PDP For Fleets - 3 Months Free

Struggling to find a tax accountant these days? The accounting industry lost 300,000 professionals since COVID began. Mark Sullivan Consulting, PLLC is adding income tax preparation services in response to taxpayer demand.

Embark on this journey with Mark Sullivan Consulting as we launch our new income tax preparation services. Let us take the complexity out of taxes, allowing you to thrive personally and in your business endeavors. Cheers to a seamless tax season ahead!

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

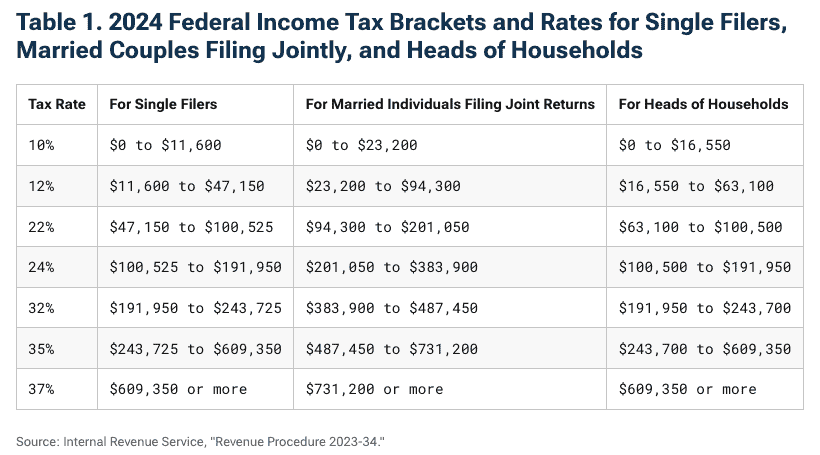

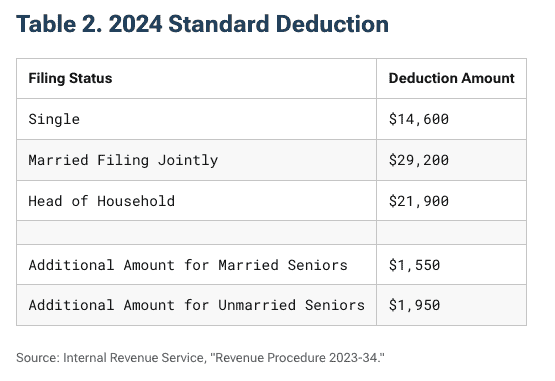

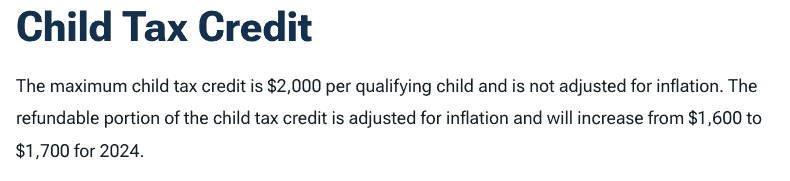

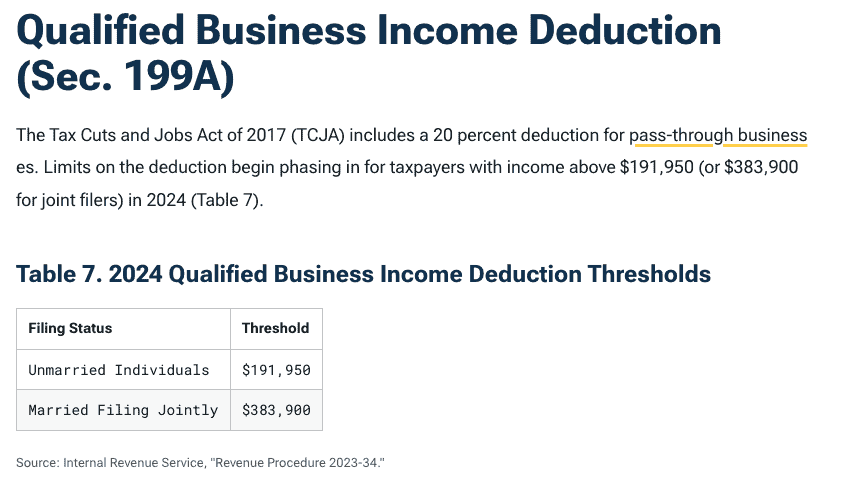

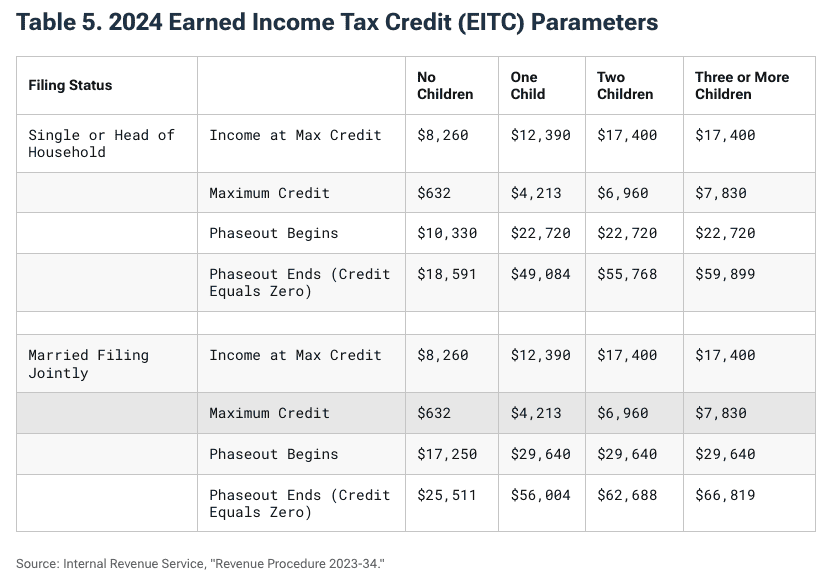

2024 trucker per diem rates and tax brackets were released by the IRS in Revenue Procedure 2023-34. For detailed information, please refer to the Tax Foundation.

For taxpayers in the transportation industry who are subject to DOT HOS the per diem rate remains unchanged from 2023 at $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS), i.e. Canada.

Mark Sullivan Consulting Launches New Income Tax Services For Truckers

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Source: "2024 Tax Brackets", Alex Durante, Tax Foundation (November 8, 2023)

Unlock Fleet Tax Savings Using Per Diem

The freight industry's landscape is evolving, and as diesel prices rise, fleet managers like you face challenges. However, here's the silver lining: optimizing your driver per diem can be a game-changer. Many fleets overlook the tax-deductible benefits of per diem, leaving money on the table.

In 2021 and 2022, Congress raised the trucker per diem deduction to 100%, making it even more enticing. But some might think that at 80% deductibility, per diem won't save much. That's where they're mistaken.

Case Study: Tax Savings

Let's break it down with a case study for a 25-truck fleet. The motor carriers realizes $71,428 or $2,857 per driver in savings. For married drivers earning $65,000 annually, the potential tax savings are around $3,457 or $0.03 cents per mile. Single over-the-road drivers in the same income bracket can save roughly $4,485, or $0.04 cents per mile. The fleet achieves

The key takeaway here is leveraging a fixed daily rate can maximize your tax offset, and it's a strategy worth considering. 💰

The Per Diem Plus Advantage

To make this process smoother, consider using the Per Diem Plus Software Platform to manage per diem effectively.

By implementing an automated, GPS-based solution, you can navigate economic uncertainties and maximize tax savings for your fleet and drivers.

Amid economic uncertainty, mastering per diem boosts fleet financial stability. Remember, it's not just about cost savings but also boosting driver pay, retention and enhancing your overall operation. 🌟

Optimizing your fleet's per diem management isn't just about savings; it's a powerful way to navigate economic challenges, boost driver pay, and secure your financial stability. With tools like Per Diem Plus, you can drive your fleet towards greater success in your balance sheet.

Feel free to reach out if you have more questions or need further insights into this topic. Happy driving! 🛣️

At Per Diem Plus, we understand the significance of efficiency when it comes to per diem tracking and payroll reporting for truck drivers and fleets. That's why we've made automation a cornerstone of our platform.

Streamlined Per Diem Tracking: With Per Diem Plus, the days of manual calculations and ELD backups are long gone. Our automated system ensures that per diem tracking is a breeze. Truck drivers can focus on the road, not record keeping. It's accuracy without the effort.

Real-Time Compliance: Our automation doesn't stop there. We keep you in compliance with the latest IRS regulations in real-time. No more worrying about keeping up with changing rules - our system does it for you.

The Power of Time: By automating per diem tracking and payroll reporting, we give you the gift of time. Time to focus on what truly matters for your business, and time to ensure your drivers are getting the reimbursements they deserve.

With Per Diem Plus, you're not just getting a tool; you're getting a solution that transforms your per diem process. Say goodbye to the tedious and hello to the efficient. Make the smart choice today and experience the difference that automation can make.

Mark W. Sullivan, EA, the founder of Sullivan Consulting, established the firm's roots in St. Louis, MO, in 1998. In 2020, he made a strategic move to the thriving business environment of Arizona. Mark specializes in the intricate realm of federal tax controversy representation, appeals, and consulting, catering not only to individuals and businesses but also extending his expertise to renowned law and accounting firms nationwide.

Mark's distinguished career includes serving as a consulting and expert witness in a multitude of civil and criminal cases, spanning several federal district courts. His credentials are underscored by an unlimited Enrolled Agents license, a testament to his exceptional knowledge and unwavering commitment to his craft. His recognition by the Internal Revenue Service for admission to practice is grounded in his extensive background as a Revenue Officer, having worked in demanding locations such as New York, NY, St. Louis, MO, and Washington, D.C.

Mark's extensive experience as a Revenue Officer has uniquely positioned him to navigate the intricate landscape of federal tax matters. Now, based in Scottsdale, AZ, Mark continues to offer his expertise to clients across the nation, ensuring that their interests are diligently and professionally represented.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

IR-2023-193

WASHINGTON – As part of a larger effort to protect small businesses and organizations from scams, the Internal Revenue Service today announced the details of a special withdrawal process to help those who filed an Employee Retention Credit (ERC) claim and are concerned about its accuracy.

This new withdrawal option allows certain employers that filed an Employee Retention Credit claim but have not yet received a refund to withdraw the claim. Employers that submitted an ERC claim can withdraw their claim and avoid the possibility of getting a refund for which they’re ineligible.

Who can ask to withdraw an ERC claim

Employers can use the ERC claim withdrawal process if all of the following apply:

Taxpayers who are not eligible to use the withdrawal process can reduce or eliminate their ERC claim by filing an amended return. For details, see the Correcting an ERC claim – Amending a return section of the frequently asked questions about the ERC.

How to withdraw an ERC claim

To take advantage of the claim withdrawal procedure, taxpayers should carefully follow the special instructions at IRS.gov/withdrawmyERC, summarized below.

Should fax withdrawal requests to the IRS using a computer or mobile device.

The IRS has set up a special fax line to receive withdrawal requests. This enables the agency to stop processing before the refund is approved. Taxpayers who are unable to fax their withdrawal can mail their request, but this will take longer for the IRS to receive.

Employers who have been notified they are under audit:

Those who received a refund check, but haven’t cashed or deposited it, can still withdraw their claim. They should mail the voided check with their withdrawal request using the instructions at IRS.gov/withdrawmyERC.

Upcoming webinar and other resources for help

Tax professionals and others can register for a Nov. 2 IRS webinar, Employee Retention Credit: Latest information on the moratorium and options for withdrawing or correcting previously filed claims. Those who can’t attend can view a recording later.

This tax credit program that was poorly designed by Congress at the outset. Creating an escape route for taxpayers who fell victim to ERC scammers is a prudent response by the IRS. The ability to withdraw an ERC claim should eliminate thousands of unnecessary audits and criminal prosecutions for a

Do you need assistance in filing an ERC withdrawal? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO. He relocated to Scottsdale, AZ in 2020 and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

IRS Newswire Issue Number: IR-2023-193

"Can I claim my emotional support dog as a tax deduction" is a common questioned posed to tax professionals by long-haul truckers. Every pet owner claims their animal is a member of the family and they are an essential companion for thousands of truckers. The emergence of the "Emotional Support" registration industry reinforces this fact.

It understandable that taxpayers may want to recoup some of their emotional support dog expenses with a creative medical expense tax deduction[i]. To counter the urge to claim Fido as a tax deduction the IRS has promulgated guidance on what type of animals qualify.

How does the IRS define a service dog versus an emotional support dog?

The IRS does not offer a definition of a "service dog" oe "emotional support" animal, but guidance can be gleaned from the Americans With Disability Act (ADA). Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability including a physical, sensory, psychiatric, intellectual or other mental disability. An animal is defined as "emotional support" when it has not been specifically trained, for example:

A review of IRC § 213 is required to answer the question, "Can I use my emotional support dog as a tax deduction?" The costs of buying, training, and maintaining a service animal to assist an individual with mental disabilities may qualify as medical care if the taxpayer can establish that the taxpayer is using the service animal primarily for medical care to alleviate a mental defect or illness and that the taxpayer would not have paid the expenses but for the disease or illness.

IRS Chief Counsel Note: A taxpayer who claims that an expense of a peculiarly personal nature is primarily for medical care must establish that fact. The courts have looked toward objective factors to determine whether an otherwise personal expense is for medical care:

A personal expense is not deductible as medical care if the taxpayer would have paid the expense even in the absence of a medical condition. Commissioner v. Jacobs, 62 T.C. 813 (1974). [ii]

You can include in medical expenses:

In general, this includes any costs, such as food, grooming, and veterinary care, incurred in maintaining the health and vitality of the service animal so that it may perform its duties.

2024 Trucker Per Diem Rates Published (September 25, 2023)

Flying With A Service Dog? Here's Everything You Need To Know (Becca Bond, The Points Guy, 9/12/23)

What Is The IRS Definition Of A Service Dog?

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Generally, you can deduct on Schedule A, Itemized Deductions (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). However, with tax reform drastically increasing the Standard Deduction (2022: $12,950 Single, $25,900 Married) most taxpayers will not have sufficient itemized deductions to warrant pursuing a tax break for their pet expenses.

No, emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

"Prior to January 2021, the law allowed emotional support animals to fly with documentation from a medical doctor verifying the animal was necessary for comforting the passenger. ESAs did not have to be trained. But after rampant abuse of the system that included people taking everything from peacocks to snakes to untrained and aggressive dogs on flights, the DOT revised its regulations to allow airlines to ban ESAs from the skies. Although the ultimate decision was left up to the airlines themselves, all major U.S. and Canadian carriers quickly changed their policies to stop non-ESA pets from flying. You can still fly with a small dog (under 25 pounds), but the pup must be in a carrier and you will need to pay the airline pet fee to fly."

Becca Bond, The Points Guy (9/12/23)

Can I use my dog as a tax deduction if it guards my truck? The absence of specific guidance on guard dogs from IRS compels a taxpayer to evaluate the appropriateness of claiming a tax deduction for expenses related to a guard dog used to protect a truck that is constantly on the move as opposed to a drop-yard or terminal. Kay Bell writing for Bankrate.com provided a great analysis,

“That “Beware of dog” sign in your business’s window is no idle threat. Break-ins have stopped since you set up a place for your Rottweiler to stay overnight. In this case, the IRS would likely be amenable to business deduction claims of the animal’s work-related expenses.

Standard business deduction rules still apply, notably that the cost of keeping an animal on work premises is ordinary and necessary in your line of business. Once you show that, the dollars spent each year keeping your pooch in good guard condition — food, vet bills and training — would be deductible as a business expense.

As with all deductions, be prepared to provide full and accurate records of your animal’s hours on the job. You’ll also find your tax claim more acceptable when you demonstrate how the animal protects your livelihood inventory. In addition, as is often the case with business property, the dog must be depreciated, a way of allocating its cost over its useful life for IRS purposes.

Keep in mind, too, that your claims carry more weight when your pet is a breed that’s typically used for such jobs. So even though your Chihuahua has a loud bark, your tax claim is more credible if your guard dog is a German shepherd, Doberman pinscher or a similar imposing breed”.[iv]

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

Need assistance resolving a tax controversy issue? Contact Mark W. Sullivan, EA or request a free consultation HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He leads the Tax Controversy practice at Price Kong, CPAs & Consultants and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2025 Price Kong, CPAs & Consultants, PC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] 2014 American Pet Producers Association market study

[ii]https://www.irs.gov/pub/irs-wd/10-0129.pdf

[iii]https://www.irs.gov/pub/irs-pdf/p502.pdf

[iv]https://www.bankrate.com/finance/taxes/tax-write-offs-for-pet-owners-1.aspx#slide=3

2024 trucker per diem rates were released by the IRS in an annual bulletin, Notice 2023-68, on September 25, 2023. For taxpayers in the transportation industry the per diem rate remains unchanged from 2023: $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS).

Mark Sullivan Consulting Launches New Income Tax Preparation Service for Truckers

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

In this article we attempt to clear up the confusion on the rules governing truck driver per diem in the ELD era.

Trucker per diem is a per day travel expense allowance that eliminates the need for proving actual costs for meals & incidental expenses incurred by a driver while away from home on a truck driving trip.

When did the IRS first recognize per diem for the transportation industry?

19911

When did IRS introduce the Special Transportation Industry daily rate per diem?

20002

What makes the Special Transportation Industry per diem unique?

Can all truck drivers can claim per diem as a federal tax deduction?

No. Only self-employed truckers

Can motor carriers offer per diem to employee drivers?

Yes.

IRS Issues 2024 Trucker Per Diem Rates (September 25, 2023 - IRS Notice 2023-68)

Does a driver have to spend $69 everyday?

No

What qualifies as a tax home?

Where you park your truck when home

Can a driver claim per diem if they live in their truck?

No

Can a driver or motor carrier claim per diem for lodging?

No. A receipt is required for all lodging expenses.

What are the IRS per diem substantiation requirements for trucker per diem?

Only DOT Electronic Logging Device backups or the equivalent, i.e., Per Diem Plus

What are Incidental Expenses?

Only fees and tips

Are showers & parking fees incidental expenses?

No

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount

How long should tax records be retained?

No less than 3 years

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truck drivers and fleet managers.

Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

1 TAM 9146003

2 Revenue Procedure 2000-39, 2000-9 Sec. 4.04 [Notice 2000-48].

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

IR-2023-169

Moratorium on processing of new Employee Retention Credit claims through year’s end will allow IRS to add more safeguards to prevent future abuse, protect businesses from predatory tactics; IRS working with Justice Department to pursue fraud fueled by aggressive marketing.

WASHINGTON – Amid rising concerns about a flood of improper Employee Retention Credit claims, the Internal Revenue Service today announced an immediate moratorium through at least the end of the year on processing new claims for the pandemic-era relief program to protect honest small business owners from scams. IRS Commissioner Danny Werfel ordered the immediate moratorium, beginning today, to run through at least Dec. 31 following growing concerns inside the tax agency, from tax professionals as well as media reports that a substantial share of new claims from the aging program are ineligible. This increasingly is putting businesses at financial risk by being pressured and scammed by aggressive promoters and marketing. The IRS continues to work previously filed Employee Retention Credit (ERC) claims received prior to the moratorium but renewed a reminder that increased fraud concerns means processing times will be longer.

On July 26, the agency announced it was increasingly shifting its focus to review these claims for compliance concerns, including intensifying audit work and criminal investigations on promoters and businesses filing dubious claims. The IRS announced today that hundreds of criminal cases are being worked, and thousands of ERC claims have been referred for audit.

This action by the IRS is long overdue. These scammers lure taxpayers with promises of fast money, an "easy application process" and lie about eligibility in exchange for sizeable fees. Unfortunately, unwitting taxpayers selected for audit will learn the time spent filing an ERC will pale in comparison to assembling documentation to substantiate eligibility for the claim.

Has IRS selected your ERC claim for audit? Request a free consultation HERE with Mark W. Sullivan, EA

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

IRS Newswire Issue Number: IR-2023-169

The freight market has experienced steady softening over the past year while diesel prices have gained more than 40 cents from a month ago. So how can fleets mitigate softening freight rates and the exploding cost of fuel? Most fleets aren’t maximizing the tax deductible benefits of per diem, leaving thousands of dollars per driver on the table every year. Below is a guide on how best to manage this within your carrier operation, and unlock significant fleet savings while boosting driver pay amid economic uncertainty and record inflation.

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility, per diem will not save a motor carrier money. The below tables prove otherwise.

Assumptions

The following analysis assumes:

Twenty-three states are members of the National Council on Compensation Insurance (NCCI), and 39 rely on NCCI regulations. Under NCCI rules, a motor carrier paying substantiated per diem under an IRS-accountable plan can exclude up to $69/day of per diem from taxable wages, which provides a significant per driver annual savings to a fleet. (IRS Publishes 2024 Trucker Per Diem Rates)

Even with growing economic uncertainty and recessionary clouds on the horizon, Congress elected not to extend the 100% deduction for per diem. However, a motor carrier that implements an automated per diem solution will be in a stronger position to weather the economic storm.

As of January 1, 2018, employee drivers can no longer claim per diem as an itemized deduction on their federal income tax return. However, motor carriers can offer per diem to employee drivers to recapture the lost tax savings. The average Married over-the-road driver earning $65,000 annually will save approximately $3,457 in federal income taxes equivalent to $0.03 cents per mile.

The average Single over-the-road driver earning $65,000 annually will save approximately $4,485 in federal income taxes equivalent to $0.04 cents per mile.

In short, you are virtually always better off leveraging a fixed $69/day (as of this writing) to maximize your per diem tax offset from wages.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Conta

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Michigan-based specialty auto transporter Select 1 Group selects Per Diem Plus API for Samsara to raise driver pay and improve operational efficiency of its 70-vehicle fleet.

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

The Select 1 Group specializes in automotive transport, event transport and event logistics, in addition to creative design, production and staffing services for corporate training, marketing and events of all types

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®