PDP For Fleets - 3 Months Free

IR-2023-193

WASHINGTON – As part of a larger effort to protect small businesses and organizations from scams, the Internal Revenue Service today announced the details of a special withdrawal process to help those who filed an Employee Retention Credit (ERC) claim and are concerned about its accuracy.

This new withdrawal option allows certain employers that filed an Employee Retention Credit claim but have not yet received a refund to withdraw the claim. Employers that submitted an ERC claim can withdraw their claim and avoid the possibility of getting a refund for which they’re ineligible.

Who can ask to withdraw an ERC claim

Employers can use the ERC claim withdrawal process if all of the following apply:

Taxpayers who are not eligible to use the withdrawal process can reduce or eliminate their ERC claim by filing an amended return. For details, see the Correcting an ERC claim – Amending a return section of the frequently asked questions about the ERC.

How to withdraw an ERC claim

To take advantage of the claim withdrawal procedure, taxpayers should carefully follow the special instructions at IRS.gov/withdrawmyERC, summarized below.

Should fax withdrawal requests to the IRS using a computer or mobile device.

The IRS has set up a special fax line to receive withdrawal requests. This enables the agency to stop processing before the refund is approved. Taxpayers who are unable to fax their withdrawal can mail their request, but this will take longer for the IRS to receive.

Employers who have been notified they are under audit:

Those who received a refund check, but haven’t cashed or deposited it, can still withdraw their claim. They should mail the voided check with their withdrawal request using the instructions at IRS.gov/withdrawmyERC.

Upcoming webinar and other resources for help

Tax professionals and others can register for a Nov. 2 IRS webinar, Employee Retention Credit: Latest information on the moratorium and options for withdrawing or correcting previously filed claims. Those who can’t attend can view a recording later.

This tax credit program that was poorly designed by Congress at the outset. Creating an escape route for taxpayers who fell victim to ERC scammers is a prudent response by the IRS. The ability to withdraw an ERC claim should eliminate thousands of unnecessary audits and criminal prosecutions for a

Do you need assistance in filing an ERC withdrawal? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO. He relocated to Scottsdale, AZ in 2020 and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

IRS Newswire Issue Number: IR-2023-193

IR-2023-169

Moratorium on processing of new Employee Retention Credit claims through year’s end will allow IRS to add more safeguards to prevent future abuse, protect businesses from predatory tactics; IRS working with Justice Department to pursue fraud fueled by aggressive marketing.

WASHINGTON – Amid rising concerns about a flood of improper Employee Retention Credit claims, the Internal Revenue Service today announced an immediate moratorium through at least the end of the year on processing new claims for the pandemic-era relief program to protect honest small business owners from scams. IRS Commissioner Danny Werfel ordered the immediate moratorium, beginning today, to run through at least Dec. 31 following growing concerns inside the tax agency, from tax professionals as well as media reports that a substantial share of new claims from the aging program are ineligible. This increasingly is putting businesses at financial risk by being pressured and scammed by aggressive promoters and marketing. The IRS continues to work previously filed Employee Retention Credit (ERC) claims received prior to the moratorium but renewed a reminder that increased fraud concerns means processing times will be longer.

On July 26, the agency announced it was increasingly shifting its focus to review these claims for compliance concerns, including intensifying audit work and criminal investigations on promoters and businesses filing dubious claims. The IRS announced today that hundreds of criminal cases are being worked, and thousands of ERC claims have been referred for audit.

This action by the IRS is long overdue. These scammers lure taxpayers with promises of fast money, an "easy application process" and lie about eligibility in exchange for sizeable fees. Unfortunately, unwitting taxpayers selected for audit will learn the time spent filing an ERC will pale in comparison to assembling documentation to substantiate eligibility for the claim.

Has IRS selected your ERC claim for audit? Request a free consultation HERE with Mark W. Sullivan, EA

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

IRS Newswire Issue Number: IR-2023-169

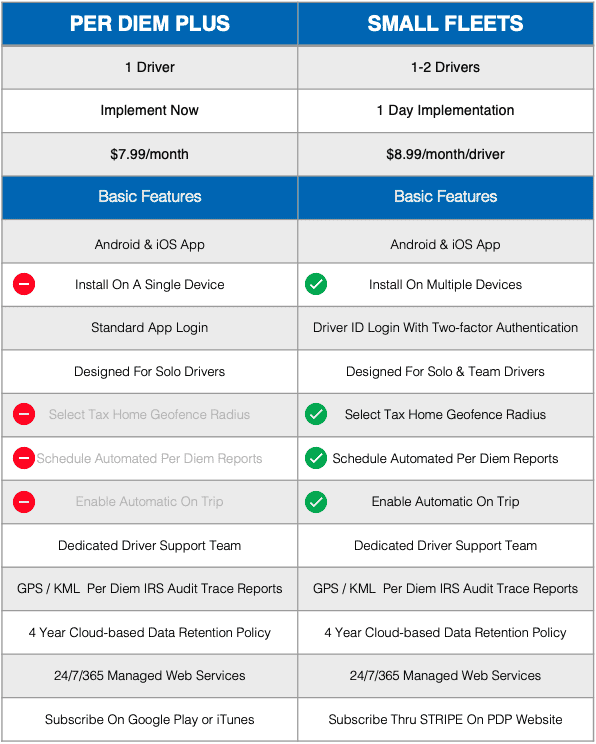

Drivers have spoken! Based on user feedback Per Diem Plus introduces Small Fleets, which enables drivers to customize settings and automate features within the Per Diem Plus mobile app.

Small Fleets will automatically track each qualifying day and partial day of travel away from home in the US and Canada.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

IRS-Compliant: Per Diem Plus® is the only IRS-compliant, mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada to substantiate away-from-home travel for solo and team drivers.

GPS-Based Tracking: Per Diem Plus utilizes a devices GPS to establish IRS-required “time, date and place” substantiation to prove away-from-home travel

Proven: Drivers have logged millions of miles using Per Diem Plus! Join those that value their time, love to eliminate inefficient paperwork, and want to simplify tax compliance and save money.

Easy Setup: An IRS-compliant cloud-based mobile app platform that allows for rapid deployment.

Secure Login: Two-Factor authentication with fleet code and driver ID login.

Data Plan Friendly: The average user on the road for a month will use less than 50MB per month.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

On September 22, 2022 the US Treasury's Financial Crimes Enforcement Network (FinCEN) issued final rules requiring beneficial ownership reporting for small businesses, i.e. single truck owner operators. The rule requires businesses to file reports with FinCEN that identify two categories of individuals:

This rule requires most corporations, LLC's and similar businesses created in or registerd to do business in the United States to report (disclose) information about their beneficial owners to FinCEN. The rules came out of Corporate Transparency Act passed by the Biden administration in January 2021.

The purpose of the new reporting rule is to allow the Federal government to create a national database of information concerning the individuals who, directly or indirectly, own a substantial interest in, or substantial control over (beneficial owners) certain types of domestic and foreign entities.

Penalties for failure to file reports: $500 per day!

Domestic reporting company – any entity that is a corporation, a limited liability company, or otherwise created by the filing of a document with a secretary of state or similar office.

Foreign reporting company – any entity formed under the law of a foreign country and registered to do business in any U.S. state by the filing of a document with a secretary of state or similar office.

There is also an exemption for entities that employ more than 20 full-time employees in the U.S., have an operating presence at a physical office in the U.S., and demonstrate more than $5 million in gross receipts or sales on their federal income tax return (excluding receipt/sales from sources outside the U.S.). If a company falls below these thresholds in the future, a report must be filed within 30 days. An updated report is required if a reporting company later becomes eligible for the exemption.

The Corporate Transparency Act is an expansion of anti-money laundering laws and is intended to help prevent and combat money laundering, terrorist financing, corruption, tax fraud, and other illicit activity. Broadly speaking, it requires most U.S. business to disclose to the federal government in reports about who owns their business and lumps ordinary small businesses in with the nefarious underworld. Will this new rule deter illicit activity? Probably not but it ensures registering with FinCEN as opposed to running their business now becomes the single most important priority for American businesses lest they go bankrupt from the $500 per day penalties!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

"The Corporate Transparency Act: Questions and Answers", Jonathan A. Greene and Casandra J. Creekman, WrickRobbins, March 1, 2023

A motor carrier with 55 over-the-road drivers received this convoluted email explanation from their trucker per diem solution provider who claims to have thousands of drivers covered by their plan. It was sent in response to the Per Diem Plus tax pros reviewing the plan details and advising the driver per diem program would be classified as a nonaccountable plan that produces over $415,000 of improper employee business expenses, evades over $100,000 of taxes and mischaracterizes over $1.2 million of driver wages.

"Your trucking company is using the lodging option, so your amounts are $59 for meals and $74 for lodging. Meal per diem can be awarded each day, while lodging is limited to 2 days a week. Lodging can be used but it follows some different rules. The daily total is limited to $155 which we stay well under to ensure compliance. Lodging has always been 100% deductible, that's why some people use that option. Both options (meals and incidentals only; meals and incidentals and lodging) are compliant with IRS regulations."

Copied from promotor email

See IRS Rev. Proc. 2011-47.1, 3.01(1), 4.04 and 6.06; Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48, IRC 267(b), Tres. Reg. Sec 1.274-5(c)(2)(iii)

The following analysis is based 55 over-the-road drivers working 51 weeks annually, paid a twice-weekly $74 lodging per diem and 20% effective corporate income tax rate:

Under a nonaccountable plan the per diem is included in an employee's gross wages and reported on Form W-2. The following analysis is based 55 over-the-road drivers who travel away from home 255 nights per year

The word salad explanation provided by the per diem solution promotor is reminiscent of listed tax transactions that have the potential for tax avoidance or evasion. Any trucking company that is considering implementing or modifying a driver per diem program needs to carefully review the IRS guidelines. If the tax professional they are using raises questions about the accuracy of the promoters claims, people should listen to their advice.

Have you been approached by one of these "lodging per diem" promoters? Contact us HERE to anonymously tell us about your experience.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®