PDP For Fleets - 3 Months Free

No per diem tax analysis would be complete without addressing the state income tax considerations on driver per diem. In our last blog post, No Driver Per Diem Yields Surprise Tax Bill, we showed you an example of a driver not receiving per diem. In this article, we will show you the negative impact of living in a high-tax state.

Johnny Mills is an over-the-road company driver

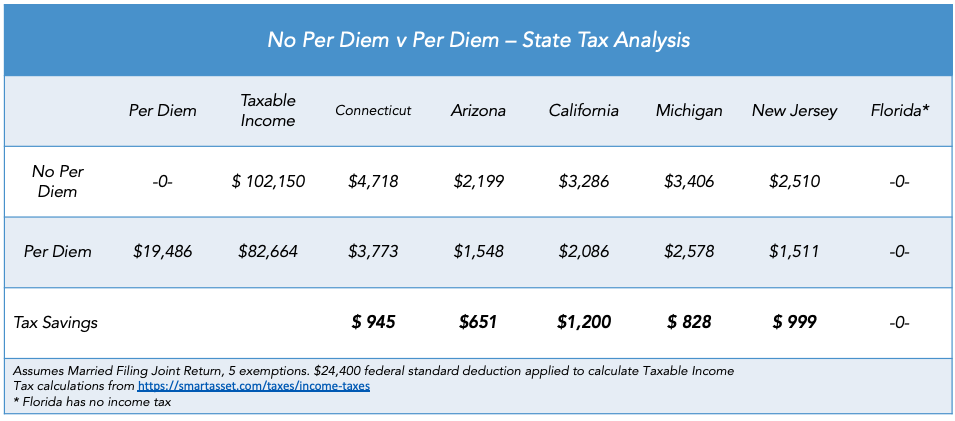

Since, Johnny elected not to enroll in the employer plan when he joined the company, he paid an extra $7,064 in federal income and payroll taxes. But how much extra state income tax did he pay? Would it make financial sense for him to move his family and transfer to one of the company's other terminals, like nearby Arizona?

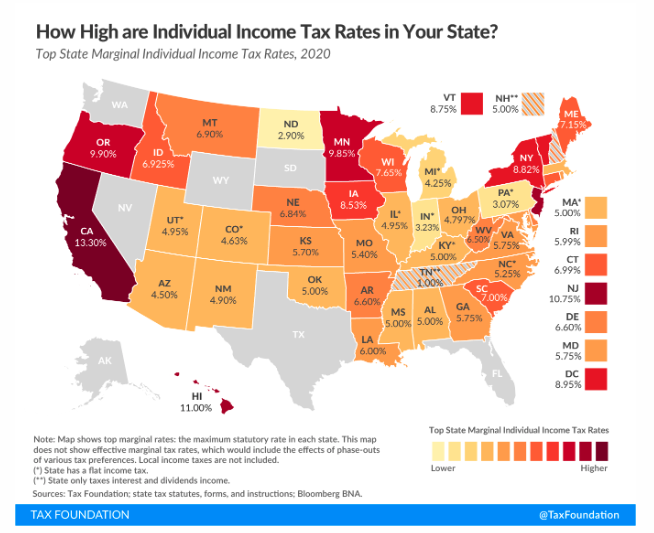

No discussion on the benefits of per diem for truck drivers would be complete without considering state income taxes. State income taxes substantially impact a driver's overall income tax burden. Drivers in high-tax states like California, Connecticut or New York should consider the state tax savings of per diem. These savings are even more pronounced when compared to low-tax states like Arizona.

State Tax Savings: Enrolling in the company per diem plan would have saved Johnny $ 945 in Connecticut income tax for 2019.

State vs State Analysis: A Connecticut driver paid $4,718 of state income tax in 2019. An identical Arizona-based driver paid only $2,199 - a $2,519 difference.

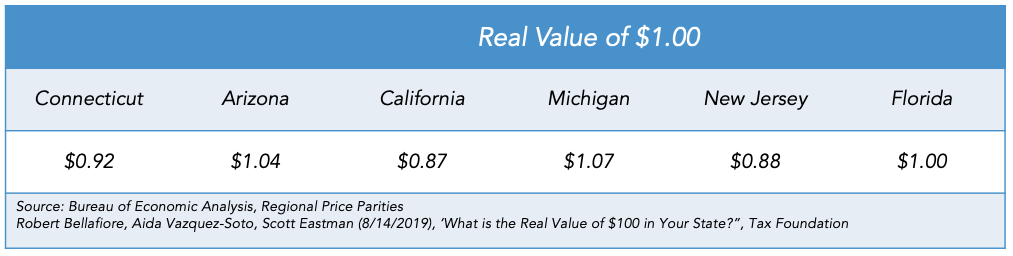

The real value of a dollar (purchasing value) must be taken into consideration in order to make state-to-state comparisons. For example, $1.00 is only worth $0.92 cents in Connecticut but $1.04 in Arizona - a 11.5% difference.

No per diem tax analysis would be complete without addressing the state income tax considerations on driver per diem. Johnny Mills received an unpleasant surprise this tax season because he did not participate in his employer offered per diem plan - an additional $7,064 of federal and $ 945 in state income taxes. Living in high-cost, high-tax Connecticut further reduced the value of his earnings by over $11,136. However, if Johnny enrolls in the company per diem plan and moves his family to a low-cost, low-tax state like Arizona it would generate about $16,198 in real dollar value.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Reference:

https://taxfoundation.org/real-value-100-state-2019/

https://taxfoundation.org/state-individual-income-tax-rates-and-brackets-for-2020/

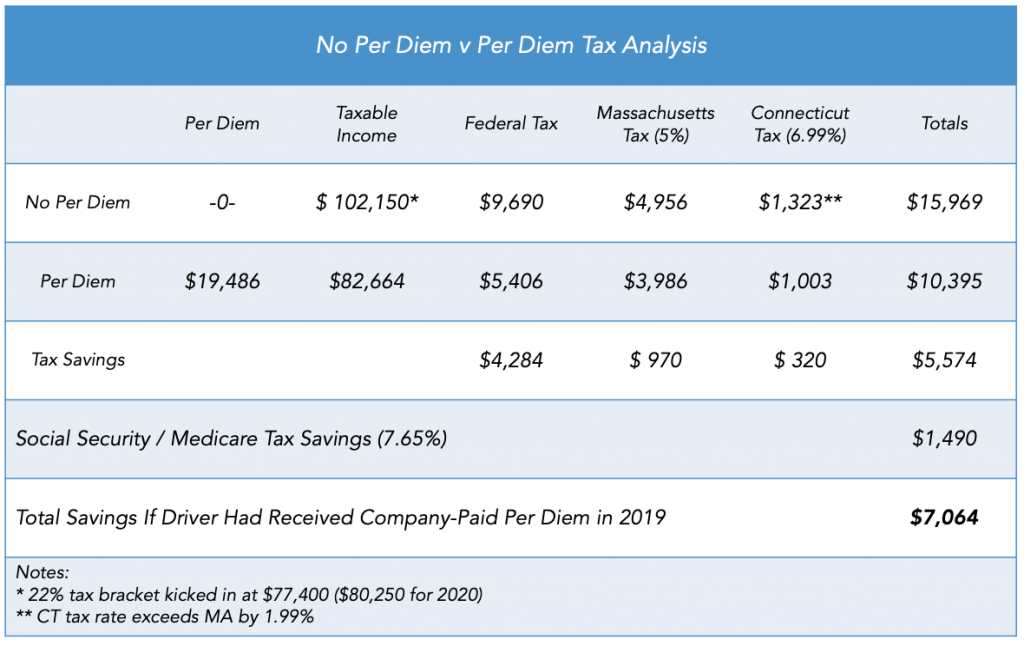

Billy is an over-the-road company driver who lives in a high-tax state with his wife and 3 children. His previous employer administered their plan through Per Diem Plus FLEETS. Unfortunately, his new company doesn't offer per diem. He understood per diem saves a driver significant taxes and worried his tax refund would be much smaller.

After quickly assembling his tax records for his accountant he received an unwelcome surprise:

The table highlights the federal and state tax consequence of Billy's employer not having a driver per diem program.

Billy received an unpleasant surprise this tax season because his employer did not offer per diem

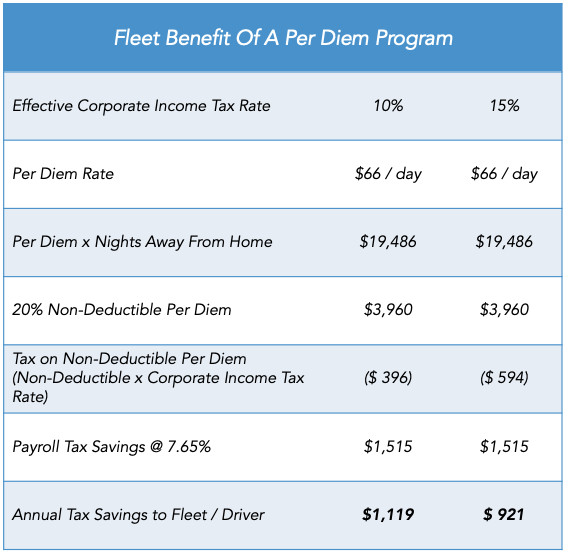

Why does Billy's employer not have a per diem program? Like many trucking companies they incorrectly assume that a company-sponsored per diem program will cost them money. In fact, the table below shows the tax due on the 20% non-deductible portion of per diem is offset by the payroll tax savings. In addition, a CASE STUDY demonstrated a trucking company saved $3,000 per driver by imlementing the Per Diem Plus FLEETS. Billy's employer would actually have saved over a thousand dollars in taxes per driver.

Fleets that adopt the Per Diem Plus FLEETS mobile platform will not only enhance driver retention and recruiting, but save many thousands of dollars in the process.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. Furthrmore, it is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.