2019-2020 Special Trucker Per Diem Rates

The 2019-2020 special trucker per diem rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

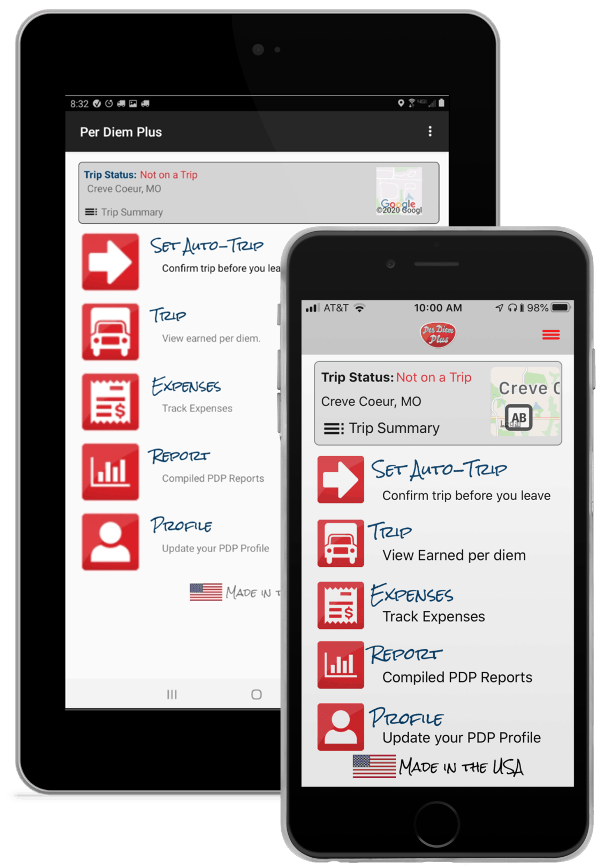

Introducing Per Diem Plus Small Fleets, an affordable, customizable per diem solution for solo and team operators

This annual notice provides the 2019-2020 special per diem rates for taxpayers to use in substantiating the amount of ordinary and necessary business expenses incurred while traveling away from home, specifically (1) the special transportation industry meal and incidental expenses (M&IE) rates.

Information on the 2020-2021 per diem rates can be found HERE

BACKGROUND

Rev. Proc. 2011-47, 2011-42 I.R.B. 520 (or successor), provides rules for using a per diem rate to substantiate, under § 274(d) of the Internal Revenue Code and § 1.274-5 of the Income Tax Regulations, the amount of ordinary and necessary business expenses paid or incurred while traveling away from home.

The special M&IE rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

- Furthermore, it is section 4.04 that allows an Owner-Operator or a motor carrier that offers a company-sponsored per diem plan to deduct 80% of per diem.

- The tax deductibility of per diem is limited to 50% for the other substantiated per diem options governed by Section 4.01 and 5 of Rev. Proc. 2011-47.

Are you unsure what per diem is or which drivers can claim travel-related expenses? Our tax experts answer the most common question in a prior post, Trucker Per Diem Simply Explained

Drivers, try Per Diem Plus or Small Fleets absolutely free for 30 days!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

About Per Diem Plus

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.