Designed by drivers, built by tax pros

Our tax expert responds to a common question we receive from drivers and fleets.

Substantiated per diem provides the largest benefit to both a driver and fleet over the old cent-per-mile method. Decades before the advent of TMS software, telematics and ELD's fleets adopted cent-per-mile per diem. Why? Because it was easy to calculate and substantiate using trip sheets[i]. However, there is no correlation between the miles a driver travels and frequency of meal breaks.

Under the cent-per-mile method a driver is paid only for miles driven and not nights away from home. Although, a driver may travel 500 miles one day they may only clock 200 miles the next. In the end, the distance traveled does not affect the need to eat 3 meals a day.

The special transportation industry per diem

The IRS introduced the Special Transportation Industry substantiated per diem to simplify tax compliance for fleets by relying on days away from home instead of miles traveled. This method accurately reflects the number of meals a driver eats and resolved the problem that driver’s regularly travel away from home and stop during a single trip at localities with differing federal M&IE rates.

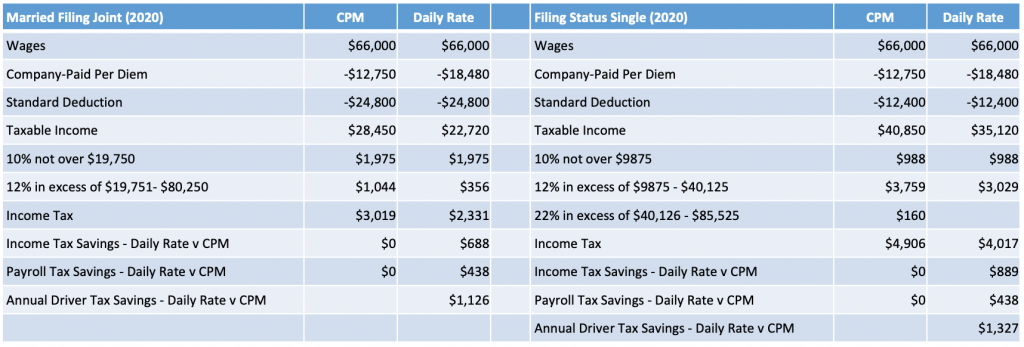

- The most beneficial aspect to a driver is that substantiated method at $69/day yields on average 25% more per diem than cent-per-mile.

- Substantiated per diem can be earned during a 34-hour restart and unforeseen delays like detention, breakdowns, or weather.

- A typical driver will save an additional $2,300 - $3,600 in income and payroll taxes over cent-per-mile.

- Well-known motor carriers that utilize substantiated per diem include Averitt Express, TMC Transportation, Transport America and EPES Transport System.

- Fleets that implement the Per Diem Plus FLEETS platform will save about 27% or $1,000 more per driver in reduced payroll and income taxes and workers compensation than cent-per-mile.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

[i] 1-274-5T(c) Rules of substantiation, Rev. Proc. 2011-47 § 4.02(5)

Both the substantiated and cent-per-mile per diem methods are IRS-compliant. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Get in touch with the experts at Per Diem Plus today to discuss a smooth rollout for your system.

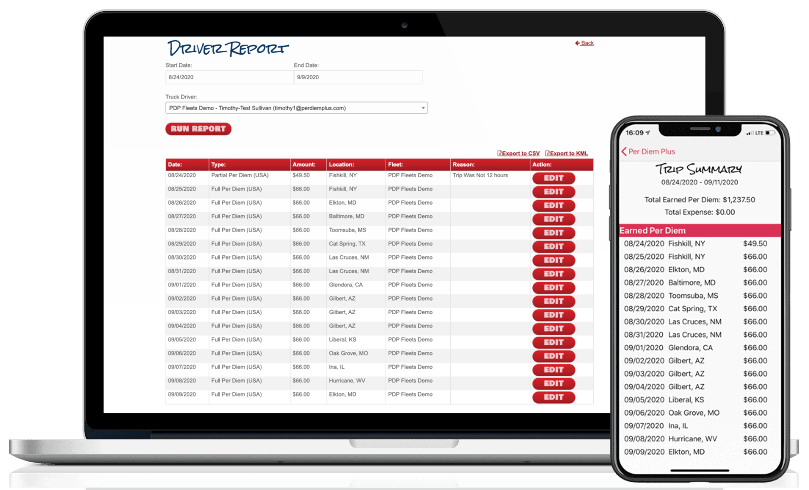

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

About Per Diem Plus FLEETS

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service.

Questions? Contact Mark W. Sullivan, EA.

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®