PDP For Fleets - 3 Months Free

The freight market has experienced steady softening over the past year while diesel prices have gained more than 40 cents from a month ago. So how can fleets mitigate softening freight rates and the exploding cost of fuel? Most fleets aren’t maximizing the tax deductible benefits of per diem, leaving thousands of dollars per driver on the table every year. Below is a guide on how best to manage this within your carrier operation, and unlock significant fleet savings while boosting driver pay amid economic uncertainty and record inflation.

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility, per diem will not save a motor carrier money. The below tables prove otherwise.

Assumptions

The following analysis assumes:

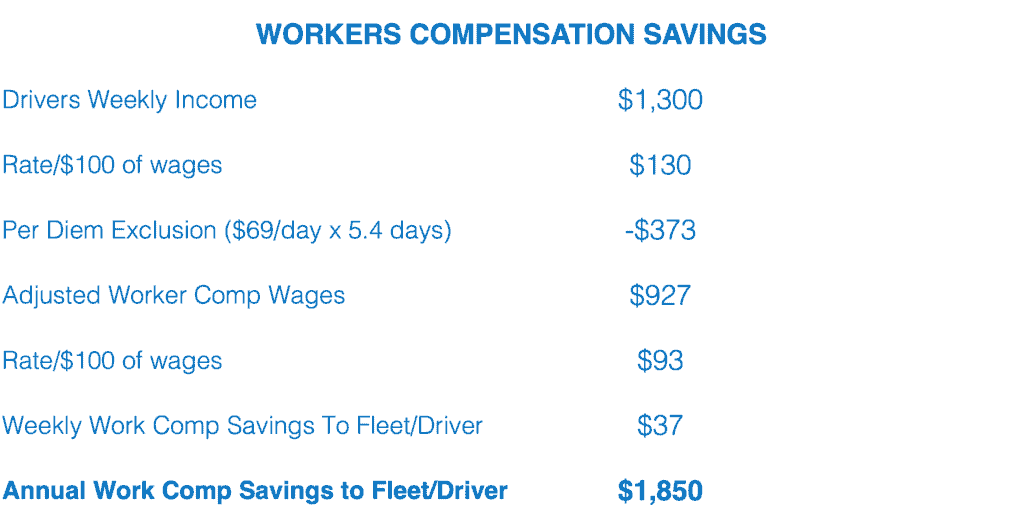

Twenty-three states are members of the National Council on Compensation Insurance (NCCI), and 39 rely on NCCI regulations. Under NCCI rules, a motor carrier paying substantiated per diem under an IRS-accountable plan can exclude up to $69/day of per diem from taxable wages, which provides a significant per driver annual savings to a fleet. (IRS Publishes 2024 Trucker Per Diem Rates)

Even with growing economic uncertainty and recessionary clouds on the horizon, Congress elected not to extend the 100% deduction for per diem. However, a motor carrier that implements an automated per diem solution will be in a stronger position to weather the economic storm.

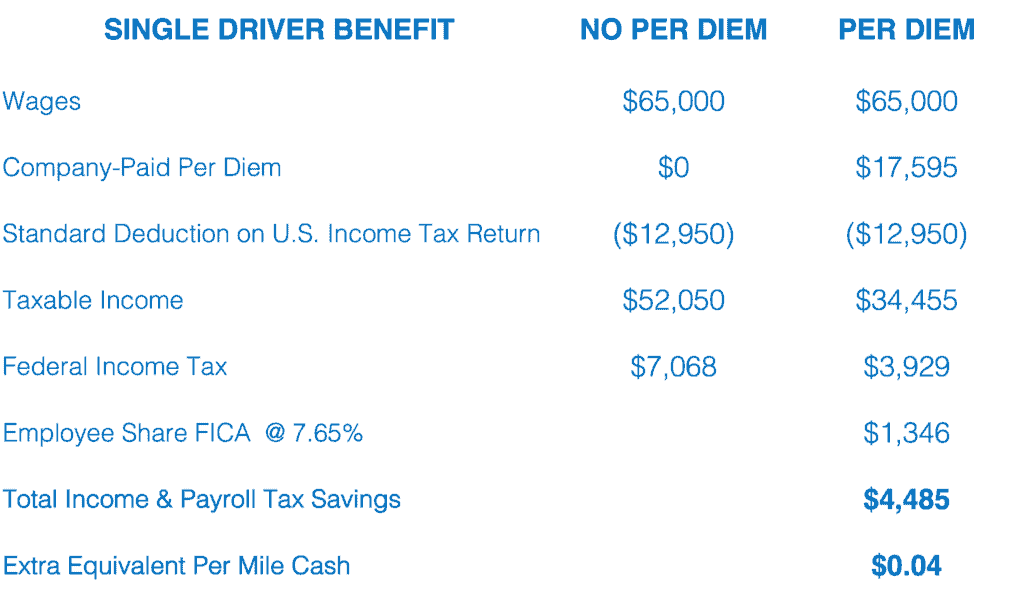

As of January 1, 2018, employee drivers can no longer claim per diem as an itemized deduction on their federal income tax return. However, motor carriers can offer per diem to employee drivers to recapture the lost tax savings. The average Married over-the-road driver earning $65,000 annually will save approximately $3,457 in federal income taxes equivalent to $0.03 cents per mile.

The average Single over-the-road driver earning $65,000 annually will save approximately $4,485 in federal income taxes equivalent to $0.04 cents per mile.

In short, you are virtually always better off leveraging a fixed $69/day (as of this writing) to maximize your per diem tax offset from wages.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Conta

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

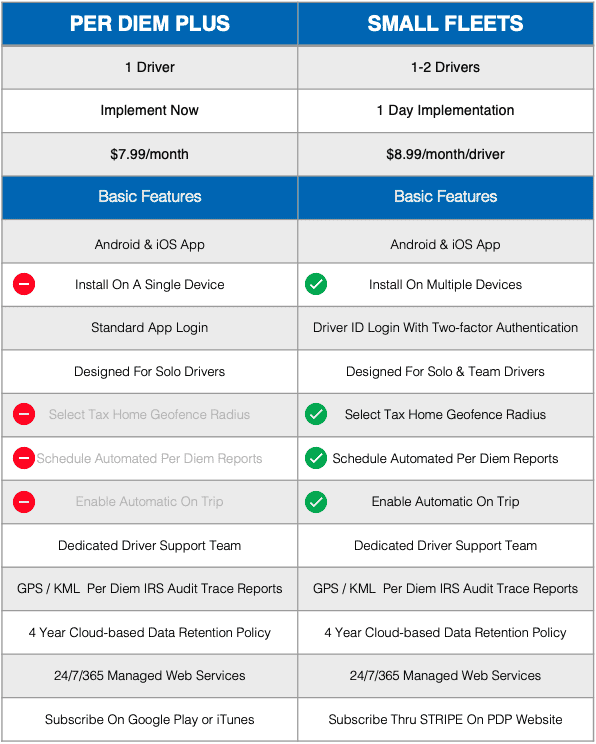

Drivers have spoken! Based on user feedback Per Diem Plus introduces Small Fleets, which enables drivers to customize settings and automate features within the Per Diem Plus mobile app.

Small Fleets will automatically track each qualifying day and partial day of travel away from home in the US and Canada.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

IRS-Compliant: Per Diem Plus® is the only IRS-compliant, mobile-enabled application for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada to substantiate away-from-home travel for solo and team drivers.

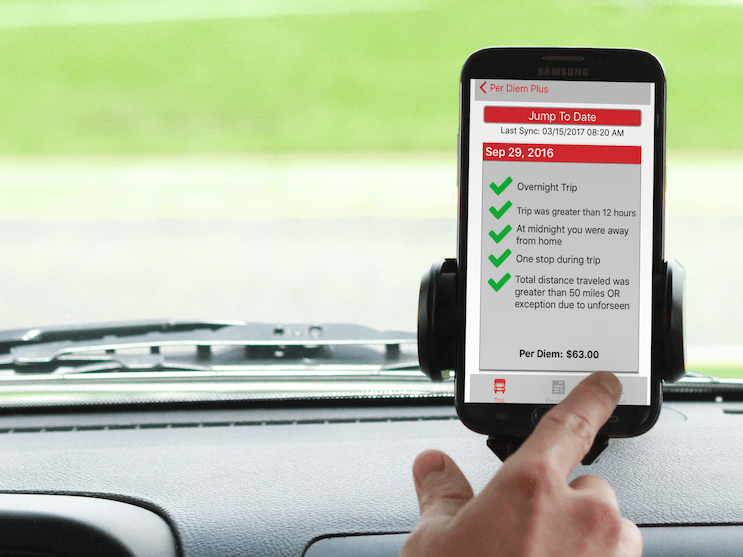

GPS-Based Tracking: Per Diem Plus utilizes a devices GPS to establish IRS-required “time, date and place” substantiation to prove away-from-home travel

Proven: Drivers have logged millions of miles using Per Diem Plus! Join those that value their time, love to eliminate inefficient paperwork, and want to simplify tax compliance and save money.

Easy Setup: An IRS-compliant cloud-based mobile app platform that allows for rapid deployment.

Secure Login: Two-Factor authentication with fleet code and driver ID login.

Data Plan Friendly: The average user on the road for a month will use less than 50MB per month.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus Releases Samsara Driver App. The leader in mobile-enabled transportation per diem solutions today announced the release of the Samsara Driver App. The web-based portal enables drivers to view per diem on their personal mobile device. This feature was developed in response to feedback from fleet managers to enhance per diem data visibility for drivers using Per Diem Plus Fleets API for Samsara, the pioneer of the Connected Operations Cloud. Per Diem Plus Fleets is available to all fleets on the Samsara App Marketplace.

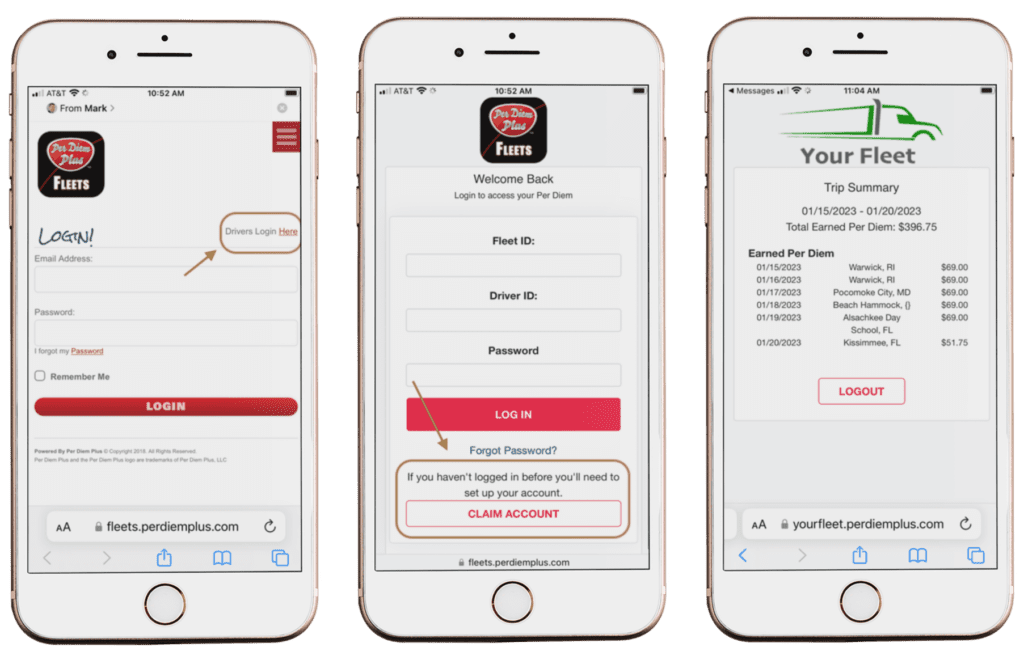

Initial driver login steps:

You only must register once

The Trip Summary list earned per diem for the current payroll period and includes the date, place and amount of per diem.

The Per Diem Plus Fleets API adapter was developed in response to growing industry demand to build integrations and PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA. It is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Help us test and develop features and functionality of our integration with Per Diem Plus Fleets for Motive (Keeptruckin) beta. Per Diem Plus® Fleets API is a configurable, ELD-integrated enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleet managers.

Truckers designed. Tax pros built it. Your drivers want it. It takes only minutes to start up an IRS-compliant per diem plan with Per Diem Plus Fleets for Motive (Keeptruckin).

Take a deep dive into the benefits of offering per diem, for both your company and drivers.

Benefits:

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility per diem will not save a motor carrier money. The below tables prove otherwise.

The following analysis assumes 2,500 average weekly miles / driver; $69 per diem; $75,000 annual driver wages; 255 nights away from home; a 12% effective federal income tax rate, and $10/$100 workers' comp rate.

Motive builds technology to improve the safety, productivity, and profitability of businesses that power the physical economy. The Motive Automated Operations Platform combines IoT hardware with AI-powered applications to automate vehicle and equipment tracking, driver safety, compliance, maintenance, spend management, and more. Motive serves more than 120,000 businesses, across a wide range of industries including trucking and logistics, construction, oil and gas, food and beverages, field services, agriculture, passenger transit, and delivery. Visit gomotive.com to learn more.

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of individual experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

On Monday, November 21, 2022, Mark W. Sullivan, EA, Tax Counsel for Per Diem Plus hosted a webinar for the American Trucking Association titled, "Unlock Fleet Savings With Per Diem Amid Economic Uncertainty". The following are excerpts from that presentation.

The freight market has experienced steady softening over the past few months while the nationwide average price for a gallon of diesel fuel hovering around $5.36 or about $2.02 more than just one-year ago1. So how can fleets mitigate the exploding cost of fuel and softening freight rates2? Use per diem compliance tech to unlock fleet savings amid economic uncertainty and record inflation.

An automated telematic solution, like Per Diem Plus®, allows motor carriers to rapidly deploy a solution to realize immediate savings, offset pain at the pump and boost driver pay. Additionally, our cloud-based mobile-enabled platform offers flexible Service Plan Options allowing motor carriers to easily implement an IRS-compliant fleet per diem plan that:

“We are seeing increased inflationary pressures throughout the business," U.S. Xpress CEO Eric Fuller said during a May 5 call. "Wages, both office and driver, are increasing [and] new equipment prices, insurance, maintenance, and fuel expenses are all up. Taken together, the cost of doing business is increasing across our industry.”1

FleetOwner, May 23, 2022

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility per diem will not save a motor carrier money. The below tables prove otherwise.

The following analysis assumes 2,500 average weekly miles / driver; $69 per diem; $65,000 annual driver wages; 255 nights away from home; a 12% effective federal income tax rate, and $10/$100 workers' comp rate.

Twenty-three states are members of the National Council on Compensation Insurance (NCCI), 39 rely on NCCI regulations. Under NCCI rules a motor carrier paying substantiated per diem under an IRS-accountable plan can exclude up to $69/day of per diem from taxable wages, which provides a significant per driver annual savings to a fleet3.

With growing economic uncertainty and recessionary clouds on the horizon it is not known if Congress will extend the 100% deduction for per diem. However, a motor carrier that implements Per Diem Plus will be in a stronger position to weather the economic storm.

As of January 1, 2018, employee drivers can no longer claim per diem as an itemized deduction on their federal income tax return. However, motor carriers can offer per diem to employee drivers to recapture the lost tax savings. The average Married over-the-road driver earning $65,000 annually will save approximately $3,457 in federal income taxes equivalent to $0.03 cents per mile.

The average Single over-the-road driver earning $65,000 annually will save approximately $4,485 in federal income taxes equivalent to $0.04 cents per mile.

GPS-Based Tracking: Per Diem Plus® utilizes telematics to establish IRS-required “time, date and place” substantiation to prove away-from-home travel.

Proven: Drivers have logged millions of miles using Per Diem Plus! Join those that value their time, love to eliminate inefficient paperwork, and want to simplify tax compliance and save money.

Easy Setup: Our IRS-compliant cloud-based ELD-integrated platform and mobile app solutions allow for rapid deployment with minimal investment in IT resources.

Easy to Use: Web services interface that allows non-technical users to manage individual and team drivers.

Scalable: Whether 5 or 15,000 trucks, our secure cloud-based platform will meet the growing needs of your fleet.

Data Plan Friendly: An average driver using our mobile app solution will use less than 50MB per month.

Per Diem Plus Fleets is also available on the Samsara App Marketplace and Platform Science Marketplace

For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

1 Kingston, John, "Weekly DOE/EIA diesel price decline is biggest since 2008", Freightwaves, July 25, 2022 LINK

2 Achelpohl, Scott, "Survey points to exodus of small operators - and fuel costs as the culprit", FleetOwner, May 23, 2022 LINK

3 North Carolina allows a $75 exemption for per diem Rule 2-B-2 LINK

Data Law – About Our Practices & Your Privacy

At Per Diem Plus, our users are our most important asset. Therefore, we are committed to maintaining the confidentiality, integrity and security of any information you provide. These are the core privacy policies we adhere to across our services:

Select the links below to read more about our practices & your privacy

If you have any questions, concerns or comments regarding this Policy or any other security concern, contact us at: Per Diem Plus, LLC, 943 E. Ivanhoe St, Phoenix, AZ 85295 or at info@perdiemplus.com or by telephone at 314-488-1818.

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

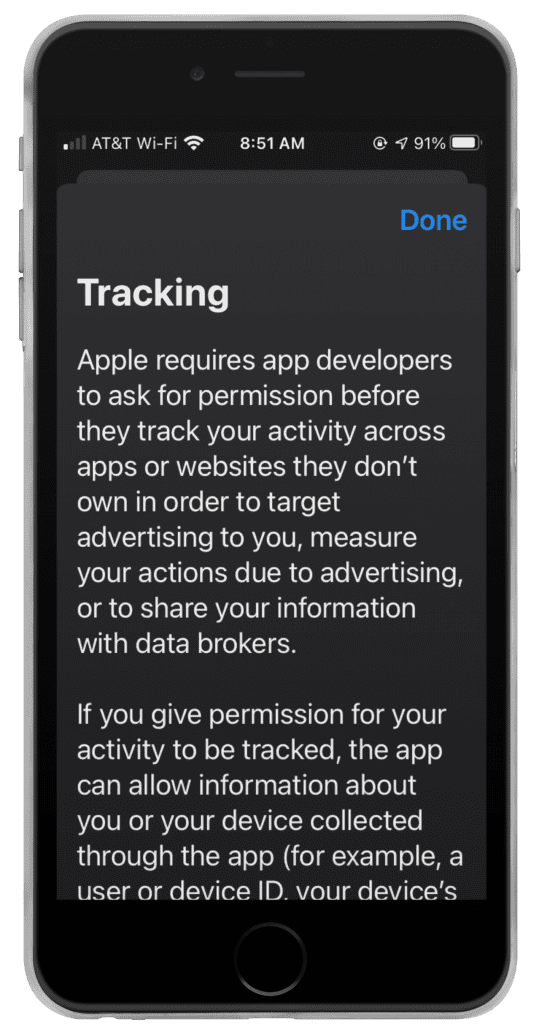

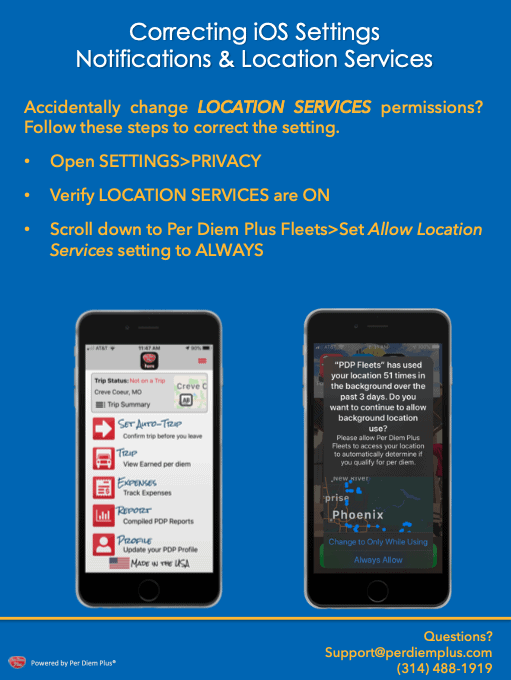

Per Diem Plus Fleets releases Build 56 to resolve location services permission restrictions imposed with OS 14.

What's new? The app will post a notification alerting an iOS user that location services permissions were changed by iOS and instructing the user to reset permissions to "Always Allow".

Why was this needed? Per Diem Plus was designed to run passively in the background to determine IRS-required "time, date and location" for per diem. However, because of abuses by Big Tech, like Facebook, Apple no longer allows apps to lock Location Services with "Always Allow" during initial login and setup. As a result, iOS automatically changes the setting to "Only while using app", which prevents PDP from functioning as designed.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

2021 TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

Implementing a fleet per diem solution is something that should be on many fleet managers’ to-do list. They know the benefits to drivers, they know the incredible ROI, and yet it still manages to slip down the list of immediate priorities. One of the main perceived barriers to implementing Per Diem Plus Fleets is the rollout process.

With such a dramatic overhaul of your fleet, surely there will be some bumps along the way — translating to tech overload and a hit to back-office productivity, right? Perhaps you’re worried that there are things you’ve missed, and you’ll suffer teething issue after teething issue before you see the benefits you were promised.

The good news is that this needn’t be the case, no matter the size of your fleet.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Configure your fleet per diem plan in minutes with our simple check-the-box menu.

For example, the platform allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 25 miles and best matches fleet lanes and app installation type. Or to minimize cellular data plan usage for mobile app users you can whitelist the app using our static IP address.

Per Diem Plus was purpose-built to simplify substantiated per diem tax compliance. Have you thought about how you can use the data gathered? There are a few important things to note.

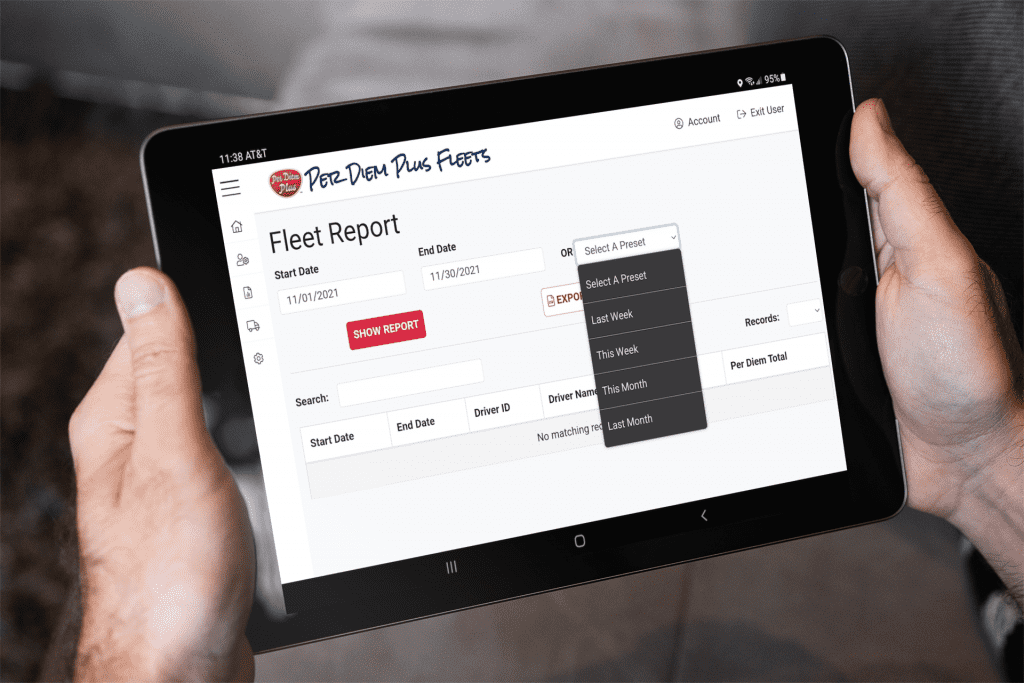

Use your Fleet Reports quickly audit your per diem program or to support the Workers Compensation per diem exemption in addition to or instead of your paper documents.

To run a Fleet Report in the FLEETS Web App:

Generate reports with Per Diem Plus:

When you use Per Diem Plus Fleets Web App for Premium users, you have access to your fleetwide reporting that you can use to analyze your per diem program. The report tracks per diem totals for each driver for a given period. If you are interested in a map of a trip route to see exactly where a driver traveled, you can access that from a KML export within a Driver Report.

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

Copyright 2022 Per Diem Plus, LLC.

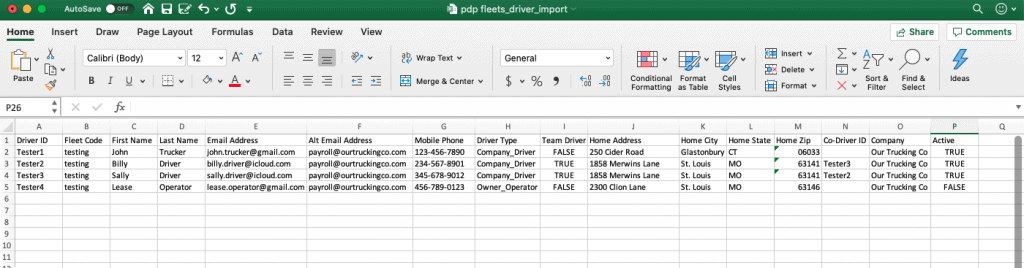

Importing your truck drivers into the Per Diem Plus FLEETS mobile application platform is the final implementation step. Retain a copy of the Driver Import CSV Form, which can be continously update by a customer to:

Driver Import CSV Format Notes

Questions? Contact Us

About Per Diem Plus

The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet trucker per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators.

Copyright 2020 Per Diem Plus, LLC

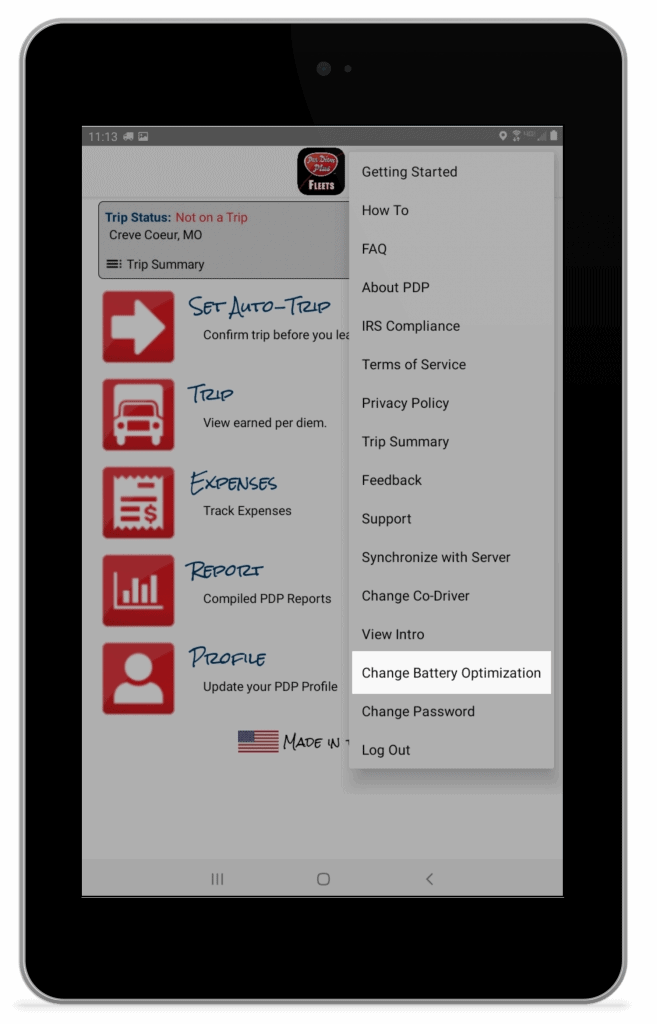

Here is how you fix battery optimization issues when you update to Android 9. It came to our attention that updating a device to Android 9 may automatically optimize the battery settings. Unfortunately, the optimized battery setting prevents the Per Diem Plus FLEETS and Per Diem Plus - Owner Operators app from waking up to establish location.

Follow these steps to adjust the battery optimization setting for Per Diem Plus Fleets on your Android device:

Follow these steps to adjust the battery optimization setting Per Diem Plus - Owner Operators on your Android device:

This setting prevents Android from blocking the app from tracking per diem trips.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®