PDP For Fleets - 3 Months Free

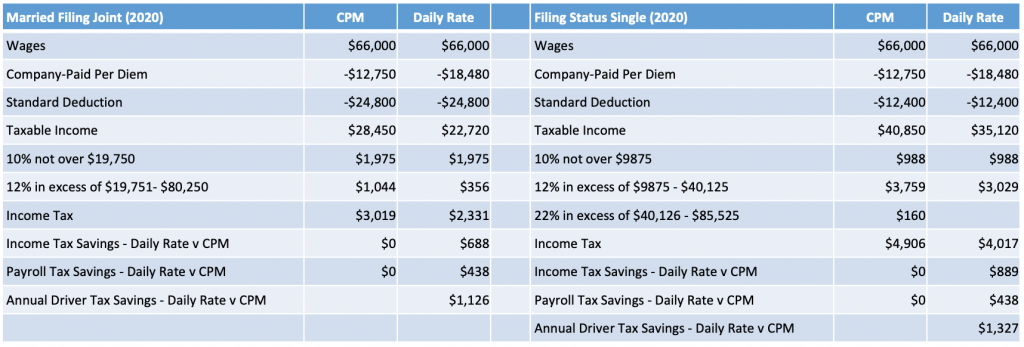

Substantiated per diem provides the largest benefit to both a driver and fleet over the old cent-per-mile method. Decades before the advent of TMS software, telematics and ELD's fleets adopted cent-per-mile per diem. Why? Because it was easy to calculate and substantiate using trip sheets[i]. However, there is no correlation between the miles a driver travels and frequency of meal breaks.

Under the cent-per-mile method a driver is paid only for miles driven and not nights away from home. Although, a driver may travel 500 miles one day they may only clock 200 miles the next. In the end, the distance traveled does not affect the need to eat 3 meals a day.

The IRS introduced the Special Transportation Industry substantiated per diem to simplify tax compliance for fleets by relying on days away from home instead of miles traveled. This method accurately reflects the number of meals a driver eats and resolved the problem that driver’s regularly travel away from home and stop during a single trip at localities with differing federal M&IE rates.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

[i] 1-274-5T(c) Rules of substantiation, Rev. Proc. 2011-47 § 4.02(5)

Both the substantiated and cent-per-mile per diem methods are IRS-compliant. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

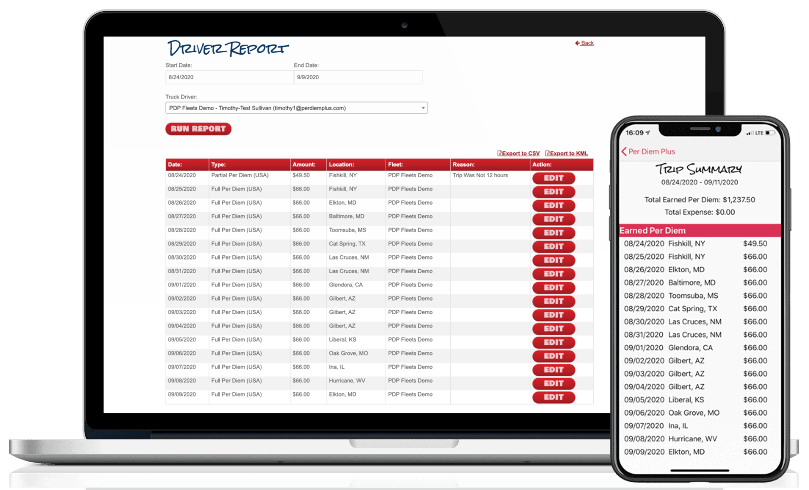

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service.

Questions? Contact Mark W. Sullivan, EA.

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

First, and foremost, you want to make sure you have all expense receipts and documentation needed for any expenses you will be deducting on your tax return for 2016, especially major expense items like per diem and fuel. For your per diem expenses, be sure you have all 12 months of paper or electronic logs to substantiate time, date and place of the expense. Or, if you use Per Diem Plus®, all you need to do is run a report and send it to your accountant directly from the app. Unfortunately, per IRS Regulations, a calendar is not sufficient substantiation for per diem expenses.

If you are self-employed and have the ability to control when you invoice for end-of-year work, then delay invoicing for an end-of-year run until January, which will push the income into next year. This only makes sense if you expect to be in the same, or lower, tax bracket next year as this year.

If there are repairs that need to be made to your truck or supplies you need to purchase, etc. then make and pay for those purchases by year-end versus waiting until next year. Payment can be made using a credit card and still qualify for deduction in the current year even if you do not pay the credit card bill until next year.

Do you itemize your deductions rather than take the standard deduction? If so, then make some extra charitable contributions, cash or non-cash by the end of the year. However, be sure to obtain receipts for all charitable contributions regardless of the amount.

If you are on the borderline of being able to itemize, then aggregate deductions into one year or the other. This takes a little more planning. Examples include, paying an extra mortgage payment in one year to pay extra interest; paying two years of real estate taxes in one year, if you have control over the timing of payment (pay one on January 2nd to minimize interest and penalties and the other at the end of the year); and bunching charitable contributions into one year. Although the chance is slim, you do need to be cognizant of the Alternative Minimum Tax and whether this strategy could trigger it. You would want to discuss this with your tax professional before engaging in this strategy.

If you are self-employed, contributing to a retirement plan is a great way not only to save for retirement but to save taxes as well. There are several different plans to choose from. However, depending on which one you choose, governs when it needs to be set up. A SIMPLE plan would need to be set by October 31st of the first year of contributions; others need to be set up by December 31st. A SEP plan can be set up all the way up to the due date of the tax return, including extensions. Therefore, if you want to make a contribution but do not have the money by April 15th, you can extend your return in order to buy more time to make the contribution. Just remember, an extension to file the return is not an extension of time to pay the tax, just the SEP contribution.

IRA contributions must be made by April 15th even if you have filed for an extension. Generally, you can make a larger contribution to a plan other than an IRA, unless you plan to use the spousal IRA rules in order to double your contribution. This is another area where consulting with your tax professional may be beneficial to determine the best course of action.

Want to join the conversation? Drop us a line at info@perdiemplus.com

This article was written by Donna R. Sullivan, CPA of Per Diem Plus, LLC. Sullivan has over 25 years of tax consulting and preparation experience.

Please remember that everyone’s tax and financial situations are different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. Per Diem Plus® proprietary software is the trademark of Per Diem Plus, LLC.