PDP For Fleets - 3 Months Free

Presented by Mark W. Sullivan, EA - Tax Counsel for Per Diem Plus, LLC

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

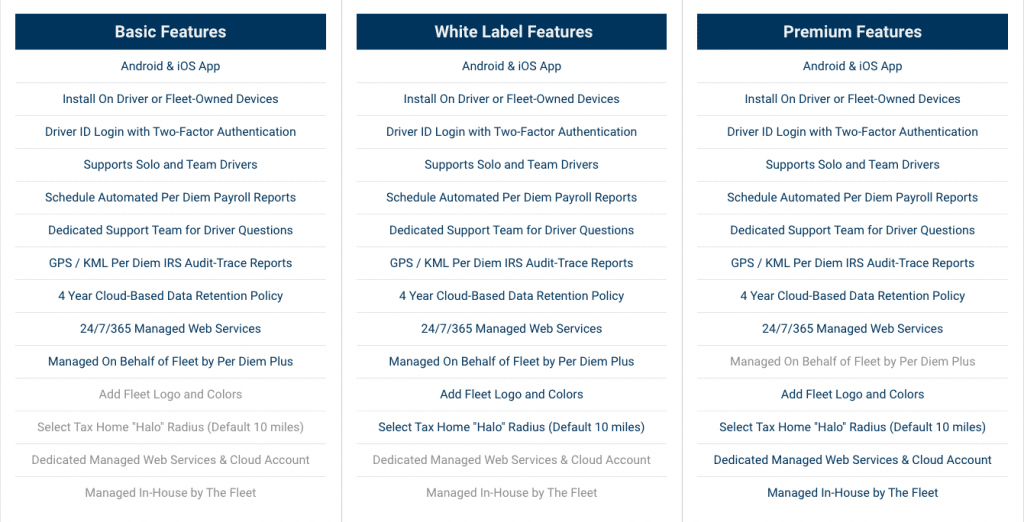

Per Diem Plus® FLEETS is a configurable mobile application platform that automates administration of an IRS-compliant accountable trucker per diem plan for fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Truckers designed it, tax pros built it, drivers want it. Our cloud-based FLEETS mobile app platform enables motor carriers to implement an IRS-compliant fleet per diem plan that will:

"Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions.

Configure your per diem app in minutes with our simple check-the-box menu.

For example, the app allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 50 miles and that best matches fleet lanes and app installation type. Or to minimize cellular data plan usage you can white list the app using our static IP address.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

* Deep-link integration scheduled for Q4 2020 release

Per Diem Plus 2020. All rights reserved. Per Diem Plus is a trademark of Per Diem Plus, LLC. A proprietary software application, which provides automatic per diem and expense tracking for truckers (USPTO Registration #86754053)

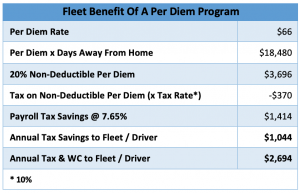

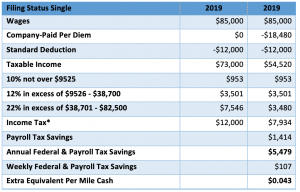

The ELD mandate has contributed to record freight rates that, along with tax reform, have been a boon for trucking companies. Unfortunately, due to the prospect of lower wages for employee drivers resulting from the elimination of itemized deductions, many prospective drivers are opting for a gig-economy. As such, the driver shortage will continue to get worse unless fleets take proactive steps that mitigate the negative financial impact on drivers[i]. A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

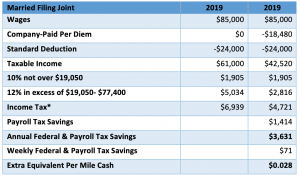

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.

A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.

On November 16, 2017 The U.S. House of Representatives passed H.R. 1 “Tax Cuts and Job Act”[1]. The U.S. Senate has released a companion tax overhaul bill that is scheduled for debate in the coming weeks. The House bill proposes 4 tax brackets and the Senate 7, but both bills propose among other things eliminating the deductibility of unreimbursed business expenses for employee truck drivers. In general, under both the Senate and House proposals company OTR drivers that previously claimed itemized deductions for unreimbursed expenses will experience a tax increase.

Example – Single Driver: OTR driver Wayne earned $50,600 in 2016. He filed his tax return as single and claimed itemized deductions of $21,038, which included $14,868 of net per diem, $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. His tax bill will increase $1,052 under the Senate plan and $1,243 under the House plan.

What would the impact be on Wayne if he was married? The tax overhaul increases his tax bill by $ 469 under the Senate plan and $850 under the House plan.

This article was written by Mark W. Sullivan, EA, who has been providing taxpayer advocacy, consulting, and litigation services since 1998. Mr. Sullivan has over a decade of experience advising transportation industry clients in per diem issues.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2017 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.

[1] https://www.congress.gov/congressional-report/115th-congress/house-report/409/1

To enroll or not to enroll in a company-paid per diem program that includes a fleet per diem administration fee, that is the question.

Background: ABC is a truckload carrier that offers voluntary company-paid per diem. Drivers who enroll are paid $.045 CPM of which $0.10 CPM is allocated to per diem, less a $0.02 CPM fleet administration fee. Drivers who choose not to enroll earn a flat $0.45 CPM and can deduct per diem on their own tax return.

John Smith recently went to work for ABC and is unsure if he should enroll in the company per diem plan. He departs home every Monday morning and returns home Friday evening, averages 2250 miles per week and works 50 weeks a year. John is married, but his wife is not working. He owns a modest home, and pays state income, real estate and personal property taxes.

The motor carrier claims he will take home more money and pay less taxes if he enrolls in their per diem program even after giving back $2,250 in fleet administration fees.

Conclusion: John may save a few hundred dollars in federal taxes, but he must forfeit $2,250 of additional income to do so. In addition, the tax savings come at an additional cost: $9,000 of wages omitted from his Form W-2 that will be noticed by a home or auto lender and may lower his employer 401(k) match, social security and workers compensation benefits.

This article was written by D R Sullivan & Company, CPA PC, an accounting firm that has been providing taxpayer advocacy, consulting, and litigation services since 1998. The firm is tax counsel for Per Diem Plus, an automated per diem and expense tracking mobile app.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.

A Catch 22 For Drivers

Drivers currently retain ownership of their paper logbooks to comply with the IRS income tax regulations. Now that the U.S. Court of Appeals for the Seventh Circuit has upheld the ELD mandate and ruled that the FMCSA has satisfied the objections made by the Owner Operators Independent Drivers Association, who will “own” the logbook data1? While the media is awash with articles either applauding or deriding the court's decision, everyone has overlooked the mandate’s impact on tax compliance recordkeeping obligations for individual truck drivers. Everyone but Per Diem Plus.

The history of the IRS is that they ONLY accept driver DOT logbooks as proof of overnight truck driving trips to substantiate travel expenses, like per diem. Treasury Regulation 1.274-5A(c)(2) governs the rules for substantiation of travel expenses. A logbooks meets the requirements because it is a contemporaneous record that is created "at or near the time the expense or travel occurred"2 and establishes the "time, date and place" of the travel3. Contrary to popular belief a calendar or bookkeeper’s guesstimate worksheet of per diem trips does not fulfill these statutory requirements.

A Statutory Conflict - 6 month / 3 year rules

FMCSA Part 395 section 395.8(k)(1) requires motor carriers to retain all supporting documents used by the motor carrier to verify the information recorded on the driver’s record of duty status for a period of 6 months4. But...

Internal Revenue Code section 6501(a) establishes the statute of limitations for the IRS to assess taxes on a taxpayer expires three (3) years from the due date of the return or the date on which it was filed, whichever is later.

Drivers currently retain their logbooks to comply with income tax reporting and filing obligations. However, in my experience, since motor carriers own the ELD device they will assert ownership of the ELD data as well. And while fleets retain certain records required by FMCSA to comply with tax regulations, those using ELD’s promptly discard driver logbooks after 6 months. More troublesome is the revelation that many large fleets who were early adopters of ELD’s are now refusing to provide copies of the e-logs to their drivers. Will this behavior permeate the industry as fleets transition from paper to electronic logs?

What this means to you is that you may not have access to ELD data that is critical to both accurately claiming per diem expenses and defending yourself in the event of an audit. This will be particularly true if a driver is employed by multiple fleets during a calendar year. In the end, drivers will find themselves in a Catch 22 - a driver can have only one logbook that the motor carrier will now own so a driver cannot properly file income tax returns as they no longer have access to the logbook data.

Drivers that use Per Diem Plus have access to their data for four years whether they are driving for a company or themselves. Own your data and simplify your life by using the Per Diem Plus mobile app.

Want to join the conversation? Drop us a line at info@perdiemplus.com

This article was written by Mark W. Sullivan of D R Sullivan & Company, CPA PC, an accounting firm that has been providing taxpayer advocacy, consulting, and litigation services since 1998. The firm has nearly a decade of experience advising motor carriers and telematics providers on IRS substantiated per diem and is tax counsel for Per Diem Plus®, an IRS-compliant automated per diem and expense tracking Android and iOS app.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.

FMCSA Part 395 section 395.8(k)(1)

Supporting documents are the records of the motor carrier which are maintained in the ordinary course of business and used by the motor carrier to verify the information recorded on the driver’s record of duty status. Examples are: bills of lading, carrier pros, freight bills, dispatch records, electronic mobile communication/tracking records, gate record receipts, weight/scale tickets, fuel receipts, fuel billing statements, toll receipts, toll billing statements, port of entry receipts, cash advance receipts, delivery receipts, lumper receipts, interchange and inspection reports, lessor settlement sheets, over/short and damage reports, agricultural inspection reports, driver and vehicle examination reports, crash reports, telephone billing statements, credit card receipts, border crossing reports, custom declarations, traffic citations, and overweight/oversize permits and traffic citations. Supporting documents may include other documents which the motor carrier maintains and can be used to verify information on the driver’s records of duty status. If these records are maintained at locations other than the principal place of business but are not used by the motor carrier for verification purposes, they must be forwarded to the principal place of business upon a request by an authorized representative of the Federal Highway Administration (FHWA) or State official within 2 business days.

Per diem simply means a “per day” travel expense allowance. Although taxpayers have the option of keeping actual records of their travel expenses, the IRS has provided per diem allowances under which the amount of away-from-home meals and incidental expenses may be deemed to be substantiated. These per diem allowances eliminate the need for proving actual costs. However, a taxpayer must substantiate the amount, time, place and business purpose of expenses paid or incurred by adequate records or other evidence when traveling away from home1.

Both self-employed and employee truck drivers subject to the hours of services limitations of the Department of Transportation (DOT) can claim $63 for meals & incidental expenses (M&IE) for travel with the United States ($68 in Canada) and are not required to retain receipts or sales slips for these expenses. A trucker can deduct 80% of these expenses on their income tax returns2.

A truck driver who is away from home for only a portion of a day can prorate the M&IE allowance. For example, Per Diem Plus allows 75% of the M&IE rate where a driver departs their tax home after noon or returns home from a trip before noon.

No. Incidental expenses include only fees and tips given to porters, baggage carriers, hotel staff and staff on ships. Transportation between place of lodging and place where meals are taken and the mailing cost of filing expense reports are no longer included in the definition of incidental expenses3. Drivers using per diem rates may separately deduct expenses for postage, showers and reserved parking fees.

In order to claim any deduction, a taxpayer must be able to prove, if a tax return is audited, that the expenses were in fact paid or incurred. The IRS deems travel expenses particularly susceptible to abuse and requires truck drivers maintain an adequate accounting and sufficient documentary evidence to prove overnight travel. For example, logbooks, expense diaries or an IRS-approved software tool like Per Diem Plus.

Self-employed and employee drivers cannot claim per diem for lodging and are required to maintain documentary evidence for all lodging expenses4.

No. An individual is not away from home unless their duties require them to be away from the general area of their home for a period substantially longer than an ordinary workday and it is reasonable for them to need to sleep or rest5. For example, drivers who start and end a trip at home within the DOT 14 consecutive-hour “driving window” cannot claim per diem.

Tax home defined: An individual’s tax home is considered to be: (1) the taxpayer’s regular place of business, or (2) the taxpayer’s home in a real and substantial sense6. A taxpayer who is itinerant or someone who has a home wherever they happen to be working is never away from home for purposes of deducting traveling expenses.

This article was written by D R Sullivan & Company, CPA PC, an accounting firm that has been providing taxpayer advocacy, consulting, and litigation services since 1998. The firm has nearly a decade of experience advising large fleets and telematics providers on IRS substantiated per diem and is tax counsel for Per Diem Plus, an automated per diem and expense tracking Android app.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. The Per Diem Plus logo and Per Diem Plus are trademarks of Per Diem Plus, LLC.

An employee truck driver asked the following question to the Per Diem Plus tax experts during the 2016 MidAmerica Truck Show: "Is cent per mile or IRS daily rate per diem better for a driver?"

The cent per mile per diem method has been the transportation industry standard for decades and is most often utilized by fleets who offer employee drivers company paid per diem. Under the cent per mile method a driver is paid only for miles driven and not nights away from home.

Although, a driver may travel 500 miles one day but only 250 miles the next, the distance traveled does not affect the need to eat three meals a day. To remedy this problem the IRS introduced the Special Transportation Industry* daily rate per diem that ignores miles traveled and relies on days away from home. The most beneficial aspect to a driver is that per diem can be claimed during a 34 hour restart and unforeseen delays like breakdowns, waiting for permits or weather.

The table below illustrates the advantage of choosing daily rate per diem:

This article was written by D R Sullivan & Company, CPA PC, an accounting firm that has been providing taxpayer advocacy, consulting, and litigation services since 1998. The firm has nearly a decade of experience advising large fleets and telematics providers on IRS substantiated per diem and is tax counsel for Per Diem Plus, an automated per diem and expense tracking Android app.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. The Per Diem Plus logo and Per Diem Plus are trademarks of Per Diem Plus, LLC.

Per Diem Plus has released two new updates:

Delete Expense: Allows users to delete duplicate or erroneous expenses entries.

Fuel (IFTA) Expense Category: Allows users to record and track IFTA and Non-IFTA Fuel / Oil / Additives purchases separately.

Note: As devices pick-up the Expense List changes users may see both the "Fuel / Oil / Additives" and "Non-IFTA Fuel / Oil /Additives" listed in the Reports. Per Diem Plus will run a routine a few times over the next two weeks to get all the "Fuel / Oil / Additives" entries in the data base changed to "Non-IFTA Fuel / Oil /Additives". Once updated users will only see previously recorded Fuel / Oil / Additives expenses under "Non-IFTA Fuel / Oil /Additives" in the Reports.

User Tip: Edit combined IFTA / Non-IFTA Fuel purchases by creating separate expenses for each category. Users can edit the original expense entry for IFTA purchases and create a new expense Non-IFTA purchases. Use the "Select Photo From Gallery" to import a receipt image for the edited expenses.

If you have any questions regarding the Per Diem Plus Android application, please do not hesitate to contact us at support@perdiemplus.com.

We recently communicated with a 27-year ex-trucker turned IRS Revenue Agent who was interested in how Per Diem Plus calculates overnights for Per Diem.

Per Diem Plus’ tax logic is based on a decade of experience advising motor carriers on IRS-compliant per diem programs. The app software applies the Treasury Regulations and GSA federal travel rules to establish “overnight” travel where the app pings the mobile device throughout a 24-hour day (12:01 am – Midnight) and determines GPS location relative to specific times of the day, most notably noon and midnight, to establish the required “time, date and place” substantiation required by Treasury Regulation 1.274-5A and IRS Revenue Procedure 2011-47 (superseded most recently by 2015-63).

Highlights: