Tax Saving Tips For Owner Operators & Family-Run Trucking Businesses - Schedule C vs S-Corp Election

Pros & Cons: Schedule C vs S-Corp for Self-Employed Truckers is from "Making The IRS Work In Your Favor" presented by Mark W. Sullivan, EA at the CMC LIVE hosted by Kevin Rutherford and Let's Truck.

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

General rule of thumb

Pros & Cons: Schedule C vs S-Corp for Self-Employed Truckers general rule of thumb:

- Net earnings below $65,000 - Schedule C sole-proprietorship

- Net earnings in excess of $65,000 - LLC taxed as an S-Corporation

It is important to note that entity classifications like Limited Liability Company (LLC) and Limited Liability Partnership (LLP) are a function of state law and not federal. For federal purposes the entity type is a tax election.

Schedule C

Pros

- One owner

- No requirement to pay W-2 wages

- Lower tax compliance costs

- No quarterly employment taxes to remit

- No unemployment taxes to pay

- Simpler income tax return

- Qualifies for 20% pass-through deduction applies to net income

Cons

- Owner cannot take non-wages draws not subject to self-employment tax

- All income is subject to self-employment tax

- Higher income tax rates

Introducing Per Diem Plus Small Fleets, an affordable, customizable per diem solution for solo and team operators

S-Corporation

Pros

- One owner

- Owner can take non-wage draws not subject to self-employment tax

- Only wages subject to self-employment tax

- Lower income tax rates

- Qualifies for 20% pass-through deduction applies to net income less wages

Cons

- Owner must receive reasonable wages

- Higher tax compliance costs

- Quarterly employment taxes to remit

- Annual unemployment taxes to pay

- Form 1120S

What qualifies as "reasonable wages" has been a matter of debate for more than 100 years. However, in trucking a safe-haven would be to pay yourself a wage equal to that which an employee truck driver would be paid for doing the same job. Hint: Paying yourself $20,000 of wages as an OTR driver clocking 110,000 miles annually and $80,000 of draw would likely be classified as unreasonable.

The procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect. Below are topics that frequently arise when new business owners ask the Internal Revenue Service questions about paying themselves.

Corporate officers

An officer of a corporation is generally an employee. However, an officer who performs no services or only minor services and who neither receives nor is entitled to receive any pay is not considered an employee. Refer to "Who Are Employees?" in Publication 15-A, Employer's Supplemental Tax Guide.

Partners

Partners are not employees and should not be issued a Form W-2, Wage and Tax Statement, in lieu of Form 1065, Schedule K-1, for distributions or guaranteed payments from the partnership. Refer to Tax Information for Partnerships page for more information.

Dividend distributions

Any distribution to shareholders from earnings and profits is generally a dividend. However, a distribution is not a taxable dividend if it is a return of capital to the shareholder. Most distributions are in money, but they may also be in stock or other property. For information on shareholder reporting of dividends and other distributions, refer to Publication 550, Investment Income and Expenses.

Form 1099-NEC or Form W-2

You cannot designate a worker, including yourself, as an employee or independent contractor solely by the issuance of Form W-2, Wage and Tax Statement or Form 1099-NEC, Nonemployee Compensation. It does not matter whether the person works full time or part time. You use Form 1099-NEC to report payments to others who are not your employees. You use Form W-2 to report wages, car allowance, and other compensation for employees.

Treating employees as nonemployees

You will be liable for social security and Medicare taxes and withheld income tax if you do not deduct and withhold them because you treat an employee as a nonemployee, including yourself if you are a corporate officer, and you may be liable for a trust fund recovery penalty. Refer to Publication 15, Circular E, Employer's Tax Guide for details about the trust fund recovery penalty or Independent Contractor (Self-Employed) or Employee? for more information on employee classification.

Shareholder loan or officer's compensation?

A loan by a corporation to a corporate officer should include the characteristics of a loan made at arm's length. That is, there should be a contract with a stated interest rate, a specified length of time for repayment, and a consequence for failure to repay the loan. Collateral would also be an indication of a loan. A below-market loan is a loan which provides for no interest or interest at a rate below the federal rate that applies. If a corporation issues you, as a shareholder or an employee, a below-market loan, then depending on the substance of the transaction the lender's payment to the borrower is treated as a gift, dividend, contribution to capital, payment of wages, or other payment.

See "Below-market interest rate loans" under Employees' Pay / Kinds of Pay / Loans or Advances in Publication 535, Business Expenses for more information.

Reasonable compensation

Because an officer of a corporation is generally an employee with wages subject to withholding, corporate officers may question what is considered reasonable compensation for the efforts they contribute to conducting their trade or business. Wages paid to you as an officer of a corporation should generally be commensurate with your duties. Refer to "Employee's Pay, Tests for Deducting Pay" in Publication 535, Business Expenses for more information. Public libraries may have reference sources that provide averages of compensation paid for various types of services. The Internal Revenue Service may determine that adjustments must be made to the income and expenses of tax returns for both the corporation and an individual shareholder if the officer is underpaid for services provided.

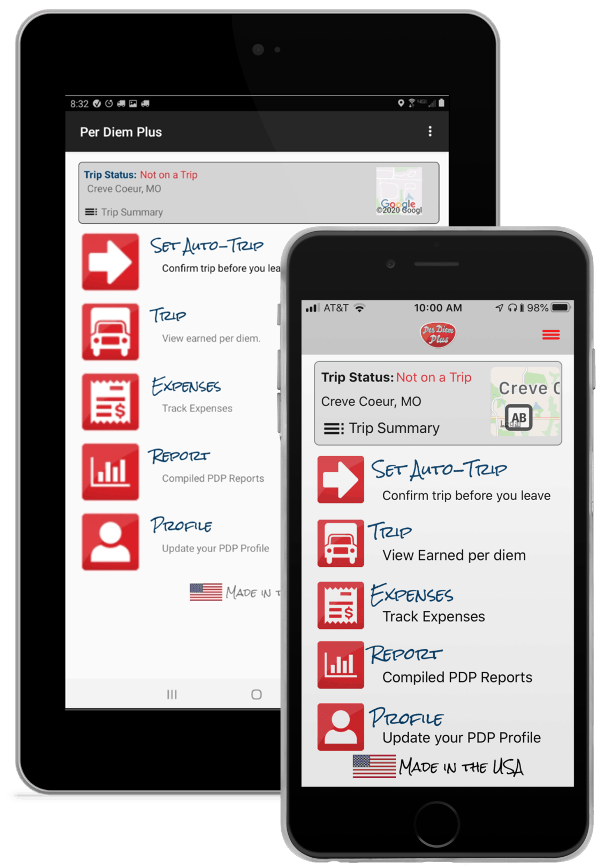

Drivers, try Per Diem Plus absolutely free for 30 days!

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus Software Platform

- ELD-Integrated: Per Diem Plus API for Samsara

- Native Android & iOS Mobile Apps: Per Diem Plus - Owner Operators and Per Diem Plus Small Fleets

- Deep Link for Platform Science and Transflo Mobile

- APK to distribute via MDM

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

About Per Diem Plus

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article includes general tax information, and therefore may not be relied upon as legal authority. This means that the information cannot be used to support a legal argument in a court case. Please consult with a licensed tax professional.

Copyright 2020-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®