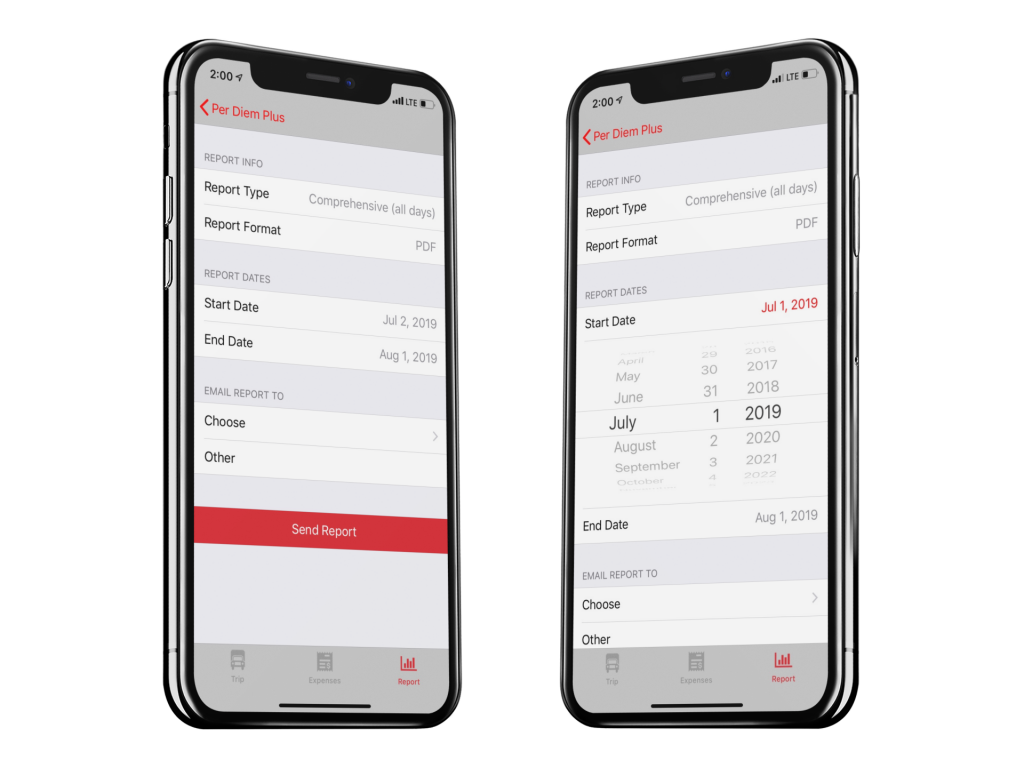

Create an itemized per diem and expense report in the Per Diem Plus app by following these simple steps.

Tip 1: If you scan a lot of receipts the report may exceed your email providers file size permission. Select a shorter start and end date, i.e. run quarterly reports

Tip 2: Check your SPAM / JUNK folder if did not receive the report

Have a tax question? Request a free consultation HERE with Mark W. Sullivan, EA

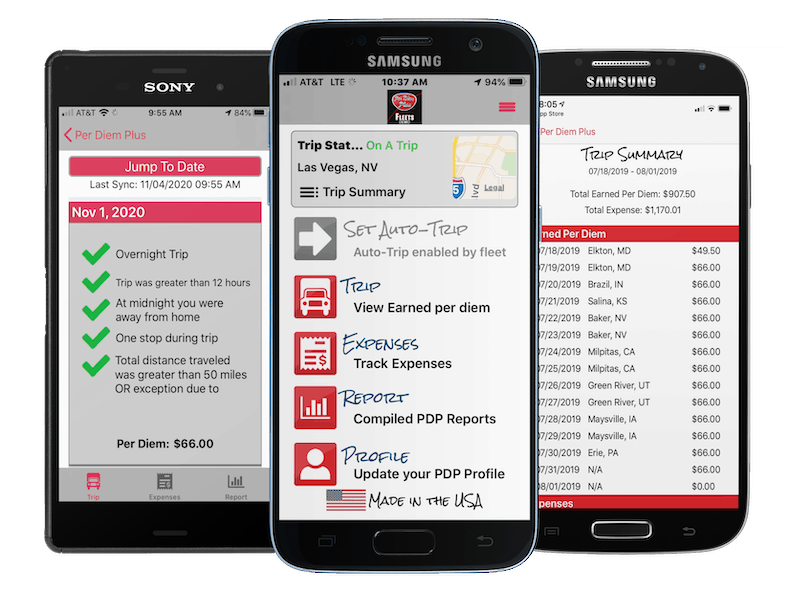

The Per Diem Plus mobile app was designed by drivers to be easy to use.

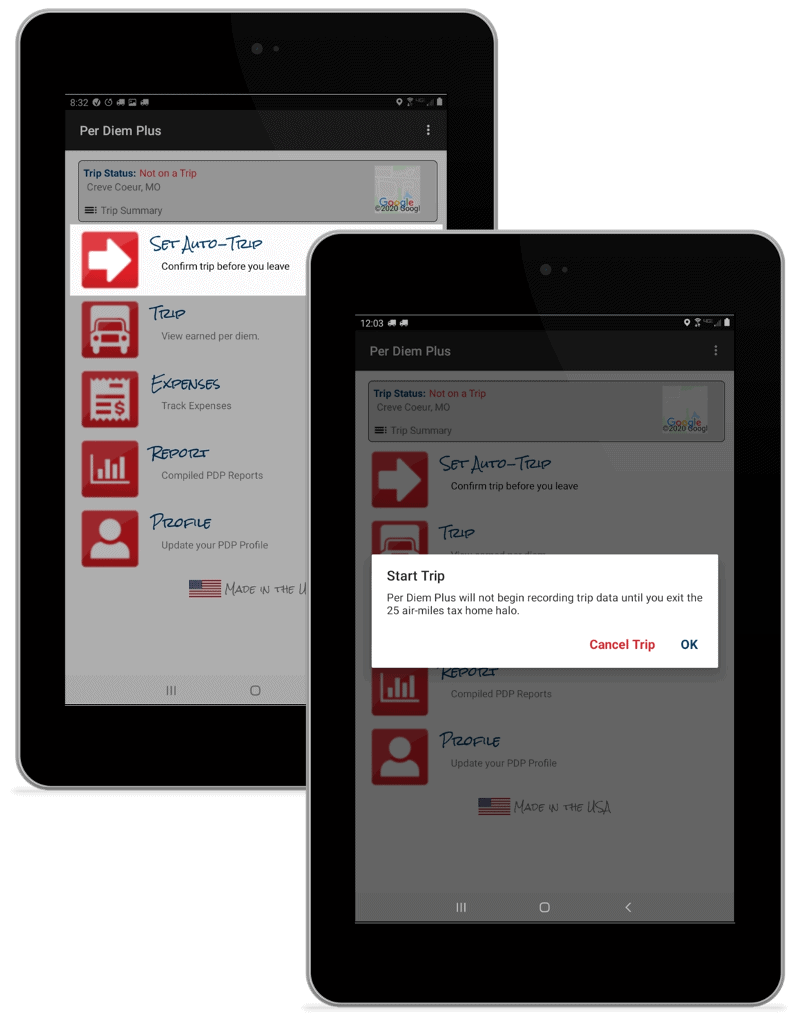

How do I start a trip? Select "Set Auto Trip". The app will begin tracking your trip automatically when you exit the 25 air-miles tax home halo.

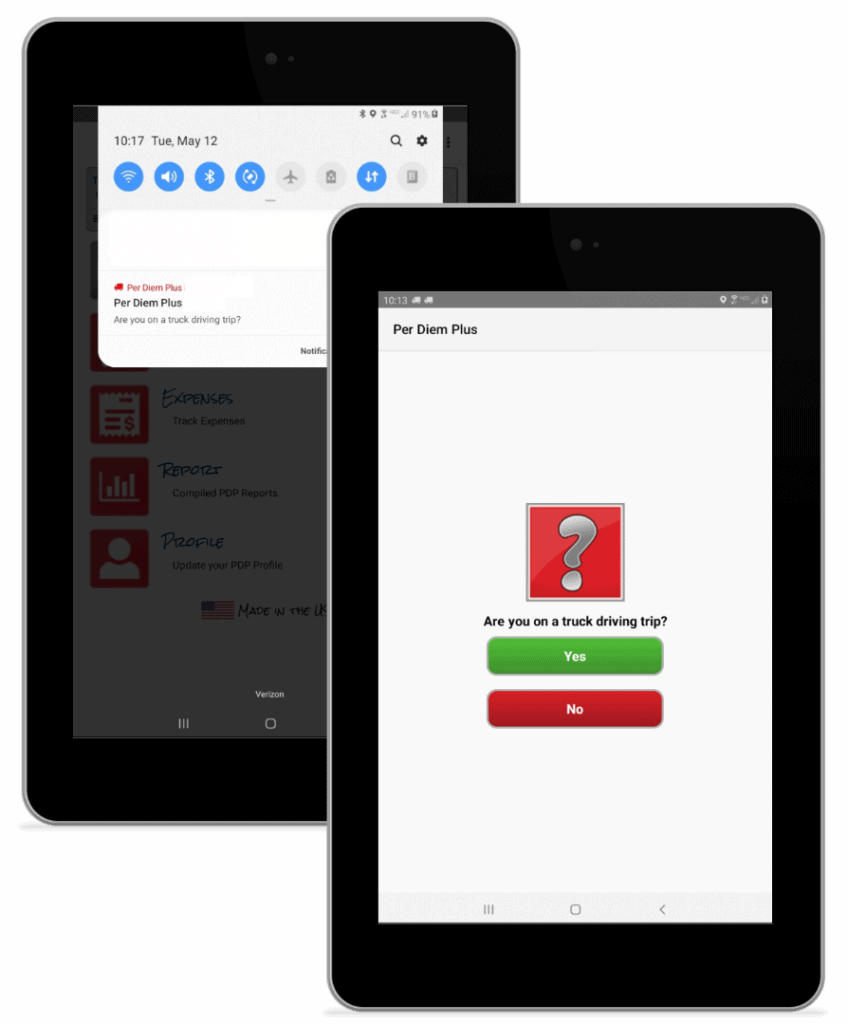

How do I start a trip if I forgot to Set Auto-Trip? The app will post a notification asking if you are on a truck driving trip. Confirm the notification to track per diem for your current trip.

When will I see my per diem? Per diem is recorded the following afternoon and includes 34-hour restarts and unforeseen delays like detention, weather and breakdowns.

How do I end a trip? The app ends a trip automatically when you return to your tax home.

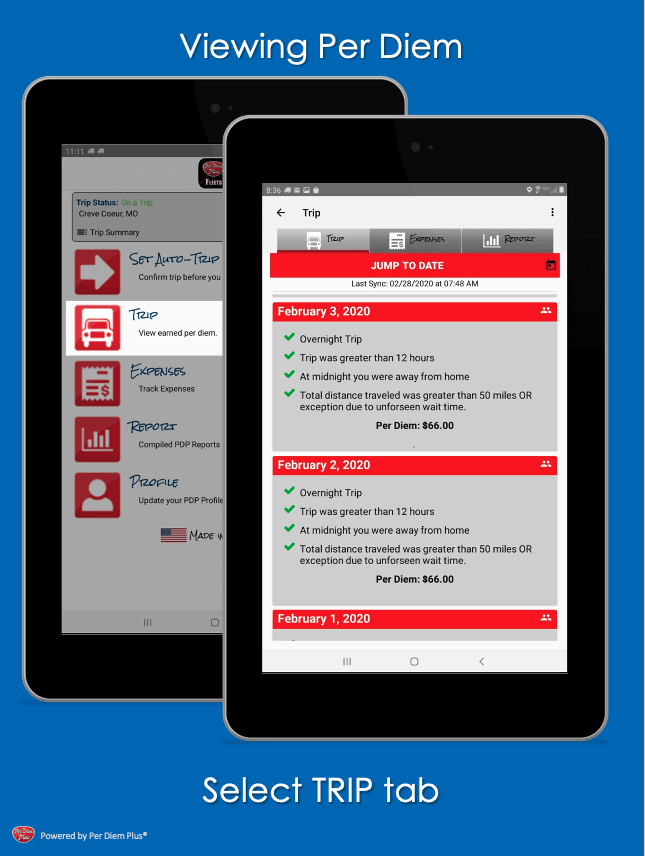

How do I view my per diem? Select the TRIP tab or TRIP SUMMARY.

Still have questions? Support@perdiemplus.com or (314) 488-1919

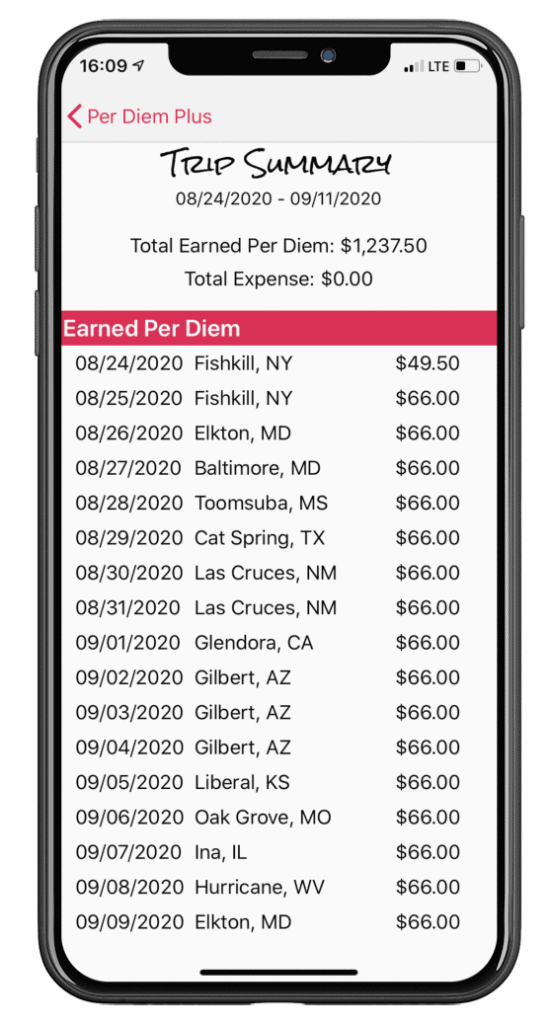

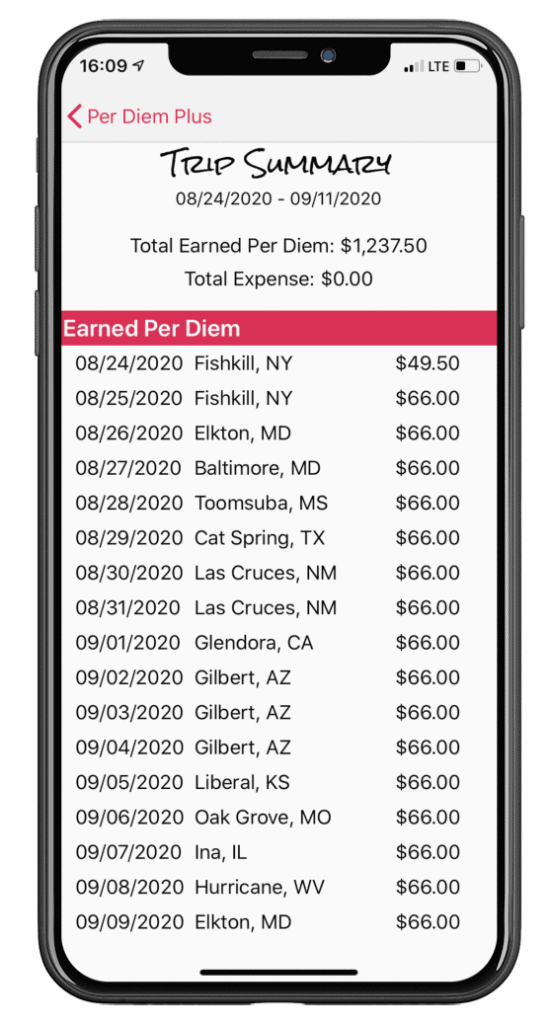

Use the Trip Summary get a quick snapshot of your driver per diem.

Trip Summary: Features includes an itemized record with IRS-required "date, place and per diem amount" for the current truck driving trip, total expenses and expenses totals summarized by categorized by type.

These feature can be accessed by tapping Trip Summary on the app home screen.

Still have questions? Support@perdiemplus.com or (314) 488-1919

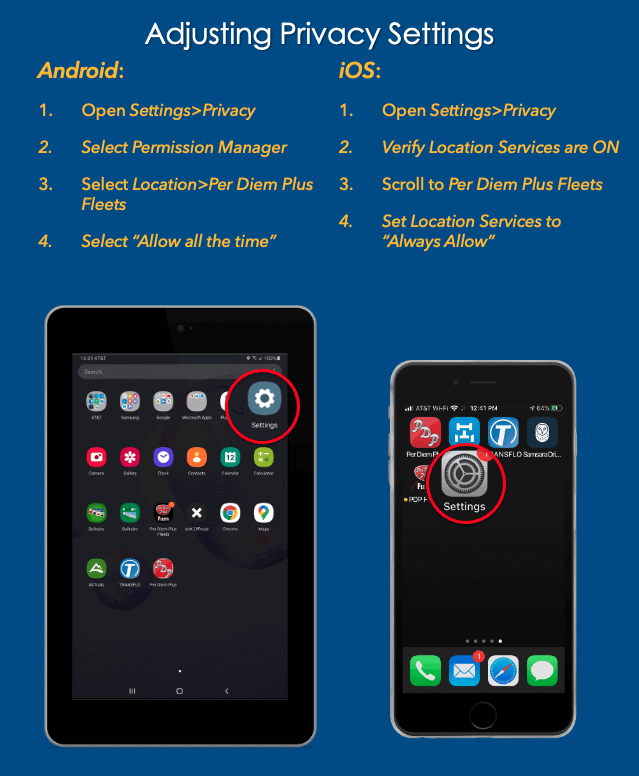

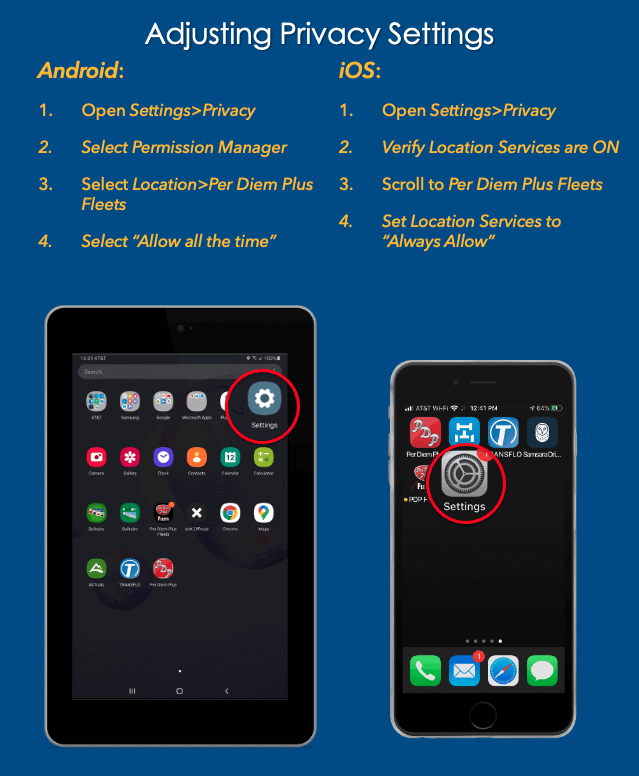

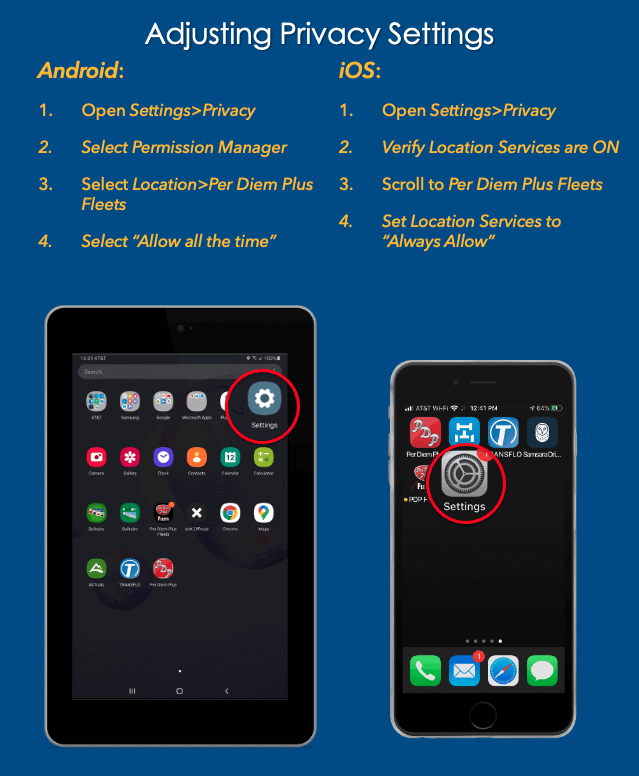

The Per Diem Plus-Owner Operators mobile app requires your location to determine if you qualify for per diem. Both Android and iOS OS may change app privacy settings back to "Only While Using App" without notice. Please confirm Privacy Settings are set to "Always Allow":

Android

iOS

Have a tax question? Request a free consultation HERE with Mark W. Sullivan, EA

Still have questions? Support@perdiemplus.com or (314) 488-1919

Welcome to Per Diem Plus, the IRS-compliant mobile solution that automatically records trucker per diem for travel in the USA & Canada.

Starting a trip

Did you forget to set auto-trip or driver through the tax home halo?

Have a tax question? Request a free consultation HERE with Mark W. Sullivan, EA

Still have questions? Support@perdiemplus.com or (314) 488-1919

Here are some tips to insure you maximize your driver per diem with Per Diem Plus.

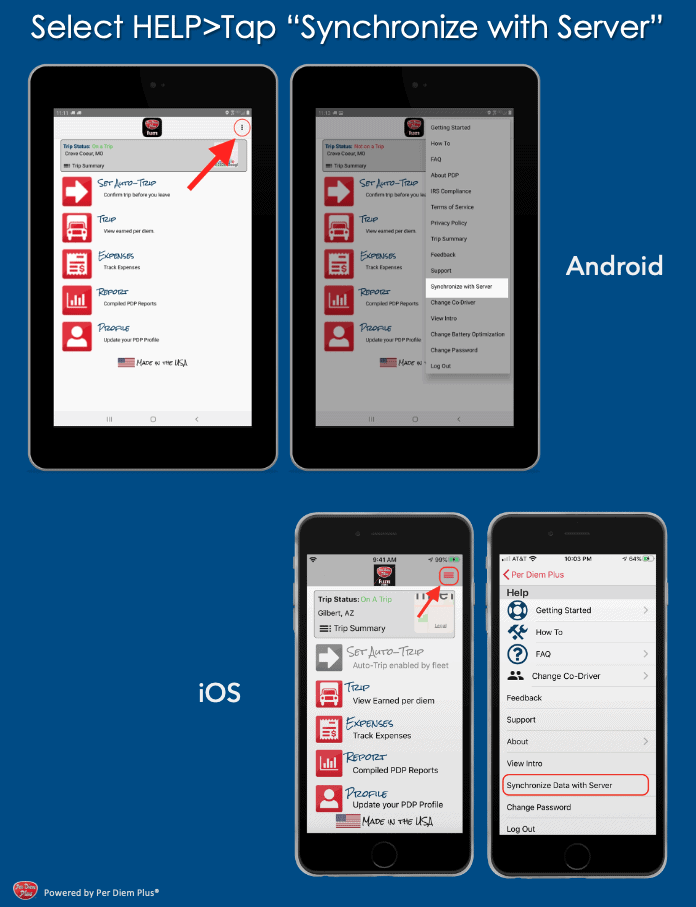

Tip 1: The app attempts to pull trip data hourly while you are on a trip, however, cellular network and connectivity issues may prevent the data from uploading to our cloud servers where per diem is calculated and download back to your device. You can manually push trip data to our servers by selecting "Synchronize with Server" in the HELP menu.

Tip 2: Synchronize your device data weekly

Tip 3: Use the Trip Summary to get a quick snapshot of your driver per diem that includes an itemized record with IRS-required "date, place and per diem amount" for the current truck driving trip, total expenses and expenses totals summarized by categorized by type.

These feature can be accessed by tapping Trip Summary on the app home screen.

Have a tax question? Request a free consultation HERE with Mark W. Sullivan, EA

Still have questions? Support@perdiemplus.com or (314) 488-1919

The Per Diem Plus Owner Operators and Fleets mobile apps require your location to determine if you qualify for per diem. Both Android and iOS OS require you to change app privacy settings "Always Allow" or "Allow all the time". Please confirm Privacy Settings are set correctly:

Android

iOS

Motorola

Android display issues: Can't view permission acknowledgement buttons?

On your device, open the Settings app. Search and select Display size. To change your preferred display size, move the slider left or right.

Is the IRS hounding you or do you have a tax question? Request a free consultation HERE with Mark W. Sullivan, EA

Still have questions? Support@perdiemplus.com or (314) 488-1919

The Per Diem Plus Fleets mobile app was designed by drivers to be easy to use.

How do I start a trip? Simply drive and the app will begin tracking your trip automatically when you exit the tax home halo defined by your fleet.

When will I see my per diem? Per diem is recorded the following afternoon and includes 34-hour restarts and unforeseen delays like detention, weather and breakdowns.

How do I end a trip? The app ends a trip automatically when you return to your tax home.

How do I view my per diem? Select the TRIP tab or TRIP SUMMARY.

Still have questions? Support@perdiemplus.com or (314) 488-1919

Welcome to Per Diem Plus Fleets mobile app. Participation in your company per diem program is optional, but here is what you need to do to get started.

The Per Plus Fleets mobile app has been pre-installed on your device.

Login:

Still have questions? Support@perdiemplus.com or (314) 488-1919

Welcome to Per Diem Plus Fleets mobile app. Participation in your company per diem program is optional, but here is what you need to do to get started.

Step 1: Download the Per Plus Fleets mobile app for Android HERE or iOS HERE

Step 2: Confirm Privacy Settings

Android

iOS

Still have questions? Support@perdiemplus.com or (314) 488-1919