PDP For Fleets - 3 Months Free

A Statutory Conflict - 6 month / 3-year rule

FMCSA Part 395 section 395.8(k)(1) requires motor carriers to retain all supporting documents used by the motor carrier to verify the information recorded on the driver’s record of duty status for a period of 6 months. But,

Internal Revenue Code section 6501(a) establishes the statute of limitations for the IRS to assess taxes on a taxpayer expires three (3) years from the due date of the return or the date on which it was filed, whichever is later.

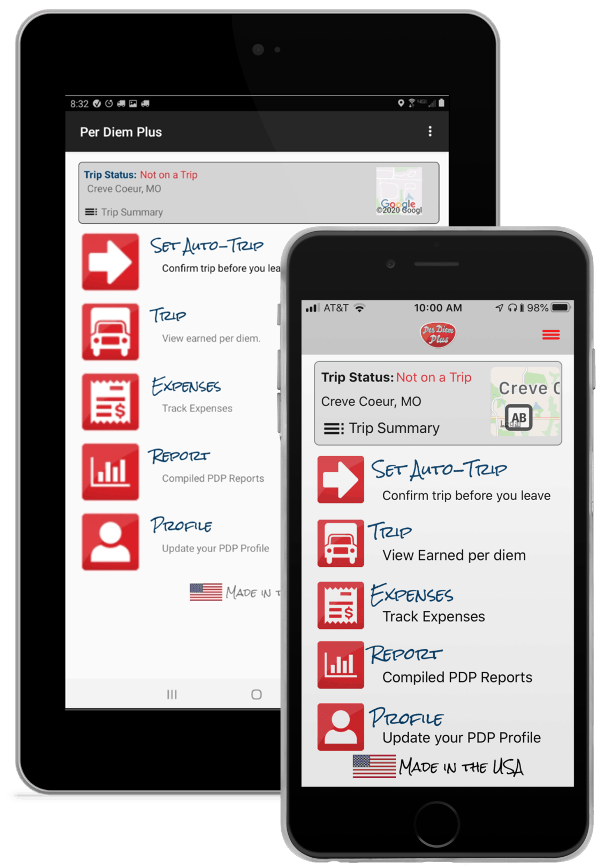

Fleets and self-employed drivers retain certain records required by FMCSA to comply with DOT regulations, but prudently discard ELD backups after 6 months. However, the IRS only accepts driver logbooks as proof of overnight truck driving trips to substantiate per diem[ii]. Contrary to popular belief trip sheets, mileage logs or settlement statements do not fulfill these statutory requirements. Therefore, fleets adding an accountable per diem program and self-employed drivers face a Catch-22; shield themselves from FMCSA exposure or risk the wrath of IRS auditors. ELD / AOBR backups are straightforward until one considers an e-log for a one driver for a single week can be 20-plus pages or 1,000 pages annually and requires manual reconciliation to establish qualifying overnight truck driving trips. Per Diem Plus was designed to resolve this regulatory Catch-22 by separating FMCSA and IRS retention rules. Per Diem Plus Fleets is the only IRS-compliant mobile application cloud-based solution that replaces logbooks by automating per diem tracking for travel in the USA and Canada. Users can run an itemized “date, place and amount” report for a week, a month or even a year in less than 30 seconds. Per diem and expenses data and receipts are instantly available for 4 years. PDP Fleets Product Sheet

In this post I attempt to clear up the confusion over tax reform and trucker per diem. Tax Reform has contributed to much confusion within the professional truck driver community about the changes as they related to the deductibility of certain expenses. Case in point: a recent magazine article declared,

Additional good news for truckers in this bill is that HR1 does not change overnight per diems (Section 274(n)(3) of the IRC Code). That means truckers retain the ability to claim 80 percent of the $63 per diem for nights away from home.

Land Line “Tax Reform and Trucking” (January 8, 2018)

This statement is misleading and overlooks a significant difference between owner operators who are self-employed and employee (company) drivers. The article cited the retention of per diem under Internal Revenue Code Section 274(n)(3)[ii], which is correct.

Unfortunately, the articles author misunderstood the meaning of Sec. 274, which pertains solely to the meals expense disallowance and establishes the 80% deduction limitation for per diem of a truck driver during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation. What the article failed to articulate was that:

The Tax Reform and Jobs Act (H.R. 1 Sec. 11045) amended IRC Sec 67 and suspended (eliminated) miscellaneous itemized deductions for employee drivers, which includes per diem and other unreimbursed employee business expenses[v]. As a result, self-employed owner operators will still be allowed to claim per diem, but employee drivers will not.

The Act did not amend IRC 62(2)(a), thus trucking companies will be allowed to continue offering company-paid per diem under an accountable plan that is treated as a non-taxable reimbursement to their employees.

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

[ii] 26 U.S. Code § 274 - Disallowance of certain entertainment, etc., expenses

(n) Only 50 percent of meal and entertainment expenses allowed as deduction

(1) In general, The amount allowable as a deduction under this chapter for—

(3) Special rule for individuals subject to Federal hours of service

In the case of any expenses for food or beverages consumed while away from home (within the meaning of section 162(a)(2)) by an individual during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation, paragraph (1) shall be applied by substituting “80 percent” for “50 percent”.

[iii] IRC 162(a) In general

There shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including—

(2) traveling expenses (including amounts expended for meals and lodging other than amounts which are lavish or extravagant under the circumstances) while away from home in the pursuit of a trade or business

[iv] IRC 67 (a) General rule

In the case of an individual, the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.

IRC 62(2)(a) - Reimbursed expenses of employees

The deductions allowed by part VI (section 1616 and following) which consist of expenses paid or incurred by the taxpayer, in connection with the performance by him of services as an employee, under a reimbursement or other expenses allowance arrangement with his employer. The fact that the reimbursement may be provided by a third party shall not be determinative of whether or not the preceding sentence applies.

[v] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction under IRC 67 for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits”.

In general, under “Tax Reform and Jobs Act” company OTR drivers that previously claimed itemized deductions for unreimbursed employee expenses will likely experience a tax increase[1]. The following tables are designed to assist OTR employee truck drivers in evaluating the impact of the Tax Reform Act passed into law on December 22, 2017.

Example A: Earned $50,000 in 2017 and claimed itemized deductions of $21,601, which included $14,868 of net per diem[2], $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. Your tax bill will increase $1,034.

Example B: Earned $50,000 in 2017 and claimed the standard deduction of $6,350. Your tax bill will decrease $1,309.

Example A: Earned $50,000 in 2017 and claimed itemized deductions of $21,601, which included $14,868 of net per diem, $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. Your tax bill will increase about $475.

Example B: Earned $50,000 in 2017 and claimed the standard deduction of $12,700 with no dependent children. Your tax bill will decrease about $717.

Questions? Contact Mark W. Sullivan, EA

This article was written by Mark W. Sullivan, EA, who has been providing taxpayer advocacy, consulting, and litigation services since 1998. Prior to starting a private practice, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. He has over a decade of experience advising transportation industry clients with respect to per diem issues.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and miscellaneous expenses.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.