PDP For Fleets - 3 Months Free

Arka Express selects Per Diem Plus for Samsara to raise driver pay and enhance operational efficiency for its 400-vehicle "first in excellence" fleet.

“The API was quick and easy to set up and run, which was a significant factor in our choosing Per Diem Plus for Samsara.”

Art Astrauskas, President

Arka Express has evolved from a small 35-unit carrier located out of Markham, IL, to an elite, state-of-the-art fleet of 400 units built by the top transportation professionals in the industry in only 10 years.

In addition to our Markham terminal, they are currently establishing headquarters in Indiana, Atlanta, Georgia and Marlboro Township, New Jersey as they continue to deliver services throughout the Midwest, east coast and Southeast. Drivers typically operate in a 400-mile regional radius in both Chicago and Atlanta. In addition, they have developed an OTR presence from the Dakotas to Florida to New York—and everything in between.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

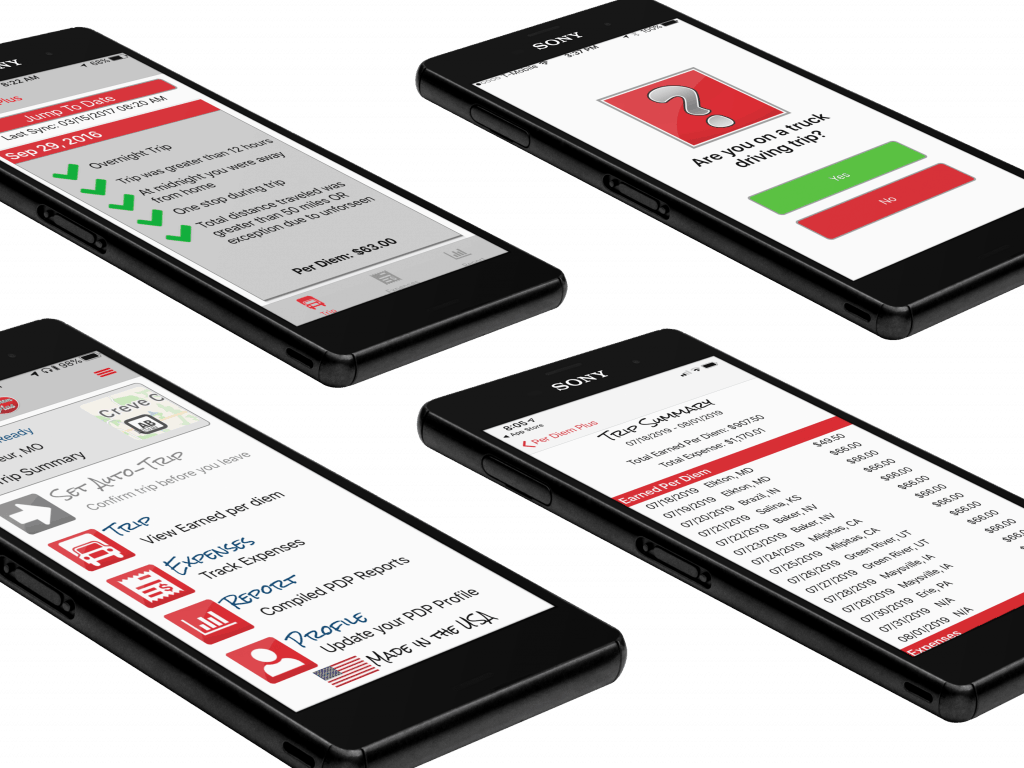

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Intercity Lines case study highlights how the specialized automotive transporter improved safety and operational efficiency of its 30-vehicle fleet using Samsara ELD and Per Diem Plus.

"The Per Diem Plus integration was a significant factor in our choosing Samsara over competing ELD solution providers."

Dean Wilson, Vice President

Dave and Linda opened Intercity Lines, Inc. more than 40 years ago, setting out to provide excellence in enclosed automotive transportation. As a driver himself, Dave took great pride in the trust customers gave him when transporting what could be their most prized possession—their classic, historic, or exotic vehicles. Together, Dave and Linda brought attention to detail, dedication, and innovation to the enclosed automotive transportation industry.

Improve safety and operational efficiency for the specialized automotive transporter and its 30-vehicle fleet using Samsara’s complete fleet platform. Intercity deployed VG-series gateways, CM-series dash cams, Galaxy tablets, fuel, maintenance and per diem program. According to Dean Wilson, VP of Intercity Lines, “Per Diem Plus integrating directly into Samsara TMS was a significant factor in our choosing Samsara over competing ELD solution providers. The API was quick and easy to set up and run; it was a no-brainer. ”

“Per Diem Plus has a per diem solution regardless of what you use to track Hours of Service, while others offer limited solutions with limited partners,” said Wilson. Jay Leno's favorite auto transport company is transitioning to the API from the PDP Fleets mobile app. Wilson cited the modern and intuitive web services dashboard, flexible report formats and ability to track per diem in the event the ELD goes down that distinguish Per Diem Plus. “Since introducing our driver per diem program in 2020 Intercity has achieved 85% driver participation, cut driver turnover to 10%, and saved over $3,000 per driver annually that was used to raise driver pay by several cents per mile. PDP’s customer service is top-notch, allowing you to have a trusted partner to handle all your per diems needs. And we prefer the features and benefits of PDP offers,” he said.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Data Law – About Our Practices & Your Data

At Per Diem Plus, we believe customers deserve to understand our policies for responding to government requests for their data. In addition to the detailed frequently asked questions (FAQs) below, there are some core policies we adhere to across our services:

Q: What is the process for disclosing customer information in response to government legal demands?

Q: Is rejecting a request the only way Per Diem Plus resists government requests?

Q: Does Per Diem Plus provide any data to governments absent a formal legal request?

Q: Does Per Diem Plus notify users of its consumer services, such as Per Diem Plus – Owner Operators, when law enforcement or another governmental entity in the U.S. requests their data?

Q: Does Per Diem Plus notify its enterprise customers when law enforcement or another governmental entity requests their data?

Q: Does Per Diem Plus disclose additional data as a result of the CLOUD Act?

Q: Does Per Diem Plus provide customer data in response to legal demands from civil litigation parties?

If you have any questions, concerns or comments regarding this Policy or any other security concern, contact us at: Per Diem Plus, LLC, 8924 E Pinnacle Peak Rd, G5-452, Scottsdale, AZ 85295 or by telephone at 314-488-1818.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus, the leader in mobile-enabled transportation per diem solutions, today announced the release of the Per Diem Plus Fleets application programming interface (API) integration for Samsara, the pioneer of the Connected Operations Cloud. Now, Per Diem Plus Fleets will be available to all fleets on the Samsara App Marketplace.

The Per Diem Plus Fleets API adapter was developed in response to growing industry demand to build integrations and is a part of PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Per Diem Plus completed months of beta testing in December with several motor carriers, including Intercity Lines. Jay Leno's favorite auto transport company is transitioning from the PDP Fleets mobile app to the API. "Setting up the API could not have been easier. It took us less than 5 minutes to configure the PDP Fleets API with our Samsara account," said Dean Wilson, Vice President at Intercity Lines. "Since introducing our driver per diem program in 2020 Intercity has achieved 85% driver participation, cut driver turnover by 10%, and saved over $3,000 per driver annually that was used to raise driver pay by several cents per mile," said Wilson.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

100% deduction for trucker per diem in COVID-19 Pandemic Relief Package confirmed by the IRS in Notice 2021-63 (12/6/2021)

[Update: The temporary 100% deduction for per diem expired on December 31, 2022]

Congress used a single line on page 4871 of the Consolidated Appropriations Act, 2021 (CAA) to allow the full deduction for per diem. Section 210 of the act temporarily raised the allowance of business meals (for food or beverages provided by a restaurant) under IRC § 274(n) to 100% from 50% for tax years 2021 and 2022.

The IRS issued Notice 2021-25 on April 8, 2021 (updated by Notice 2021-63 on December 6, 2021) that explains when the temporary 100-percent deduction applies and when the 50-percent limitation continues to apply for purposes of § 274 of the Internal Revenue Code (Code), as amended by § 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Act), enacted as Division EE of the Consolidated Appropriations Act, 2021, Pub. L. No. 116- 260, 134 Stat. 1182 (December 27, 2020)

The IRS previously allowed motor carriers and self-employed truckers using the Special Transportation Industry per diem to deduct business meals at 80% under 274(n)(3). Unfortunately, Congress omitted any commentary on the interplay of 274(n)(1) and (3) in the CAA. On April 9, 2021, I called the Office of Associate Chief Counsel (Income Tax & Accounting) and obtained confirmation the temporary 100-percent deduction for business meal expenses applied to the transportation industry as well. The Associate Chief Counsel's opinion was affirmed by issuance of IRS Notice 2021-63 on December 6, 2021.

"Absolutely yes, we tried to allow as many taxpayers to use it as possible"

Deena Devereux, IRS Office of Associate Chief Counsel

26 U.S. Code § 274 - Disallowance of certain entertainment, etc., has been revised as follows (as modified by the CAA):

(n) 100 percent of meal expenses allowed as deduction

(1) In general:

The amount allowable as a deduction under this chapter for any expense for food or beverages shall not exceed 100 percent of the amount of such expense which would (but for this paragraph) be allowable as a deduction under this chapter.

(2) Exceptions

Paragraph (1) shall not apply to any expense if—

(A) such expense is described in paragraph (2), (3), (4), (7), (8), or (9) of subsection (e),

(B) in the case of an employer who pays or reimburses moving expenses of an employee, such expenses are includible in the income of the employee under section 82, or

(C) such expense is for food or beverages— (i) required by any Federal law to be provided to crew members of a commercial vessel,(ii) provided to crew members of a commercial vessel.

(D) such expense is—

(i) for food or beverages provided by a restaurant, and

(ii) paid or incurred before January 1, 2023.

(3) Special rule for individuals subject to Federal hours of service (superseded by CAA)

In the case of any expenses for food or beverages consumed while away from home (within the meaning of section 162(a)(2)) by an individual during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation, paragraph (1) shall be applied by substituting “80 percent” for “50 percent”

Motor Carrier: A motor carrier with an effective Federal tax rate of 10% paying trucker per diem to a driver who is away from home an average 280 nights per year will save with the full deduction for per diem an additional $370 per year in 2021 and 2022.

Owner Operator: An independent owner operator operating one-truck with an effective Federal tax rate of 18% claiming trucker per diem and averaging 280 nights away from home per year will save with the full deduction for per dieman additional $665 per year in 2021 and 2022.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

The Per Diem Plus® is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2021, 2022, 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

The 2022 trucker per diem rates and tax brackets have been released. For taxpayers in the transportation industry the per diem rate increased to $69 for for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

IRS Orders Immediate Stop To New Employee Retention Claims (September 14, 2023)

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

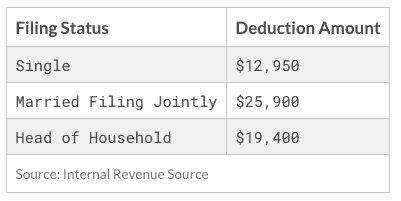

The standard deduction for single filers will increase to $12,950, $25,900 for married filing jointly, and $19,400 for head of household.

The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA)

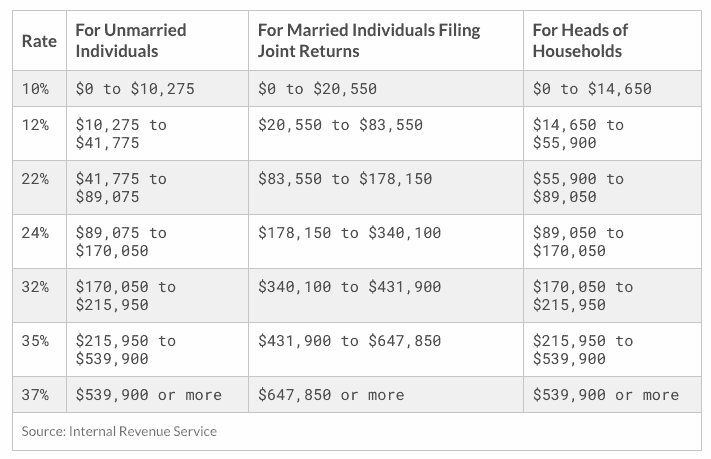

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $539,900 and higher for single filers and $647,850 and higher for married couples filing jointly.

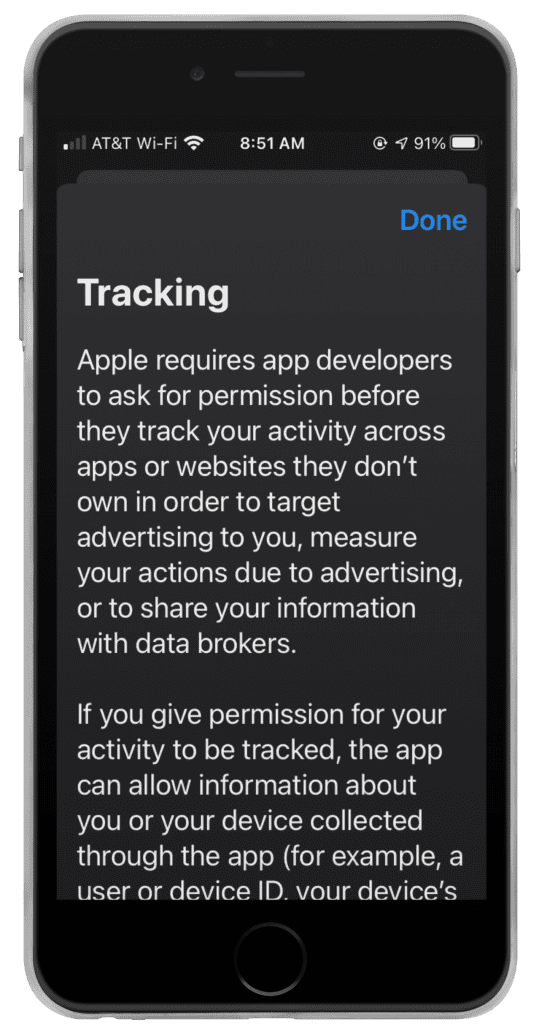

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

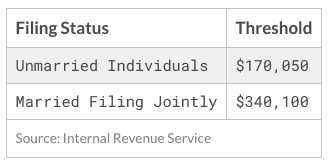

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses up to $170,050 and $340,100 for joint filers.

The maximum Child Tax Credit is $2,000 per qualifying child and is not adjusted for inflation. The refundable portion of the Child Tax Credit is adjusted for inflation and will increase from $1,400 to $1,500 for 2022.

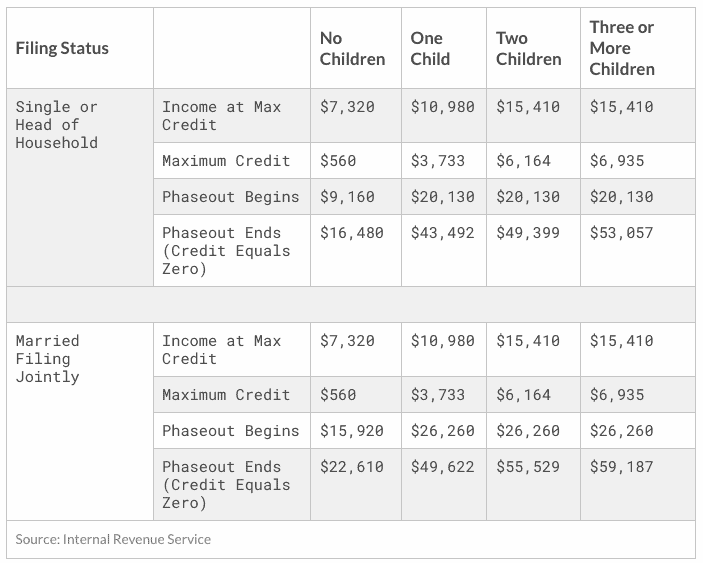

The maximum Earned Income Tax Credit (EITC) in 2022 for single and joint filers is $560 if the filer has no children (Table 5). The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Source: "2022 Tax Brackets", Erica York, Tax Foundation (11/10/21)

Data Law – About Our Practices & Your Privacy

At Per Diem Plus, our users are our most important asset. Therefore, we are committed to maintaining the confidentiality, integrity and security of any information you provide. These are the core privacy policies we adhere to across our services:

Select the links below to read more about our practices & your privacy

If you have any questions, concerns or comments regarding this Policy or any other security concern, contact us at: Per Diem Plus, LLC, 943 E. Ivanhoe St, Phoenix, AZ 85295 or at info@perdiemplus.com or by telephone at 314-488-1818.

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The 2022 special trucker per diem rates for taxpayers in the transportation industry have increased $3/day from 2020-2021 and are $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

View Notice 2021-52

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

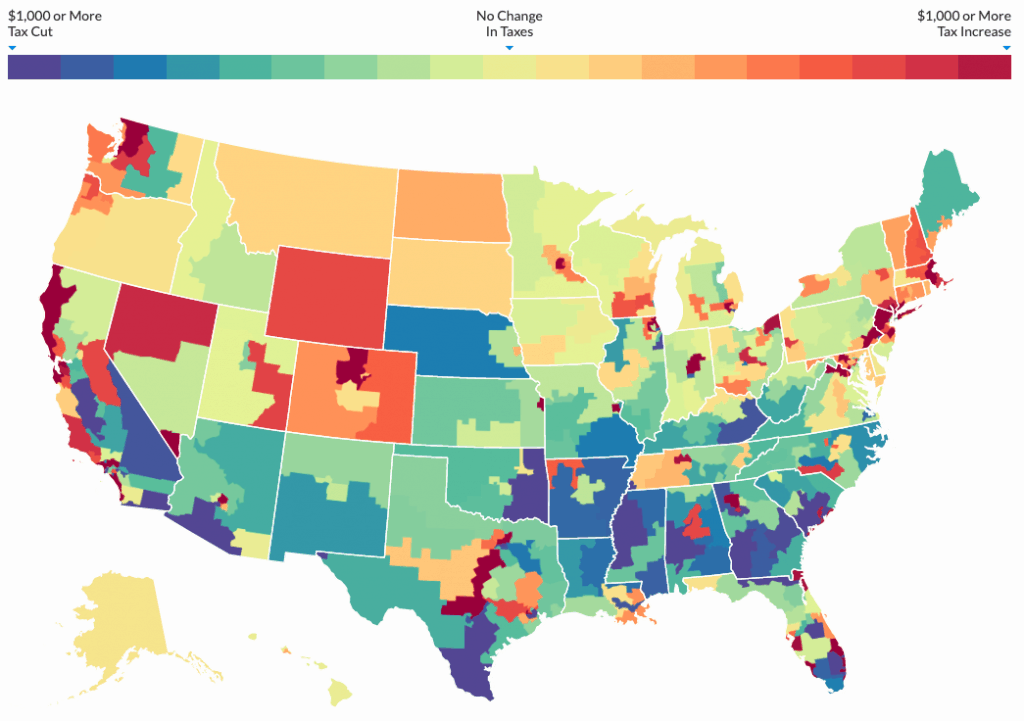

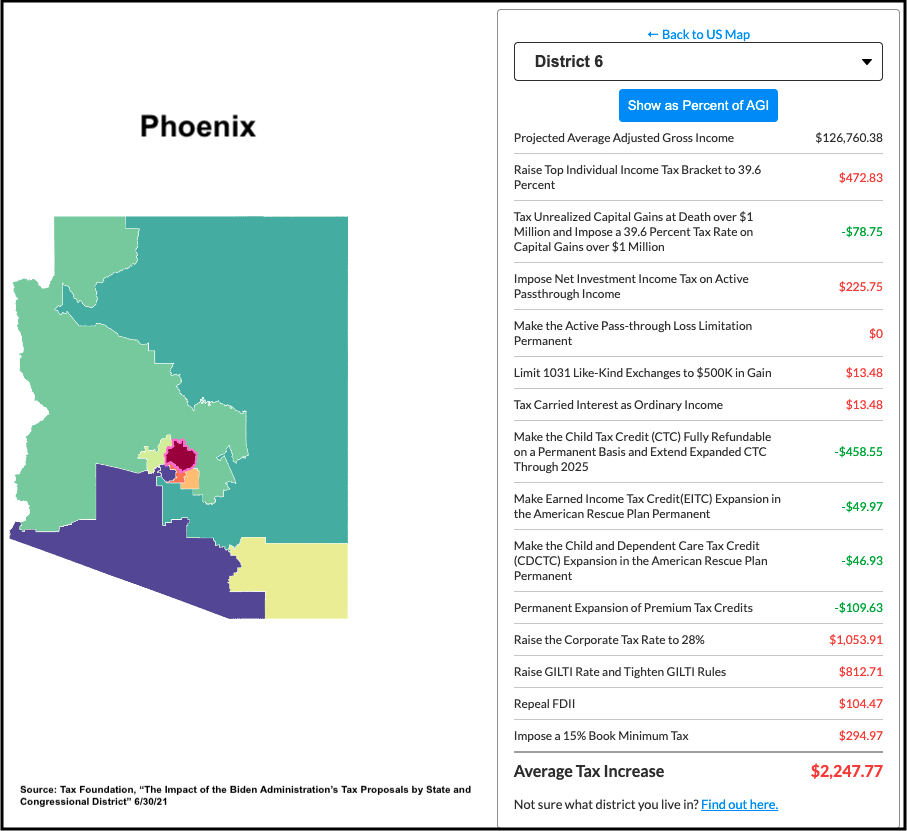

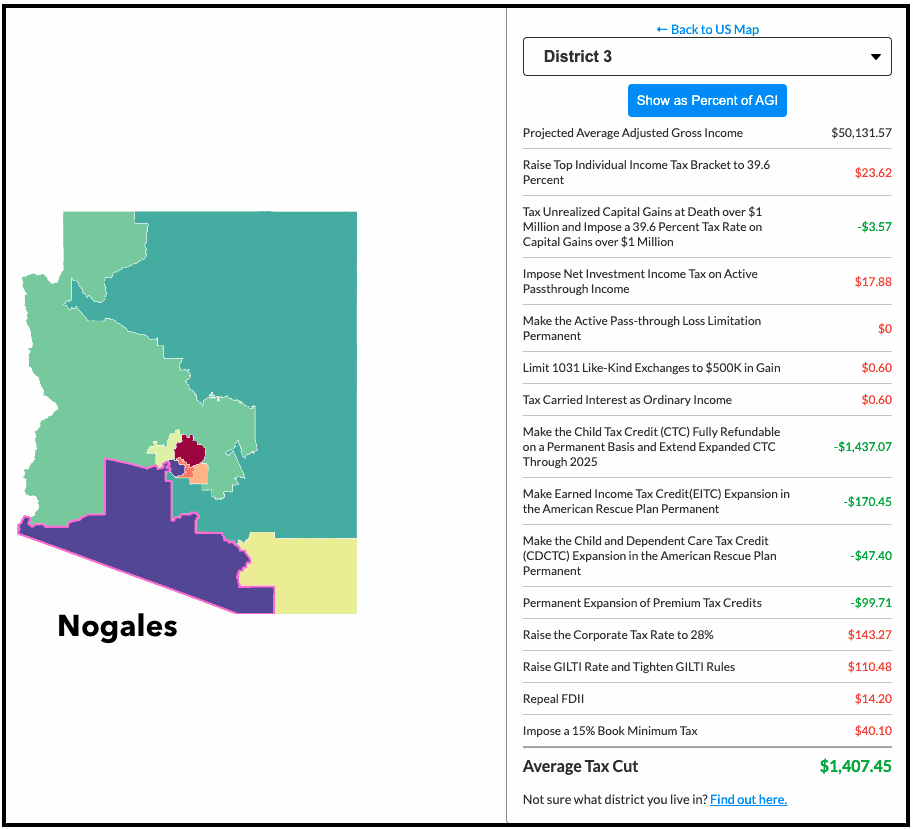

The Biden administration has proposed $2.3 trillion in new taxes in its 2022 budget essentially undoing the significant tax cuts implemented by the 2017 Tax Cuts and Jobs Act. Under Biden's proposal taxes will increase for the 40% of taxpayers that paid income taxes in 2020 in roughly 96% of congressional districts. Residents of the District of Columbia, Massachusetts, Connecticut and New York will experience the largest average tax increases - $1,000 in 2022 alone. Taxpayers with kids living in Mississippi, Alabama, and Oklahoma should expect a tax cut of over $400 in 2022. However, by 2025 (after the next Presidential election) taxpaying residents of every state and the District of Columbia will see a tax increase.

Whether or not your taxes will increase depends on several factors 1) income source, self-employed or W-2 employee 2) the number of qualifying children you have, and 3) the state and congressional district you reside. Click HERE to to use the Tax Foundation interactive map to project tax changes by your state and district.

Arizona taxpayers residing in District 6 (Phoenix) on average earn $126,760 and can expect their taxes to increase $2,247.77. For comparison District 3 (Nogales) residents on average earn only $50,131 and will receive a significant tax cut of $1,407. In fact, the largest tax cuts on average per filer are in majority-Hispanic districts in California, Texas, and Arizona, with tax cuts exceeding $1,500 per filer in 2022. However, this is not a result of carve-out legislation but primarily to the expanded Child Tax Credit, Hispanic population density and predominance of the nuclear, Roman Catholic family in Hispanic culture.1

The 2017 TCJA cut taxes for the majority of Americans. Unfortunately, President Biden believes the 40% of Americans that paid income taxes in 2020 are not paying enough and has proposed $2.3 trillion in new taxes. Whether your income taxes will increase can be projected based your state of residence and congressional district.

The Per Diem Plus® is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

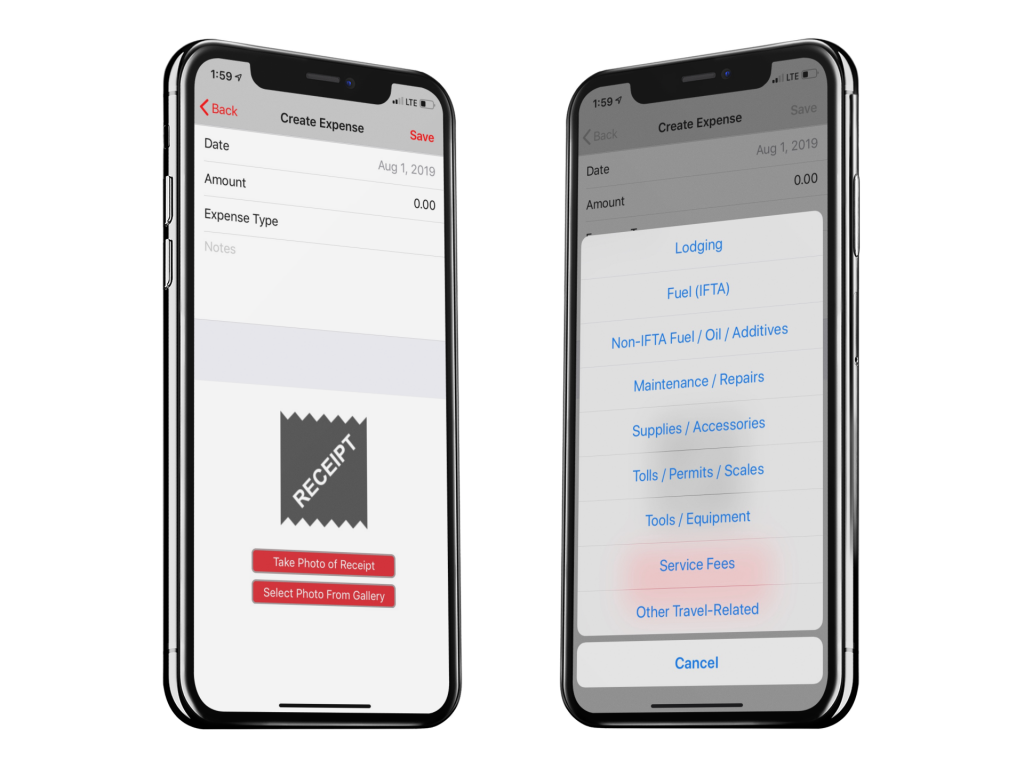

Per Diem Plus was designed by tax pro's to make trucker expense tracking easy! Follow these simple steps to record your first expense:

Tip 1: Receipts images are stored on the PDP cloud servers for 4 years

Tip 2: You can delete receipt photos after saving an expense to free up memory / storage on your device.

Have a tax question? Request a free consultation HERE with Mark W. Sullivan, EA

Still have questions? Support@perdiemplus.com or (314) 488) 1919