PDP For Fleets - 3 Months Free

The Internal Revenue Service announced disaster tax relief for all individuals and businesses affected by Hurricane Helene, including the entire states of Alabama, Georgia, North Carolina and South Carolina and parts of Florida, Tennessee and Virginia.

Taxpayers in these areas now have until May 1, 2025, to file various federal individual and business tax returns and make tax payments. Among other things, this includes 2024 individual and business returns normally due during March and April 2025, 2023 individual and corporate returns with valid extensions and quarterly estimated tax payments.

Besides all of Alabama, Georgia, North Carolina and South Carolina, this currently includes 41 counties in Florida, eight counties in Tennessee and six counties and one city in Virginia.

Individuals and households that reside or have a business in any one of these localities qualify for tax relief. The same relief will be available to other states and localities that receive FEMA disaster declarations related to Hurricane Helene.

The tax relief postpones various tax filing and payment deadlines that occurred beginning on Sept. 22, 2024, in Alabama; Sept. 23 in Florida; Sept. 24 in Georgia; Sept. 25 in North Carolina, South Carolina and Virginia; and Sept. 26 in Tennessee. In all of these states, the relief period ends on May 1, 2025 (postponement period). As a result, affected individuals and businesses will have until May 1, 2025, to file returns and pay any taxes that were originally due during this period.

This means, for example, that the May 1, 2025, deadline will now apply to:

In addition, the IRS is also providing penalty relief to businesses that make payroll and excise tax deposits. Relief periods vary by state. Visit the Around the Nation page for details.

Mark Sullivan Consulting is here to support taxpayers affected by recent natural disasters. We understand the complexities and stress that come with navigating tax relief during such challenging times, and our experienced team is ready to help you make sense of the available IRS relief options. Whether you're facing filing delays, penalty notices, or need assistance claiming disaster-related losses, we are committed to guiding you through every step of the process with compassion and expertise. Let us take the burden off your shoulders so you can focus on recovery.

Request a free consultation HERE with Mark W. Sullivan, EA

Mark opened Mark Sullivan Consulting, PLLC in October 2022 after decade of tax consulting in FinTech. He is fairly new to the Phoenix area having moved here from St. Louis, Missouri in July 2020.

Mark has over 30 years of experience, including several years with the IRS as a Revenue Officer and over 16 years as director at a firm that specialized in civil and criminal tax accounting, IRS representation and forensic accounting. He has been admitted as an expert witness for civil and criminal tax cases in both State and Federal courts. Since relocating to Arizona and returning to practice, he has concentrated on tax compliance for individuals and businesses, advisory and representation services.

Mark graduated from the St. Louis University with a Bachelor of Arts in Sociology – International Relations degree. He has an unlimited licensed to practice as an Enrolled Agent nationwide and is a member of the National Association of Enrolled Agents.

A long-time Jeep enthusiast, Mark enjoys off-roading in his 2006 Jeep Wrangler LJ around the Southwest or wherever he goes on vacation.

Copyright 2024

Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Additional references:

IR-2024-253 (October 1, 2024)

"Can I claim my emotional support dog as a tax deduction" is a common questioned posed to tax professionals by long-haul truckers. Every pet owner claims their animal is a member of the family and they are an essential companion for thousands of truckers. The emergence of the "Emotional Support" registration industry reinforces this fact.

It understandable that taxpayers may want to recoup some of their emotional support dog expenses with a creative medical expense tax deduction[i]. To counter the urge to claim Fido as a tax deduction the IRS has promulgated guidance on what type of animals qualify.

Mark Sullivan Consulting Launches New Income Tax Preparation Service for Truckers

How does the IRS define a service dog versus an emotional support dog?

The IRS does not offer a definition of a "service dog" oe "emotional support" animal, but guidance can be gleaned from the Americans With Disability Act (ADA). Under the ADA, a service animal is defined as a dog that has been individually trained to do work or perform tasks for an individual with a disability. The task(s) performed by the dog must be directly related to the person's disability including a physical, sensory, psychiatric, intellectual or other mental disability. An animal is defined as "emotional support" when it has not been specifically trained, for example:

A review of IRC § 213 is required to answer the question, "Can I use my emotional support dog as a tax deduction?" The costs of buying, training, and maintaining a service animal to assist an individual with mental disabilities may qualify as medical care if the taxpayer can establish that the taxpayer is using the service animal primarily for medical care to alleviate a mental defect or illness and that the taxpayer would not have paid the expenses but for the disease or illness.

IRS Chief Counsel Note: A taxpayer who claims that an expense of a peculiarly personal nature is primarily for medical care must establish that fact. The courts have looked toward objective factors to determine whether an otherwise personal expense is for medical care:

A personal expense is not deductible as medical care if the taxpayer would have paid the expense even in the absence of a medical condition. Commissioner v. Jacobs, 62 T.C. 813 (1974). [ii]

You can include in medical expenses:

In general, this includes any costs, such as food, grooming, and veterinary care, incurred in maintaining the health and vitality of the service animal so that it may perform its duties.

2024 Trucker Per Diem Rates Published (September 25, 2023)

Flying With A Service Dog? Here's Everything You Need To Know (Becca Bond, The Points Guy, 9/12/23)

What Is The IRS Definition Of A Service Dog?

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Generally, you can deduct on Schedule A, Itemized Deductions (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). However, with tax reform drastically increasing the Standard Deduction (2022: $12,950 Single, $25,900 Married) most taxpayers will not have sufficient itemized deductions to warrant pursuing a tax break for their pet expenses.

No, emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

"Prior to January 2021, the law allowed emotional support animals to fly with documentation from a medical doctor verifying the animal was necessary for comforting the passenger. ESAs did not have to be trained. But after rampant abuse of the system that included people taking everything from peacocks to snakes to untrained and aggressive dogs on flights, the DOT revised its regulations to allow airlines to ban ESAs from the skies. Although the ultimate decision was left up to the airlines themselves, all major U.S. and Canadian carriers quickly changed their policies to stop non-ESA pets from flying. You can still fly with a small dog (under 25 pounds), but the pup must be in a carrier and you will need to pay the airline pet fee to fly."

Becca Bond, The Points Guy (9/12/23)

Can I use my dog as a tax deduction if it guards my truck? The absence of specific guidance on guard dogs from IRS compels a taxpayer to evaluate the appropriateness of claiming a tax deduction for expenses related to a guard dog used to protect a truck that is constantly on the move as opposed to a drop-yard or terminal. Kay Bell writing for Bankrate.com provided a great analysis,

“That “Beware of dog” sign in your business’s window is no idle threat. Break-ins have stopped since you set up a place for your Rottweiler to stay overnight. In this case, the IRS would likely be amenable to business deduction claims of the animal’s work-related expenses.

Standard business deduction rules still apply, notably that the cost of keeping an animal on work premises is ordinary and necessary in your line of business. Once you show that, the dollars spent each year keeping your pooch in good guard condition — food, vet bills and training — would be deductible as a business expense.

As with all deductions, be prepared to provide full and accurate records of your animal’s hours on the job. You’ll also find your tax claim more acceptable when you demonstrate how the animal protects your livelihood inventory. In addition, as is often the case with business property, the dog must be depreciated, a way of allocating its cost over its useful life for IRS purposes.

Keep in mind, too, that your claims carry more weight when your pet is a breed that’s typically used for such jobs. So even though your Chihuahua has a loud bark, your tax claim is more credible if your guard dog is a German shepherd, Doberman pinscher or a similar imposing breed”.[iv]

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

Need assistance resolving a tax controversy issue? Contact Mark W. Sullivan, EA or request a free consultation HERE

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] 2014 American Pet Producers Association market study

[ii]https://www.irs.gov/pub/irs-wd/10-0129.pdf

[iii]https://www.irs.gov/pub/irs-pdf/p502.pdf

[iv]https://www.bankrate.com/finance/taxes/tax-write-offs-for-pet-owners-1.aspx#slide=3

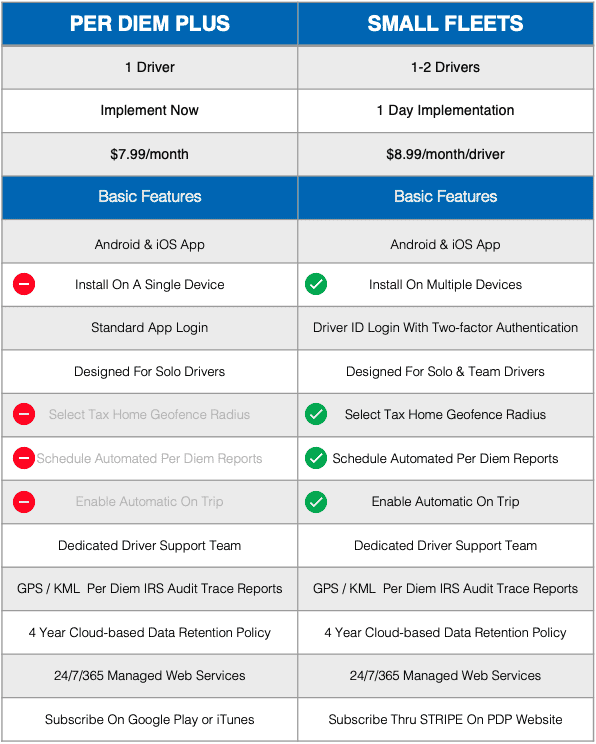

Drivers have spoken! Based on user feedback Per Diem Plus introduces Small Fleets, which enables drivers to customize settings and automate features within the Per Diem Plus mobile app.

Small Fleets will automatically track each qualifying day and partial day of travel away from home in the US and Canada.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

IRS-Compliant: Per Diem Plus® is the only IRS-compliant, mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada to substantiate away-from-home travel for solo and team drivers.

GPS-Based Tracking: Per Diem Plus utilizes a devices GPS to establish IRS-required “time, date and place” substantiation to prove away-from-home travel

Proven: Drivers have logged millions of miles using Per Diem Plus! Join those that value their time, love to eliminate inefficient paperwork, and want to simplify tax compliance and save money.

Easy Setup: An IRS-compliant cloud-based mobile app platform that allows for rapid deployment.

Secure Login: Two-Factor authentication with fleet code and driver ID login.

Data Plan Friendly: The average user on the road for a month will use less than 50MB per month.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

On September 22, 2022 the US Treasury's Financial Crimes Enforcement Network (FinCEN) issued final rules requiring beneficial ownership reporting for small businesses, i.e. single truck owner operators. The rule requires businesses to file reports with FinCEN that identify two categories of individuals:

This rule requires most corporations, LLC's and similar businesses created in or registerd to do business in the United States to report (disclose) information about their beneficial owners to FinCEN. The rules came out of Corporate Transparency Act passed by the Biden administration in January 2021.

The purpose of the new reporting rule is to allow the Federal government to create a national database of information concerning the individuals who, directly or indirectly, own a substantial interest in, or substantial control over (beneficial owners) certain types of domestic and foreign entities.

Penalties for failure to file reports: $500 per day!

Domestic reporting company – any entity that is a corporation, a limited liability company, or otherwise created by the filing of a document with a secretary of state or similar office.

Foreign reporting company – any entity formed under the law of a foreign country and registered to do business in any U.S. state by the filing of a document with a secretary of state or similar office.

There is also an exemption for entities that employ more than 20 full-time employees in the U.S., have an operating presence at a physical office in the U.S., and demonstrate more than $5 million in gross receipts or sales on their federal income tax return (excluding receipt/sales from sources outside the U.S.). If a company falls below these thresholds in the future, a report must be filed within 30 days. An updated report is required if a reporting company later becomes eligible for the exemption.

The Corporate Transparency Act is an expansion of anti-money laundering laws and is intended to help prevent and combat money laundering, terrorist financing, corruption, tax fraud, and other illicit activity. Broadly speaking, it requires most U.S. business to disclose to the federal government in reports about who owns their business and lumps ordinary small businesses in with the nefarious underworld. Will this new rule deter illicit activity? Probably not but it ensures registering with FinCEN as opposed to running their business now becomes the single most important priority for American businesses lest they go bankrupt from the $500 per day penalties!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

"The Corporate Transparency Act: Questions and Answers", Jonathan A. Greene and Casandra J. Creekman, WrickRobbins, March 1, 2023

A motor carrier with 55 over-the-road drivers received this convoluted email explanation from their trucker per diem solution provider who claims to have thousands of drivers covered by their plan. It was sent in response to the Per Diem Plus tax pros reviewing the plan details and advising the driver per diem program would be classified as a nonaccountable plan that produces over $415,000 of improper employee business expenses, evades over $100,000 of taxes and mischaracterizes over $1.2 million of driver wages.

"Your trucking company is using the lodging option, so your amounts are $59 for meals and $74 for lodging. Meal per diem can be awarded each day, while lodging is limited to 2 days a week. Lodging can be used but it follows some different rules. The daily total is limited to $155 which we stay well under to ensure compliance. Lodging has always been 100% deductible, that's why some people use that option. Both options (meals and incidentals only; meals and incidentals and lodging) are compliant with IRS regulations."

Copied from promotor email

See IRS Rev. Proc. 2011-47.1, 3.01(1), 4.04 and 6.06; Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48, IRC 267(b), Tres. Reg. Sec 1.274-5(c)(2)(iii)

The following analysis is based 55 over-the-road drivers working 51 weeks annually, paid a twice-weekly $74 lodging per diem and 20% effective corporate income tax rate:

Under a nonaccountable plan the per diem is included in an employee's gross wages and reported on Form W-2. The following analysis is based 55 over-the-road drivers who travel away from home 255 nights per year

The word salad explanation provided by the per diem solution promotor is reminiscent of listed tax transactions that have the potential for tax avoidance or evasion. Any trucking company that is considering implementing or modifying a driver per diem program needs to carefully review the IRS guidelines. If the tax professional they are using raises questions about the accuracy of the promoters claims, people should listen to their advice.

Have you been approached by one of these "lodging per diem" promoters? Contact us HERE to anonymously tell us about your experience.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

"Can I use my dog as a tax deduction" is a common questioned posed to tax professionals by long-haul truckers. Every pet owner claims their animal is a member of the family and they are an essential companion for thousands of truckers. The emergence of the "Emotional Support" registration industry reinforces this fact.

It understandable that taxpayers may want to recoup some of their pet expenses with a creative medical expense tax deduction[i]. To counter the urge to claim Fido as a tax deduction the IRS has promulgated guidance on what type of animals qualify.

A review of IRC § 213 is required to answer the question, "Can I use my dog as a tax deduction?". The costs of buying, training, and maintaining a service animal to assist an individual with mental disabilities may qualify as medical care if the taxpayer can establish that the taxpayer is using the service animal primarily for medical care to alleviate a mental defect or illness and that the taxpayer would not have paid the expenses but for the disease or illness.

IRS Chief Counsel Note: A taxpayer who claims that an expense of a peculiarly personal nature is primarily for medical care must establish that fact. The courts have looked toward objective factors to determine whether an otherwise personal expense is for medical care:

A personal expense is not deductible as medical care if the taxpayer would have paid the expense even in the absence of a medical condition. Commissioner v. Jacobs, 62 T.C. 813 (1974). [ii]

You can include in medical expenses:

In general, this includes any costs, such as food, grooming, and veterinary care, incurred in maintaining the health and vitality of the service animal so that it may perform its duties.

2024 Trucker Per Diem Rates Published (September 25, 2023)

Flying With A Service Dog? Here's Everything You Need To Know (Becca Bond, The Points Guy, 9/12/23)

What Is The IRS Definition Of A Service Dog?

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Generally, you can deduct on Schedule A, Itemized Deductions (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). However, with tax reform drastically increasing the Standard Deduction (2022: $12,950 Single, $25,900 Married) most taxpayers will not have sufficient itemized deductions to warrant pursuing a tax break for their pet expenses.

No, emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

"Prior to January 2021, the law allowed emotional support animals to fly with documentation from a medical doctor verifying the animal was necessary for comforting the passenger. ESAs did not have to be trained. But after rampant abuse of the system that included people taking everything from peacocks to snakes to untrained and aggressive dogs on flights, the DOT revised its regulations to allow airlines to ban ESAs from the skies. Although the ultimate decision was left up to the airlines themselves, all major U.S. and Canadian carriers quickly changed their policies to stop non-ESA pets from flying. You can still fly with a small dog (under 25 pounds), but the pup must be in a carrier and you will need to pay the airline pet fee to fly."

Becca Bond, The Points Guy (9/12/23)

Can I use my dog as a tax deduction if it guards my truck? The absence of specific guidance on guard dogs from IRS compels a taxpayer to evaluate the appropriateness of claiming a tax deduction for expenses related to a guard dog used to protect a truck that is constantly on the move as opposed to a drop-yard or terminal. Kay Bell writing for Bankrate.com provided a great analysis,

“That “Beware of dog” sign in your business’s window is no idle threat. Break-ins have stopped since you set up a place for your Rottweiler to stay overnight. In this case, the IRS would likely be amenable to business deduction claims of the animal’s work-related expenses.

Standard business deduction rules still apply, notably that the cost of keeping an animal on work premises is ordinary and necessary in your line of business. Once you show that, the dollars spent each year keeping your pooch in good guard condition — food, vet bills and training — would be deductible as a business expense.

As with all deductions, be prepared to provide full and accurate records of your animal’s hours on the job. You’ll also find your tax claim more acceptable when you demonstrate how the animal protects your livelihood inventory. In addition, as is often the case with business property, the dog must be depreciated, a way of allocating its cost over its useful life for IRS purposes.

Keep in mind, too, that your claims carry more weight when your pet is a breed that’s typically used for such jobs. So even though your Chihuahua has a loud bark, your tax claim is more credible if your guard dog is a German shepherd, Doberman pinscher or a similar imposing breed”.[iv]

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

Need assistance resolving a tax controversy issue? Contact Mark W. Sullivan, EA or request a free consultation HERE

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] 2014 American Pet Producers Association market study

[ii]https://www.irs.gov/pub/irs-wd/10-0129.pdf

[iii]https://www.irs.gov/pub/irs-pdf/p502.pdf

[iv]https://www.bankrate.com/finance/taxes/tax-write-offs-for-pet-owners-1.aspx#slide=3

According to recent article in the New York Post by Glenn Reynolds a recent tweet says it all.

“Sam Bankman-Fried: I don’t know where $10 billion went. The Pentagon: We don’t know where $2.2 trillion went. The IRS: You just received $601.37 on Venmo don’t forget to report it.”

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

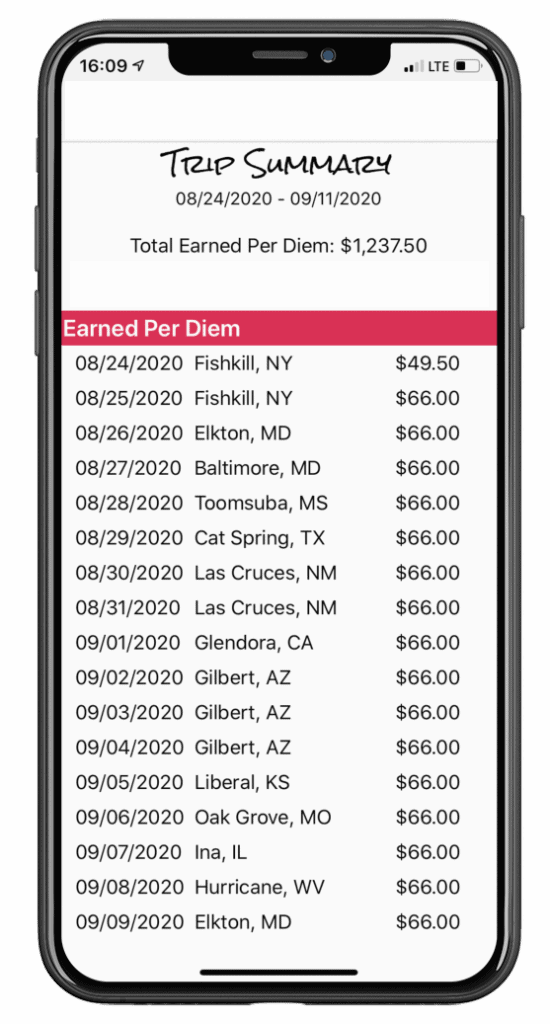

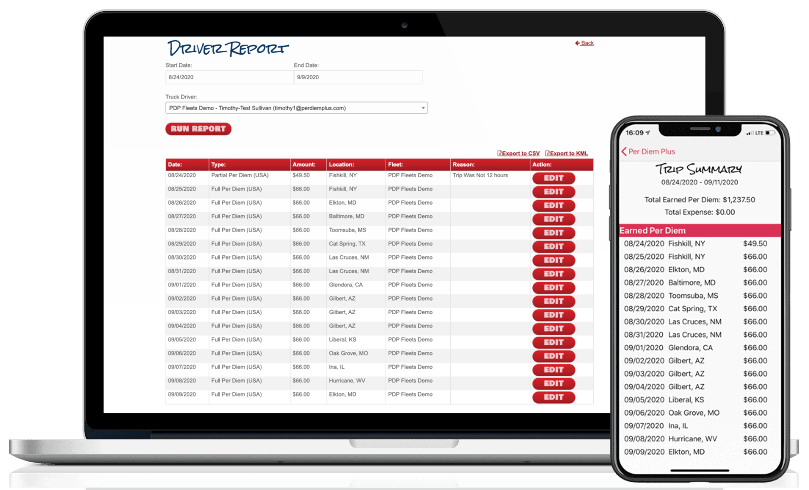

The ability of Per Diem Plus to calculate 8,892 partial per diem days yielded one customer $460,000 of additional per diem

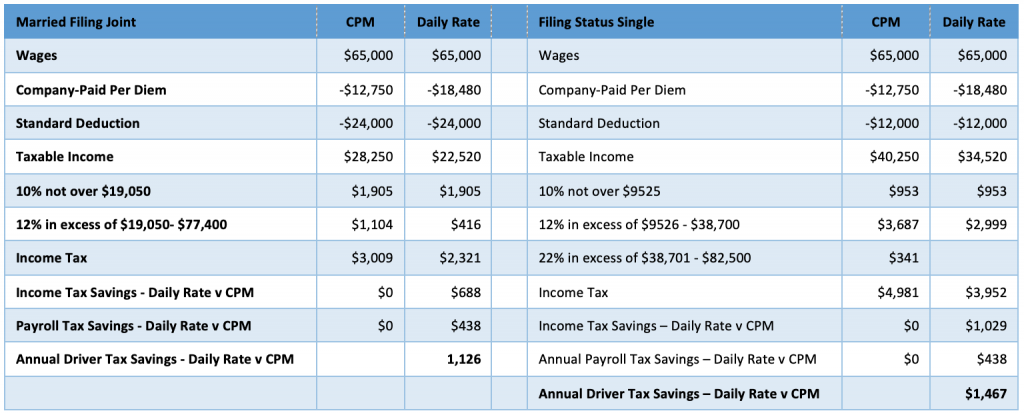

Beware: How inadequate per diem solutions can rob you of savings. A recent New York Post article acutely observed that the Producer Price Index, the most useful measure of general inflation, was up a whopping 16.3% from April 2021, per the Bureau of Labor Statistics. That means that roughly $1 out of every $6 that people earn has been lost to inflation in a single year. Or to put it another way, 80 minutes’ earnings out of every eight-hour day have been eaten up.1 Motor carriers that figure out how to best navigate sky-high inflation and a shrinking U.S. labor force while recruiting and retaining drivers will have a market advantage over lesser fleets when inflation decreases. The keywords: Recruiting and retention.

Introducing a fleet-sponsored driver per diem program, coupled with temporary 100% deduction for per diem in 2022, will immediately reduce a motor carrier's expenses, enhance recruiting and retention and increase driver take-home pay. Per Diem Plus® customers can implement in minutes our IRS-compliant telematics-based substantiated per diem solution, which automates trucker per diem tracking for solo and teams traveling in the USA and Canada. The Per Diem Plus API and mobile apps include the unique ability to calculate full and qualifying partial per diem days, which can substantially increase the tax savings for both fleets and drivers2.

Analyzing real-world fleet per diem data is the best method for quantifying this exceptional feature to project the financial benefit partial per diem days have for both the fleet and drivers.

Based on an automated weekly fleet per diem report, 129 or 36% of 354 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

A motor carrier that offers a $0.11/mile per diem is evaluating switching to a substantiated per diem program using the free trial of Per Diem Plus for Samsara. Based on an automated weekly beta test fleet report, 30 of 100 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

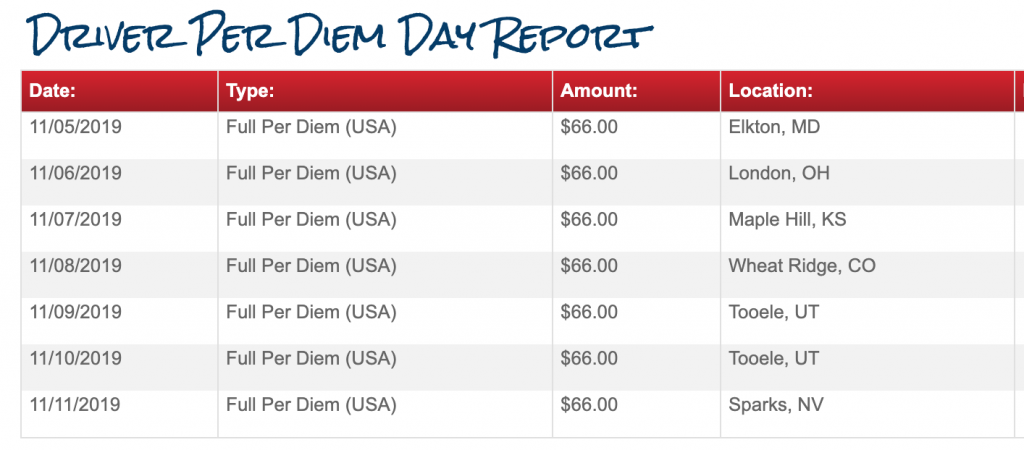

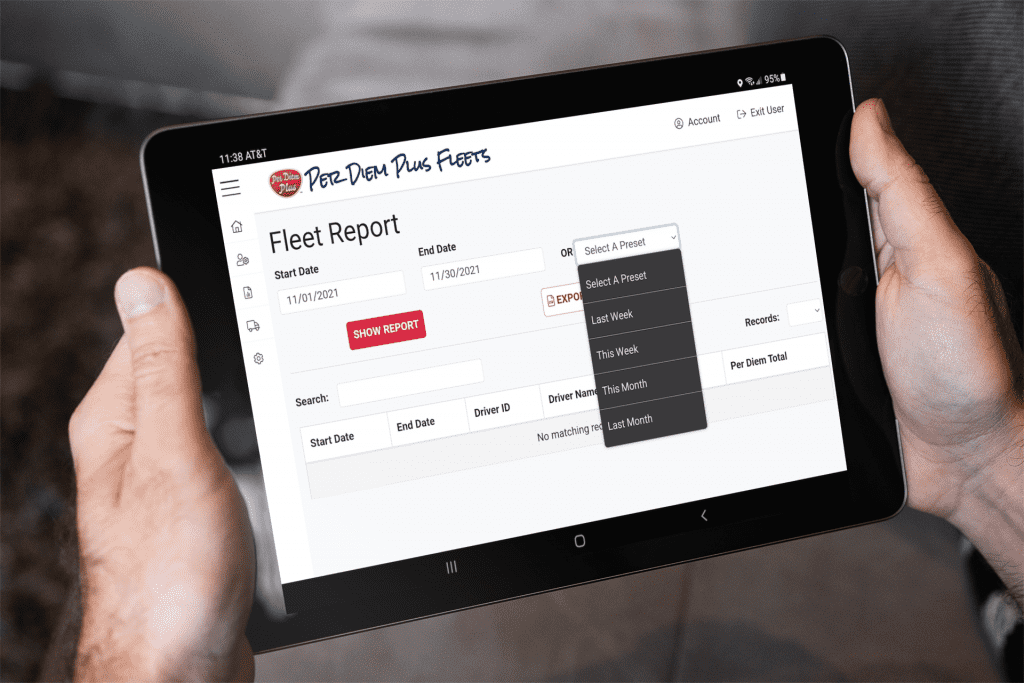

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

No matter how big or small your company is, Per Diem Plus has a cost-effective solution for you.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

1 - Glenn H. Reynolds, "Why team Biden might be purposely grinding down the middle class", New York Post, May 26, 2022

2 - IRS Rev. Proc. 2011-47 6.04

3 - IRS Rev. Proc. 2011-47 6.04.2

Copyright 2017-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Patriot Transport selects Per Diem Plus Fleets. The Arkansas-based specialty bulk hauler implemented the Fleets mobile app for Android and iOS to enhance recruiting and retention and raise driver pay for its OTR fleet.

“The Per Diem Plus Fleets implementation was seamless and smooth. Their automated per diem tax compliance solution enabled Patriot staff to avoid the increased administrative burdens commonly associated with traditional trucker per diem programs ”

April Stobbs, HR Manager

Patriot Transport and 3D Corporate Solutions were founded in 2002 as a marketer and logistics provider sourcing specialty, value-added pet food ingredients. Today, they are the leading manufacturer of protein ingredients used to make premium pet food. 3D has earned a reputation as the go-to source for high quality and differentiated ingredients separate themselves from competitors through a portfolio of specialty proteins, specialty flavors, and premium and specialty fats. They operate six manufacturing facilities across the Midwest and Southeast, each with world-class manufacturing capabilities.

The driver per diem program was introduced in 2021. In order to distinguish itself in the industry Patriot adopted a per diem program that does not reclassify a portion of wages as per diem, which has been standard industry practice for over 30 years.

According to April Stobbs, HR Manager at Patriot Transport, “Drivers rave about the $12,750 or so of tax-free per diem they receive annually that has resulted in 100% participation of qualifying drivers. This especially true of veteran drivers who previously received per diem at other motor carriers that utilized the traditional trucker per diem methods. Meanwhile the feedback from drivers about the Per Diem Plus Support team can be summed up as simply amazing.”

“Per Diem Plus has multiple per diem solutions regardless of what ELD you use to track Hours of Service, like their mobile app and API, while others offer a single solution with one partner. This was a significant factor in our choosing Per Diem Plus as it allows Patriot flexibility to switch ELD solution providers without affecting our per diem program should the need arise. They have a great team and allow you to have a trusted partner to handle all your per diems needs” said Stobbs.

Apply at patriottransport.com or Contact April Stobbs at (417) 354-0509 or astobbs@3dsolutions.com

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact us at info@perdiemplus.com

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of transportation industry tax compliance. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA. It is the only IRS-compliant mobile-enabled application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

No. The treatment of per diem as a portion of an employee’s wages is not considered an improper “wage reclassification”. The IRS first introduced per day allowances in Revenue Procedure 90-60 as a simplified method of substantiating employee business expenses. However, the first published guidance for the transportation industry was TAM 9146003 issued in 1991. According to the IRS:

The Special Transportation Industry substantiated method was introduced in 2000 to ease the burden on taxpayers, who would otherwise have to meet the extensive substantiation requirements in order to claim deductions for business related travel [See Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48], which among other things:

The Internal Revenue Code gives the IRS Commissioner discretionary authority to issue regulations, such as revenue rulings and procedures. The Revenue Procedures and Notices are updated annually and the relevant per diem provisions have remained substantially the same since 2011 [See Rev. Proc. 2011-47 ].

Biden's IRS Is Coming For Your PayPal & Venmo Payments

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

A substantiated per diem program reimburses drivers a fixed amount per day (i.e. $66) in place of a rate per mile for travel away from home. As a result, it eliminates the need for drivers to turn in receipts for actual meals and incidental expenses. Most importantly, it reduces a fleets administratives burden while providing additional cash to drivers on a pre-tax basis. However, companies must have an accountable plan to qualify, which would include these requirements [See KMS Transport Advisors (NAFC March 2019 newsletter]:

Well-known motor carriers that utilize the substantiated method include Averitt Express, EPES Transport System, TMC Transportation, G&P Trucking, Transport America and Big G Express, Danny Herman Trucking and Oakley Transport.

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event meet the IRS substantiation requirements.

Thirty years of IRS guidance and legislative history specifically reference an employer paying a driver in the transportation industry under the substantiated method and, therefore, contemplate that some portion of a driver’s wages will be treated as per diem. While, both the substantiated and cent-per-mile per diem methods are IRS-compliant, neither method has been considered an improper wage reclassification for over 30 years. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS. Additional information can be found at IRS.gov

[i] The 2019 per diem rate for travel in the USA is $66 and $49.50 for a partial day.

ii] The raised the deductible percentage of employee travel related expenses to 80% in 2008

iii] Federal Register-1989-12-12 Vol 54 Page 51038 pursuant to “Family Support Act of 1988”

[iv] Rev. Ruling 2006-56, 2006-2 CB 274

[i] Updated annually IRS Notice 2019-55, 2018-77, 2017-54, 2016-58, 2015-63, 2014-57, 2013-65, 2012-63, Rev. Proc. 2011-47, 2010-39, 2009-47, 2008-59, 2007-63, 2006-41, 2005-67, 2004-60, 2003-80, 2002-63 and 2001-47.

Is trucker per diem an improper wage reclassification? No, the treatment of a portion of an employee’s wages as per diem has been unique to the transportation industry for over 30 years and is not considered an improper “wage reclassification”.

The IRS first introduced per diem (per day) allowances in Revenue Procedure 90-60 - a simplified method of substantiating employee business expenses - in accordance with the Family Support Act of 1988. The first published guidance for the transportation industry was issued in 1991 where, according to the IRS, a driver's weekly compensation earned on a cents-per-mile basis may be reclassified by amounts designated as per diem (i.e. $66/day) for meals and incidental expenses after determining how many days a driver was away from home overnight [TAM 9146003].

Related Article: Part II: Is Trucker Per Diem An Improper Wager Reclassification

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

Yes. The IRS introduced the Special Transportation Industry substantiated per diem method 20 years ago in Rev. Proc. 2000-39, 2000-9 Sec. 4.04 [Notice 2000-48], which among other things:

Stay In The Know: Biden's IRS Is Coming For Your PayPal & Venmo Payments

The 2017 Tax Cuts and Jobs Act eliminated per diem as an itemized deduction on drivers individual income tax returns. As a result, interest from employees in company-sponsored per diem plans swelled as drivers sought to offset the lost deduction [about $19,000 for an average OTR driver]. Since, drivers were prohibited from using the decades-old industry standard cent-per-mile per diem method, motor carriers embraced the parity to drivers substantiated per diem provided.

Unfortunately, they discovered the IRS never published a basic instructions for implementing a substantiated per diem program or payroll process for reclassifying a portion of wages to daily rate per diem. In fact, the last comprehensive guidance issued by IRS on substantiated per diem method was Rev. Proc. 2011-47, however, it was silent on wage reclassification for per diem. So too was the last relevant court case, Beech Trucking, Inc. v. IRS (USTC 2002). The only published guidance that referenced "wage recharacterization" could be found in the Rev. Rul. 2012-25.

IRS issued Rev. Rul. 2012-25 in response to an emerging audit trend whereby businesses that did not historically offer per diem were implementing abusive per diem plans that recharacterized taxable wages as nontaxable reimbursements or allowances. Although unrelated to trucking the tax practitioner community, and especially those that offered cent-per-mile per diem audit services, elevated the ruling to misplaced prominence.

No. Based on the foregoing Rev. Rul. 2012-25 is inapplicable to transportation industry:

The employer’s cited in 2012-25 failed to fulfill the business connection requirement of the regulations because they took liberties with IRS published guidance and ignored the limitations set forth in Rev. Proc. 2011-47 Section 3.03(2) which states in part, “An allowance that is computed on a basis similar to that used in computing an employee's wages or other compensation does not meet the business connection requirement unless, as of December 12, 1989, (a) the allowance was identified by the payor either by making a separate payment or by specifically identifying the amount of the allowance, or (b) an allowance computed on that basis was commonly used in the industry in which the employee performed services.” Furthermore, neither cable contractors, nurses, construction workers or house cleaners enjoy industry-specific rules prescribed by the IRS Commissioner like those covering the transportation industry introduced in Rev. Proc. 2000-9 Section 4.04 that established the Special Transportation Industry per diem[i].

1. A truck driver employee travels away from home on business for 24 days during a calendar month. A payor pays him the $66 special trucking daily allowance for meal and incidental expenses only. The amount deemed substantiated is the total per diem allowance paid for the month or $1,584 (24 days away from home at $66 per day). The employer treats $1,584 as a pre-tax deduction; calculated withholdings; adds per diem to payroll as a non-taxable reimbursement.

2. A truck driver is paid 45 cents-per-mile. The employer classifies 10 cents-per-mile to a per diem allowance based on the number of miles driven. He travels away from home for 24 days but only drives for 20. Driver’s employer pays an allowance of $1,000 for the month based on 2500 miles per week. The amount deemed substantiated is the full $1,000 because that amount does not exceed $1,584 (24 days away from home at $66 per day). The employer calculates taxable wages at 35 cents-per-mile and per diem at 10 cents-per-mile as a non-taxable reimbursement.

Although, a driver may travel 600 miles one day but only 100 miles the next, the distance traveled does not affect the need to eat 3 meals a day. As a result, substantiated per diem accurately reflects the definition of per diem in Rev. Proc. 2011-47 section 3.01: "Paid for ordinary and necessary business expenses the payor reasonably anticipates will be incurred, by an employee for meal and incidental expenses, for travel away from home performing services as an employee of the employer." Thus, the IRS introduced the Special Transportation Industry substantiated per diem to enhance and simplify tax compliance for fleets by relying on nights away from home instead of miles traveled.

The most beneficial aspect to a driver is that:

The Internal Revenue Code gives the IRS Commissioner discretionary authority to issue regulations, such as revenue rulings and procedures, to ease the burden on taxpayers, who would otherwise have to meet the extensive substantiation requirements in order to claim deductions for business related travel. The Commissioner updates these Revenue Procedures annually, but the relevant per diem provisions have remained substantially the same since 2011.

Thirty years of IRS guidance and legislative history specifically reference an employer paying a driver in the transportation industry under the substantiated method and, therefore, contemplate that some portion of a driver’s wages will be treated as per diem. While, both the substantiated and cent-per-mile per diem methods are IRS-compliant, neither method has been considered a wage reclassification for over 30 years. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

[i] The 2019 per diem rate for travel in the USA is $66 and $49.50 for a partial day.

ii] The IRS raised the deductible percentage of employee travel related expenses to 80% in 2008

iii] Federal Register-1989-12-12 Vol 54 Page 51038 pursuant to “Family Support Act of 1988”

[iv] Rev. Ruling 2006-56, 2006-2 CB 274

[i] Updated annually IRS Notice 2019-55, 2018-77, 2017-54, 2016-58, 2015-63, 2014-57, 2013-65, 2012-63, Rev. Proc. 2011-47, 2010-39, 2009-47, 2008-59, 2007-63, 2006-41, 2005-67, 2004-60, 2003-80, 2002-63 and 2001-47.

In this article we attempt to clear up the confusion on the rules governing truck driver per diem.

What is per diem? Trucker per diem is a per day travel expense allowance. Eliminates the need for proving actual costs for meals & incidental expenses incurred.

Do I have to spend all the per diem?

No. This is the maximum amount the IRS will let you claim on your tax return.

Who can claim trucker per diem?

Self-employed truckers who are subject to DOT HOS and who travel away from home overnight where sleep or rest is required. The Per Diem Plus mobile app software takes the guesswork out of tracking trucker per diem for OTR truckers.

Can all truck drivers receive per diem?

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot claim per diem.

What qualifies as a tax home?

Where you park your truck. Your regular place of business, or home in a real and substantial sense.

If I live in my truck, can I claim per diem?

No. A taxpayer who’s constantly in motion is a "tax turtle," or someone with no fixed residence who carries their “home” with them.

Are truck drivers allowed to claim a mileage allowance per diem?

Only fleets can use a cents-per-mile per diem. IRS’ standard mileage allowance is for use of a personal vehicle.

Can a driver claim per diem for lodging?

No. Trucker per diem is exclusively for meals and incidental expenses. You must have a receipt for all lodging expenses. A self-employed driver falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is the location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Motorola Devices

What documentation meets the IRS substantiation requirements to prove overnight travel and expense?

Only Per Diem Plus or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Unlike ELD backups, Per Diem Plus a can create an IRS-compliant itemized per diem report in seconds.

Can motor carriers pay per diem to employee drivers?

Yes. A motor carrier can offer per diem to drivers subject to DOT HOS and who travel away from home overnight where sleep or rest is required under an accountable per diem plan.

Is company-paid per diem taxable as income to an employee driver under an accountable fleet per diem plan?

No. Per diem is classified as a non-taxable reimbursement to an employee driver.

What are the current per diem rates for travel in USA & Canada?

The per diem rates for 2023 & 2024 are:

(IRS released annual update on September 25, 2023 in Notice 2023-68)

Can a driver prorate per diem for partial days of travel?

Yes. A partial day is 75% of the per diem rate.

How much per diem can I deduct on my income tax return?

A self-employed trucker can deduct 80% of per diem (100% for tax years 2021 & 2022) on their tax return.

What are Incidental Expenses?

Only fees and tips.

Are showers & parking fees incidental expenses?

No. Self-employed drivers may separately deduct expenses for: Per Diem Plus subscription, showers, reserved parking fees, mailing expenses, supplies and laundry.

Can employee drivers deduct company-paid per diem on their tax return?

No.

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount are required. You can upload and store receipts on the Per Diem Plus app and share them electronically with your tax preparer in seconds.

How long should tax records be retained?

No less than 3 years from the filing date of an income tax return. You have access to your Per Diem Plus tax records for four years.

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47 or use the Per Diem Plus app that takes the guesswork out of tax-related record keeping.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2017-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Lending money to loved ones can be tricky. To avoid potential pitfalls and protect your relationships, treat the loan like a professional financial agreement. Here's a structured approach to make the process smoother:

Make It Official

Treat the loan as a formal agreement. Outline clear terms, including interest rates, payment schedules, and actions to be taken in case of default. A signed contract, possibly drafted by an attorney, ensures both parties understand their responsibilities.

Ask for a full credit report from the borrower. Understanding their financial situation helps you evaluate their ability to repay. This also helps avoid lending to someone who may be seeking a temporary fix without addressing deeper financial issues.

Familiarize yourself with Applicable Federal Rates (AFRs) to set a fair interest rate. Charging less than the AFR could have tax implications. The IRS updates these rates monthly, so stay informed and document everything for audit purposes.

Work with the borrower to create a realistic budget that includes repayment terms. Detail how much is owed, the frequency of payments, payment methods, and any grace periods. For borrowers with spending issues, consider adding a requirement for financial therapy to the agreement.

Offer incentives to encourage timely payments. These could be financial, like forgiving the last few payments if the borrower is consistent, or nonfinancial, such as a special outing if the loan is repaid early.

If the borrower refuses to agree to your terms, or if you can't afford to lose the money, it’s okay to say no. Lending to someone without a plan for financial recovery can put both of you in a vulnerable position.

Following this framework helps protect both the lender and borrower while offering a responsible path to financial recovery.

At Mark Sullivan Consulting, we understand the complexities of lending money to friends and family. With years of experience navigating financial agreements and tax implications, we can help you structure a loan that protects your interests while maintaining your personal relationships. Whether it's drafting formal agreements, advising on interest rates, or providing tax guidance, our expert advisory services will ensure you make informed, secure decisions. Reach out today to get professional advice tailored to your unique situation and safeguard your financial future.

Do you need assistance with tax analysis and consulting? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2025 Mark Sullivan Consulting, PLLC.

Additional references:

"If You Really, Really Need to Lend Money to Friends or Family…", Jonathan I. Shenkman, The Wall Street Journal (October 16, 2024)

Copyright 2025 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Tax season is upon us, and it's time to prepare and file your tax return. But before you rush to submit your documents, it's crucial to take a step back and ensure your return is bulletproof against costly mistakes and potential IRS audits. Avoiding common filing errors by hiring a tax professional who can save you time, money, and stress in the long run.

By following these steps and exercising diligence in preparing your tax return, you can significantly reduce the likelihood of costly mistakes and IRS audits. Remember, investing time and effort in ensuring accuracy now can save you from headaches down the road. Stay proactive, stay informed, and bulletproof your tax return for a smoother filing experience.

By entrusting your tax preparation needs to us, you gain access to years of experience, comprehensive knowledge of tax laws, and a commitment to excellence in every aspect of our service. We'll work closely with you to understand your unique situation, identify opportunities for savings, and navigate any complexities with confidence.

Don't leave your financial well-being to chance. Partner with Mark Sullivan Consulting and gain peace of mind knowing that your tax return is in the hands of trusted professionals. Contact us today to schedule a consultation and take the first step toward a stress-free tax season. Let's make this year's filing process smooth, efficient, and rewarding together.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2025 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Refunds sent by mail are a popular target for check fraud

Taxpayer refund checks are being stolen from the mail, and in some cases, replacement checks are also being stolen.

While over 90% of taxpayers use direct deposit for refunds, millions still prefer paper checks.

Refunds sent by mail have become a popular target for check fraud, as reported by the Treasury Department last year.

IRS Commissioner Danny Werfel has repeatedly emphasized in public comments that direct deposit is the fastest and safest way to receive refunds.

The IRS has a process in place to replace lost or stolen checks.

The Treasury’s Financial Crimes Enforcement Network has issued alerts about a nationwide rise in mail theft-related check fraud.

The IRS is modernizing its core systems, with a significant upgrade planned to roll out next year.

With refund checks increasingly becoming a target for fraud, the safest way to receive a refund is through direct deposit. While the IRS is working on improvements, taxpayers should act now to protect their refunds from theft.

Mark Sullivan Consulting assists taxpayers who have fallen victim to refund fraud, providing expert guidance through the IRS refund replacement process. Our team will navigate the complexities of filing refund traces, working with the Treasury Department, and ensuring your case is handled promptly. With years of experience in federal tax controversy, we are dedicated to securing the refunds our clients rightfully deserve while protecting them from further fraud risks. Let us advocate on your behalf and restore your peace of mind.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2025 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Additional references: "Millions of Dollars in Tax Refund Checks Are Getting Stolen", Ashlea Ebeling, The Wall Street Journal (October 4, 2024)

2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

2025 trucker per diem rates were released by the IRS in an annual bulletin, Notice 2024-68, on September 20, 2024.

For taxpayers in the transportation industry the per diem rate remains unchanged form 2022 to $80 from $69 for any locality of travel in the continental United States (CONUS) and $86 from $74 for any locality of travel outside the continental United States (OCONUS), i.e Canada.

Effective Date: This notice is effective for per diem allowances for meal and incidental expenses, that are paid to any employee on or after October 1, 2024, for travel away from home on or after October 1, 2024.

Note: A motor carrier fleet or owner operator can continue to use the 2024 per diem rate of $69 / $74 until December 31, 2024.

See Notice 2024-68

Have questions about trucker per diem? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Copyright 2024 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

The IRS is ramping up its audit rates for large corporations, complex partnerships, and multimillionaires, thanks to a substantial funding boost from the Biden administration. By 2026, audit rates for corporations with over $250 million in assets will nearly triple, while complex partnerships and high-income individuals will also see significant increases. Despite these changes, the IRS reassures that individuals and small businesses earning under $400,000 won't face increased audit rates. This new focus underscores the importance of robust tax compliance and expert guidance.

Massive Funding Boost

Increased Audit Rates for Corporations

Focus on Complex Partnerships

Targeting Wealthy Individuals

Assurance for Lower-Income Entities

Audit Process

Discrepancies can lead to:

This detailed audit plan reflects the IRS's enhanced capacity to scrutinize high-value entities, backed by significant federal support.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Additional References: "The IRS says audits are about to surge — here’s who’s most at risk" Shannon Thayler, New York Post (May 3, 2024)

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Hey there, tax-savvy pals! Ever wondered if your trusty four-legged friend could actually help you fetch some a tax deduction on your tax return? Well, let's dive into the world of guard dogs and their potential impact on your taxes.

Picture this: your business has that intimidating "Beware Of Dog" sign on the window. Break-ins? Zilch since your Rottweiler moved in. So, can you actually claim a tax deduction for your guard dog's expenses? The IRS might just say yes!

But, as always, standard business deduction rules apply. Your dog's presence and the expenses associated with it must be ordinary and necessary for your line of business. If you can prove that, then the costs of keeping your loyal guardian well-fed, healthy, and trained can be deducted as a legitimate business expense.

Oh, and breed matters, too! Your tax claim gains more credibility if your guard dog is a formidable breed like a German shepherd, Doberman pinscher, or something similarly imposing. Sorry, Chihuahua, but your bark may not cut it for the IRS.

In a nutshell, while you can't exactly claim your dog as a tax deduction (no matter how loyal and fierce they are), you can potentially deduct the expenses associated with their "guard dog" role if you meet all the necessary criteria.

So, there you have it, folks. Guard dogs - not just your business's best friend, but potentially your wallet's best friend too! 🐕💰

Remember, it's always wise to consult with a tax professional to ensure you're on the right track. Stay pawsitive, and keep those business premises safe! 🐾

Do you need assistance with tax analysis and consulting? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Navigating Tax Time: Tips To Avoid Common Pitfalls & Maximize Savings

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Why choose Mark Sullivan Consulting, PLLC? As high-income taxpayers navigate the complexities of addressing unfiled tax returns and potential IRS settlements, it's essential to seek expert guidance and support. Mark Sullivan Consulting stands ready to assist in this critical process. With years of specialized experience in federal tax controversy, audit, and appeals representation, as well as tax consulting and advisory services, Mark offers unparalleled expertise and dedication to client success.

By retaining Mark Sullivan Consulting, high-income taxpayers can benefit from personalized guidance tailored to their unique financial situations and tax challenges. From preparing unfiled tax returns to negotiating settlements with the IRS, Mark Sullivan Consulting provides comprehensive support every step of the way. With a commitment to integrity, transparency, and excellence in service, Mark Sullivan Consulting empowers clients to navigate IRS compliance initiatives with confidence and peace of mind.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Navigating Tax Time: Tips To Avoid Common Pitfalls & Maximize Savings

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Tax season can be a stressful time for many Americans, but with a little knowledge and preparation, you can navigate it with confidence. Here are some practical tips to help you avoid common pitfalls and maximize your tax savings.

In conclusion, while tax season may seem daunting, taking proactive steps to understand your tax obligations and opportunities can lead to significant savings. Whether you're filing your taxes independently or with the help of a professional, attention to detail and awareness of potential pitfalls are key. By staying informed and organized, you can navigate tax time with confidence and optimize your financial outcomes. Remember, every dollar saved in taxes is a dollar that can contribute to your future financial security.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Struggling to find a tax accountant these days? The accounting industry lost 300,000 professionals since COVID began. Mark Sullivan Consulting, PLLC is adding income tax preparation services in response to taxpayer demand.

Embark on this journey with Mark Sullivan Consulting as we launch our new income tax preparation services. Let us take the complexity out of taxes, allowing you to thrive personally and in your business endeavors. Cheers to a seamless tax season ahead!

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®