PDP For Fleets - 3 Months Free

Warren, Massachusetts-based Intercity Lines, an enclosed car carrier, transitions from PDP Fleets mobile app to Per Diem Plus API for Samsara to further streamline operational efficiency of its 30-vehicle fleet.

The Per Diem Plus API integration was a significant factor in our choosing Samsara over competing ELD solution providers.

Dean Wilson, Vice President

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

Dave and Linda opened Intercity Lines, Inc. more than 40 years ago, setting out to provide excellence in enclosed automotive transportation. As a driver himself, Dave took great pride in the trust customers gave him when transporting what could be their most prized possession—their classic, historic, or exotic vehicles. Together, Dave and Linda brought attention to detail, dedication, and innovation to the enclosed automotive transportation industry.

A hallmark of that innovation: the adoption of lift-gates on trailers. Intercity Lines, Inc. was the first in the industry to use lift-gates on their trucks—a practice that has since become an industry standard. Over the years, Dave and Linda began recruiting industry-leading drivers, growing the Intercity Lines, Inc. fleet, and providing trusted transport services to an ever-expanding customer base. Their customers include several European automotive manufacturers, classic car auction houses, and car collectors throughout America.

Learn more about Intercity Lines services HERE

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

New England-based regional carrier M&D Transportation selects Per Diem Plus API for Samsara to raise driver pay and improve operational efficiency of its 20-vehicle fleet.

“The API was quick and easy to set up and was a significant factor in our choosing Per Diem Plus for Samsara.”

Mike Collins, President

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

M&D Transportation was founded by Michael and David Collins. Having worked in all aspects of the transportation industry through other family businesses, the two brothers decided to go on their own in 1987 and were granted full operating authority in 1988. Mainly focused on local and intermodal transportation they saw a need for a niche carrier to service dedicated, over the road and supply chain logistics. Currently, M&D Transportation has become a multi‐mode asset fleet, servicing local, mid‐range and long-haul markets.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

St. Louis-based Mido's Trucking, a truckload carrier, transitions from PDP Fleets mobile app to Per Diem Plus API for Samsara to further streamline operational efficiency of its 100-vehicle fleet.

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

Mido Selimovic came to the US in 1999 as an 18-year-old refugee from Vlasenica, Bosnia-Herzegovina where his family struggled to stay alive in a country destroyed by the Bosnian War. At age 25 Mido entered the transportation industry by purchasing his first truck. In 2008, he opened Mido's Trucking with his sole purpose being to provide a workplace for fellow war refugees who were looking for a reliable carrier they could work for and call their home. Since starting Mido’s 15 years ago the company has grown to 100 trucks serving 48 states with the help of his wife Azra, a fellow refugee who fled Kozarska-Dubic at the outset of the war when she was 12.

As with many small businesses in America, Mido’s is a family affair with many relatives working for the company as drivers, dispatchers and mechanics. Mido’s mission as refugee haven remains unchanged to this day; they employ drivers from Africa, Asia, Bulgaria, Eastern Europe and Thailand looking for an opportunity to make a fresh start in the USA.

Learn more about Mido's Trucking, LLC services HERE

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Rochester, Michigan-based Sharco Express, a full truckload, LTL, expedited, and cross border transportation services fleet raises driver pay and improves operational efficiency of its 100-vehicle fleet using Per Diem Plus API for Samsara.

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

Sharco Express was founded in 2008 by George Franczyk and his wife Joy in their family kitchen after nearly 20 years on the road as an owner-operator, buying one truck at a time. Now in its 2nd generation of family ownership, the company has grown to nearly 100 trucks and 200 trailers out of the main 25,000 square foot company terminal in Burton, MI.

Learn more about Sharco Express services HERE

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Unlock Fleet Savings With Per Diem Amid Economic Uncertainty

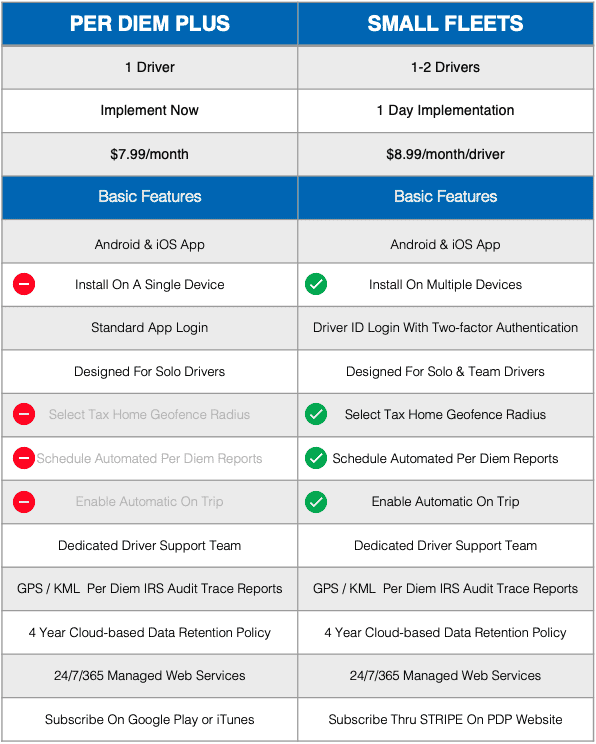

Introducing Per Diem Plus Small Fleets

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

“First in excellence” carrier Arka Express selects Per Diem Plus for Samsara to raise driver pay and operational efficiency of its 400-vehicle fleet.

“The API was quick and easy to set up and run, which was a significant factor in our choosing Per Diem Plus for Samsara.”

Art Astrauskas, President

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

Arka Express has evolved from a small 35-unit carrier located out of Markham, IL, to an elite, state-of-the-art fleet of 400 units built by the top transportation professionals in the industry in only 10 years.

In addition to the Markham terminal, they are currently establishing headquarters in Indiana, Atlanta and New Jersey as they continue to deliver services throughout the Midwest, East Coast and Southeast with a 400-mile regional radius in both Chicago and Atlanta. In addition, they also developed an OTR presence from the Dakotas to Florida—and everything in between.

Learn more about Arka Express services HERE

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Unlock Fleet Savings With Per Diem Amid Economic Uncertainty

Introducing Per Diem Plus Small Fleets

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Battle Creek, Michigan-based Behnke, Inc raises driver pay and improves operational efficiency of its 55-vehicle fleet using Per Diem Plus API for Samsara.

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

Behnke Inc. is a family-owned trucking business that has been a part of southern Michigan for more than 85 years. Based in Battle Creek, Michigan, Behnke Inc. was started in 1930 after Carl Behnke bought out the Lafler Moving Company. Under Behnke Inc. he continued to handle moving jobs throughout the Midwest. One of the first major jobs Behnke Inc. had was to move the famous magician Harry Blackstone to his various shows around the Midwest. Four generations later, we’re proud to remain a family-orientated business and one of Battle Creek’s longest standing businesses. Today Behnke Inc. is one of the largest transportation firms in the Battle Creek-Kalamazoo area. We move freight across the U.S., but the majority of our business is moving freight within the Midwest area.

Learn more about Behnke services HERE

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Unlock Fleet Savings With Per Diem Amid Economic Uncertainty

Introducing Per Diem Plus Small Fleets

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

World class automotive transporter Virginia Transportation raises driver pay and improves operational efficiency of its 550-vehicle fleet using Per Diem Plus API for Samsara.

Per Diem Plus® Fleets is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers operating in the USA and Canada. The Per Diem Plus API integration utilizes the Samsara GPS gateway to establish IRS-required “time, date and place” substantiation to prove away-from-home travel. No matter how big or small your company is, Per Diem Plus has a solution for you.

Virginia Transportation Corporation was founded in 1994 and has since transformed from a one-truck company to a premier nationwide vehicle carrier and network logistics service provider. Our clientele includes renowned automobile manufacturers, car dealerships, and automotive auctions, among others.

From the port to the rail yard, from the manufacturing facility to the dealership, and everywhere in between, we work with most major Automobile Manufacturers and Logistics Service Providers in the United States and Canada to ensure that we are meeting the needs of our Customers quickly, safely, and efficiently.

Learn more about Virginia Transportation services HERE

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus.

Related articles

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Unlock Fleet Savings With Per Diem Amid Economic Uncertainty

Introducing Per Diem Plus Small Fleets

Per Diem Plus is a proprietary software application that was designed by truckers and built by tax pros. It is the only IRS-compliant, GPS-integrated and mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Drivers have spoken! Based on user feedback Per Diem Plus introduces Small Fleets, which enables drivers to customize settings and automate features within the Per Diem Plus mobile app.

Small Fleets will automatically track each qualifying day and partial day of travel away from home in the US and Canada.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

IRS-Compliant: Per Diem Plus® is the only IRS-compliant, mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada to substantiate away-from-home travel for solo and team drivers.

GPS-Based Tracking: Per Diem Plus utilizes a devices GPS to establish IRS-required “time, date and place” substantiation to prove away-from-home travel

Proven: Drivers have logged millions of miles using Per Diem Plus! Join those that value their time, love to eliminate inefficient paperwork, and want to simplify tax compliance and save money.

Easy Setup: An IRS-compliant cloud-based mobile app platform that allows for rapid deployment.

Secure Login: Two-Factor authentication with fleet code and driver ID login.

Data Plan Friendly: The average user on the road for a month will use less than 50MB per month.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

On September 22, 2022 the US Treasury's Financial Crimes Enforcement Network (FinCEN) issued final rules requiring beneficial ownership reporting for small businesses, i.e. single truck owner operators. The rule requires businesses to file reports with FinCEN that identify two categories of individuals:

This rule requires most corporations, LLC's and similar businesses created in or registerd to do business in the United States to report (disclose) information about their beneficial owners to FinCEN. The rules came out of Corporate Transparency Act passed by the Biden administration in January 2021.

The purpose of the new reporting rule is to allow the Federal government to create a national database of information concerning the individuals who, directly or indirectly, own a substantial interest in, or substantial control over (beneficial owners) certain types of domestic and foreign entities.

Penalties for failure to file reports: $500 per day!

Domestic reporting company – any entity that is a corporation, a limited liability company, or otherwise created by the filing of a document with a secretary of state or similar office.

Foreign reporting company – any entity formed under the law of a foreign country and registered to do business in any U.S. state by the filing of a document with a secretary of state or similar office.

There is also an exemption for entities that employ more than 20 full-time employees in the U.S., have an operating presence at a physical office in the U.S., and demonstrate more than $5 million in gross receipts or sales on their federal income tax return (excluding receipt/sales from sources outside the U.S.). If a company falls below these thresholds in the future, a report must be filed within 30 days. An updated report is required if a reporting company later becomes eligible for the exemption.

The Corporate Transparency Act is an expansion of anti-money laundering laws and is intended to help prevent and combat money laundering, terrorist financing, corruption, tax fraud, and other illicit activity. Broadly speaking, it requires most U.S. business to disclose to the federal government in reports about who owns their business and lumps ordinary small businesses in with the nefarious underworld. Will this new rule deter illicit activity? Probably not but it ensures registering with FinCEN as opposed to running their business now becomes the single most important priority for American businesses lest they go bankrupt from the $500 per day penalties!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

"The Corporate Transparency Act: Questions and Answers", Jonathan A. Greene and Casandra J. Creekman, WrickRobbins, March 1, 2023

A motor carrier with 55 over-the-road drivers received this convoluted email explanation from their trucker per diem solution provider who claims to have thousands of drivers covered by their plan. It was sent in response to the Per Diem Plus tax pros reviewing the plan details and advising the driver per diem program would be classified as a nonaccountable plan that produces over $415,000 of improper employee business expenses, evades over $100,000 of taxes and mischaracterizes over $1.2 million of driver wages.

"Your trucking company is using the lodging option, so your amounts are $59 for meals and $74 for lodging. Meal per diem can be awarded each day, while lodging is limited to 2 days a week. Lodging can be used but it follows some different rules. The daily total is limited to $155 which we stay well under to ensure compliance. Lodging has always been 100% deductible, that's why some people use that option. Both options (meals and incidentals only; meals and incidentals and lodging) are compliant with IRS regulations."

Copied from promotor email

See IRS Rev. Proc. 2011-47.1, 3.01(1), 4.04 and 6.06; Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48, IRC 267(b), Tres. Reg. Sec 1.274-5(c)(2)(iii)

The following analysis is based 55 over-the-road drivers working 51 weeks annually, paid a twice-weekly $74 lodging per diem and 20% effective corporate income tax rate:

Under a nonaccountable plan the per diem is included in an employee's gross wages and reported on Form W-2. The following analysis is based 55 over-the-road drivers who travel away from home 255 nights per year

The word salad explanation provided by the per diem solution promotor is reminiscent of listed tax transactions that have the potential for tax avoidance or evasion. Any trucking company that is considering implementing or modifying a driver per diem program needs to carefully review the IRS guidelines. If the tax professional they are using raises questions about the accuracy of the promoters claims, people should listen to their advice.

Have you been approached by one of these "lodging per diem" promoters? Contact us HERE to anonymously tell us about your experience.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®