The ability of Per Diem Plus to calculate 8,892 partial per diem days yielded one customer $460,000 of additional per diem

Beware: How Inadequate Per Diem Solutions Can Rob You Of Savings

Beware: How inadequate per diem solutions can rob you of savings. A recent New York Post article acutely observed that the Producer Price Index, the most useful measure of general inflation, was up a whopping 16.3% from April 2021, per the Bureau of Labor Statistics. That means that roughly $1 out of every $6 that people earn has been lost to inflation in a single year. Or to put it another way, 80 minutes’ earnings out of every eight-hour day have been eaten up.1 Motor carriers that figure out how to best navigate sky-high inflation and a shrinking U.S. labor force while recruiting and retaining drivers will have a market advantage over lesser fleets when inflation decreases. The keywords: Recruiting and retention.

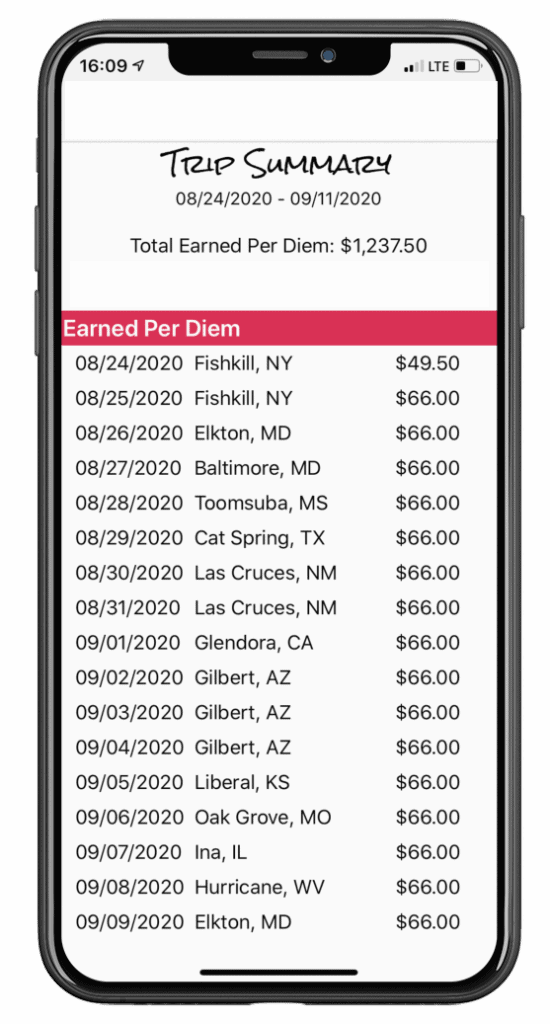

Introducing a fleet-sponsored driver per diem program, coupled with temporary 100% deduction for per diem in 2022, will immediately reduce a motor carrier's expenses, enhance recruiting and retention and increase driver take-home pay. Per Diem Plus® customers can implement in minutes our IRS-compliant telematics-based substantiated per diem solution, which automates trucker per diem tracking for solo and teams traveling in the USA and Canada. The Per Diem Plus API and mobile apps include the unique ability to calculate full and qualifying partial per diem days, which can substantially increase the tax savings for both fleets and drivers2.

Analyzing real-world fleet per diem data is the best method for quantifying this exceptional feature to project the financial benefit partial per diem days have for both the fleet and drivers.

Example 1

Based on an automated weekly fleet per diem report, 129 or 36% of 354 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

- 8,580 partial per diem days increased annual driver per diem by $444,015

- The fleet realized an additional $33,301 in payroll tax savings from partial per diem…which only PDP can do!

- Married and single drivers saved an additional $240 and $312 respectively in federal income taxes

- Overall annual tax savings to fleet of $476,490

Example 2

A motor carrier that offers a $0.11/mile per diem is evaluating switching to a substantiated per diem program using the free trial of Per Diem Plus for Samsara. Based on an automated weekly beta test fleet report, 30 of 100 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

- 1,716 partial per diem days increased annual driver per diem by $88,764

- The fleet realized an additional $6,730 in payroll tax savings from partial per diem…which only PDP can do!

- Married and single drivers saved an additional $205 and $267 respectively in federal income taxes

- Overall annual tax savings to fleet of $134,602 or $27,311 more than a cent-per-mile program

Trucker Per Diem Overview

What is the IRS special trucker per diem rate?

- $69/day for travel in the US

- $74/day for travel in Canada

What is partial per diem?

- Generally, a driver departs their tax home AFTER noon or returns to their tax home BEFORE noon is entitled to partial per diem3

- A truck driving trip lasting less than 12 hours [IRS day is 12:01 - Midnight]

- Partial per diem rate USA $51.75, Canada $55.50

Which employee drivers qualify for per diem?

- Subject to DOT HOS,

- Who travel away from home overnight where sleep or rest is required, and

- Do not start and end a trip at home on the same DOT HOS 14-hour workday

What documentation is required to substantiate driver per diem?

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Read Intercity Lines Case Study

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

About Per Diem Plus

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

No matter how big or small your company is, Per Diem Plus has a cost-effective solution for you.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

1 - Glenn H. Reynolds, "Why team Biden might be purposely grinding down the middle class", New York Post, May 26, 2022

2 - IRS Rev. Proc. 2011-47 6.04

3 - IRS Rev. Proc. 2011-47 6.04.2

Copyright 2017-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®