“Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

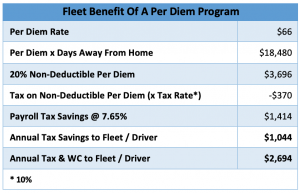

The Per Diem Plus® FLEETS mobile platform is a cost-effective solution that enables fleets to easily implement an IRS-compliant substantiated per diem plan[ii] that will raise employee driver take-home pay and enhance recruiting and retention. Implementing a per diem plan will offset the elimination of driver tax deductions for per diem and unreimbursed employee business expenses[iii]. A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

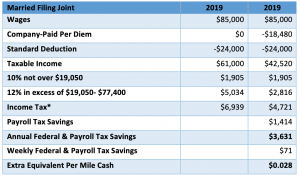

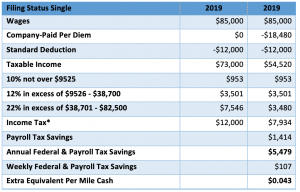

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.

A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.

Payroll computation: Per diem is treated as pre-tax deduction; employment and income taxes are computed and withheld; per diem is added back to payroll as a non-taxable reimbursement. A company that offers a per diem program is required to prove

- Drivers were away from home overnight

- Identify the “date, place and amount” of each per diem event

- Retain substantiation through the retention of ELD backups or Per Diem Plus platform for no less than 3 years[v]

BOTTOM LINE: Fleets that offer a per diem program can increase their driver’s earning potential by thousands of dollars per year with relative ease by partnering with Per Diem Plus.

Drivers, tell your fleet managers about Per Diem Plus or download it yourself and try it free for 30 days – No Credit Card Required.

Fleets, please contact us to learn more about partnering with Per Diem Plus. Or, download our FLEETS Product Sheet for a high-level overview on how we can work together.

for a high-level overview on how we can work together.