PDP For Fleets - 3 Months Free

Tax season can be a stressful time for many Americans, but with a little knowledge and preparation, you can navigate it with confidence. Here are some practical tips to help you avoid common pitfalls and maximize your tax savings.

In conclusion, while tax season may seem daunting, taking proactive steps to understand your tax obligations and opportunities can lead to significant savings. Whether you're filing your taxes independently or with the help of a professional, attention to detail and awareness of potential pitfalls are key. By staying informed and organized, you can navigate tax time with confidence and optimize your financial outcomes. Remember, every dollar saved in taxes is a dollar that can contribute to your future financial security.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

A motor carrier with 55 over-the-road drivers received this convoluted email explanation from their trucker per diem solution provider who claims to have thousands of drivers covered by their plan. It was sent in response to the Per Diem Plus tax pros reviewing the plan details and advising the driver per diem program would be classified as a nonaccountable plan that produces over $415,000 of improper employee business expenses, evades over $100,000 of taxes and mischaracterizes over $1.2 million of driver wages.

"Your trucking company is using the lodging option, so your amounts are $59 for meals and $74 for lodging. Meal per diem can be awarded each day, while lodging is limited to 2 days a week. Lodging can be used but it follows some different rules. The daily total is limited to $155 which we stay well under to ensure compliance. Lodging has always been 100% deductible, that's why some people use that option. Both options (meals and incidentals only; meals and incidentals and lodging) are compliant with IRS regulations."

Copied from promotor email

See IRS Rev. Proc. 2011-47.1, 3.01(1), 4.04 and 6.06; Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48, IRC 267(b), Tres. Reg. Sec 1.274-5(c)(2)(iii)

The following analysis is based 55 over-the-road drivers working 51 weeks annually, paid a twice-weekly $74 lodging per diem and 20% effective corporate income tax rate:

Under a nonaccountable plan the per diem is included in an employee's gross wages and reported on Form W-2. The following analysis is based 55 over-the-road drivers who travel away from home 255 nights per year

The word salad explanation provided by the per diem solution promotor is reminiscent of listed tax transactions that have the potential for tax avoidance or evasion. Any trucking company that is considering implementing or modifying a driver per diem program needs to carefully review the IRS guidelines. If the tax professional they are using raises questions about the accuracy of the promoters claims, people should listen to their advice.

Have you been approached by one of these "lodging per diem" promoters? Contact us HERE to anonymously tell us about your experience.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Bonnie is an Amazing Race superfan recently selected to participate in the upcoming season of the reality TV show. Contestants are required to have a valid U.S. passport and submit their passports to obtain visas for the countries that may be visited during filming. Our fictitious character, Bonnie, subsequently received IRS Notice CP508C informing her that the State Department had revoked her passport.

Bonnie's devastation is courtesy of the IRS and State Department implementing in January 2018 provisions of the 2015 Fixing America's Surface Transportation (FAST) Act to deny issuance or renewal of a passport to taxpayer’s owing more than $50,000 in delinquent taxes (adjusted for inflation). The law also allowed the State Department to revoke or limit a passport previously issued to a delinquent taxpayer living overseas allowing only for direct return to the United States.

"IRS collects $1.2 billion in less than two years from taxpayers with the passport revocation program who the IRS certified to the State Department as being seriously delinquent in their tax debt."

Internal Revenue Service

Note: The IRS will not reverse the passport certification just because you pay the debt below the threshold

The IRS certifies seriously delinquent tax debt to the State Department. Seriously delinquent tax debt is an individual's unpaid, legally enforceable federal tax debt (including interest and penalties) totaling more than $55,000 (adjusted yearly for inflation) for which a:

Some tax debt is not included in seriously delinquent tax debt such as:

In addition, the IRS will not certify anyone as owing a seriously delinquent tax debt:

No. The IRS will postpone certification only while an individual is serving in a designated combat zone or participating in a contingency operation.

The IRS may ask the State Department to exercise its authority to revoke your passport. For example, the IRS may recommend revocation if the IRS had reversed your certification because of your promise to pay, and you failed to pay. The IRS may also ask the State Department to revoke your passport if you could use offshore activities or interests to resolve your debt but choose not to.

Before the IRS sends a revocation referral to the State Department, the IRS will send you Letter 6152 asking you to call the IRS within 30 days to resolve your account to prevent this action.

The IRS will send a taxpayer Notice CP508R at the time it reverses certification. The IRS will reverse a certification when:

The IRS will make this reversal within 30 days and provide notification to the State Department as soon as practicable.

The IRS will not reverse certification if your request for a collection due process hearing or innocent spouse relief is on a debt that's not certified. Also, the IRS will not reverse the certification because you pay the debt below the threshold.

The State Department will notify you in writing, if the State Department denies your U.S. passport application or revokes your U.S. passport.

If you need your U.S. passport to keep your job, once the IRS certifies your seriously delinquent tax debt to the State Department, you must fully pay the balance or make an alternative payment arrangement to have your certification reversed.

Do not wait to resolve outstanding IRS issues! The FAST Act will wreak havoc on taxpayers owing the IRS at least $55,000 that need to apply for or renew their U.S. passport to keep their jobs or have imminent foreign travel planned.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] IRS Rev. Proc. 2011-47 (most recently superseded by 2017-42) & IRC 162(a)(2); Reg 1.162-2) A tax deduction is allowed for ordinary and necessary traveling expenses incurred by a taxpayer while away from home in the conduct of a trade or business. A truck driver is not away from home unless his or her duties require the individual to be away from the general area of his or her tax home for a period substantially longer than an ordinary workday and it is reasonable to need rest or sleep.

[ii] Rev. Ruling 75-432

[iii] HATEM ELSAYED, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. 8935-07S. Filed May 26, 2009

Are you a "Tax Turtle" if you live in your truck and still claim travel-related expenses like per diem?

There are frequent posts on trucker social media forums and even in trucking publications that suggest merely having a post office box will be sufficient to meet the IRS’ regulations for claiming travel-related expenses. However, if you are an over-the-road truck driver who lives in the truck when you are "home" you may be a classified a "tax turtle".

Sole-proprietorship trade or business expense deductions are the most litigated issue before the US Tax Court.

Taxpayer Advocate Service, "Most Litigated IRS Issues 2022"

Whether John had a tax home and whether his mother’s house was indeed his permanent residence were factual questions:

John was a “tax turtle” who was not entitled to claim per diem and travel-related expenses.As this case demonstrates the PO Box gambit will not survive scrutiny in a tax audit. For a self-employed truck who lives in their truck to claim travel-related expenses, like per diem, some amount of expenses must be incurred at your declared tax home. It would also be wise to spend some time there lest you risk being classified a “tax turtle”.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] IRS Rev. Proc. 2011-47 (most recently superseded by 2017-42) & IRC 162(a)(2); Reg 1.162-2) A tax deduction is allowed for ordinary and necessary traveling expenses incurred by a taxpayer while away from home in the conduct of a trade or business. A truck driver is not away from home unless his or her duties require the individual to be away from the general area of his or her tax home for a period substantially longer than an ordinary workday and it is reasonable to need rest or sleep.

[ii] Rev. Ruling 75-432

[iii] HATEM ELSAYED, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent Docket No. 8935-07S. Filed May 26, 2009

Trucker Per Diem & the 10% Ownership-Related Party Rule. Can an Owner-Operator claim trucker per diem under the related party rule if they own more than 10% of the company? Yes.

The 10% ownership - related party rule and per diem creates much confusion and is frequently misunderstood by both drivers and tax practitioners alike. Under the related party rule an Owner-Operator can claim substantiated meals & incidental expenses-only per diem even if they own 10% or more of the trucking company. Based on the foregoing the related party rule does not apply to the trucking industry.

Section 4.04 applies to:

Section 6.07 applies to:

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

What is the IRS definition of a service dog? The IRS does not offer a definition of a service dog, but guidance can be gleaned from the Americans With Disability Act (ADA). Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability.

The dog must be trained to take a specific action when needed to assist the person with a disability. For example, a person with diabetes may have a dog that is trained to alert him when his blood sugar reaches high or low levels. A person with depression may have a dog that is trained to remind her to take her medication. Or, a person who has epilepsy may have a dog that is trained to detect the onset of a seizure and then help the person remain safe during the seizure.

No. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

Flying with a service dog? Here's everything you need to know (Becca Blond, The Points Guy, 9/12/23)

It depends. The ADA makes a distinction between psychiatric service animals and emotional support animals. If the dog has been trained to sense that an anxiety attack is about to happen and take a specific action to help avoid the attack or lessen its impact, that would qualify as a service animal. However, if the dog's mere presence provides comfort, that would not be considered a service animal under the ADA.

No. People with disabilities have the right to train the dog themselves and are not required to use a professional service dog training program.

Yes. The ADA does not restrict the type of dog breeds that can be service animals.

I found dozens of websites pitching “Service Animal” registration services while researching this article. All had variations on what disabilities qualified for the tax-deductible classification. My purpose is to analyze the tax implications and not to evaluate the merits of the service animal designation. Therefore, the below discussion (where applicable) uses definitions under the Americans With Disabilities Act (ADA).

Service Dog: Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability.

Emotional Support Dog: Emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. The types of emotional conditions that may require the assistance of an ESD are:

Guard Dog: There is scant guidance on the deductibility of guard dogs, however, it is clear they do not meet the statutory requirement to qualify under Internal Revenue Code 213.

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i]https://esadoctors.com/esa-letter-service-dog-certification/

Can A Truck Driver Have Two Tax Homes? A driver claims Nevada as his residence, but his wife resides in Oregon.

"If a driver has two different home addresses, can he claim per diem while off duty at either location?"

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

100% deduction for trucker per diem in COVID-19 Pandemic Relief Package confirmed by the IRS in Notice 2021-63 (12/6/2021)

[Update: The temporary 100% deduction for per diem expired on December 31, 2022]

Congress used a single line on page 4871 of the Consolidated Appropriations Act, 2021 (CAA) to allow the full deduction for per diem. Section 210 of the act temporarily raised the allowance of business meals (for food or beverages provided by a restaurant) under IRC § 274(n) to 100% from 50% for tax years 2021 and 2022.

The IRS issued Notice 2021-25 on April 8, 2021 (updated by Notice 2021-63 on December 6, 2021) that explains when the temporary 100-percent deduction applies and when the 50-percent limitation continues to apply for purposes of § 274 of the Internal Revenue Code (Code), as amended by § 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Act), enacted as Division EE of the Consolidated Appropriations Act, 2021, Pub. L. No. 116- 260, 134 Stat. 1182 (December 27, 2020)

The IRS previously allowed motor carriers and self-employed truckers using the Special Transportation Industry per diem to deduct business meals at 80% under 274(n)(3). Unfortunately, Congress omitted any commentary on the interplay of 274(n)(1) and (3) in the CAA. On April 9, 2021, I called the Office of Associate Chief Counsel (Income Tax & Accounting) and obtained confirmation the temporary 100-percent deduction for business meal expenses applied to the transportation industry as well. The Associate Chief Counsel's opinion was affirmed by issuance of IRS Notice 2021-63 on December 6, 2021.

"Absolutely yes, we tried to allow as many taxpayers to use it as possible"

Deena Devereux, IRS Office of Associate Chief Counsel

26 U.S. Code § 274 - Disallowance of certain entertainment, etc., has been revised as follows (as modified by the CAA):

(n) 100 percent of meal expenses allowed as deduction

(1) In general:

The amount allowable as a deduction under this chapter for any expense for food or beverages shall not exceed 100 percent of the amount of such expense which would (but for this paragraph) be allowable as a deduction under this chapter.

(2) Exceptions

Paragraph (1) shall not apply to any expense if—

(A) such expense is described in paragraph (2), (3), (4), (7), (8), or (9) of subsection (e),

(B) in the case of an employer who pays or reimburses moving expenses of an employee, such expenses are includible in the income of the employee under section 82, or

(C) such expense is for food or beverages— (i) required by any Federal law to be provided to crew members of a commercial vessel,(ii) provided to crew members of a commercial vessel.

(D) such expense is—

(i) for food or beverages provided by a restaurant, and

(ii) paid or incurred before January 1, 2023.

(3) Special rule for individuals subject to Federal hours of service (superseded by CAA)

In the case of any expenses for food or beverages consumed while away from home (within the meaning of section 162(a)(2)) by an individual during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation, paragraph (1) shall be applied by substituting “80 percent” for “50 percent”

Motor Carrier: A motor carrier with an effective Federal tax rate of 10% paying trucker per diem to a driver who is away from home an average 280 nights per year will save with the full deduction for per diem an additional $370 per year in 2021 and 2022.

Owner Operator: An independent owner operator operating one-truck with an effective Federal tax rate of 18% claiming trucker per diem and averaging 280 nights away from home per year will save with the full deduction for per dieman additional $665 per year in 2021 and 2022.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

The Per Diem Plus® is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2021, 2022, 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

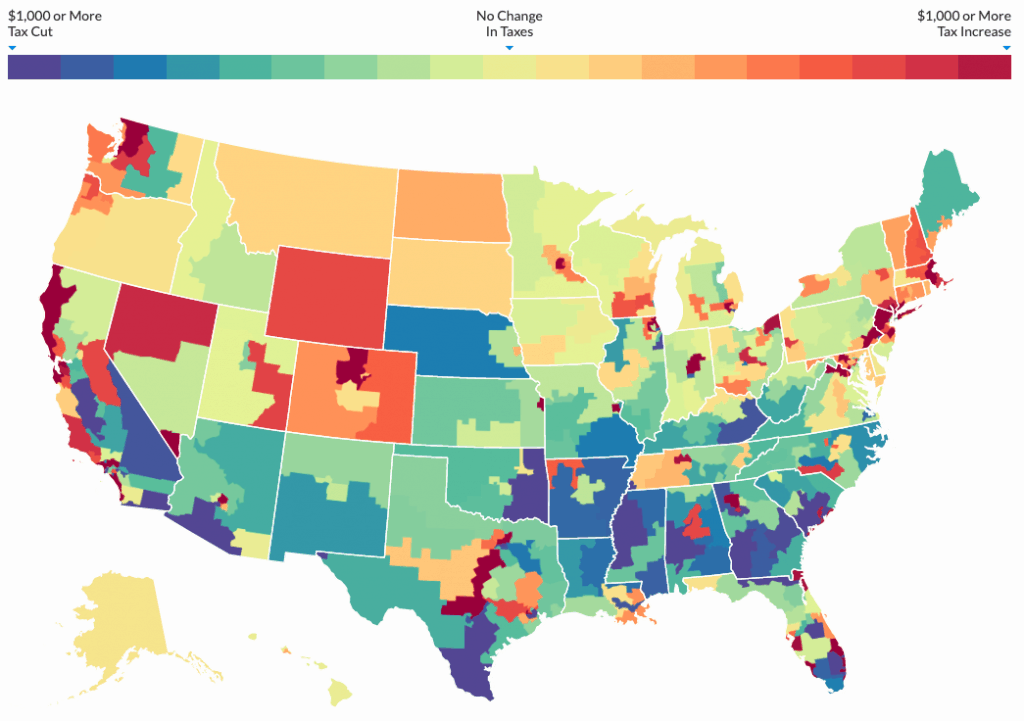

The Biden administration has proposed $2.3 trillion in new taxes in its 2022 budget essentially undoing the significant tax cuts implemented by the 2017 Tax Cuts and Jobs Act. Under Biden's proposal taxes will increase for the 40% of taxpayers that paid income taxes in 2020 in roughly 96% of congressional districts. Residents of the District of Columbia, Massachusetts, Connecticut and New York will experience the largest average tax increases - $1,000 in 2022 alone. Taxpayers with kids living in Mississippi, Alabama, and Oklahoma should expect a tax cut of over $400 in 2022. However, by 2025 (after the next Presidential election) taxpaying residents of every state and the District of Columbia will see a tax increase.

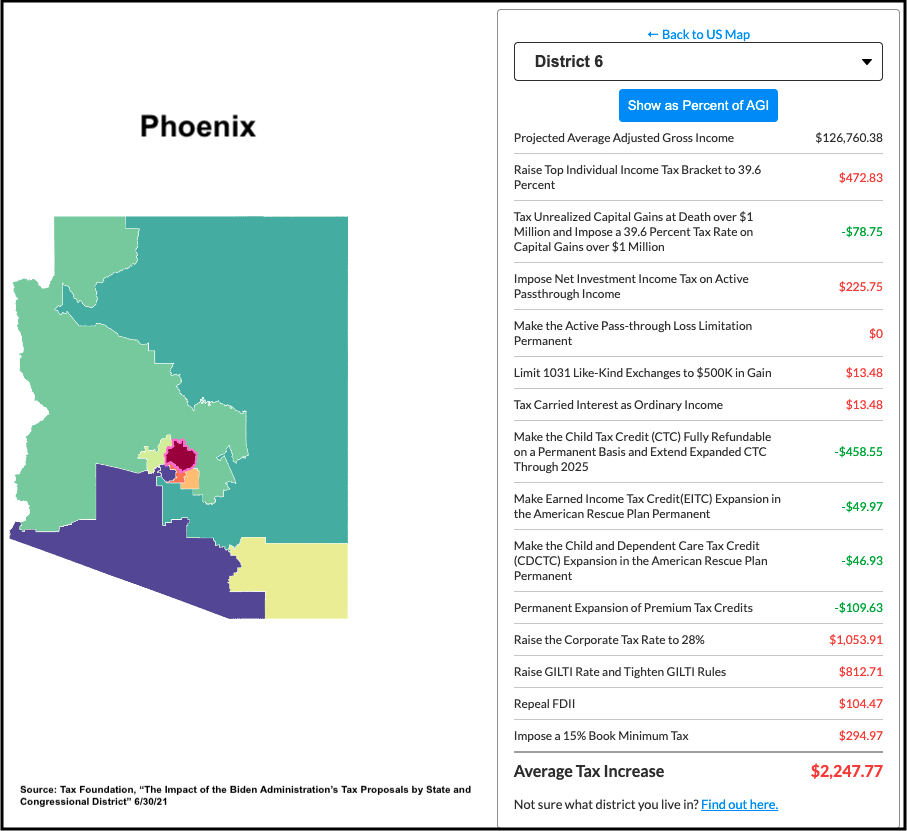

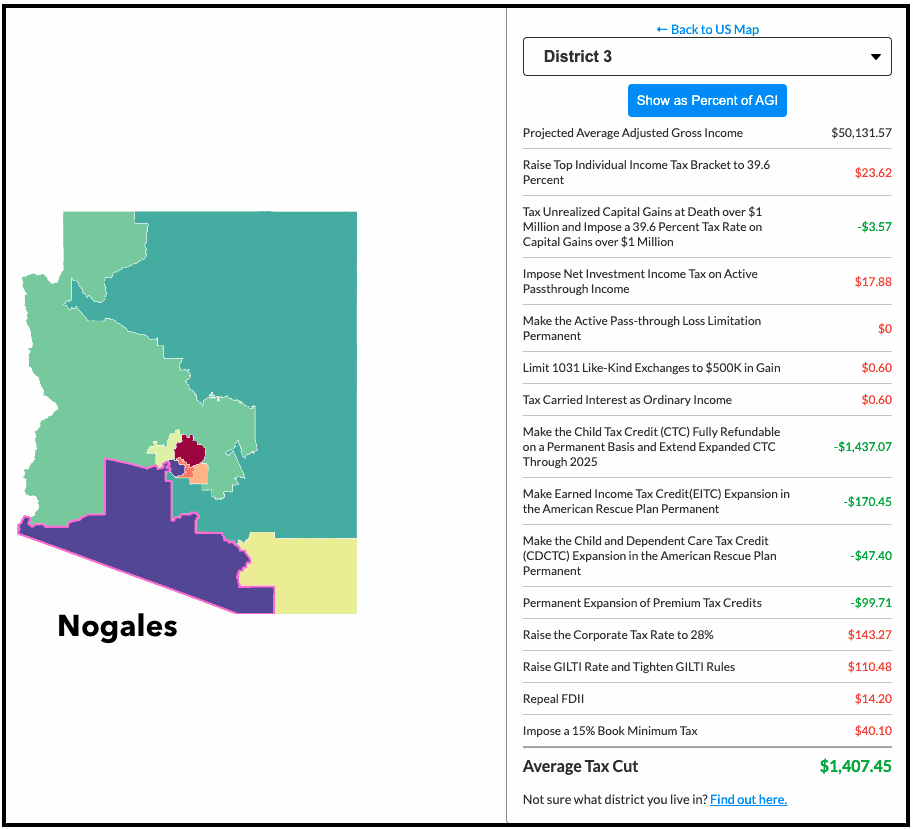

Whether or not your taxes will increase depends on several factors 1) income source, self-employed or W-2 employee 2) the number of qualifying children you have, and 3) the state and congressional district you reside. Click HERE to to use the Tax Foundation interactive map to project tax changes by your state and district.

Arizona taxpayers residing in District 6 (Phoenix) on average earn $126,760 and can expect their taxes to increase $2,247.77. For comparison District 3 (Nogales) residents on average earn only $50,131 and will receive a significant tax cut of $1,407. In fact, the largest tax cuts on average per filer are in majority-Hispanic districts in California, Texas, and Arizona, with tax cuts exceeding $1,500 per filer in 2022. However, this is not a result of carve-out legislation but primarily to the expanded Child Tax Credit, Hispanic population density and predominance of the nuclear, Roman Catholic family in Hispanic culture.1

The 2017 TCJA cut taxes for the majority of Americans. Unfortunately, President Biden believes the 40% of Americans that paid income taxes in 2020 are not paying enough and has proposed $2.3 trillion in new taxes. Whether your income taxes will increase can be projected based your state of residence and congressional district.

The Per Diem Plus® is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

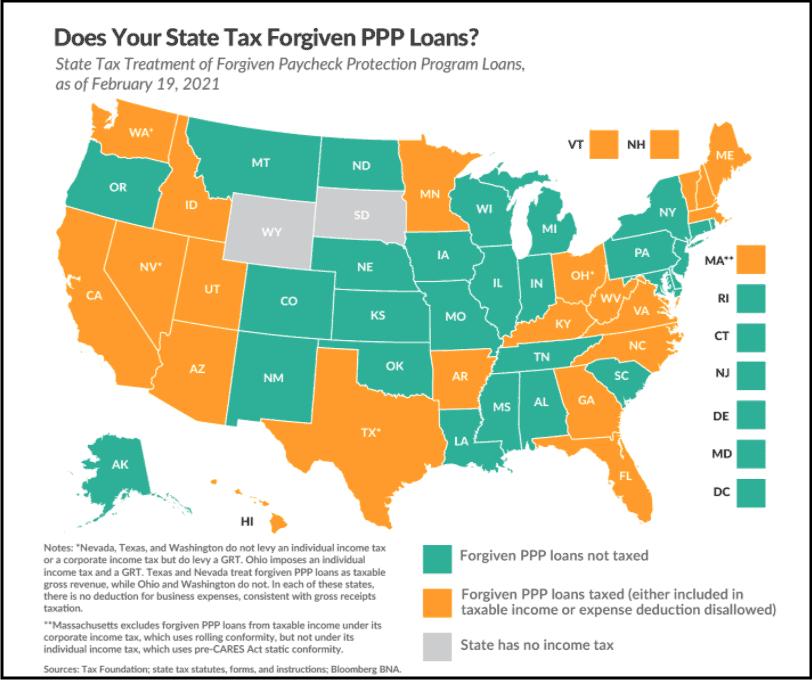

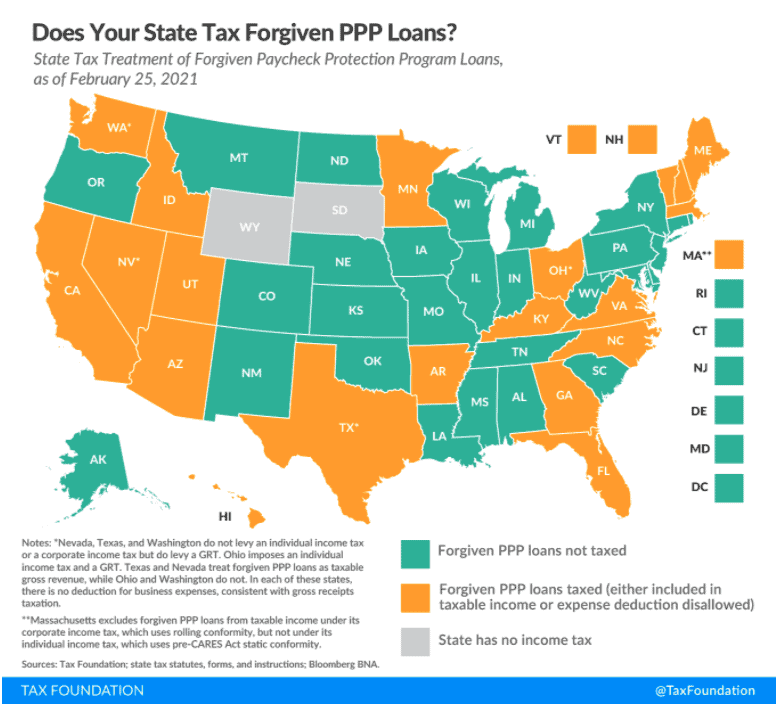

Did you receive a Paycheck Protection Program Loan (PPP) in 2020 to keep your small trucking company from going under? Did you use the loan proceeds for qualifying purposes, like payroll costs, mortgage interest payments, rent, and utilities? The good news is your loan should be forgiven AND it will be exempt from federal taxation. The bad news is that many states do not conform to the federal tax code and will tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both. The Tax Foundation map below and (click HERE to view state-by-state table show states’ tax treatment of forgiven PPP loans.

Fortunately several states that currently tax forgiven PPP loans, including Arizona, Arkansas, Hawaii, Maine, Minnesota, New Hampshire, Virginia, and Wisconsin, bills have been introduced to prevent such taxation.

If you received a PPP loan, and with tax deadlines fast approaching, you should consult with your tax advisor to determine if you will incur a state tax liability for the forgiven loan.

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2021, 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.