Tax Saving Tips For Owner Operators & Family-Run Trucking Businesses - Home Office Deduction

The following excerpt on the home office deduction is from "Making The IRS Work In Your Favor" presented by Mark W. Sullivan, EA at the 2018 CMC LIVE hosted by Kevin Rutherford and Let's Truck.

The Home Office Deduction

Taxpayers are not entitled to claim the home office deduction unless the expenses are attributable to a portion of the home, or a separate structure, used exclusively on a regular basis for business purposes. Here is what you need to know to take advantage of a great tax saving opportunity.

Who can claim the home office deduction?

Only self-employed individuals may claim the home office deduction.

- Sole proprietorships claim it on Form 1040 Schedule C

- S-corporations claim it as an office expense on Form 1120S

The IRS has two tough tests to meet:

- Statutory Administrative / Management Activities Test

- Comparative Analysis Test

Administrative / Management Activities Test

Portion of home used exclusively

- Billing customers

- Keeping books and records

- There is no fixed office location

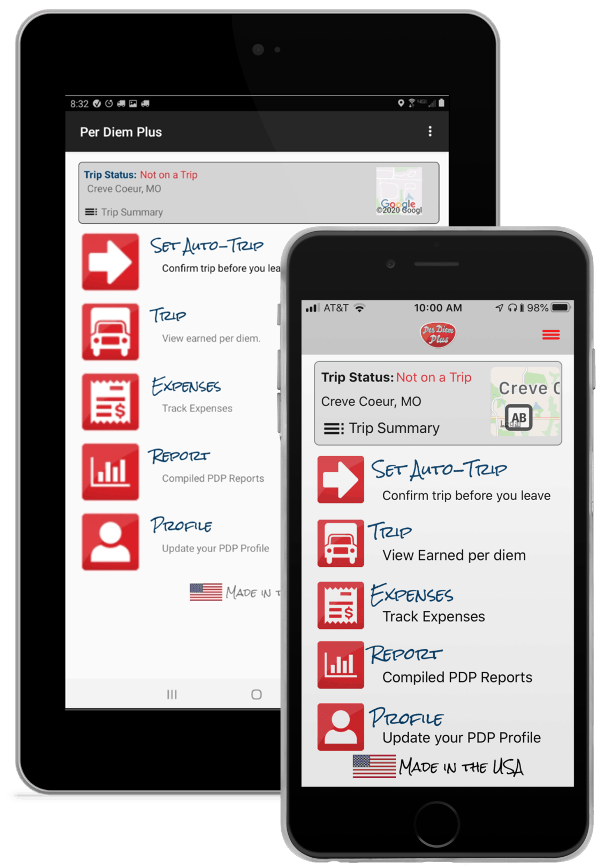

Introducing Per Diem Plus Small Fleets, an affordable, customizable per diem solution for solo and team operators

Comparative Analysis Test

- Determining principal place of business

- Importance of activities performed at home office

- Time spent at location

(Refer to IRC Sec 280A(a), 280A(c), 280A(c)(1)(A))

Example:

Using a den to write legal briefs and tax opinions as well as for personal purposes does not meet the requirements to claim the home office deduction.

- Fails the Comparative Analysis Test - Importance of activities performed at home office

Two options for calculating the home office deduction:

- Safe Harbor Method

- Allocable Portion of Home Method

Safe harbor method

- Calculate percentage of home or structure used for business

- $5 per square foot, up to maximum of 300 sq. ft. or $1500

- Deduction cannot exceed business income

Allocation portion of home method

- Calculate percentage of home or structure used for business

- Multiply by total costs of maintaining home

- Deduction cannot exceed business income

(Refer to IRC Sec 280A(c)(5)(A))

Drivers, try Per Diem Plus or Small Fleets absolutely free for 30 days!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

About Per Diem Plus

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®