PDP For Fleets - 3 Months Free

"It's my accountant's fault" is not a good defense in a tax audit. Tax season is in full swing and the airwaves are awash with ads for tax services fighting for a piece of the $168 billion income tax preparation market[i]. While, most of tax firms provide quality services, there are invariably bad actors who come out of the woodwork. The foregoing highlights the importance of selecting a competent tax professional who is knowledgeable in tax accounting for truck drivers lest your effort to blame the accountant for a tax bill will fall on deaf ears.

For the tax year under audit Johnny showed tax owed on his return of $446. Unfortunately, an audit revealed Johnny did not take the time to properly review his tax returns and ask questions of his tax preparer. He failed to report over $40,000 of income, which resulted in:

He blamed the accountant.

Taxpayers in similar situations can avoid the substantial understatement of tax penalty if they can show that they relied on the advice of a professional tax adviser[ii]. Even if the court assumed Johnny received “advice,” the case law lists three factors to decide whether reliance on a professional was reasonable[iii].

Johnny claimed he relied on Frank, a qualified professional tax preparer. As proof, he provided printouts of the preparers advertising material. He argued that each type of truck driving requires a different type of tax preparer, but he provided no evidence for this theory.

However, the courts biggest issue was that Johnny could not possibly have relied on advice from a tax preparer to whom he did not give the necessary taxinformation. Afterall, he did not report all of the income from the Forms 1099-MISC that he received. And not reporting income is a special sign of negligence[iv], and it might not get a taxpayer off the hook for a penalty even if he gives the information to his preparer[v]. Therefore, it is not surprising that the court concluded Johnny did not meet the "due diligence" burden of proof.

Johnny’s lone defense in claiming "It's my accountant's fault" was providing Frank’s advertising material. However, the court discovered:

The unique nature of the trucking industry compels drivers to exercise due diligence when assembling tax records, reviewing the tax return and selecting a licensed tax return preparer lest you end up like Johnny.

Available as a $7.99 monthly subscription on Google Play and App Store

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Per Diem Plus, LLC Copyright 2018

[i] https://townhall.com/tipsheet/katiepavlich/2014/04/14/americans-spend-billions-of-dollars-and-hundreds-of-hours-doing-their-taxes-each-year-n1824148

[ii] Sec. 1.6664-4(b), Income Tax Regs.

[iii] Neonatology Assocs., P.A. v. Commissioner, 115 T.C. 43, 99 (2000), aff’d , 299 F.3d 221 (3d Cir. 2002).

[iv] sec. 1.6662-3(b)(1)(i), Income Tax Regs.

[v] see Metra Chem Corp. v. Commissioner, 88 T.C. 654, 662-63 (1987) (reliance on preparer with complete information not reasonable cause where cursory review would have revealed errors); Magill v. Commissioner , 70 T.C. 465, 479-80 (1978) (taxpayer still has duty to read return to make sure all income included even if all data given to tax preparer), aff’d , 651 F.2d 1233 (6th Cir. 1981).

[vi] IRS Circular 230 governs licensed tax preparers and establishes the annual continuing professional education requirements

[vii] SHALOM JOHNNY, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent UNITED STATES TAX COURT - SUMMARY OPINION T.C. Summary Opinion 2015-3 Docket No. 21078-11S. Filed January 20, 2015.

If you are an OTR truck driver who lives in the truck you may be a classified a "tax turtle" by IRS and unable to claim travel-related expenses.

There are frequent posts on trucker social media forums and even in trucking publications that suggest merely having a post office box will be sufficient to meet the IRS’ regulations for claiming travel-related expenses.

John was an OTR truck driver who for the year under audit was away from home for 358 days, exceeded the PO Box requirements and claimed to live with his mother[iii].

Whether John had a tax home and whether his mother’s house was indeed his permanent residence were factual questions:

John was a “tax turtle” who was not entitled to claim per diem and travel-related expenses.

As this case demonstrates the PO Box gambit will not survive scrutiny in a tax audit. For a self-employed truck who lives in their truck to claim travel-related expenses, like per diem, some amount of expenses must be incurred at your declared tax home. It would also be wise to spend some time there lest you risk being classified a “tax turtle”.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] IRS Rev. Proc. 2011-47 (most recently superseded by 2017-42) & IRC 162(a)(2); Reg 1.162-2) A tax deduction is allowed for ordinary and necessary traveling expenses incurred by a taxpayer while away from home in the conduct of a trade or business. A truck driver is not away from home unless his or her duties require the individual to be away from the general area of his or her tax home for a period substantially longer than an ordinary workday and it is reasonable to need rest or sleep.

[ii] Rev. Ruling 75-432

[iii] HATEM ELSAYED, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. 8935-07S. Filed May 26, 2009

A recent article in Freightwaves suggested “For companies that have previously considered adding a per-diem plan, but have yet to do so, now is a great time to reconsider your recruiting strategy.”[i] While the media is awash with articles covering the ELD mandate and tax reform, everyone has overlooked the impact on tax compliance recordkeeping obligations to substantiate trucker per diem. Everyone but Per Diem Plus.A Statutory Conflict - 6 month / 3-year rule

FMCSA Part 395 section 395.8(k)(1) requires motor carriers to retain all supporting documents used by the motor carrier to verify the information recorded on the driver’s record of duty status for a period of 6 months. But,

Internal Revenue Code section 6501(a) establishes the statute of limitations for the IRS to assess taxes on a taxpayer expires three (3) years from the due date of the return or the date on which it was filed, whichever is later.

Fleets and self-employed drivers retain certain records required by FMCSA to comply with DOT regulations, but prudently discard ELD backups after 6 months. However, the IRS only accepts driver logbooks as proof of overnight truck driving trips to substantiate per diem[ii]. Contrary to popular belief trip sheets, mileage logs or settlement statements do not fulfill these statutory requirements. Therefore, fleets adding an accountable per diem program and self-employed drivers face a Catch-22; shield themselves from FMCSA exposure or risk the wrath of IRS auditors. ELD / AOBR backups are straightforward until one considers an e-log for a one driver for a single week can be 20-plus pages or 1,000 pages annually and requires manual reconciliation to establish qualifying overnight truck driving trips. Per Diem Plus was designed to resolve this regulatory Catch-22 by separating FMCSA and IRS retention rules. Per Diem Plus Fleets is the only IRS-compliant mobile application cloud-based solution that replaces logbooks by automating per diem tracking for travel in the USA and Canada. Users can run an itemized “date, place and amount” report for a week, a month or even a year in less than 30 seconds. Per diem and expenses data and receipts are instantly available for 4 years. PDP Fleets Product Sheet

In this post I attempt to clear up the confusion over tax reform and trucker per diem. Tax Reform has contributed to much confusion within the professional truck driver community about the changes as they related to the deductibility of certain expenses. Case in point: a recent magazine article declared,

Additional good news for truckers in this bill is that HR1 does not change overnight per diems (Section 274(n)(3) of the IRC Code). That means truckers retain the ability to claim 80 percent of the $63 per diem for nights away from home.

Land Line “Tax Reform and Trucking” (January 8, 2018)

This statement is misleading and overlooks a significant difference between owner operators who are self-employed and employee (company) drivers. The article cited the retention of per diem under Internal Revenue Code Section 274(n)(3)[ii], which is correct.

Unfortunately, the articles author misunderstood the meaning of Sec. 274, which pertains solely to the meals expense disallowance and establishes the 80% deduction limitation for per diem of a truck driver during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation. What the article failed to articulate was that:

The Tax Reform and Jobs Act (H.R. 1 Sec. 11045) amended IRC Sec 67 and suspended (eliminated) miscellaneous itemized deductions for employee drivers, which includes per diem and other unreimbursed employee business expenses[v]. As a result, self-employed owner operators will still be allowed to claim per diem, but employee drivers will not.

The Act did not amend IRC 62(2)(a), thus trucking companies will be allowed to continue offering company-paid per diem under an accountable plan that is treated as a non-taxable reimbursement to their employees.

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

[ii] 26 U.S. Code § 274 - Disallowance of certain entertainment, etc., expenses

(n) Only 50 percent of meal and entertainment expenses allowed as deduction

(1) In general, The amount allowable as a deduction under this chapter for—

(3) Special rule for individuals subject to Federal hours of service

In the case of any expenses for food or beverages consumed while away from home (within the meaning of section 162(a)(2)) by an individual during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation, paragraph (1) shall be applied by substituting “80 percent” for “50 percent”.

[iii] IRC 162(a) In general

There shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including—

(2) traveling expenses (including amounts expended for meals and lodging other than amounts which are lavish or extravagant under the circumstances) while away from home in the pursuit of a trade or business

[iv] IRC 67 (a) General rule

In the case of an individual, the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.

IRC 62(2)(a) - Reimbursed expenses of employees

The deductions allowed by part VI (section 1616 and following) which consist of expenses paid or incurred by the taxpayer, in connection with the performance by him of services as an employee, under a reimbursement or other expenses allowance arrangement with his employer. The fact that the reimbursement may be provided by a third party shall not be determinative of whether or not the preceding sentence applies.

[v] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction under IRC 67 for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits”.

In general, under “Tax Reform and Jobs Act” company OTR drivers that previously claimed itemized deductions for unreimbursed employee expenses will likely experience a tax increase[1]. The following tables are designed to assist OTR employee truck drivers in evaluating the impact of the Tax Reform Act passed into law on December 22, 2017.

Example A: Earned $50,000 in 2017 and claimed itemized deductions of $21,601, which included $14,868 of net per diem[2], $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. Your tax bill will increase $1,034.

Example B: Earned $50,000 in 2017 and claimed the standard deduction of $6,350. Your tax bill will decrease $1,309.

Example A: Earned $50,000 in 2017 and claimed itemized deductions of $21,601, which included $14,868 of net per diem, $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. Your tax bill will increase about $475.

Example B: Earned $50,000 in 2017 and claimed the standard deduction of $12,700 with no dependent children. Your tax bill will decrease about $717.

Questions? Contact Mark W. Sullivan, EA

This article was written by Mark W. Sullivan, EA, who has been providing taxpayer advocacy, consulting, and litigation services since 1998. Prior to starting a private practice, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. He has over a decade of experience advising transportation industry clients with respect to per diem issues.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and miscellaneous expenses.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

Disclaimer: I would advocate that the trucking industry should adopt the well-established business practice of reimbursing employee drivers for travel-related meals and incidental expenses[i]. However, prudence demands formulation of tax mitigation strategies based on the current law and established business methods and not how I believe they should be.

For over 30 years fleets have utilized a unique, IRS-approved reimbursement method for drivers  whereby traveled-related expenses (i.e. meals) are deducted from a driver’s gross wages, reclassified as a pre-tax deduction and then added back into wages as non-taxable “per diem” reimbursement – all without changing the gross pay of the driver[ii]. The largest drawback to company-paid per diem is that it lowers A) wages recorded on Form W-2 Wage and Income Statement B) Social Security Administration contributions and C) may affect the ability to secure a mortgage or other loan, workers compensation and 401(k) contributions.

whereby traveled-related expenses (i.e. meals) are deducted from a driver’s gross wages, reclassified as a pre-tax deduction and then added back into wages as non-taxable “per diem” reimbursement – all without changing the gross pay of the driver[ii]. The largest drawback to company-paid per diem is that it lowers A) wages recorded on Form W-2 Wage and Income Statement B) Social Security Administration contributions and C) may affect the ability to secure a mortgage or other loan, workers compensation and 401(k) contributions.

Example[3] – Single Driver: OTR driver Tim earned $50,000 in 2017. He filed his tax return as single and claimed itemized deductions of $21,038, which included $14,868 of net per diem, $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. If he does not receive company-paid per diem his tax bill will increase $1,094 but save $256 under a CPM per diem plan and $796 under daily rate per diem.

What would the impact be if Tim was married? If he does not receive company-paid per diem his tax bill will increase $535 but save $729 under a CPM per diem plan and $1,219 under daily rate per diem.

If H.R. 1 “Tax Cuts and Job Act” becomes law OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits”. As a result, drivers will be required to choose between participating in company-paid per diem plan or cover the cost of their travel-related expenses from after-tax income. Unfortunately, Congress’s “one size fits all” approach to tax reform overlooked the negative impact on drivers.

Per Diem Plus®, a proprietary software application, which provides automatic per diem, expense tracking and reporting to transportation professionals.

This article was written by Mark W. Sullivan, EA, Tax Counsel for Per Diem Plus, who has been providing taxpayer advocacy, consulting, and litigation services since 1998. Prior to starting a private practice, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, St. Louis, MO and Washington, D.C. offices of the Internal Revenue Service. He has over a decade of experience advising transportation industry clients in per diem issues. Questions? Contact Mr. Sullivan at marks@perdiemplus.com.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2017 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits”.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2016-58) covers meals and incidental expenses only.

[3] The foregoing discussion utilizes the Senate’s version of “Tax Cuts and Job Act”

[i] Cents-per-mile is the prevailing trucking industry method for calculating company-paid per diem. Drivers subject to DOT Hours of Service regulations are prohibited from using this method.

[ii] Drivers who declined company-paid per diem had the option to claim unreimbursed business expenses at the end of the year as an itemized deduction on Schedule A.

On November 16, 2017 The U.S. House of Representatives passed H.R. 1 “Tax Cuts and Job Act”[1]. The U.S. Senate has released a companion tax overhaul bill that is scheduled for debate in the coming weeks. The House bill proposes 4 tax brackets and the Senate 7, but both bills propose among other things eliminating the deductibility of unreimbursed business expenses for employee truck drivers. In general, under both the Senate and House proposals company OTR drivers that previously claimed itemized deductions for unreimbursed expenses will experience a tax increase.

Example – Single Driver: OTR driver Wayne earned $50,600 in 2016. He filed his tax return as single and claimed itemized deductions of $21,038, which included $14,868 of net per diem, $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. His tax bill will increase $1,052 under the Senate plan and $1,243 under the House plan.

What would the impact be on Wayne if he was married? The tax overhaul increases his tax bill by $ 469 under the Senate plan and $850 under the House plan.

This article was written by Mark W. Sullivan, EA, who has been providing taxpayer advocacy, consulting, and litigation services since 1998. Mr. Sullivan has over a decade of experience advising transportation industry clients in per diem issues.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2017 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.

[1] https://www.congress.gov/congressional-report/115th-congress/house-report/409/1

In this article we attempt to clear up the confusion on the rules governing truck driver per diem.

What is per diem? Trucker per diem is a per day travel expense allowance. Eliminates the need for proving actual costs for meals & incidental expenses incurred.

Do I have to spend all the per diem?

No. This is the maximum amount the IRS will let you claim on your tax return.

Who can claim trucker per diem?

Self-employed truckers who are subject to DOT HOS and who travel away from home overnight where sleep or rest is required. The Per Diem Plus mobile app software takes the guesswork out of tracking trucker per diem for OTR truckers.

Can all truck drivers receive per diem?

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot claim per diem.

What qualifies as a tax home?

Where you park your truck. Your regular place of business, or home in a real and substantial sense.

If I live in my truck, can I claim per diem?

No. A taxpayer who’s constantly in motion is a "tax turtle," or someone with no fixed residence who carries their “home” with them.

Are truck drivers allowed to claim a mileage allowance per diem?

Only fleets can use a cents-per-mile per diem. IRS’ standard mileage allowance is for use of a personal vehicle.

Can a driver claim per diem for lodging?

No. Trucker per diem is exclusively for meals and incidental expenses. You must have a receipt for all lodging expenses. A self-employed driver falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is the location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Motorola Devices

What documentation meets the IRS substantiation requirements to prove overnight travel and expense?

Only Per Diem Plus or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Unlike ELD backups, Per Diem Plus a can create an IRS-compliant itemized per diem report in seconds.

Can motor carriers pay per diem to employee drivers?

Yes. A motor carrier can offer per diem to drivers subject to DOT HOS and who travel away from home overnight where sleep or rest is required under an accountable per diem plan.

Is company-paid per diem taxable as income to an employee driver under an accountable fleet per diem plan?

No. Per diem is classified as a non-taxable reimbursement to an employee driver.

What are the current per diem rates for travel in USA & Canada?

The per diem rates for 2023 & 2024 are:

(IRS released annual update on September 25, 2023 in Notice 2023-68)

Can a driver prorate per diem for partial days of travel?

Yes. A partial day is 75% of the per diem rate.

How much per diem can I deduct on my income tax return?

A self-employed trucker can deduct 80% of per diem (100% for tax years 2021 & 2022) on their tax return.

What are Incidental Expenses?

Only fees and tips.

Are showers & parking fees incidental expenses?

No. Self-employed drivers may separately deduct expenses for: Per Diem Plus subscription, showers, reserved parking fees, mailing expenses, supplies and laundry.

Can employee drivers deduct company-paid per diem on their tax return?

No.

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount are required. You can upload and store receipts on the Per Diem Plus app and share them electronically with your tax preparer in seconds.

How long should tax records be retained?

No less than 3 years from the filing date of an income tax return. You have access to your Per Diem Plus tax records for four years.

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47 or use the Per Diem Plus app that takes the guesswork out of tax-related record keeping.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2017-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

(Revised July 2023)

Do home loan lenders understand how trucker per diem works, that is the question.

Background: An employee truck driver was recently denied a zero-down VA home loan. The reasoning? Because he received tax-free, company-paid per diem that was not reported as wages on Form W-2 and his income was too low for the VA loan. But if he did not receive per diem for two years they could use his wage statements as pure income. The loan officer’s position was,“You received it, therefore you spent it. So it's not available as part of your income."

I cannot help but wonder if this loan officer has ever actually prepared or even filed a U.S. individual income tax return. It is obvious he/she knows nothing about U.S. income taxes let alone how taxable income is computed.

Loan Officer Education - Taxes 101: Most taxpayers claims the standard deduction on their income tax return. The standard deduction is subtracted from adjusted gross income to calculate taxable income. The taxes owed to Uncle Sam are calculated from this figure.

Conclusion: The home loan lender clearly does not know that taxable income is always lower than adjusted gross income as a function of the Form 1040.

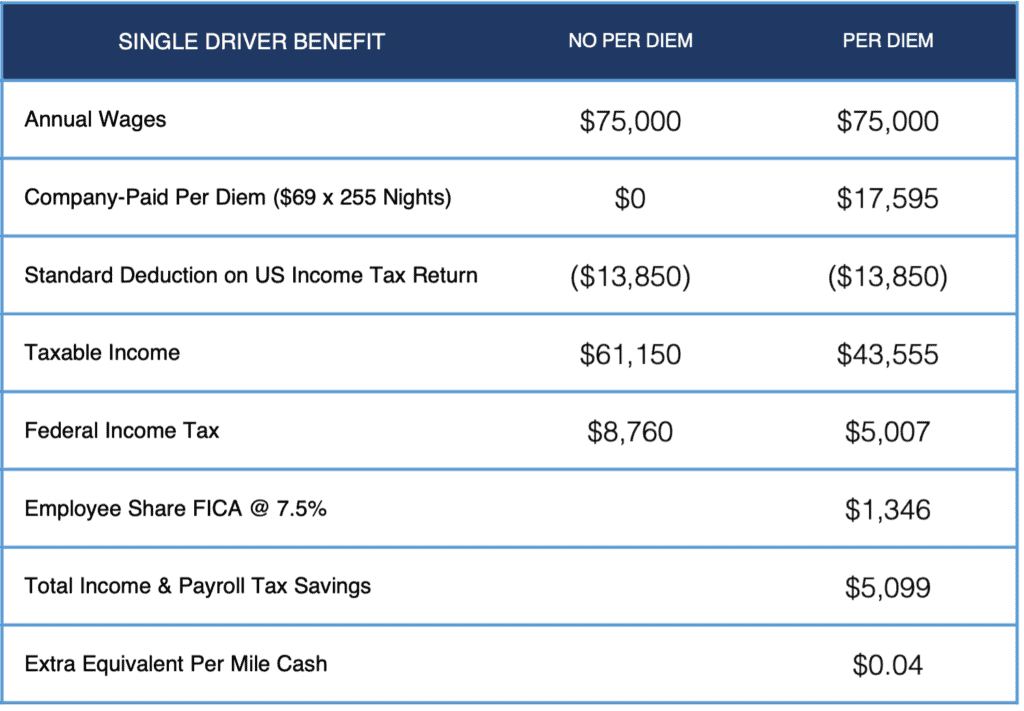

Discussion: For the sake of argument let us assume the driver participated in a company-paid per diem program that was reported in Box 12 of the Form W-2. Would the loan officer be correct? Maybe. In the below example the driver’s Form W-2 would show income of $43,555, which is $17,595 less than what would be reported if he did not receive company-paid per diem and will likely be noticed by a lender.

What the lender does not realize is the unique treatment of trucker per diem in the transportation industry. Per diem is first recorded as a pre-tax deduction; income and payroll taxes are deducted, and per diem is added back to the drivers settlement as a non-taxable reimbursement. The driver receives neither more or less money - per diem simply serves to lower the income and employment taxes and raises their tax home pay.

In the below table per diem saves a single driver about $5,099 in taxes, which equates to $99 extra tax-free cash to the driver (based 51 week).

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2016-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus launches enhancements to its automated per diem and expense tracking Android app for truck drivers

5/13/2016

ST. LOUIS — Per Diem Plus, LLC, the first ever automated per diem and expense tracking Android app for truck drivers, today announced the launch of several enhancements. Per Diem Plus is designed to streamline and eliminate the guesswork out of taxrelated recording keeping for drivers who deduct travel and business expenses on their own tax returns.

“We encourage feedback from the drivers using Per Diem Plus and the enhancements we recently launched are a direct result of their valuable input” said John Stefek, Director of Client Experience.

Enhancements to the Per Diem Plus app include:

An Apple iOS version of Per Diem Plus is currently in development and scheduled for release in the late summer of 2016.

Please visit www.perdiemplus.com for more information including a step-by-step demonstration of how Per Diem Plus works.

Per Diem Plus was developed and is managed in the USA by tax professionals with experience in the transportation industry. For more information or to schedule an interview with one of our tax experts, please contact John Stefek at johns@perdiemplus.com or 3144096454.