Designed by drivers, built by tax pros

Our tax experts jotted down some common questions customers have asked us about trucker per diem rules for fleets.

What is per diem?

The term"per diem allowance" means a payment under a reimbursement or other expense allowance arrangement that is — (1)

- Paid for ordinary and necessary business expenses incurred, or that the payor reasonably anticipates will be incurred, by an employee for meal and incidental expenses, for travel away from home performing services as an employee of the employer.

- Paid at or below the applicable transportation industry per diem rate.

Trucker per diem rules for fleets eliminate the need for proving actual costs for meals & incidental expenses incurred.

Related Articles:

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Under the 2017 Tax Cuts & Job Act can motor carriers still offer per diem to employee drivers?

Yes. Drivers that receive a non-taxable per diem reimbursement from their employer (trucking company) do so under IRC Sec 62(2)(a).

Which employee drivers qualify for per diem?

Under the trucker per diem rules for fleets a motor carrier can offer per diem only to drivers who are:

- Subject to DOT HOS,

- Who travel away from home overnight where sleep or rest is required, and

- Do not start and end a trip at home on the same DOT HOS 14-hour work day.

Can all truck drivers receive per diem?

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot receive per diem.

- Per Diem Plus automatically detects truck driving trips that do not meet the IRS per diem requirements.

- As of January 1, 2018 employee (company) drivers can no longer claim per diem on their Form 1040, US Income Tax Return, as an itemized deduction on Schedule A.

Will a motor carrier save money by implementing a company-paid per diem plan?

A fleet will save approximately $3,000 annually or $0.03/mile/driver as the payroll tax and worker compensation savings exceed the tax on the 20% nondeductible portion of per diem.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Will a per diem plan raise driver pay?

Yes. On average driver pay will increase from $0.03 - $0.04/per mile.

What documentation is required to substantiate driver per diem?

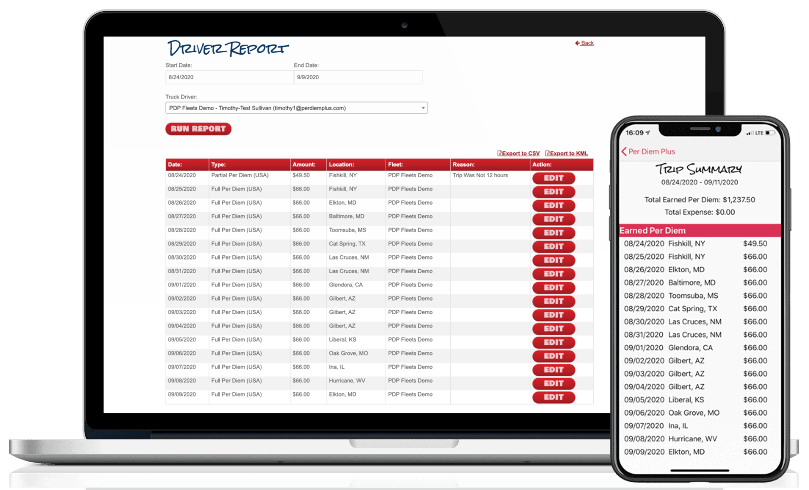

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

What documentation meets the IRS substantiation requirements?

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Per Diem Plus automatically records per diem for travel in the USA and Canada for solo and team drivers.

Is company-paid per diem taxable as income to an employee driver under an accountable fleet per diem plan?

No. Per diem is classified as a non-taxable reimbursement to an employee driver and is not reported under wages on Form W-2.

What are the current per diem rates for travel in the USA & Canada?

IRS increased per diem rates effective October 1, 2018 (Revised 10/01/2021)

USA $69 from $66

Canada $74 from $71

Can a driver receive per diem for partial days of travel?

Yes. A partial day is 75% of the per diem rate.

- Partial per diem rate USA $51.75, Canada $55.50

- Per Diem Plus will record 3/4 per diem when a driver departs their tax home AFTER noon or returns to their tax home BEFORE noon.

- Per Diem Plus - Owner Operators and Fleets platform are the only telematics-based solutions that can calculate partial per diem. [See IRS Rev. Proc. 2011-47 Sec 6.04]

How much per diem can a fleet deduct on the corporate income tax return?

A fleet can deduct 80% of per diem on their income tax return. However, the payroll tax and worker compensation savings ordinarily exceed the tax on the nondeductible portion of per diem.

- Congress increased the deductibility of per diem to 100% for tax years 2021 and 2022

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount are required. Drivers can upload and store receipts on the Per Diem Plus FLEETS app. Watch Run IRS Compliant Reports with Receipts video to see how easy drivers can send an itemized expense reports with receipts to payroll or accounting.

Can a fleet pay per diem for lodging?

No. There is no published guidance from IRS that allows a fleet to pay a lodging per diem.

A self-employed driver (owner operator) falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

How long should tax records be retained?

No less than 3 years from the filing date of an income tax return. Per Diem Plus FLEETS customers have instant access to itemized per diem tax records for four years.

ELD backups used to substantiate "time, date and place" are considered tax records.

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47. Or, use the Per Diem Plus FLEETS platform that automates administration of a company-paid per diem plan and takes the guesswork out of tax-related record keeping. Our How it Works video demonstrates just easy the app is to use.

Get in touch with the experts at Per Diem Plus today to discuss a smooth rollout for your system.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus Software Platform

- ELD-Integrated: Per Diem Plus API for Samsara

- Native Android & iOS Mobile Apps: Per Diem Plus - Owner Operators and Per Diem Plus Small Fleets

- Deep Link for Platform Science and Transflo Mobile

- APK to distribute via MDM

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

About Per Diem Plus

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®