PDP For Fleets - 3 Months Free

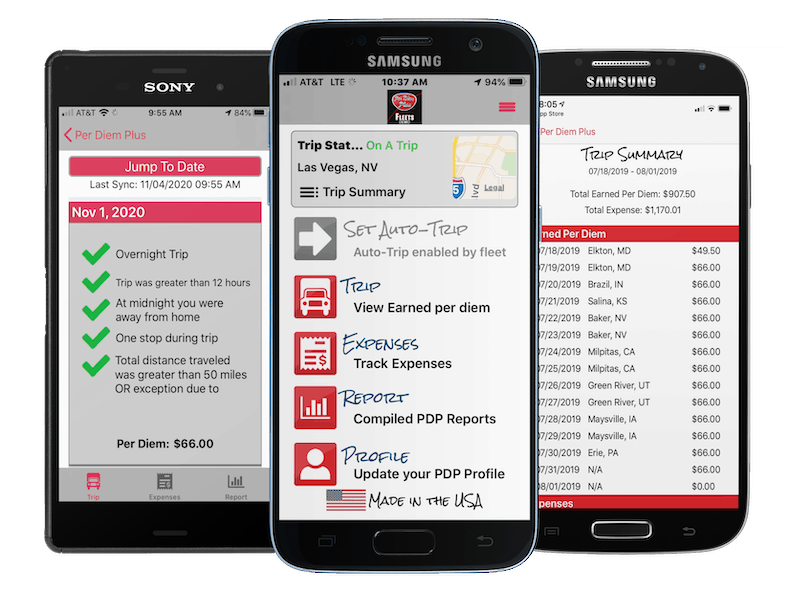

The Per Diem Plus Fleets mobile app was designed by drivers to be easy to use.

How do I start a trip? Simply drive and the app will begin tracking your trip automatically when you exit the tax home halo defined by your fleet.

When will I see my per diem? Per diem is recorded the following afternoon and includes 34-hour restarts and unforeseen delays like detention, weather and breakdowns.

How do I end a trip? The app ends a trip automatically when you return to your tax home.

How do I view my per diem? Select the TRIP tab or TRIP SUMMARY.

Still have questions? Support@perdiemplus.com or (314) 488-1919

Welcome to Per Diem Plus Fleets mobile app. Participation in your company per diem program is optional, but here is what you need to do to get started.

The Per Plus Fleets mobile app has been pre-installed on your device.

Login:

Still have questions? Support@perdiemplus.com or (314) 488-1919

Welcome to Per Diem Plus Fleets mobile app. Participation in your company per diem program is optional, but here is what you need to do to get started.

Step 1: Download the Per Plus Fleets mobile app for Android HERE or iOS HERE

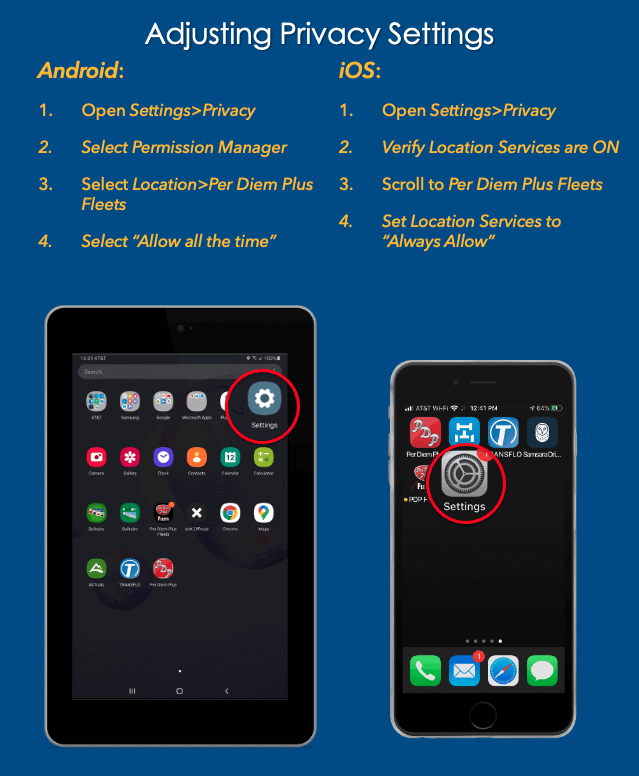

Step 2: Confirm Privacy Settings

Android

iOS

Still have questions? Support@perdiemplus.com or (314) 488-1919

Related Articles

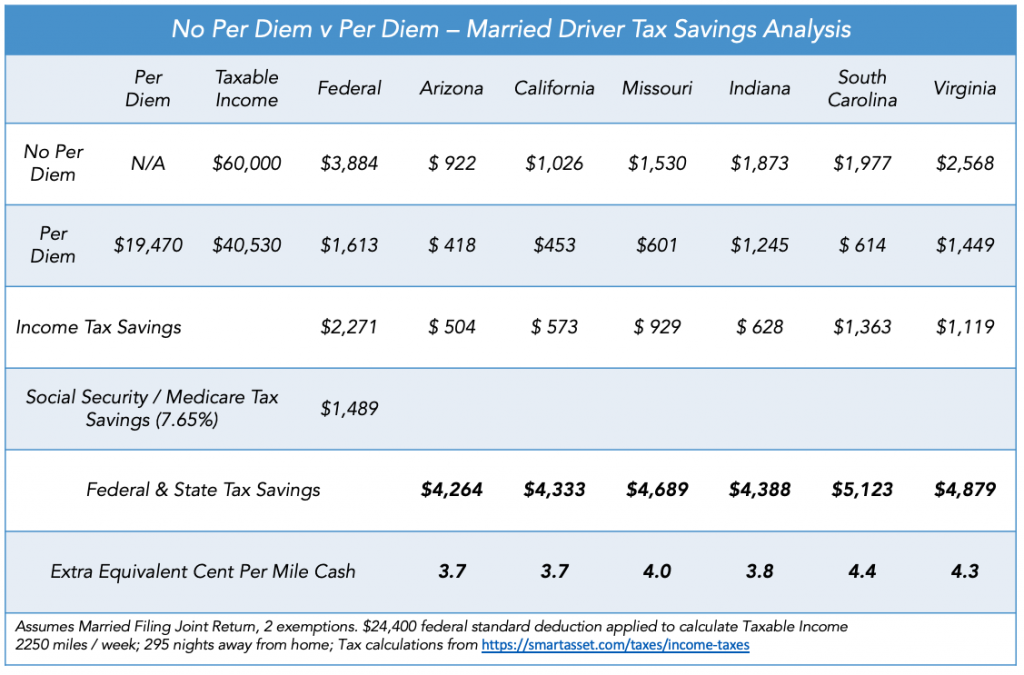

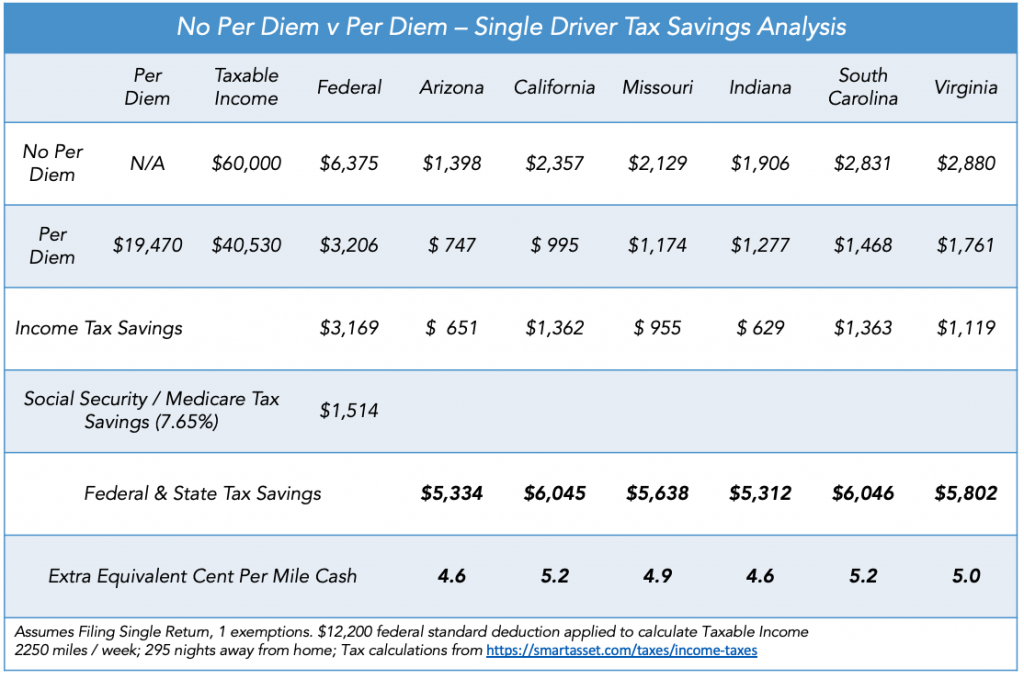

A company-sponsored substantiated per diem plan will save a fleet money and raise driver take-home pay by several cents per mile.

Truckers designed it, tax pros built it, your drivers want it. Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

Adding a substantiated per diem program for employee drivers is a sure-fire way for a motor carrier to save money and raise driver take-home pay. Consider the following:

For example, a married driver from South Carolin could save $5,123 in taxes equal to an extra 4.4 cents per mile.

A single driver from Missouri could save $5,638 in taxes equal to an extra 4.6 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

To enroll or not to enroll in a company-paid per diem program that includes a fleet per diem administration fee, that is the question.

Background: ABC is a truckload carrier that offers voluntary company-paid per diem. Drivers who enroll are paid $.045 CPM of which $0.10 CPM is allocated to per diem, less a $0.02 CPM fleet administration fee. Drivers who choose not to enroll earn a flat $0.45 CPM and can deduct per diem on their own tax return.

John Smith recently went to work for ABC and is unsure if he should enroll in the company per diem plan. He departs home every Monday morning and returns home Friday evening, averages 2250 miles per week and works 50 weeks a year. John is married, but his wife is not working. He owns a modest home, and pays state income, real estate and personal property taxes.

The motor carrier claims he will take home more money and pay less taxes if he enrolls in their per diem program even after giving back $2,250 in fleet administration fees.

Conclusion: John may save a few hundred dollars in federal taxes, but he must forfeit $2,250 of additional income to do so. In addition, the tax savings come at an additional cost: $9,000 of wages omitted from his Form W-2 that will be noticed by a home or auto lender and may lower his employer 401(k) match, social security and workers compensation benefits.

This article was written by D R Sullivan & Company, CPA PC, an accounting firm that has been providing taxpayer advocacy, consulting, and litigation services since 1998. The firm is tax counsel for Per Diem Plus, an automated per diem and expense tracking mobile app.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.

The Per Diem Plus show truck, affectionately known as “Truck 4.04,” headed to the Great American Trucking Show in Dallas, TX. The show exceeded our expectations as we debuted our Apple iOS platform and educated drivers and fleet operators on how Per Diem Plus® takes the guesswork out tax-related record keeping.

The Per Diem Plus show truck, affectionately known as “Truck 4.04,” headed to the Great American Trucking Show in Dallas, TX. The show exceeded our expectations as we debuted our Apple iOS platform and educated drivers and fleet operators on how Per Diem Plus® takes the guesswork out tax-related record keeping.

“DON’T WAIT TO GET THE MOBILE APP EVERYONE IN THE TRUCKING INDUSTRY IS TALKING ABOUT” , Dave Nemo

According to Dave Nemo, per diem is one of the most common issues raised during his tax-talk call-in segment. Our tax experts, Donna and Mark Sullivan, sat down with Dave (Sirius/XM Road Dog Radio) to discuss how Per Diem Plus automates per diem tracking for drivers on paper or electronic logs and expense accounting and reporting.

GATS provided us a great opportunity to teach owner operators and company drivers, fleet operators and even Dave Nemo how easy PDP is to use. We had hundreds of attendees visit with us and learn about our 30-day FREE trial subscription with no credit card required.

Kellie, a veteran driver with Crete Carrier Corp, was the lucky winner in our YETI cooler.

Download Per Diem Plus today!

Copyright 2016 Per Diem Plus, LLC

Per Diem Plus®, a proprietary software application, which provides automatic per diem and expense tracking to truckers.

An employee truck driver asked the following question to the Per Diem Plus tax experts during the 2016 MidAmerica Truck Show: "Is cent per mile or IRS daily rate per diem better for a driver?"

The cent per mile per diem method has been the transportation industry standard for decades and is most often utilized by fleets who offer employee drivers company paid per diem. Under the cent per mile method a driver is paid only for miles driven and not nights away from home.

Although, a driver may travel 500 miles one day but only 250 miles the next, the distance traveled does not affect the need to eat three meals a day. To remedy this problem the IRS introduced the Special Transportation Industry* daily rate per diem that ignores miles traveled and relies on days away from home. The most beneficial aspect to a driver is that per diem can be claimed during a 34 hour restart and unforeseen delays like breakdowns, waiting for permits or weather.

The table below illustrates the advantage of choosing daily rate per diem:

This article was written by D R Sullivan & Company, CPA PC, an accounting firm that has been providing taxpayer advocacy, consulting, and litigation services since 1998. The firm has nearly a decade of experience advising large fleets and telematics providers on IRS substantiated per diem and is tax counsel for Per Diem Plus, an automated per diem and expense tracking Android app.

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2016 Per Diem Plus, LLC. The Per Diem Plus logo and Per Diem Plus are trademarks of Per Diem Plus, LLC.