PDP For Fleets - 3 Months Free

The 2019-2020 special trucker per diem rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

This annual notice provides the 2019-2020 special per diem rates for taxpayers to use in substantiating the amount of ordinary and necessary business expenses incurred while traveling away from home, specifically (1) the special transportation industry meal and incidental expenses (M&IE) rates.

Information on the 2020-2021 per diem rates can be found HERE

BACKGROUND

Rev. Proc. 2011-47, 2011-42 I.R.B. 520 (or successor), provides rules for using a per diem rate to substantiate, under § 274(d) of the Internal Revenue Code and § 1.274-5 of the Income Tax Regulations, the amount of ordinary and necessary business expenses paid or incurred while traveling away from home.

The special M&IE rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

Are you unsure what per diem is or which drivers can claim travel-related expenses? Our tax experts answer the most common question in a prior post, Trucker Per Diem Simply Explained

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

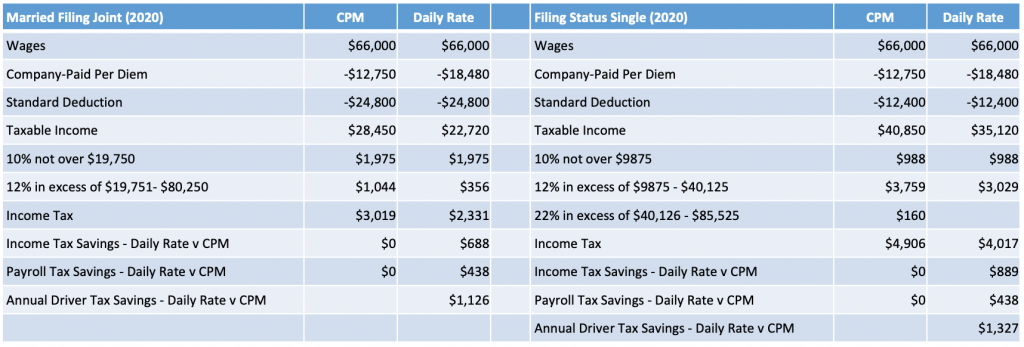

Substantiated per diem provides the largest benefit to both a driver and fleet over the old cent-per-mile method. Decades before the advent of TMS software, telematics and ELD's fleets adopted cent-per-mile per diem. Why? Because it was easy to calculate and substantiate using trip sheets[i]. However, there is no correlation between the miles a driver travels and frequency of meal breaks.

Under the cent-per-mile method a driver is paid only for miles driven and not nights away from home. Although, a driver may travel 500 miles one day they may only clock 200 miles the next. In the end, the distance traveled does not affect the need to eat 3 meals a day.

The IRS introduced the Special Transportation Industry substantiated per diem to simplify tax compliance for fleets by relying on days away from home instead of miles traveled. This method accurately reflects the number of meals a driver eats and resolved the problem that driver’s regularly travel away from home and stop during a single trip at localities with differing federal M&IE rates.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

[i] 1-274-5T(c) Rules of substantiation, Rev. Proc. 2011-47 § 4.02(5)

Both the substantiated and cent-per-mile per diem methods are IRS-compliant. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

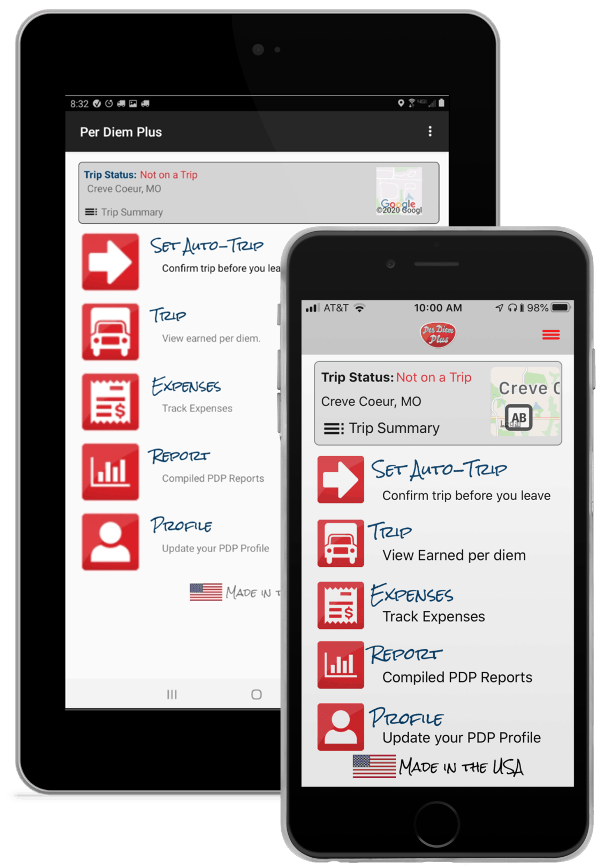

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service.

Questions? Contact Mark W. Sullivan, EA.

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The term"per diem allowance" means a payment under a reimbursement or other expense allowance arrangement that is — (1)

Trucker per diem rules for fleets eliminate the need for proving actual costs for meals & incidental expenses incurred.

Related Articles:

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Yes. Drivers that receive a non-taxable per diem reimbursement from their employer (trucking company) do so under IRC Sec 62(2)(a).

Under the trucker per diem rules for fleets a motor carrier can offer per diem only to drivers who are:

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot receive per diem.

A fleet will save approximately $3,000 annually or $0.03/mile/driver as the payroll tax and worker compensation savings exceed the tax on the 20% nondeductible portion of per diem.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Yes. On average driver pay will increase from $0.03 - $0.04/per mile.

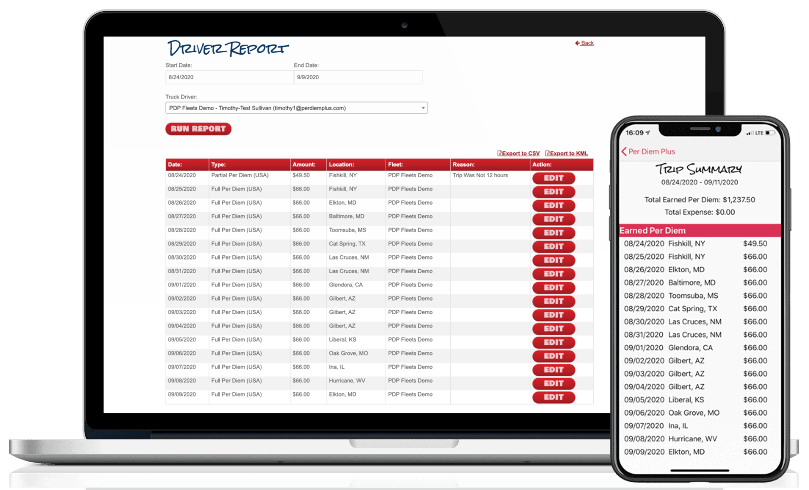

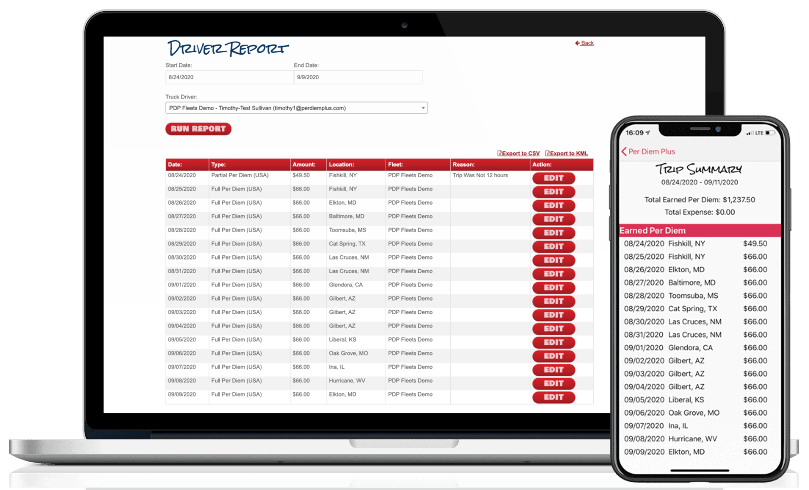

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Per Diem Plus automatically records per diem for travel in the USA and Canada for solo and team drivers.

No. Per diem is classified as a non-taxable reimbursement to an employee driver and is not reported under wages on Form W-2.

IRS increased per diem rates effective October 1, 2018 (Revised 10/01/2021)

USA $69 from $66

Canada $74 from $71

Yes. A partial day is 75% of the per diem rate.

A fleet can deduct 80% of per diem on their income tax return. However, the payroll tax and worker compensation savings ordinarily exceed the tax on the nondeductible portion of per diem.

Paper or electronic receipts that identify what, when and the amount are required. Drivers can upload and store receipts on the Per Diem Plus FLEETS app. Watch Run IRS Compliant Reports with Receipts video to see how easy drivers can send an itemized expense reports with receipts to payroll or accounting.

No. There is no published guidance from IRS that allows a fleet to pay a lodging per diem.

A self-employed driver (owner operator) falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

No less than 3 years from the filing date of an income tax return. Per Diem Plus FLEETS customers have instant access to itemized per diem tax records for four years.

ELD backups used to substantiate "time, date and place" are considered tax records.

Refer to IRS Revenue Procedure 2011-47. Or, use the Per Diem Plus FLEETS platform that automates administration of a company-paid per diem plan and takes the guesswork out of tax-related record keeping. Our How it Works video demonstrates just easy the app is to use.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The following excerpt on the home office deduction is from "Making The IRS Work In Your Favor" presented by Mark W. Sullivan, EA at the 2018 CMC LIVE hosted by Kevin Rutherford and Let's Truck.

Taxpayers are not entitled to claim the home office deduction unless the expenses are attributable to a portion of the home, or a separate structure, used exclusively on a regular basis for business purposes. Here is what you need to know to take advantage of a great tax saving opportunity.

Only self-employed individuals may claim the home office deduction.

Portion of home used exclusively

(Refer to IRC Sec 280A(a), 280A(c), 280A(c)(1)(A))

(Refer to IRC Sec 280A(c)(5)(A))

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The following excerpt, "Paying your kids", is from "Making The IRS Work In Your Favor" presented by Mark W. Sullivan, EA at the 2018 CMC LIVE hosted by Kevin Rutherford and Let's Truck.

Trucking like any small business is often a family affair. My son started working in my accounting practice after school when he was 10 - shredding paper, stamping and stuffing envelopes. Whether you are a solo owner operator or run a trucking company, it is not uncommon to put your kids to work helping in the business. Here is what you need to know to take advantage of a great tax saving opportunity.

First and foremost: Your children must be bona fide employees

WARNING:

Sole Proprietorship / Partnerships

Children under 21 wages subject to income tax withholding, but not :

Corporations

Children under 21 are subject to:

In 2018 the standard deduction for SINGLE filers raised from $6,350 to $12,000.

|

Example: Employment Tax on Wages of $12,000 |

||

|

Sole-Proprietor |

Corporation |

|

| FICA / Medicare / FUTA 16.8% | $0.00 |

$2,016 |

Reference Material:

Refer to: https://www.irs.gov/businesses/small-businesses-self-employed/family-help

Start your 30-day FREE trial with no credit card required today!

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer

This article includes general tax information, and therefore may not be relied upon as legal authority. This means that the information cannot be used to support a legal argument in a court case. Please consult with a licensed tax professional.

Internal Revenue Code Section 199A generally provides a 20% passthrough deduction for qualified business income (QBI) derived from a sole proprietorship, partnership or S corporation that is a qualified trade or business, like a trucking business.

The 199A deduction is complicated! The estimated average annual burden hours per taxpayer is 2.5 hours, thus taxpayers are advised to seek professional tax guidance when calculating the deduction for their business.

The section 199A deduction is the lesser of:

WARNING: Section 199A deduction:

Qualified Business Income (QBI) is defined at Sec 199A(c) as the net amount of qualified items of income, gain, deduction, and loss for a tax year with respect to any qualified trade or business of the taxpayer.

Line 9 of the Form 1040 for 2018 (draft). IRS will be issuing new tax returns, worksheets and other tools to assist individuals and businesses with their deduction calculation and tax preparation. DOWNLOAD 2018 DRAFT F1040 101718

Small businesses with qualified income below:

Small business qualified income exceeds:

S-corporations and partnerships are generally not taxpayers and cannot take the deduction themselves. However, all S corporations and partnerships report each shareholder’s or partner’s share of QBI and W-2 wages on Schedule K-1 so the shareholders or partners may determine their deduction.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Reference: 2017 Tax Cut & Job Act, Kenneth K. Wright (2018)

Disclaimer

This article includes information is not included in the Internal Revenue Bulletin 2018-64, and therefore may not be relied upon as legal authority. This means that the information cannot be used to support a legal argument in a court case.

Per Diem Plus® FLEETS is a configurable mobile application platform that automates administration of an IRS-compliant accountable trucker per diem plan for fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Truckers designed it, tax pros built it, drivers want it. Our cloud-based FLEETS mobile app platform enables motor carriers to implement an IRS-compliant fleet per diem plan that will:

"Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions.

Configure your per diem app in minutes with our simple check-the-box menu.

For example, the app allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 50 miles and that best matches fleet lanes and app installation type. Or to minimize cellular data plan usage you can white list the app using our static IP address.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

* Deep-link integration scheduled for Q4 2020 release

Per Diem Plus 2020. All rights reserved. Per Diem Plus is a trademark of Per Diem Plus, LLC. A proprietary software application, which provides automatic per diem and expense tracking for truckers (USPTO Registration #86754053)

The following article is summary of the impact of the 2017 Tax Cuts and Job Act (TCJA) on truckers The following is a list of common trucker tax deductions that were changed by the TCJA (except where noted).

The TCJA eliminated itemized deductions for employee drivers, which includes all unreimbursed employee business expenses. The following is a non-exhaustive list:

This provision does not apply to Owner Operators who claim travel-related and business expenses on Schedule C or Form 1120S.

IRC Section 199A generally provides a deduction of 20% of qualified business income (QBI) derived from a sole proprietorship, partnerships, or S corporation that is a qualified trade or business. The §199A deduction is taken from adjusted gross income (AGI) in determining taxable income and therefore does not reduce self-employment income. See my article titled "Understanding the 20% Passthrough Deduction" for a detailed discussion of the complicated deduction.

The §199A deduction is complicated and will require significant guidance from the IRS.

The deduction for alimony and separate maintenance payments by the payor is repealed. The payee (recipient) will not be required to include such payments in gross income for divorce or separation instruments executed after December 31, 2018.[i]

Medical expenses continue to be deductible to the extent they exceed 7.5% of adjusted gross income (AGI) for 2017 and 2018. For years after 2018 the threshold is 10% of AGI.

The moving expense deduction is repealed except for members of the Armed Forces. The exclusion from gross income and FICA wages for employer reimbursed moving expenses is repealed other than members of the Armed Forces.

This provision does not apply to Owner Operators who claim expenses related to moving a business operation on Schedule C or Form 1120S.

A taxpayer may claim an itemized deduction of up to $10,000 ($5,000 for married filing separately) for the aggregate of (1) state and local property taxes not paid or accrued in carrying on a trade or business (See IRC Sec. 212), and (2) state and local income taxes (or sales taxes in lieu of income taxes) paid or accrued in the tax year[ii].

This provision does not apply to Owner Operators who claim business-related taxes on Schedule C or Form 1120S.

The deduction for interest on home equity indebtedness is disallowed and applies to existing home equity loans. Home equity loans used for business or substantial improvement of a residence may still be deductible[iii]; any used for personal or investment purposes are not[iv].

The base for cash contributions is increased from 50% to 60%. No deduction is allowed for payments to colleges and universities in exchange for rights to purchase athletic seats.

All gambling expenses are now subject to the gambling winnings limitation and not just wagers. Schedule A filers can still deduct gambling losses to the extent of winnings but must have total itemized deductions exceeding the increased standard deductions.

The individual tax for failure to maintain minimum essential coverage is reduced to zero with respect to health coverage status for months beginning after December 31, 2018.

The standard deduction is increased to $24,000 for married filing jointly, $18,000 for head of household, and $12,000 for unmarried (single). The pre-2018 additional $1,250 standard deduction for taxpayers over age 65 or who are blind are retained.

Personal exemptions and dependency deductions are repealed. The IRS is examining how the definition of qualifying relative should be addressed.

Section 6695(g) of the internal Revenue Code requires paid return preparers to satisfy due diligence requirements to ensure clients qualify for the American opportunity credit, lifetime learning credit, earned income credit, and child tax credit.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2018-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] Notice 2018-37, 2018-18, I.R.B. 521

[ii] IRC § 164(b)(6) (flush language)

[iii] Temp. Reg. § 1.163-8T

[iv] Refer to Publication 936 (2017) Home Mortgage Interest Deduction for definitions of “substantial improvement”

In this post I attempt to clear up the confusion over tax reform and trucker per diem. Tax Reform has contributed to much confusion within the professional truck driver community about the changes as they related to the deductibility of certain expenses. Case in point: a recent magazine article declared,

Additional good news for truckers in this bill is that HR1 does not change overnight per diems (Section 274(n)(3) of the IRC Code). That means truckers retain the ability to claim 80 percent of the $63 per diem for nights away from home.

Land Line “Tax Reform and Trucking” (January 8, 2018)

This statement is misleading and overlooks a significant difference between owner operators who are self-employed and employee (company) drivers. The article cited the retention of per diem under Internal Revenue Code Section 274(n)(3)[ii], which is correct.

Unfortunately, the articles author misunderstood the meaning of Sec. 274, which pertains solely to the meals expense disallowance and establishes the 80% deduction limitation for per diem of a truck driver during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation. What the article failed to articulate was that:

The Tax Reform and Jobs Act (H.R. 1 Sec. 11045) amended IRC Sec 67 and suspended (eliminated) miscellaneous itemized deductions for employee drivers, which includes per diem and other unreimbursed employee business expenses[v]. As a result, self-employed owner operators will still be allowed to claim per diem, but employee drivers will not.

The Act did not amend IRC 62(2)(a), thus trucking companies will be allowed to continue offering company-paid per diem under an accountable plan that is treated as a non-taxable reimbursement to their employees.

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

[ii] 26 U.S. Code § 274 - Disallowance of certain entertainment, etc., expenses

(n) Only 50 percent of meal and entertainment expenses allowed as deduction

(1) In general, The amount allowable as a deduction under this chapter for—

(3) Special rule for individuals subject to Federal hours of service

In the case of any expenses for food or beverages consumed while away from home (within the meaning of section 162(a)(2)) by an individual during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation, paragraph (1) shall be applied by substituting “80 percent” for “50 percent”.

[iii] IRC 162(a) In general

There shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including—

(2) traveling expenses (including amounts expended for meals and lodging other than amounts which are lavish or extravagant under the circumstances) while away from home in the pursuit of a trade or business

[iv] IRC 67 (a) General rule

In the case of an individual, the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.

IRC 62(2)(a) - Reimbursed expenses of employees

The deductions allowed by part VI (section 1616 and following) which consist of expenses paid or incurred by the taxpayer, in connection with the performance by him of services as an employee, under a reimbursement or other expenses allowance arrangement with his employer. The fact that the reimbursement may be provided by a third party shall not be determinative of whether or not the preceding sentence applies.

[v] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction under IRC 67 for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits”.

In general, under “Tax Reform and Jobs Act” company OTR drivers that previously claimed itemized deductions for unreimbursed employee expenses will likely experience a tax increase[1]. The following tables are designed to assist OTR employee truck drivers in evaluating the impact of the Tax Reform Act passed into law on December 22, 2017.

Example A: Earned $50,000 in 2017 and claimed itemized deductions of $21,601, which included $14,868 of net per diem[2], $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. Your tax bill will increase $1,034.

Example B: Earned $50,000 in 2017 and claimed the standard deduction of $6,350. Your tax bill will decrease $1,309.

Example A: Earned $50,000 in 2017 and claimed itemized deductions of $21,601, which included $14,868 of net per diem, $4,840 for cell phone, tools, GPS unit, etc. and $1,893 of state income taxes. Your tax bill will increase about $475.

Example B: Earned $50,000 in 2017 and claimed the standard deduction of $12,700 with no dependent children. Your tax bill will decrease about $717.

Questions? Contact Mark W. Sullivan, EA

This article was written by Mark W. Sullivan, EA, who has been providing taxpayer advocacy, consulting, and litigation services since 1998. Prior to starting a private practice, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. He has over a decade of experience advising transportation industry clients with respect to per diem issues.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and miscellaneous expenses.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.