PDP For Fleets - 3 Months Free

The term"per diem allowance" means a payment under a reimbursement or other expense allowance arrangement that is — (1)

Trucker per diem rules for fleets eliminate the need for proving actual costs for meals & incidental expenses incurred.

Related Articles:

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Yes. Drivers that receive a non-taxable per diem reimbursement from their employer (trucking company) do so under IRC Sec 62(2)(a).

Under the trucker per diem rules for fleets a motor carrier can offer per diem only to drivers who are:

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot receive per diem.

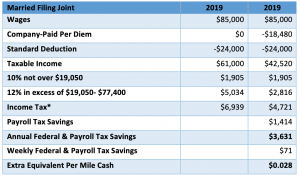

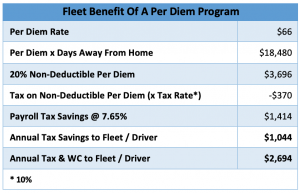

A fleet will save approximately $3,000 annually or $0.03/mile/driver as the payroll tax and worker compensation savings exceed the tax on the 20% nondeductible portion of per diem.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Yes. On average driver pay will increase from $0.03 - $0.04/per mile.

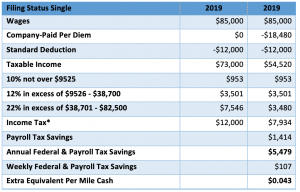

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Per Diem Plus automatically records per diem for travel in the USA and Canada for solo and team drivers.

No. Per diem is classified as a non-taxable reimbursement to an employee driver and is not reported under wages on Form W-2.

IRS increased per diem rates effective October 1, 2018 (Revised 10/01/2021)

USA $69 from $66

Canada $74 from $71

Yes. A partial day is 75% of the per diem rate.

A fleet can deduct 80% of per diem on their income tax return. However, the payroll tax and worker compensation savings ordinarily exceed the tax on the nondeductible portion of per diem.

Paper or electronic receipts that identify what, when and the amount are required. Drivers can upload and store receipts on the Per Diem Plus FLEETS app. Watch Run IRS Compliant Reports with Receipts video to see how easy drivers can send an itemized expense reports with receipts to payroll or accounting.

No. There is no published guidance from IRS that allows a fleet to pay a lodging per diem.

A self-employed driver (owner operator) falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

No less than 3 years from the filing date of an income tax return. Per Diem Plus FLEETS customers have instant access to itemized per diem tax records for four years.

ELD backups used to substantiate "time, date and place" are considered tax records.

Refer to IRS Revenue Procedure 2011-47. Or, use the Per Diem Plus FLEETS platform that automates administration of a company-paid per diem plan and takes the guesswork out of tax-related record keeping. Our How it Works video demonstrates just easy the app is to use.

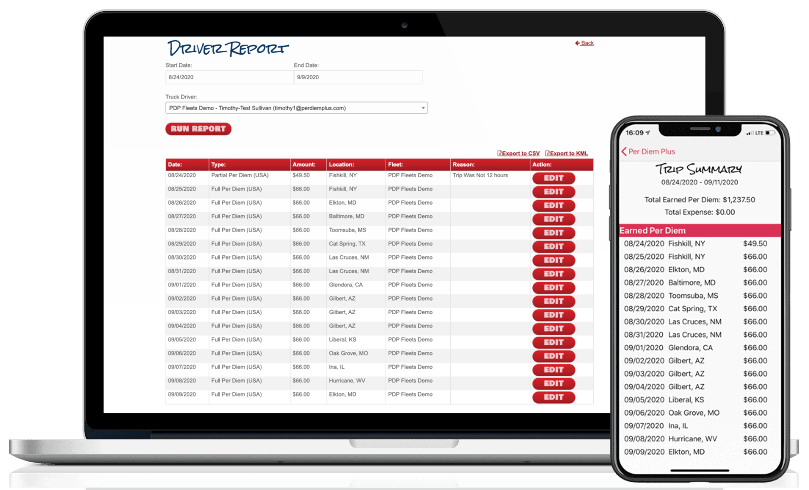

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus® FLEETS is a configurable mobile application platform that automates administration of an IRS-compliant accountable trucker per diem plan for fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Truckers designed it, tax pros built it, drivers want it. Our cloud-based FLEETS mobile app platform enables motor carriers to implement an IRS-compliant fleet per diem plan that will:

"Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions.

Configure your per diem app in minutes with our simple check-the-box menu.

For example, the app allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 50 miles and that best matches fleet lanes and app installation type. Or to minimize cellular data plan usage you can white list the app using our static IP address.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

* Deep-link integration scheduled for Q4 2020 release

Per Diem Plus 2020. All rights reserved. Per Diem Plus is a trademark of Per Diem Plus, LLC. A proprietary software application, which provides automatic per diem and expense tracking for truckers (USPTO Registration #86754053)

In this article we attempt to clear up the confusion on company-paid per diem caused by the recently passed Tax Reform and Jobs Act.

Under the 2017 Tax Reform and Jobs Act[i]:

The good news is that motor carriers can implement an IRS-compliant accountable per diem program using the Per Diem Plus® FLEETS mobile application platform to offset the lost tax deductions for their drivers, while enhancing recruiting and retention[ii].

“Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

Yes. A motor carrier implementing a company-paid per diem plan can raise effective driver pay by 2.6¢ - 4¢ CPM. All per diem paid to a driver is treated as a non-taxable reimbursement and not reported on Form W-2.

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and miscellaneous expenses.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[3] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[i] All amounts paid under the arrangement are treated as paid under an accountable plan and are excluded from income and wages.

[ii] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and other job-related expenses.

The ELD mandate has contributed to record freight rates that, along with tax reform, have been a boon for trucking companies. Unfortunately, due to the prospect of lower wages for employee drivers resulting from the elimination of itemized deductions, many prospective drivers are opting for a gig-economy. As such, the driver shortage will continue to get worse unless fleets take proactive steps that mitigate the negative financial impact on drivers[i]. A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

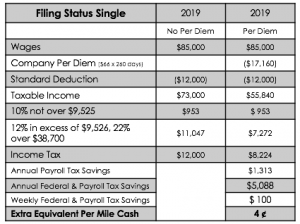

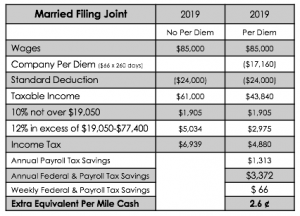

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.

A company-sponsored per diem plan can increase driver pay by 2.8ȼ - 4.3ȼ per mile, while saving the fleet over $2,600 per driver.

The IRS allows a maximum of $63 per day for travel in the USA [$68 for Canada], but a fleet can opt for a lower amount, i.e. $45 per day, so long as it is paid at a flat rate[iv].

How does a fleet convince drivers who previously itemized deductions to claim per diem and unreimbursed business expenses to participate in a company-paid per diem program? Optics are everything with drivers; show them the numbers. The average driver who is away from home 5 nights will take home an extra $70 a week or 2.8ȼ per mile.