PDP For Fleets - 3 Months Free

First impressions are that the existence of the IRS tax lien will be fatal to this trucking company and prohibit the securing of accounts receivable financing (commercial transactions financing agreement). However, the IRS is more interested in collecting unpaid taxes than putting companies out of business and has procedures for resolving tax lien issues.

The trucking company is seeking a commercial transaction financing agreement (factoring) in order to improve cash flow and insure liquidity and future tax compliance. However, the IRS filed a tax lien against the company prior to granting a monthly repayment (installment) agreement.

The appropriate action is to submit a Form 14434, Application for Certificate of Subordination of the Federal Tax Lien. In this case the factoring company will require the IRS subordinate the tax lien up to the amount of the factoring credit line, while also demanding proof that IRS has approved an installment agreement (Form 433-D) for the delinquent taxes.

Generally, these are loans to a taxpayer to operate a business. The creditor and the taxpayer, in the course of trade or business, agree that loans to the taxpayer will be secured by taxpayer’s commercial financing security. Security can include, but is not limited to, accounts receivable, mortgages on real property, and inventory.

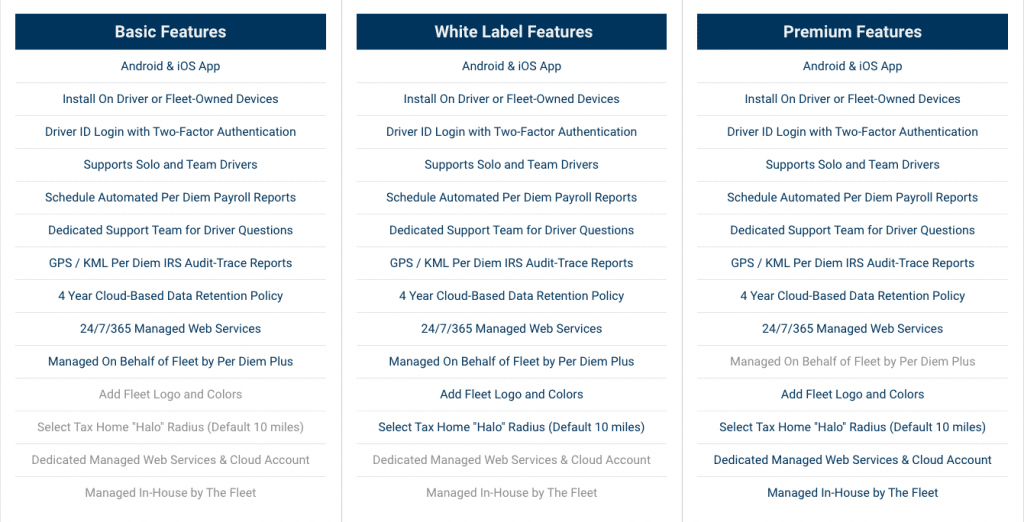

Per Diem Plus® FLEETS is a configurable mobile application platform that automates administration of an IRS-compliant accountable trucker per diem plan for fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Truckers designed it, tax pros built it, drivers want it. Our cloud-based FLEETS mobile app platform enables motor carriers to implement an IRS-compliant fleet per diem plan that will:

"Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions.

Configure your per diem app in minutes with our simple check-the-box menu.

For example, the app allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 50 miles and that best matches fleet lanes and app installation type. Or to minimize cellular data plan usage you can white list the app using our static IP address.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

* Deep-link integration scheduled for Q4 2020 release

Per Diem Plus 2020. All rights reserved. Per Diem Plus is a trademark of Per Diem Plus, LLC. A proprietary software application, which provides automatic per diem and expense tracking for truckers (USPTO Registration #86754053)

In this article we attempt to clear up the confusion on company-paid per diem caused by the recently passed Tax Reform and Jobs Act.

Under the 2017 Tax Reform and Jobs Act[i]:

The good news is that motor carriers can implement an IRS-compliant accountable per diem program using the Per Diem Plus® FLEETS mobile application platform to offset the lost tax deductions for their drivers, while enhancing recruiting and retention[ii].

“Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

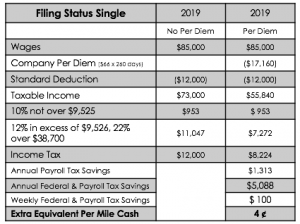

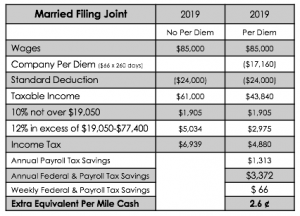

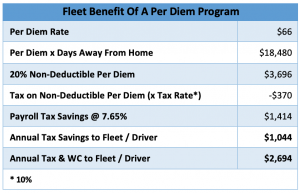

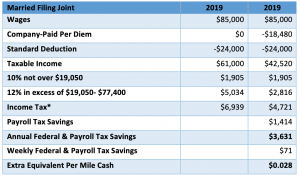

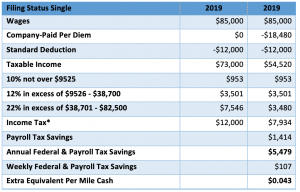

Yes. A motor carrier implementing a company-paid per diem plan can raise effective driver pay by 2.6¢ - 4¢ CPM. All per diem paid to a driver is treated as a non-taxable reimbursement and not reported on Form W-2.

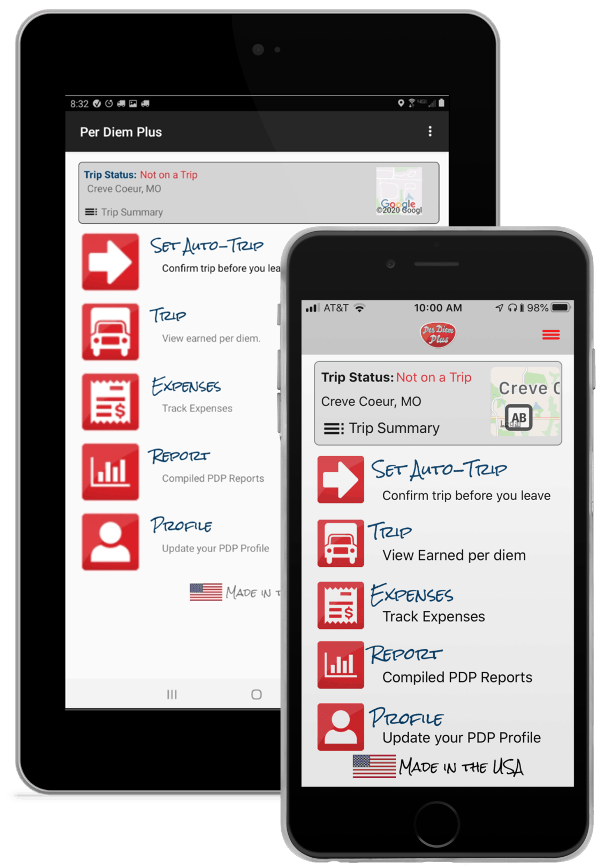

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and miscellaneous expenses.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[3] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[i] All amounts paid under the arrangement are treated as paid under an accountable plan and are excluded from income and wages.

[ii] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and other job-related expenses.

"Can I use my dog as a tax deduction" is a common questioned posed to tax professionals by long-haul truckers. Every pet owner claims their animal is a member of the family and they are an essential companion for thousands of truckers.

It understandable that taxpayers may want to recoup some of their pet expenses with a creative medical expense tax deduction[i]. To counter the urge to claim Fido as a tax deduction the IRS has promulgated guidance on what type of animals qualify.

Keep In The Know: Biden's IRS Is Coming For Your PayPal & Venmo Payments

I found dozens of websites pitching “Service Animal” registration services while researching this article. All had variations on what disabilities qualified for the tax-deductible classification. My purpose is to analyze the tax implications and not to evaluate the merits of the service animal designation. Therefore, the below discussion (where applicable) uses definitions under the Americans With Disabilities Act (ADA).

Service Dog:

Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability.

Emotional Support Dog:

Emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. The types of emotional conditions that may require the assistance of an ESD are:

Guard Dog:

There is scant guidance on the deductibility of guard dogs, however, it is clear they do not meet the statutory requirement to qualify under Internal Revenue Code 213.

A review of IRC § 213 is required to answer the question, "Can I use my dog as a tax deduction?". The costs of buying, training, and maintaining a service animal to assist an individual with mental disabilities may qualify as medical care if the taxpayer can establish that the taxpayer is using the service animal primarily for medical care to alleviate a mental defect or illness and that the taxpayer would not have paid the expenses but for the disease or illness.

IRS Chief Counsel Note:

A taxpayer who claims that an expense of a peculiarly personal nature is primarily for medical care must establish that fact. The courts have looked toward objective factors to determine whether an otherwise personal expense is for medical care:

A personal expense is not deductible as medical care if the taxpayer would have paid the expense even in the absence of a medical condition. Commissioner v. Jacobs, 62 T.C. 813 (1974). [ii]

You can include in medical expenses

In general, this includes any costs, such as food, grooming, and veterinary care, incurred in maintaining the health and vitality of the service animal so that it may perform its duties.

Generally, you can deduct on Schedule A, Itemized Deductions (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). However, with tax reform drastically increasing the Standard Deduction ($12,000 Single, $24,000 Married) most taxpayers will not have sufficient itemized deductions to warrant pursuing a tax break for their pet expenses.

The IRS does not offer a definition of a service dog, but guidance can be gleaned from the Americans With Disability Act (ADA). Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability.

The dog must be trained to take a specific action when needed to assist the person with a disability. For example, a person with diabetes may have a dog that is trained to alert him when his blood sugar reaches high or low levels. A person with depression may have a dog that is trained to remind her to take her medication. Or, a person who has epilepsy may have a dog that is trained to detect the onset of a seizure and then help the person remain safe during the seizure.

No. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

It depends. The ADA makes a distinction between psychiatric service animals and emotional support animals. If the dog has been trained to sense that an anxiety attack is about to happen and take a specific action to help avoid the attack or lessen its impact, that would qualify as a service animal. However, if the dog's mere presence provides comfort, that would not be considered a service animal under the ADA.

No. People with disabilities have the right to train the dog themselves and are not required to use a professional service dog training program.

Yes. The ADA does not restrict the type of dog breeds that can be service animals.

Can I use my dog as a tax deduction if it guards my truck? The absence of specific guidance on guard dogs from IRS compels a taxpayer to evaluate the appropriateness of claiming a tax deduction for expenses related to a guard dog used to protect a truck that is constantly on the move as opposed to a drop-yard or terminal. Kay Bell writing for Bankrate.com provided a great analysis,

“That “Beware of dog” sign in your business’s window is no idle threat. Break-ins have stopped since you set up a place for your Rottweiler to stay overnight. In this case, the IRS would likely be amenable to business deduction claims of the animal’s work-related expenses.

Standard business deduction rules still apply, notably that the cost of keeping an animal on work premises is ordinary and necessary in your line of business. Once you show that, the dollars spent each year keeping your pooch in good guard condition — food, vet bills and training — would be deductible as a business expense.

As with all deductions, be prepared to provide full and accurate records of your animal’s hours on the job. You’ll also find your tax claim more acceptable when you demonstrate how the animal protects your livelihood’s inventory. In addition, as is often the case with business property, the dog must be depreciated, a way of allocating its cost over its useful life for IRS purposes.

Keep in mind, too, that your claims carry more weight when your pet is a breed that’s typically used for such jobs. So even though your Chihuahua has a loud bark, your tax claim is more credible if your guard dog is a German shepherd, Doberman pinscher or a similar imposing breed”.[v]

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

Available as a $7.99 monthly subscription on App Store and Google Play

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018-2022 Per Diem Plus. Per Diem Plus is the trademark of Per Diem Plus, LLC

[i] 2014 American Pet Producers Association market study

[ii] https://www.irs.gov/pub/irs-wd/10-0129.pdf

[iii] https://www.irs.gov/pub/irs-pdf/p502.pdf

[iv] https://esadoctors.com/esa-letter-service-dog-certification/

[v] https://www.bankrate.com/finance/taxes/tax-write-offs-for-pet-owners-1.aspx#slide=3

The following article is summary of the impact of the 2017 Tax Cuts and Job Act (TCJA) on truckers The following is a list of common trucker tax deductions that were changed by the TCJA (except where noted).

The TCJA eliminated itemized deductions for employee drivers, which includes all unreimbursed employee business expenses. The following is a non-exhaustive list:

This provision does not apply to Owner Operators who claim travel-related and business expenses on Schedule C or Form 1120S.

IRC Section 199A generally provides a deduction of 20% of qualified business income (QBI) derived from a sole proprietorship, partnerships, or S corporation that is a qualified trade or business. The §199A deduction is taken from adjusted gross income (AGI) in determining taxable income and therefore does not reduce self-employment income. See my article titled "Understanding the 20% Passthrough Deduction" for a detailed discussion of the complicated deduction.

The §199A deduction is complicated and will require significant guidance from the IRS.

The deduction for alimony and separate maintenance payments by the payor is repealed. The payee (recipient) will not be required to include such payments in gross income for divorce or separation instruments executed after December 31, 2018.[i]

Medical expenses continue to be deductible to the extent they exceed 7.5% of adjusted gross income (AGI) for 2017 and 2018. For years after 2018 the threshold is 10% of AGI.

The moving expense deduction is repealed except for members of the Armed Forces. The exclusion from gross income and FICA wages for employer reimbursed moving expenses is repealed other than members of the Armed Forces.

This provision does not apply to Owner Operators who claim expenses related to moving a business operation on Schedule C or Form 1120S.

A taxpayer may claim an itemized deduction of up to $10,000 ($5,000 for married filing separately) for the aggregate of (1) state and local property taxes not paid or accrued in carrying on a trade or business (See IRC Sec. 212), and (2) state and local income taxes (or sales taxes in lieu of income taxes) paid or accrued in the tax year[ii].

This provision does not apply to Owner Operators who claim business-related taxes on Schedule C or Form 1120S.

The deduction for interest on home equity indebtedness is disallowed and applies to existing home equity loans. Home equity loans used for business or substantial improvement of a residence may still be deductible[iii]; any used for personal or investment purposes are not[iv].

The base for cash contributions is increased from 50% to 60%. No deduction is allowed for payments to colleges and universities in exchange for rights to purchase athletic seats.

All gambling expenses are now subject to the gambling winnings limitation and not just wagers. Schedule A filers can still deduct gambling losses to the extent of winnings but must have total itemized deductions exceeding the increased standard deductions.

The individual tax for failure to maintain minimum essential coverage is reduced to zero with respect to health coverage status for months beginning after December 31, 2018.

The standard deduction is increased to $24,000 for married filing jointly, $18,000 for head of household, and $12,000 for unmarried (single). The pre-2018 additional $1,250 standard deduction for taxpayers over age 65 or who are blind are retained.

Personal exemptions and dependency deductions are repealed. The IRS is examining how the definition of qualifying relative should be addressed.

Section 6695(g) of the internal Revenue Code requires paid return preparers to satisfy due diligence requirements to ensure clients qualify for the American opportunity credit, lifetime learning credit, earned income credit, and child tax credit.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] Notice 2018-37, 2018-18, I.R.B. 521

[ii] IRC § 164(b)(6) (flush language)

[iii] Temp. Reg. § 1.163-8T

[iv] Refer to Publication 936 (2017) Home Mortgage Interest Deduction for definitions of “substantial improvement”

“If I have two different home addresses can I claim per diem while off duty at either location? And can I claim per diem for off days spent visiting my wife in Oregon”

Can a truck driver have two tax homes? Bill is an OTR trucker who claims Las Vegas, Nevada as his tax home:

Whether his tax home is Nevada or Oregon and whether the Las Vegas home is indeed his permanent residence for per diem purposes are factual questions resolved by the fact:

As this example demonstrates, per diem issues can be complicated. It would be allowed for a driver who is away from home undergoing a 34-hour restart while in transit between a shipper and consignee, but not if the restart is done at home. Although, Bill claims Las Vegas, Nevada as his tax home, the facts dictate that Oregon is his tax home in a real and substantial sense, thus he does not qualify for per diem while visiting his wife. Additionally, attempting to claim per diem for every day he was away from his Las Vegas home - 365 days in this case - would be a red flag to IRS for audit.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The ELD mandate has contributed to record freight rates that, along with tax reform, have been a boon for trucking companies. Unfortunately, due to the prospect of lower wages for employee drivers resulting from the elimination of itemized deductions, many prospective drivers are opting for a gig-economy. As such, the driver shortage will continue to get worse unless fleets take proactive steps that mitigate the negative financial impact on drivers[i]. A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.

A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.

Novel tax defenses won't work with the Internal Revenue Service. The law allows as a deduction for all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business. This include expenses for traveling while away from home[i]. Since the average OTR truck driver is away from home 250 nights a year and accumulates hundreds of receipts, it is tempting to inflate tax deductible travel and business expenses to minimize taxes.

Billy was a self-employed truck driver subject to DOT hours of service regulations who was entitled to claim meals per diem and other business expenses as a tax deduction[ii]. However, for the tax year under audit he also claimed hometown meals and provided the IRS with a novel defense.

Billy's novel defense:

No. The novel tax defenses did not persuade the U.S. Tax Court:

As this case demonstrates novel theories for tax deductible items will not survive scrutiny in a tax audit. The unique nature of the trucking industry compels drivers to exercise due diligence when assembling tax records and reviewing the tax return lest you end up like Billy.

Available as a $7.99 monthly subscription on Google Play or App Store

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2022 Per Diem Plus, LLC. All rights reserved.

"It's my accountant's fault" is not a good defense in a tax audit. Tax season is in full swing and the airwaves are awash with ads for tax services fighting for a piece of the $168 billion income tax preparation market[i]. While, most of tax firms provide quality services, there are invariably bad actors who come out of the woodwork. The foregoing highlights the importance of selecting a competent tax professional who is knowledgeable in tax accounting for truck drivers lest your effort to blame the accountant for a tax bill will fall on deaf ears.

For the tax year under audit Johnny showed tax owed on his return of $446. Unfortunately, an audit revealed Johnny did not take the time to properly review his tax returns and ask questions of his tax preparer. He failed to report over $40,000 of income, which resulted in:

He blamed the accountant.

Taxpayers in similar situations can avoid the substantial understatement of tax penalty if they can show that they relied on the advice of a professional tax adviser[ii]. Even if the court assumed Johnny received “advice,” the case law lists three factors to decide whether reliance on a professional was reasonable[iii].

Johnny claimed he relied on Frank, a qualified professional tax preparer. As proof, he provided printouts of the preparers advertising material. He argued that each type of truck driving requires a different type of tax preparer, but he provided no evidence for this theory.

However, the courts biggest issue was that Johnny could not possibly have relied on advice from a tax preparer to whom he did not give the necessary taxinformation. Afterall, he did not report all of the income from the Forms 1099-MISC that he received. And not reporting income is a special sign of negligence[iv], and it might not get a taxpayer off the hook for a penalty even if he gives the information to his preparer[v]. Therefore, it is not surprising that the court concluded Johnny did not meet the "due diligence" burden of proof.

Johnny’s lone defense in claiming "It's my accountant's fault" was providing Frank’s advertising material. However, the court discovered:

The unique nature of the trucking industry compels drivers to exercise due diligence when assembling tax records, reviewing the tax return and selecting a licensed tax return preparer lest you end up like Johnny.

Available as a $7.99 monthly subscription on Google Play and App Store

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Per Diem Plus, LLC Copyright 2018

[i] https://townhall.com/tipsheet/katiepavlich/2014/04/14/americans-spend-billions-of-dollars-and-hundreds-of-hours-doing-their-taxes-each-year-n1824148

[ii] Sec. 1.6664-4(b), Income Tax Regs.

[iii] Neonatology Assocs., P.A. v. Commissioner, 115 T.C. 43, 99 (2000), aff’d , 299 F.3d 221 (3d Cir. 2002).

[iv] sec. 1.6662-3(b)(1)(i), Income Tax Regs.

[v] see Metra Chem Corp. v. Commissioner, 88 T.C. 654, 662-63 (1987) (reliance on preparer with complete information not reasonable cause where cursory review would have revealed errors); Magill v. Commissioner , 70 T.C. 465, 479-80 (1978) (taxpayer still has duty to read return to make sure all income included even if all data given to tax preparer), aff’d , 651 F.2d 1233 (6th Cir. 1981).

[vi] IRS Circular 230 governs licensed tax preparers and establishes the annual continuing professional education requirements

[vii] SHALOM JOHNNY, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent UNITED STATES TAX COURT - SUMMARY OPINION T.C. Summary Opinion 2015-3 Docket No. 21078-11S. Filed January 20, 2015.

If you are an OTR truck driver who lives in the truck you may be a classified a "tax turtle" by IRS and unable to claim travel-related expenses.

There are frequent posts on trucker social media forums and even in trucking publications that suggest merely having a post office box will be sufficient to meet the IRS’ regulations for claiming travel-related expenses.

John was an OTR truck driver who for the year under audit was away from home for 358 days, exceeded the PO Box requirements and claimed to live with his mother[iii].

Whether John had a tax home and whether his mother’s house was indeed his permanent residence were factual questions:

John was a “tax turtle” who was not entitled to claim per diem and travel-related expenses.

As this case demonstrates the PO Box gambit will not survive scrutiny in a tax audit. For a self-employed truck who lives in their truck to claim travel-related expenses, like per diem, some amount of expenses must be incurred at your declared tax home. It would also be wise to spend some time there lest you risk being classified a “tax turtle”.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] IRS Rev. Proc. 2011-47 (most recently superseded by 2017-42) & IRC 162(a)(2); Reg 1.162-2) A tax deduction is allowed for ordinary and necessary traveling expenses incurred by a taxpayer while away from home in the conduct of a trade or business. A truck driver is not away from home unless his or her duties require the individual to be away from the general area of his or her tax home for a period substantially longer than an ordinary workday and it is reasonable to need rest or sleep.

[ii] Rev. Ruling 75-432

[iii] HATEM ELSAYED, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. 8935-07S. Filed May 26, 2009