PDP For Fleets - 3 Months Free

The 10% ownership - related party rule and per diem creates much confusion. Under the related party rule an Owner-Operator can claim substantiated per diem even if they are the sole owner of the trucking company. However, the related-party restriction imposed by the IRS is frequently misunderstood by both drivers and tax practitioners alike. Based on the foregoing it does not apply to the trucking industry.

Section 4.01 Per diem allowance:

Section 4.04 applies to:

Section 6.07 applies to:

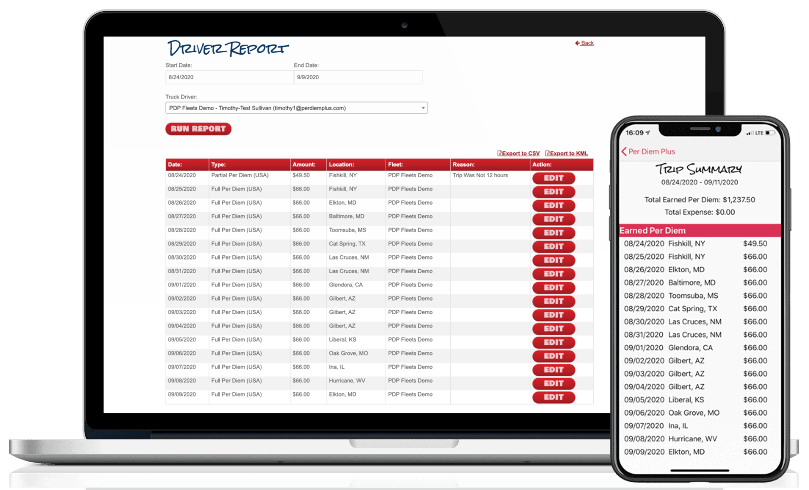

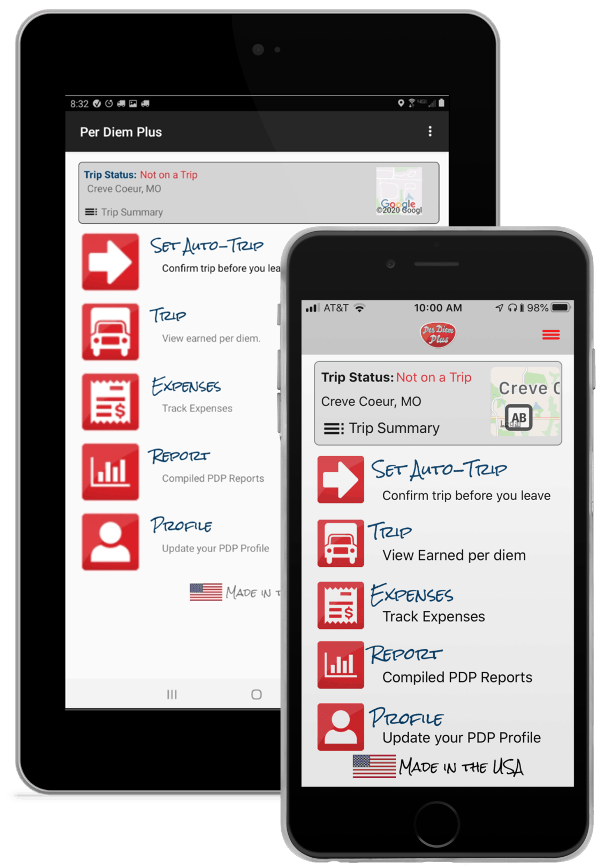

Available as a $7.99 monthly subscription on Google Play and App Store.

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

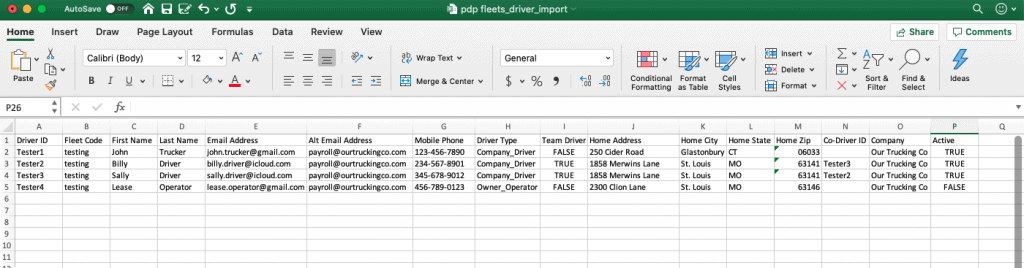

Importing your truck drivers into the Per Diem Plus FLEETS mobile application platform is the final implementation step. Retain a copy of the Driver Import CSV Form, which can be continously update by a customer to:

Driver Import CSV Format Notes

Questions? Contact Us

About Per Diem Plus

The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet trucker per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators.

Copyright 2020 Per Diem Plus, LLC

For Immediate Release

ST. LOUIS, MO — In these trying times, we at Per Diem Plus realize that it can be hard to concentrate on the business of running your business. Still, for many of us—we got into this business to have a positive impact—on our own lives, our families, and our communities at large. That’s why Per Diem Plus remains committed to you and your trucking business in these difficult times and pledge to you to do the best that we can to support you and your fleet throughout this emerging situation.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

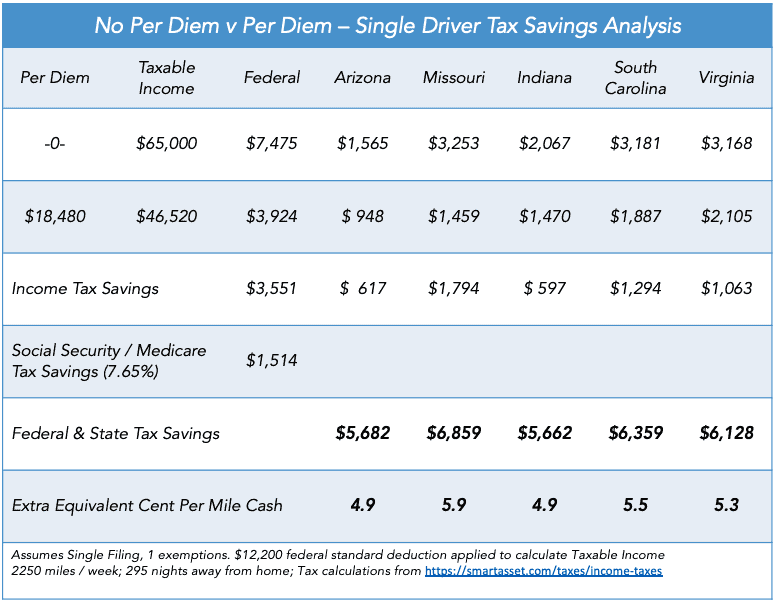

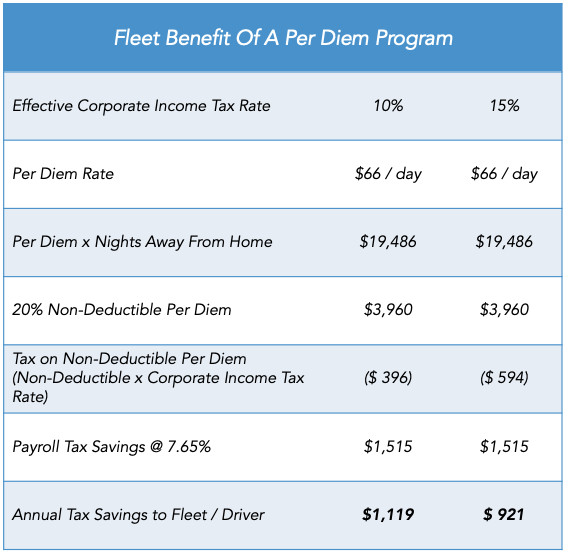

In response to the COVID-19 outbreak, Per Diem Plus is waiving the enrollment and user fees for 3 months for trucking companies that implement a per diem program using the Per Diem Plus FLEETS trucker per diem mobile application platform. Adding an accountable, substantiated per diem program for employee drivers is a sure-fire way for a motor carrier to save money, while also raising driver take home pay. Consider the following:

Our cloud-based platform enables motor carriers to implement an IRS-compliant fleet per diem plan that will save a motor carrier money that is:

One fleet with 85 company drivers was able to save $255,000 in the first year and increase driver pay by $0.04 per mile by leveraging FLEETS.

“Everyone at Per Diem Plus is just happy to do something for the trucking companies and drivers, for without trucks America cannot recover from this event” said Donna Sullivan, CPA, CEO of Per Diem Plus.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

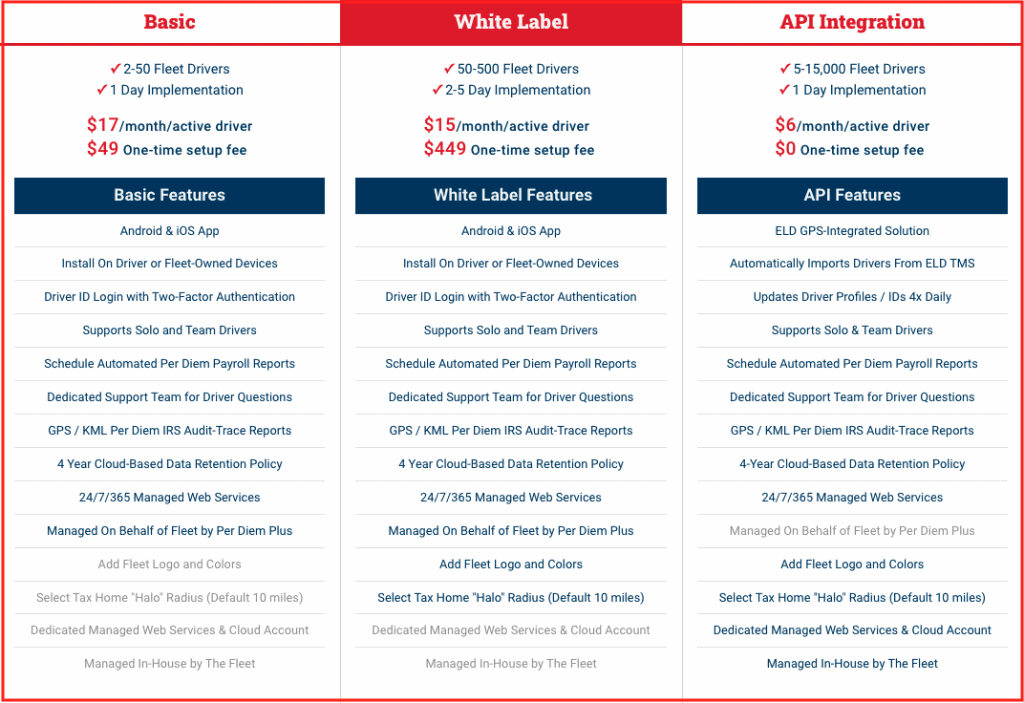

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

About Per Diem Plus

The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet trucker per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators.

For more information email donnas@perdiemplus.com or visit perdiemplus.com/for-fleets

[1] The Special Trucker Per Diem rate is established by the Internal Revenue Service in an annual notice. See IRS Notice 2019-55

* Offer expires July 1, 2020. New customers only; Unlimited number of drivers. Excludes Premium Setup Fee.

Per Diem Plus® FLEETS introduces new service plan options: BASIC, WHITE LABEL and API.

Our cloud-based Per Diem Plus Fleets platform enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

2021 TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

"We were able to buy three new trucks for our fleet with the savings we achieved by implementing a per diem program for our company drivers using the Per Diem Plus FLEETS platform." said Nick Adamczyk, Controller at Reliable Carriers.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

A trucking company is required to prove 1) drivers were away from home overnight 2) identify the “date, place and amount” of each per diem event, and 3) retain substantiation through the retention of ELD backups or Per Diem Plus FLEETS platform for no less than 3 years.

The burdensome IRS compliance requirements are one reason trucking companies eschew company-paid per diem programs. Although, ELD’s automate driver hours of service compliance, the process of creating an IRS-compliant per diem record is immensely time consuming. Fleets that implement the Per Diem Plus FLEETS platform can obtain IRS-compliant fleet per diem payroll reports for a week, month or even a year in under a minute. Furthermore, per diem records are retained on the secure cloud and instantly accessible to a fleet for four (4) years.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Do you have questions about Per Diem Plus FLEETS? Contact Us

Copyright 2020, 2021, 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

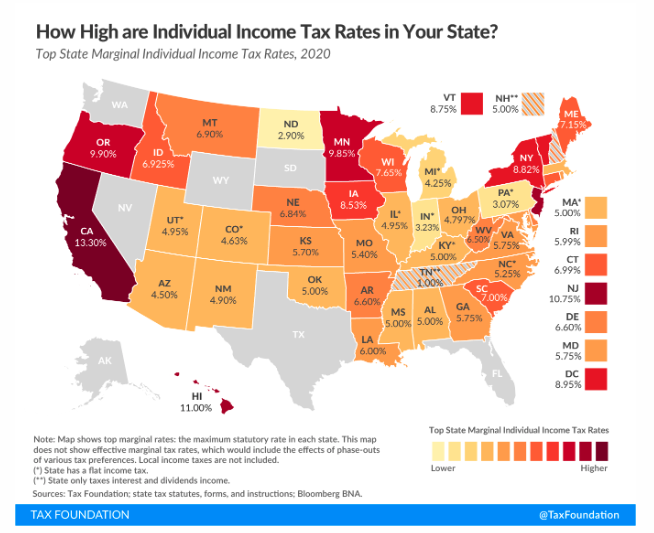

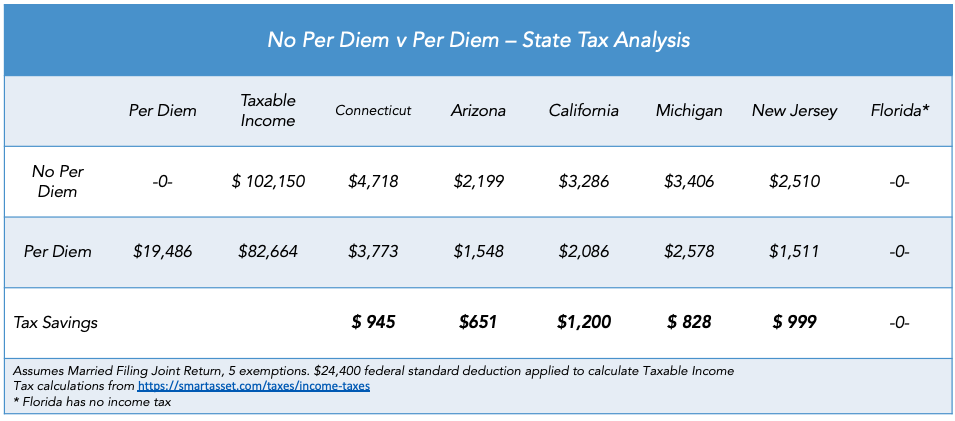

No per diem tax analysis would be complete without addressing the state income tax considerations on driver per diem. In our last blog post, No Driver Per Diem Yields Surprise Tax Bill, we showed you an example of a driver not receiving per diem. In this article, we will show you the negative impact of living in a high-tax state.

Johnny Mills is an over-the-road company driver

Since, Johnny elected not to enroll in the employer plan when he joined the company, he paid an extra $7,064 in federal income and payroll taxes. But how much extra state income tax did he pay? Would it make financial sense for him to move his family and transfer to one of the company's other terminals, like nearby Arizona?

No discussion on the benefits of per diem for truck drivers would be complete without considering state income taxes. State income taxes substantially impact a driver's overall income tax burden. Drivers in high-tax states like California, Connecticut or New York should consider the state tax savings of per diem. These savings are even more pronounced when compared to low-tax states like Arizona.

State Tax Savings: Enrolling in the company per diem plan would have saved Johnny $ 945 in Connecticut income tax for 2019.

State vs State Analysis: A Connecticut driver paid $4,718 of state income tax in 2019. An identical Arizona-based driver paid only $2,199 - a $2,519 difference.

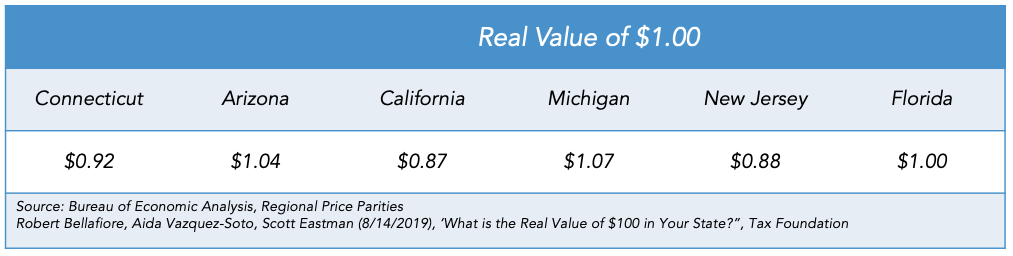

The real value of a dollar (purchasing value) must be taken into consideration in order to make state-to-state comparisons. For example, $1.00 is only worth $0.92 cents in Connecticut but $1.04 in Arizona - a 11.5% difference.

No per diem tax analysis would be complete without addressing the state income tax considerations on driver per diem. Johnny Mills received an unpleasant surprise this tax season because he did not participate in his employer offered per diem plan - an additional $7,064 of federal and $ 945 in state income taxes. Living in high-cost, high-tax Connecticut further reduced the value of his earnings by over $11,136. However, if Johnny enrolls in the company per diem plan and moves his family to a low-cost, low-tax state like Arizona it would generate about $16,198 in real dollar value.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Reference:

https://taxfoundation.org/real-value-100-state-2019/

https://taxfoundation.org/state-individual-income-tax-rates-and-brackets-for-2020/

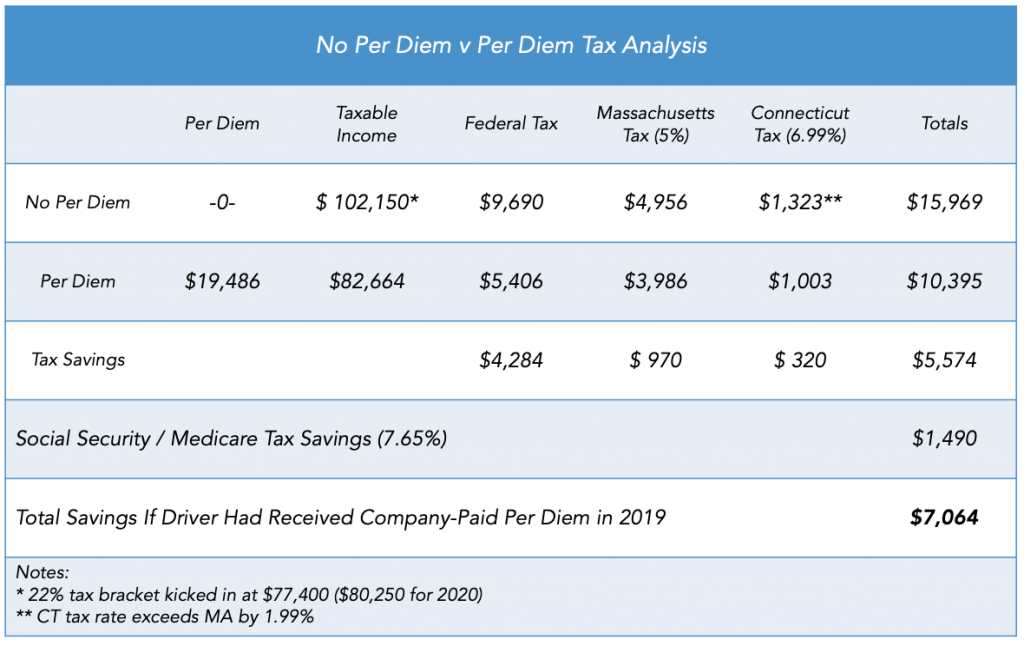

Billy is an over-the-road company driver who lives in a high-tax state with his wife and 3 children. His previous employer administered their plan through Per Diem Plus FLEETS. Unfortunately, his new company doesn't offer per diem. He understood per diem saves a driver significant taxes and worried his tax refund would be much smaller.

After quickly assembling his tax records for his accountant he received an unwelcome surprise:

The table highlights the federal and state tax consequence of Billy's employer not having a driver per diem program.

Billy received an unpleasant surprise this tax season because his employer did not offer per diem

Why does Billy's employer not have a per diem program? Like many trucking companies they incorrectly assume that a company-sponsored per diem program will cost them money. In fact, the table below shows the tax due on the 20% non-deductible portion of per diem is offset by the payroll tax savings. In addition, a CASE STUDY demonstrated a trucking company saved $3,000 per driver by imlementing the Per Diem Plus FLEETS. Billy's employer would actually have saved over a thousand dollars in taxes per driver.

Fleets that adopt the Per Diem Plus FLEETS mobile platform will not only enhance driver retention and recruiting, but save many thousands of dollars in the process.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. Furthrmore, it is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

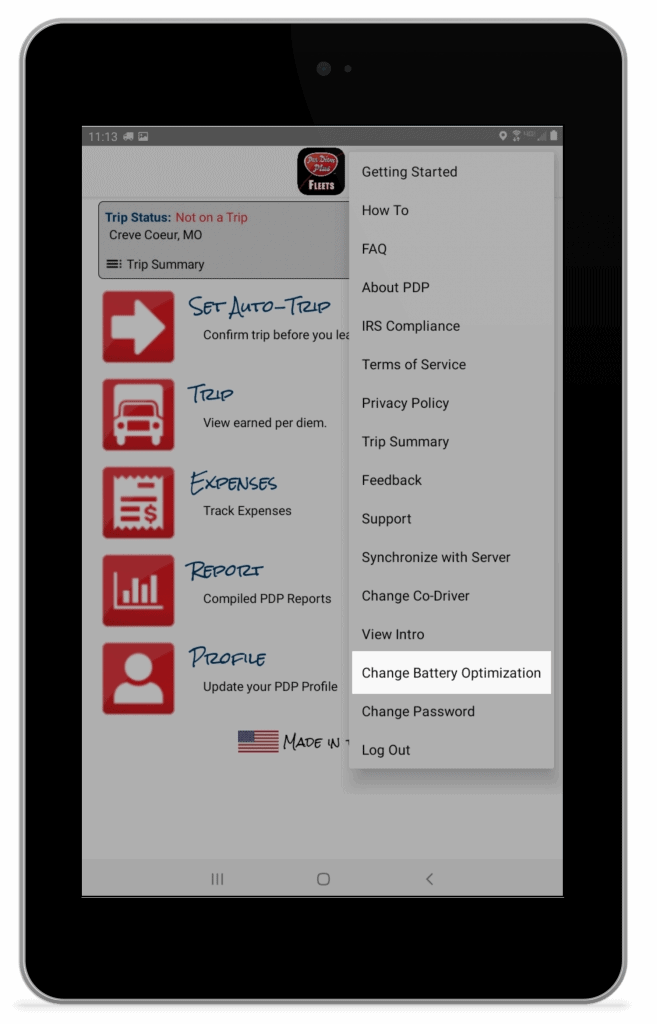

Here is how you fix battery optimization issues when you update to Android 9. It came to our attention that updating a device to Android 9 may automatically optimize the battery settings. Unfortunately, the optimized battery setting prevents the Per Diem Plus FLEETS and Per Diem Plus - Owner Operators app from waking up to establish location.

Follow these steps to adjust the battery optimization setting for Per Diem Plus Fleets on your Android device:

Follow these steps to adjust the battery optimization setting Per Diem Plus - Owner Operators on your Android device:

This setting prevents Android from blocking the app from tracking per diem trips.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

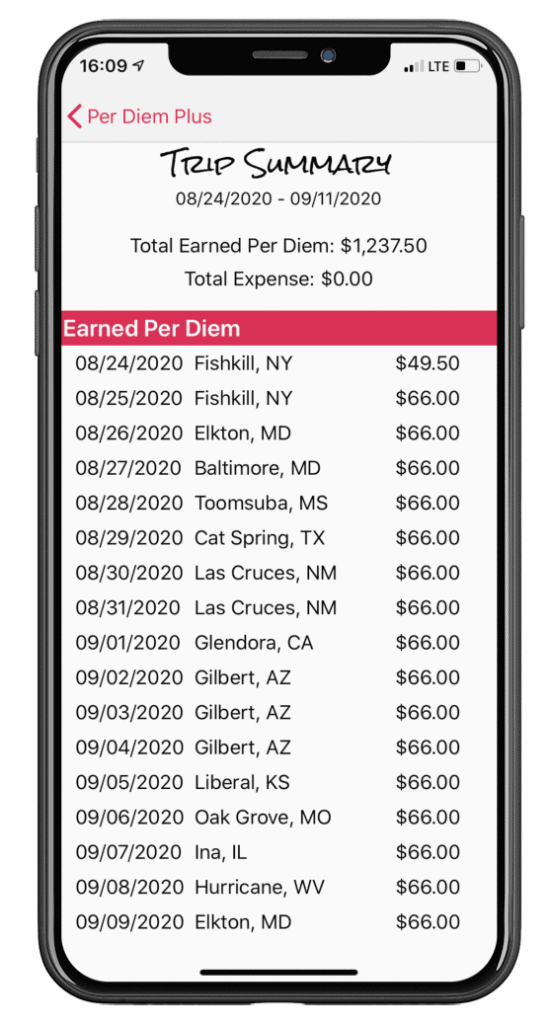

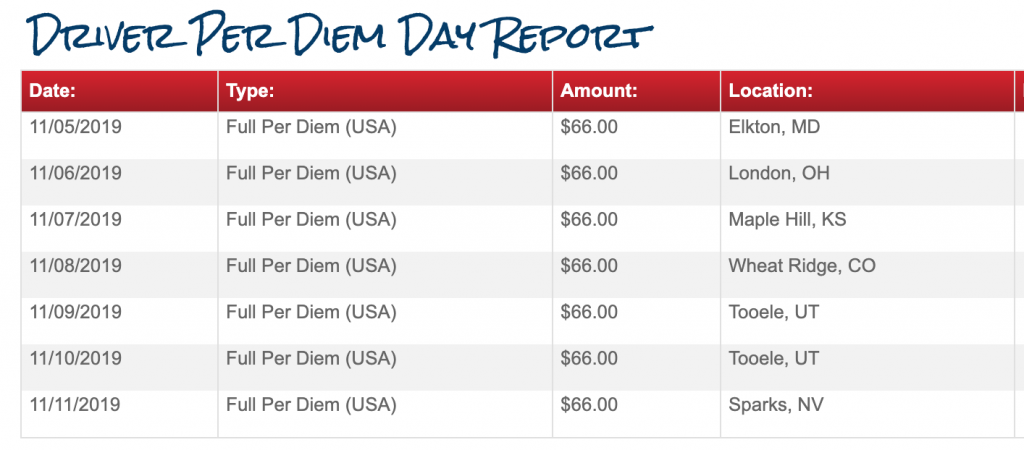

The 2020 trucker per diem rates & tax brackets for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

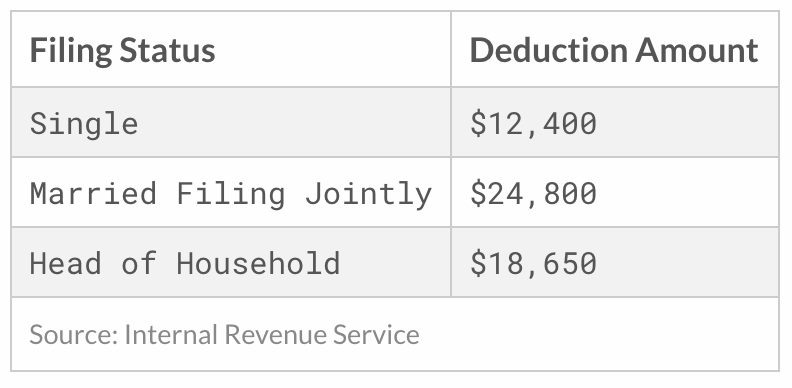

The standard deduction for single filers will increase by $200, and by $400 for married couples filing jointly.

The personal exemption for 2020 remains eliminated.

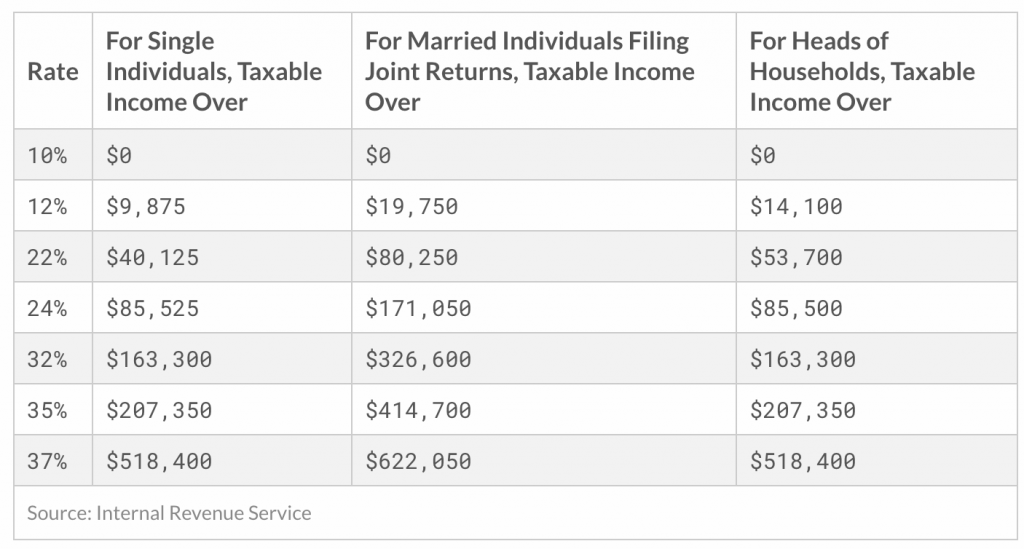

In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly.

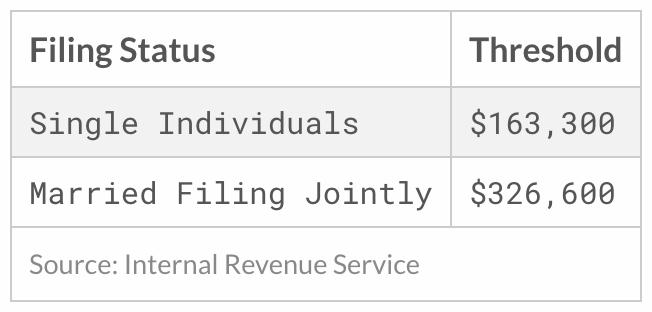

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to $163,300 of qualified business income for single taxpayers and $326,600 for married taxpayers filing jointly.

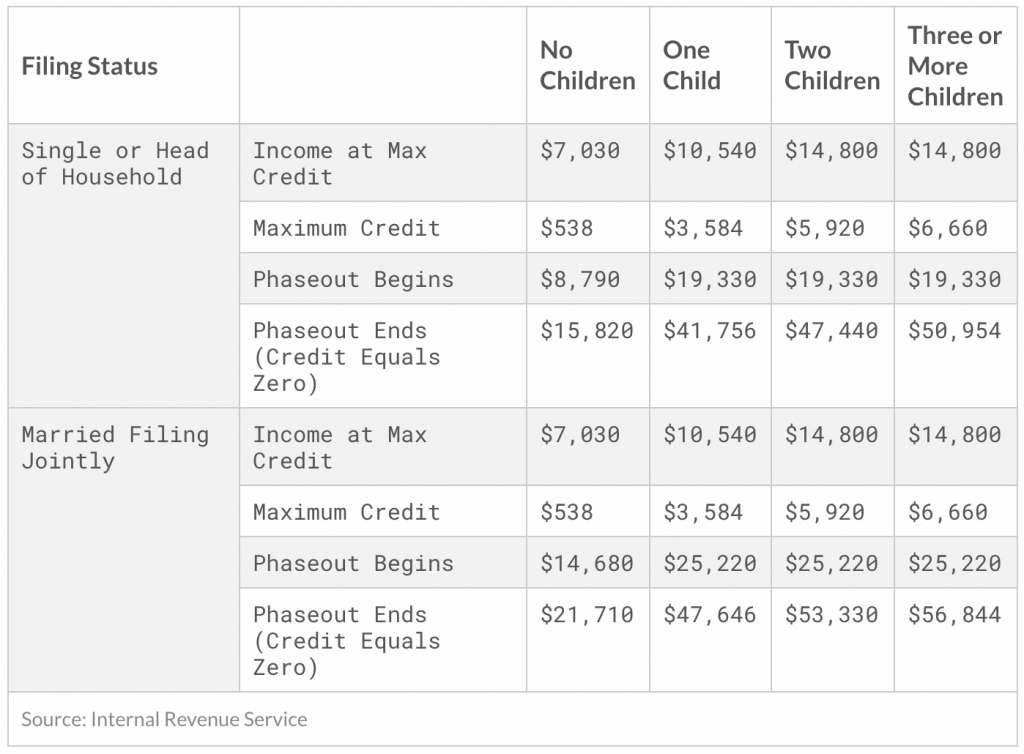

The maximum Earned Income Tax Credit in 2020 for single and joint filers is $538, if there are no children. The maximum credit is $3,584 for one child, $5,920 for two children, and $6,660 for three or more children. All these are relatively small increases from 2019.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2019-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Internal Revenue Service, “Revenue Proc. 2019-44,” https://www.irs.gov/pub/irs-drop/rp-19-44.pdf.

No. The treatment of per diem as a portion of an employee’s wages is not considered an improper “wage reclassification”. The IRS first introduced per day allowances in Revenue Procedure 90-60 as a simplified method of substantiating employee business expenses. However, the first published guidance for the transportation industry was TAM 9146003 issued in 1991. According to the IRS:

The Special Transportation Industry substantiated method was introduced in 2000 to ease the burden on taxpayers, who would otherwise have to meet the extensive substantiation requirements in order to claim deductions for business related travel [See Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48], which among other things:

The Internal Revenue Code gives the IRS Commissioner discretionary authority to issue regulations, such as revenue rulings and procedures. The Revenue Procedures and Notices are updated annually and the relevant per diem provisions have remained substantially the same since 2011 [See Rev. Proc. 2011-47 ].

Biden's IRS Is Coming For Your PayPal & Venmo Payments

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

A substantiated per diem program reimburses drivers a fixed amount per day (i.e. $66) in place of a rate per mile for travel away from home. As a result, it eliminates the need for drivers to turn in receipts for actual meals and incidental expenses. Most importantly, it reduces a fleets administratives burden while providing additional cash to drivers on a pre-tax basis. However, companies must have an accountable plan to qualify, which would include these requirements [See KMS Transport Advisors (NAFC March 2019 newsletter]:

Well-known motor carriers that utilize the substantiated method include Averitt Express, EPES Transport System, TMC Transportation, G&P Trucking, Transport America and Big G Express, Danny Herman Trucking and Oakley Transport.

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event meet the IRS substantiation requirements.

Thirty years of IRS guidance and legislative history specifically reference an employer paying a driver in the transportation industry under the substantiated method and, therefore, contemplate that some portion of a driver’s wages will be treated as per diem. While, both the substantiated and cent-per-mile per diem methods are IRS-compliant, neither method has been considered an improper wage reclassification for over 30 years. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS. Additional information can be found at IRS.gov

[i] The 2019 per diem rate for travel in the USA is $66 and $49.50 for a partial day.

ii] The raised the deductible percentage of employee travel related expenses to 80% in 2008

iii] Federal Register-1989-12-12 Vol 54 Page 51038 pursuant to “Family Support Act of 1988”

[iv] Rev. Ruling 2006-56, 2006-2 CB 274

[i] Updated annually IRS Notice 2019-55, 2018-77, 2017-54, 2016-58, 2015-63, 2014-57, 2013-65, 2012-63, Rev. Proc. 2011-47, 2010-39, 2009-47, 2008-59, 2007-63, 2006-41, 2005-67, 2004-60, 2003-80, 2002-63 and 2001-47.

The 2019-2020 special trucker per diem rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

This annual notice provides the 2019-2020 special per diem rates for taxpayers to use in substantiating the amount of ordinary and necessary business expenses incurred while traveling away from home, specifically (1) the special transportation industry meal and incidental expenses (M&IE) rates.

Information on the 2020-2021 per diem rates can be found HERE

BACKGROUND

Rev. Proc. 2011-47, 2011-42 I.R.B. 520 (or successor), provides rules for using a per diem rate to substantiate, under § 274(d) of the Internal Revenue Code and § 1.274-5 of the Income Tax Regulations, the amount of ordinary and necessary business expenses paid or incurred while traveling away from home.

The special M&IE rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

Are you unsure what per diem is or which drivers can claim travel-related expenses? Our tax experts answer the most common question in a prior post, Trucker Per Diem Simply Explained

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.