PDP For Fleets - 3 Months Free

The following article is summary of the impact of the 2017 Tax Cuts and Job Act (TCJA) on truckers The following is a list of common trucker tax deductions that were changed by the TCJA (except where noted).

The TCJA eliminated itemized deductions for employee drivers, which includes all unreimbursed employee business expenses. The following is a non-exhaustive list:

This provision does not apply to Owner Operators who claim travel-related and business expenses on Schedule C or Form 1120S.

IRC Section 199A generally provides a deduction of 20% of qualified business income (QBI) derived from a sole proprietorship, partnerships, or S corporation that is a qualified trade or business. The §199A deduction is taken from adjusted gross income (AGI) in determining taxable income and therefore does not reduce self-employment income. See my article titled "Understanding the 20% Passthrough Deduction" for a detailed discussion of the complicated deduction.

The §199A deduction is complicated and will require significant guidance from the IRS.

The deduction for alimony and separate maintenance payments by the payor is repealed. The payee (recipient) will not be required to include such payments in gross income for divorce or separation instruments executed after December 31, 2018.[i]

Medical expenses continue to be deductible to the extent they exceed 7.5% of adjusted gross income (AGI) for 2017 and 2018. For years after 2018 the threshold is 10% of AGI.

The moving expense deduction is repealed except for members of the Armed Forces. The exclusion from gross income and FICA wages for employer reimbursed moving expenses is repealed other than members of the Armed Forces.

This provision does not apply to Owner Operators who claim expenses related to moving a business operation on Schedule C or Form 1120S.

A taxpayer may claim an itemized deduction of up to $10,000 ($5,000 for married filing separately) for the aggregate of (1) state and local property taxes not paid or accrued in carrying on a trade or business (See IRC Sec. 212), and (2) state and local income taxes (or sales taxes in lieu of income taxes) paid or accrued in the tax year[ii].

This provision does not apply to Owner Operators who claim business-related taxes on Schedule C or Form 1120S.

The deduction for interest on home equity indebtedness is disallowed and applies to existing home equity loans. Home equity loans used for business or substantial improvement of a residence may still be deductible[iii]; any used for personal or investment purposes are not[iv].

The base for cash contributions is increased from 50% to 60%. No deduction is allowed for payments to colleges and universities in exchange for rights to purchase athletic seats.

All gambling expenses are now subject to the gambling winnings limitation and not just wagers. Schedule A filers can still deduct gambling losses to the extent of winnings but must have total itemized deductions exceeding the increased standard deductions.

The individual tax for failure to maintain minimum essential coverage is reduced to zero with respect to health coverage status for months beginning after December 31, 2018.

The standard deduction is increased to $24,000 for married filing jointly, $18,000 for head of household, and $12,000 for unmarried (single). The pre-2018 additional $1,250 standard deduction for taxpayers over age 65 or who are blind are retained.

Personal exemptions and dependency deductions are repealed. The IRS is examining how the definition of qualifying relative should be addressed.

Section 6695(g) of the internal Revenue Code requires paid return preparers to satisfy due diligence requirements to ensure clients qualify for the American opportunity credit, lifetime learning credit, earned income credit, and child tax credit.

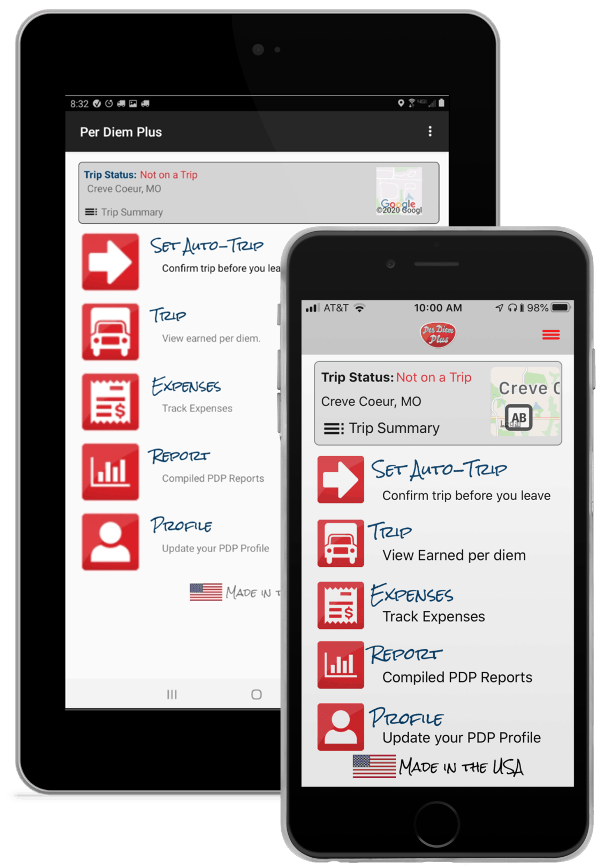

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] Notice 2018-37, 2018-18, I.R.B. 521

[ii] IRC § 164(b)(6) (flush language)

[iii] Temp. Reg. § 1.163-8T

[iv] Refer to Publication 936 (2017) Home Mortgage Interest Deduction for definitions of “substantial improvement”