Designed by drivers, built by tax pros

Which per diem method saves a fleet more money? Substantiated per diem saves a motor carrier the most money, since the fleet benefits are directly proportional to total per diem paid to drivers. So how did cent-per-mile per diem become so popular in the trucking industry? Decades before the advent of telematics fleets adopted cent-per-mile per diem for because it was easy to calculate. However, there is no correlation between the miles a driver travels and meal breaks.

Which per diem method do drivers prefer?

Drivers prefer substantiated special trucker per diem. Why? They eat 3 meals a day regardless of whether they drive 200 or 600 miles. The IRS introduced the Special Transportation Industry substantiated per diem to remedy this issue. In addition it simplified tax compliance for fleets by relying on nights away from home instead of miles traveled. It is also a more accurate reflection of anticipated meal expenses for drivers.

The most beneficial aspect of substantiated per diem to a motor carrier is that:

- Substantiated method yields on average 27% more per diem savings than cent-per-mile or $1 for every $8 of per diem paid to driver over cent-per-mile.

- The average fleet saves about $3,700 per driver in income and employment taxes and workers compensation.

- A fleet employing 5 OTR drivers would save about $5,112 more with substantiated per diem than a $0.11 cpm per diem plan.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Will adding a per diem program enhance driver recruiting?

Adding an accountable per diem program for employee drivers is a sure-fire way to enhance driver recruiting and retention. Consider the following:

- The typical over-the-road (OTR) driver averages 127,500 miles annually and is away from home 280 nights a year.

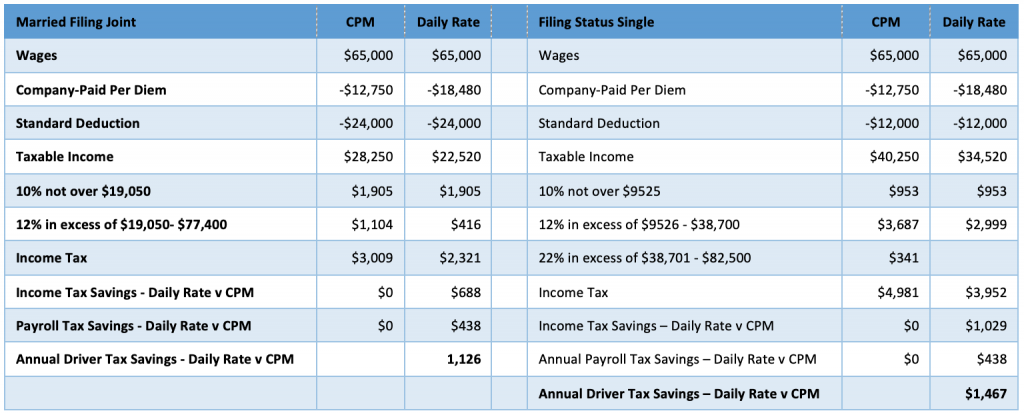

- A driver would receive $18,480 under the substantiated method, but only $12,750 under a cent-per-mile.

- Substantiated method yields on average 45% more per diem than cent-per-mile.

- Substantiated can be earned during a 34-hour restart and unforeseen delays like detention, breakdowns, or weather.

- The average driver will save an additional $1,126 - $1,467 in taxes over cent-per-mile.

Both substantiated and cent-per-mile per diem must comply with the IRS substantiation by adequate records rules. According to the IRS, "a motor carrier must maintain lrecords to establish "time, place and location" for each per diem event". The Per Diem Plus FLEETS platform satisfies this requirement since it is maintained in such manner that each recording of an element of an expenditure is made at or near the time of the expenditure.

Document retention rules:

- Per Diem Plus FLEETS utilizes a 4-year retention policy.

- A motor carrier must retain driver ELD data for a minimum of 3 years from the filing date of the corporate tax return.

The transportation industry has been unique in its treatment of driver per diem for over 30 years. The substantiated per diem method saves a motor carrier more money than cent-per-mile method. While, substantiated and cent-per-mile per diem methods are IRS-compliant, both require a motor carrier to comply with the adequate records and document retention rules.

Get in touch with the experts at Per Diem Plus today to discuss a smooth rollout for your system.

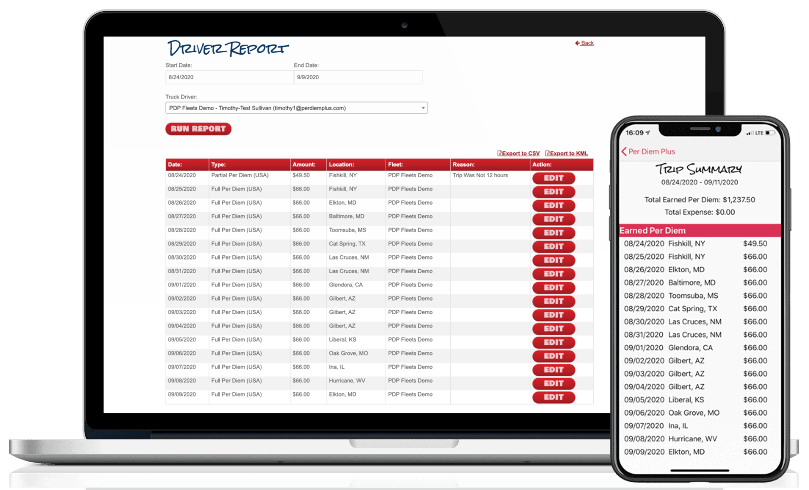

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

About Per Diem Plus FLEETS

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.