PDP For Fleets - 3 Months Free

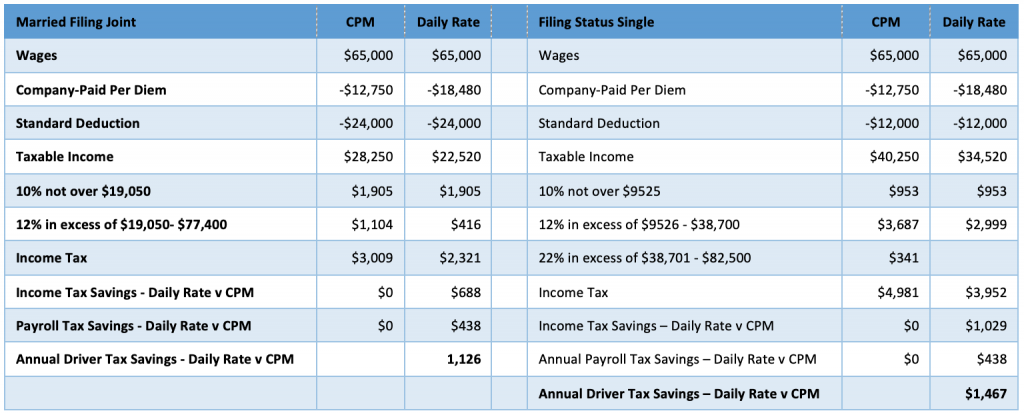

Which per diem method saves a fleet more money? Substantiated per diem saves a motor carrier the most money, since the fleet benefits are directly proportional to total per diem paid to drivers. So how did cent-per-mile per diem become so popular in the trucking industry? Decades before the advent of telematics fleets adopted cent-per-mile per diem for because it was easy to calculate. However, there is no correlation between the miles a driver travels and meal breaks.

Drivers prefer substantiated special trucker per diem. Why? They eat 3 meals a day regardless of whether they drive 200 or 600 miles. The IRS introduced the Special Transportation Industry substantiated per diem to remedy this issue. In addition it simplified tax compliance for fleets by relying on nights away from home instead of miles traveled. It is also a more accurate reflection of anticipated meal expenses for drivers.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Adding an accountable per diem program for employee drivers is a sure-fire way to enhance driver recruiting and retention. Consider the following:

Both substantiated and cent-per-mile per diem must comply with the IRS substantiation by adequate records rules. According to the IRS, "a motor carrier must maintain lrecords to establish "time, place and location" for each per diem event". The Per Diem Plus FLEETS platform satisfies this requirement since it is maintained in such manner that each recording of an element of an expenditure is made at or near the time of the expenditure.

Document retention rules:

The transportation industry has been unique in its treatment of driver per diem for over 30 years. The substantiated per diem method saves a motor carrier more money than cent-per-mile method. While, substantiated and cent-per-mile per diem methods are IRS-compliant, both require a motor carrier to comply with the adequate records and document retention rules.

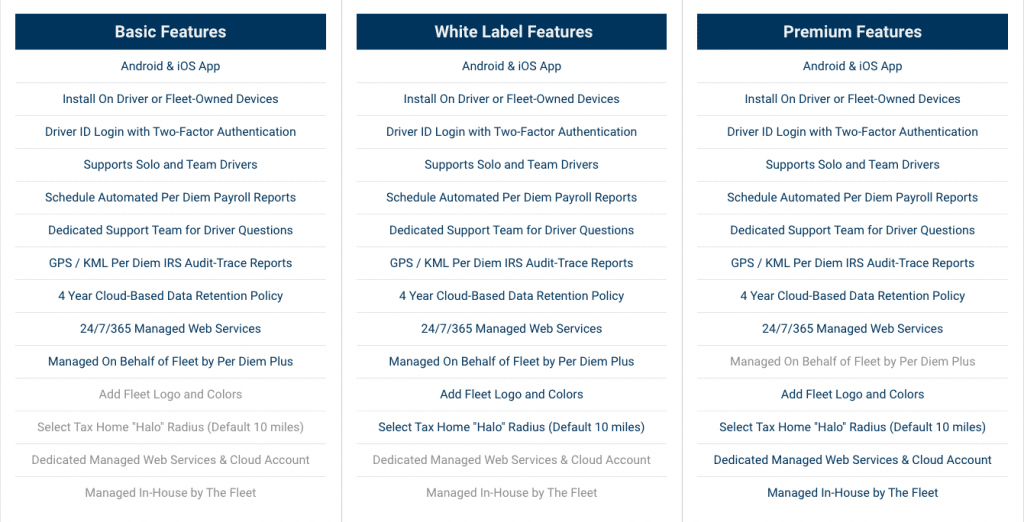

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

"Partnering with Per Diem Plus provided us a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers who love our new per diem app."

Nick A., Controller

Per diem saves fleet thousands. With over 400 power units the motor carrier is a leader among specialized companies serving the United States and Canada.

The Controller was looking for a solution to two significant challenges impeding growth. The first involved reducing driver turnover and the second was raising driver pay in a tight labor market to improve driver recruiting.

The only IRS-compliant mobile application platform that automated administration of an accountable trucker per diem plan.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Questions? Contact Mark W. Sullivan Program Manager - Per Diem Plus FLEETS

About: Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The term"per diem allowance" means a payment under a reimbursement or other expense allowance arrangement that is — (1)

Trucker per diem rules for fleets eliminate the need for proving actual costs for meals & incidental expenses incurred.

Related Articles:

Beware: Firms Promoting Illegal Trucker Per Diem Programs

Yes. Drivers that receive a non-taxable per diem reimbursement from their employer (trucking company) do so under IRC Sec 62(2)(a).

Under the trucker per diem rules for fleets a motor carrier can offer per diem only to drivers who are:

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot receive per diem.

A fleet will save approximately $3,000 annually or $0.03/mile/driver as the payroll tax and worker compensation savings exceed the tax on the 20% nondeductible portion of per diem.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Yes. On average driver pay will increase from $0.03 - $0.04/per mile.

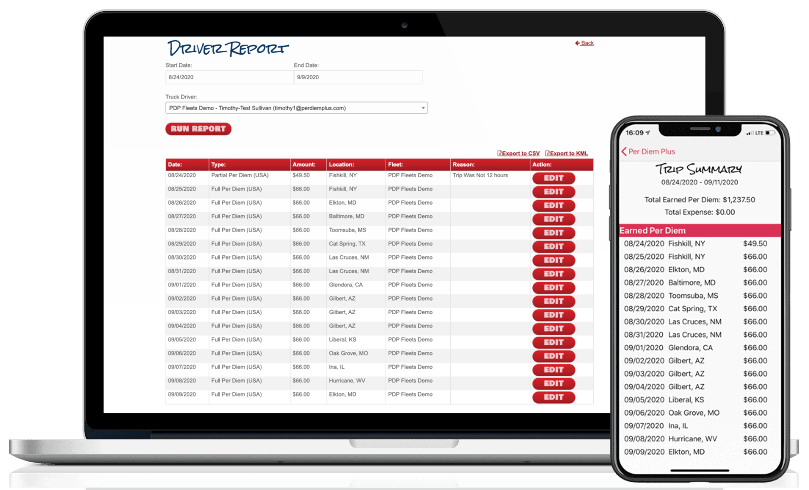

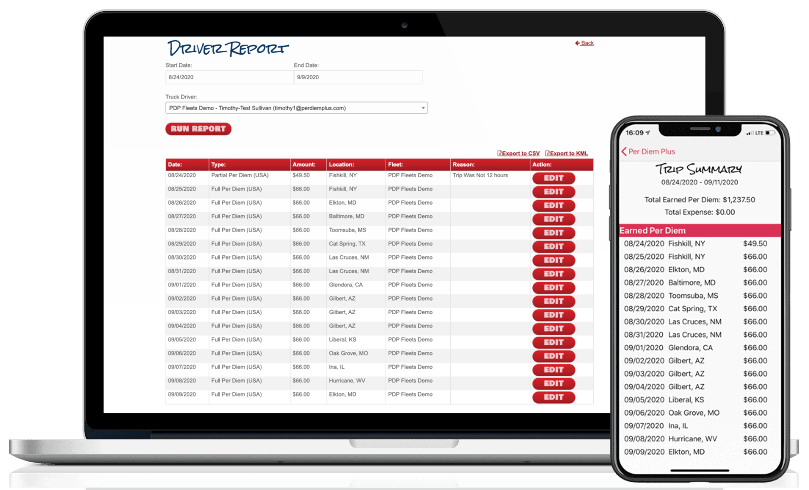

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Per Diem Plus automatically records per diem for travel in the USA and Canada for solo and team drivers.

No. Per diem is classified as a non-taxable reimbursement to an employee driver and is not reported under wages on Form W-2.

IRS increased per diem rates effective October 1, 2018 (Revised 10/01/2021)

USA $69 from $66

Canada $74 from $71

Yes. A partial day is 75% of the per diem rate.

A fleet can deduct 80% of per diem on their income tax return. However, the payroll tax and worker compensation savings ordinarily exceed the tax on the nondeductible portion of per diem.

Paper or electronic receipts that identify what, when and the amount are required. Drivers can upload and store receipts on the Per Diem Plus FLEETS app. Watch Run IRS Compliant Reports with Receipts video to see how easy drivers can send an itemized expense reports with receipts to payroll or accounting.

No. There is no published guidance from IRS that allows a fleet to pay a lodging per diem.

A self-employed driver (owner operator) falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

No less than 3 years from the filing date of an income tax return. Per Diem Plus FLEETS customers have instant access to itemized per diem tax records for four years.

ELD backups used to substantiate "time, date and place" are considered tax records.

Refer to IRS Revenue Procedure 2011-47. Or, use the Per Diem Plus FLEETS platform that automates administration of a company-paid per diem plan and takes the guesswork out of tax-related record keeping. Our How it Works video demonstrates just easy the app is to use.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus® FLEETS is a configurable mobile application platform that automates administration of an IRS-compliant accountable trucker per diem plan for fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Truckers designed it, tax pros built it, drivers want it. Our cloud-based FLEETS mobile app platform enables motor carriers to implement an IRS-compliant fleet per diem plan that will:

"Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions.

Configure your per diem app in minutes with our simple check-the-box menu.

For example, the app allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 50 miles and that best matches fleet lanes and app installation type. Or to minimize cellular data plan usage you can white list the app using our static IP address.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

* Deep-link integration scheduled for Q4 2020 release

Per Diem Plus 2020. All rights reserved. Per Diem Plus is a trademark of Per Diem Plus, LLC. A proprietary software application, which provides automatic per diem and expense tracking for truckers (USPTO Registration #86754053)