PDP For Fleets - 3 Months Free

"Partnering with Per Diem Plus provided us a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers who love our new per diem app."

Nick A., Controller

Per diem saves fleet thousands. With over 400 power units the motor carrier is a leader among specialized companies serving the United States and Canada.

The Controller was looking for a solution to two significant challenges impeding growth. The first involved reducing driver turnover and the second was raising driver pay in a tight labor market to improve driver recruiting.

The only IRS-compliant mobile application platform that automated administration of an accountable trucker per diem plan.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Questions? Contact Mark W. Sullivan Program Manager - Per Diem Plus FLEETS

About: Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The term"per diem allowance" means a payment under a reimbursement or other expense allowance arrangement that is — (1)

Trucker per diem rules for fleets eliminate the need for proving actual costs for meals & incidental expenses incurred.

Related Articles:

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Yes. Drivers that receive a non-taxable per diem reimbursement from their employer (trucking company) do so under IRC Sec 62(2)(a).

Under the trucker per diem rules for fleets a motor carrier can offer per diem only to drivers who are:

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot receive per diem.

A fleet will save approximately $3,000 annually or $0.03/mile/driver as the payroll tax and worker compensation savings exceed the tax on the 20% nondeductible portion of per diem.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Yes. On average driver pay will increase from $0.03 - $0.04/per mile.

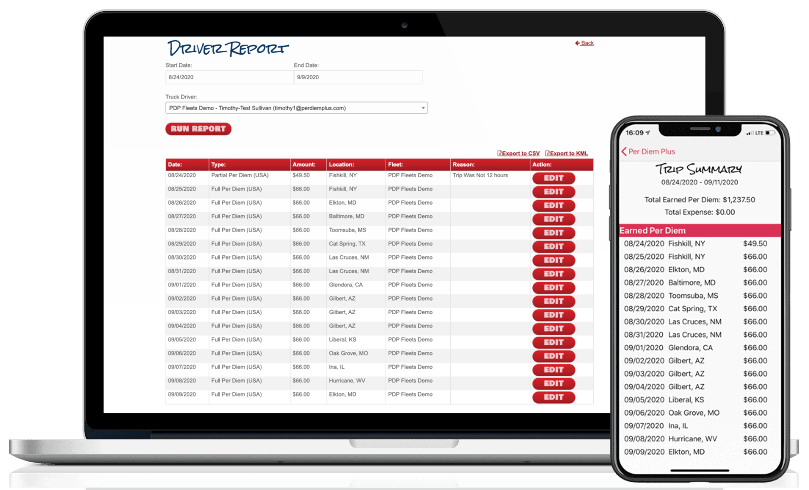

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Per Diem Plus automatically records per diem for travel in the USA and Canada for solo and team drivers.

No. Per diem is classified as a non-taxable reimbursement to an employee driver and is not reported under wages on Form W-2.

IRS increased per diem rates effective October 1, 2018 (Revised 10/01/2021)

USA $69 from $66

Canada $74 from $71

Yes. A partial day is 75% of the per diem rate.

A fleet can deduct 80% of per diem on their income tax return. However, the payroll tax and worker compensation savings ordinarily exceed the tax on the nondeductible portion of per diem.

Paper or electronic receipts that identify what, when and the amount are required. Drivers can upload and store receipts on the Per Diem Plus FLEETS app. Watch Run IRS Compliant Reports with Receipts video to see how easy drivers can send an itemized expense reports with receipts to payroll or accounting.

No. There is no published guidance from IRS that allows a fleet to pay a lodging per diem.

A self-employed driver (owner operator) falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

No less than 3 years from the filing date of an income tax return. Per Diem Plus FLEETS customers have instant access to itemized per diem tax records for four years.

ELD backups used to substantiate "time, date and place" are considered tax records.

Refer to IRS Revenue Procedure 2011-47. Or, use the Per Diem Plus FLEETS platform that automates administration of a company-paid per diem plan and takes the guesswork out of tax-related record keeping. Our How it Works video demonstrates just easy the app is to use.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

In this article we attempt to clear up the confusion on the rules governing truck driver per diem.

What is per diem? Trucker per diem is a per day travel expense allowance. Eliminates the need for proving actual costs for meals & incidental expenses incurred.

Do I have to spend all the per diem?

No. This is the maximum amount the IRS will let you claim on your tax return.

Who can claim trucker per diem?

Self-employed truckers who are subject to DOT HOS and who travel away from home overnight where sleep or rest is required. The Per Diem Plus mobile app software takes the guesswork out of tracking trucker per diem for OTR truckers.

Can all truck drivers receive per diem?

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot claim per diem.

What qualifies as a tax home?

Where you park your truck. Your regular place of business, or home in a real and substantial sense.

If I live in my truck, can I claim per diem?

No. A taxpayer who’s constantly in motion is a "tax turtle," or someone with no fixed residence who carries their “home” with them.

Are truck drivers allowed to claim a mileage allowance per diem?

Only fleets can use a cents-per-mile per diem. IRS’ standard mileage allowance is for use of a personal vehicle.

Can a driver claim per diem for lodging?

No. Trucker per diem is exclusively for meals and incidental expenses. You must have a receipt for all lodging expenses. A self-employed driver falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is the location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Motorola Devices

What documentation meets the IRS substantiation requirements to prove overnight travel and expense?

Only Per Diem Plus or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Unlike ELD backups, Per Diem Plus a can create an IRS-compliant itemized per diem report in seconds.

Can motor carriers pay per diem to employee drivers?

Yes. A motor carrier can offer per diem to drivers subject to DOT HOS and who travel away from home overnight where sleep or rest is required under an accountable per diem plan.

Is company-paid per diem taxable as income to an employee driver under an accountable fleet per diem plan?

No. Per diem is classified as a non-taxable reimbursement to an employee driver.

What are the current per diem rates for travel in USA & Canada?

The per diem rates for 2023 & 2024 are:

(IRS released annual update on September 25, 2023 in Notice 2023-68)

Can a driver prorate per diem for partial days of travel?

Yes. A partial day is 75% of the per diem rate.

How much per diem can I deduct on my income tax return?

A self-employed trucker can deduct 80% of per diem (100% for tax years 2021 & 2022) on their tax return.

What are Incidental Expenses?

Only fees and tips.

Are showers & parking fees incidental expenses?

No. Self-employed drivers may separately deduct expenses for: Per Diem Plus subscription, showers, reserved parking fees, mailing expenses, supplies and laundry.

Can employee drivers deduct company-paid per diem on their tax return?

No.

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount are required. You can upload and store receipts on the Per Diem Plus app and share them electronically with your tax preparer in seconds.

How long should tax records be retained?

No less than 3 years from the filing date of an income tax return. You have access to your Per Diem Plus tax records for four years.

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47 or use the Per Diem Plus app that takes the guesswork out of tax-related record keeping.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2017-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per diem simply means a “per day” travel expense allowance. Although taxpayers have the option of keeping actual records of their travel expenses, the IRS has provided per diem allowances under which the amount of away-from-home meals and incidental expenses may be deemed to be substantiated. These per diem allowances eliminate the need for proving actual costs. However, a taxpayer must substantiate the amount, time, place and business purpose of expenses paid or incurred by adequate records or other evidence when traveling away from home1.

Both self-employed and employee truck drivers subject to the hours of services limitations of the Department of Transportation (DOT) can claim $63 for meals & incidental expenses (M&IE) for travel with the United States ($68 in Canada) and are not required to retain receipts or sales slips for these expenses. A trucker can deduct 80% of these expenses on their income tax returns2.

A truck driver who is away from home for only a portion of a day can prorate the M&IE allowance. For example, Per Diem Plus allows 75% of the M&IE rate where a driver departs their tax home after noon or returns home from a trip before noon.

No. Incidental expenses include only fees and tips given to porters, baggage carriers, hotel staff and staff on ships. Transportation between place of lodging and place where meals are taken and the mailing cost of filing expense reports are no longer included in the definition of incidental expenses3. Drivers using per diem rates may separately deduct expenses for postage, showers and reserved parking fees.

In order to claim any deduction, a taxpayer must be able to prove, if a tax return is audited, that the expenses were in fact paid or incurred. The IRS deems travel expenses particularly susceptible to abuse and requires truck drivers maintain an adequate accounting and sufficient documentary evidence to prove overnight travel. For example, logbooks, expense diaries or an IRS-approved software tool like Per Diem Plus.

Self-employed and employee drivers cannot claim per diem for lodging and are required to maintain documentary evidence for all lodging expenses4.

No. An individual is not away from home unless their duties require them to be away from the general area of their home for a period substantially longer than an ordinary workday and it is reasonable for them to need to sleep or rest5. For example, drivers who start and end a trip at home within the DOT 14 consecutive-hour “driving window” cannot claim per diem.

Tax home defined: An individual’s tax home is considered to be: (1) the taxpayer’s regular place of business, or (2) the taxpayer’s home in a real and substantial sense6. A taxpayer who is itinerant or someone who has a home wherever they happen to be working is never away from home for purposes of deducting traveling expenses.

This article was written by D R Sullivan & Company, CPA PC, an accounting firm that has been providing taxpayer advocacy, consulting, and litigation services since 1998. The firm has nearly a decade of experience advising large fleets and telematics providers on IRS substantiated per diem and is tax counsel for Per Diem Plus, an automated per diem and expense tracking Android app.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. The Per Diem Plus logo and Per Diem Plus are trademarks of Per Diem Plus, LLC.