(Revised July 2023)

Do home loan lenders understand how trucker per diem works, that is the question.

Background: An employee truck driver was recently denied a zero-down VA home loan. The reasoning? Because he received tax-free, company-paid per diem that was not reported as wages on Form W-2 and his income was too low for the VA loan. But if he did not receive per diem for two years they could use his wage statements as pure income. The loan officer’s position was,“You received it, therefore you spent it. So it's not available as part of your income."

I cannot help but wonder if this loan officer has ever actually prepared or even filed a U.S. individual income tax return. It is obvious he/she knows nothing about U.S. income taxes let alone how taxable income is computed.

Loan Officer Education - Taxes 101: Most taxpayers claims the standard deduction on their income tax return. The standard deduction is subtracted from adjusted gross income to calculate taxable income. The taxes owed to Uncle Sam are calculated from this figure.

Conclusion: The home loan lender clearly does not know that taxable income is always lower than adjusted gross income as a function of the Form 1040.

Introducing Per Diem Plus Small Fleets, an affordable, customizable per diem solution for solo and team operators

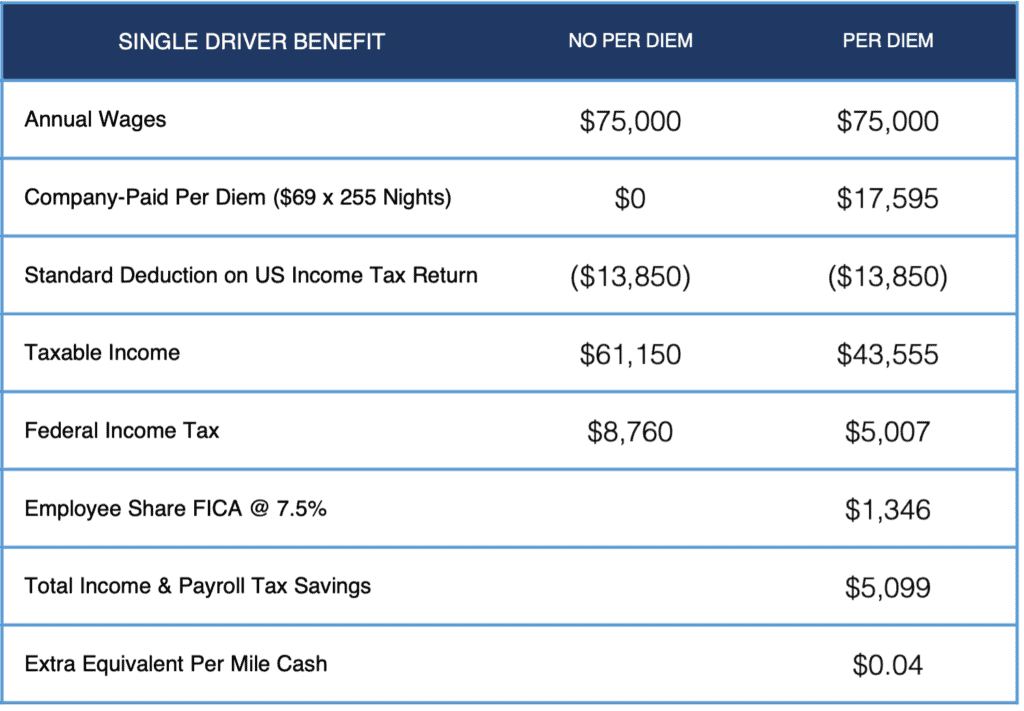

Discussion: For the sake of argument let us assume the driver participated in a company-paid per diem program that was reported in Box 12 of the Form W-2. Would the loan officer be correct? Maybe. In the below example the driver’s Form W-2 would show income of $43,555, which is $17,595 less than what would be reported if he did not receive company-paid per diem and will likely be noticed by a lender.

What the lender does not realize is the unique treatment of trucker per diem in the transportation industry. Per diem is first recorded as a pre-tax deduction; income and payroll taxes are deducted, and per diem is added back to the drivers settlement as a non-taxable reimbursement. The driver receives neither more or less money - per diem simply serves to lower the income and employment taxes and raises their tax home pay.

In the below table per diem saves a single driver about $5,099 in taxes, which equates to $99 extra tax-free cash to the driver (based 51 week).

Drivers, try Per Diem Plus or Small Fleets absolutely free for 30 days!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

About Per Diem Plus

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2016-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®