PDP For Fleets - 3 Months Free

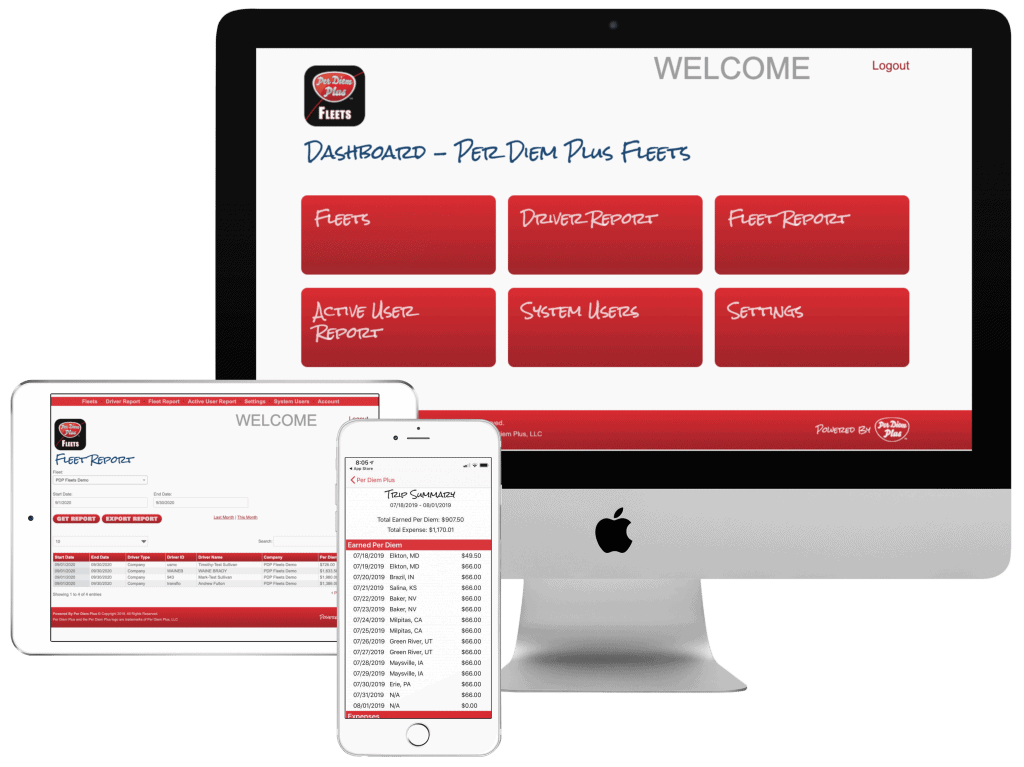

Help us test and develop features and functionality of our integration with Per Diem Plus Fleets for Motive (Keeptruckin) beta. Per Diem Plus® Fleets API is a configurable, ELD-integrated enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleet managers.

Truckers designed. Tax pros built it. Your drivers want it. It takes only minutes to start up an IRS-compliant per diem plan with Per Diem Plus Fleets for Motive (Keeptruckin).

Take a deep dive into the benefits of offering per diem, for both your company and drivers.

Benefits:

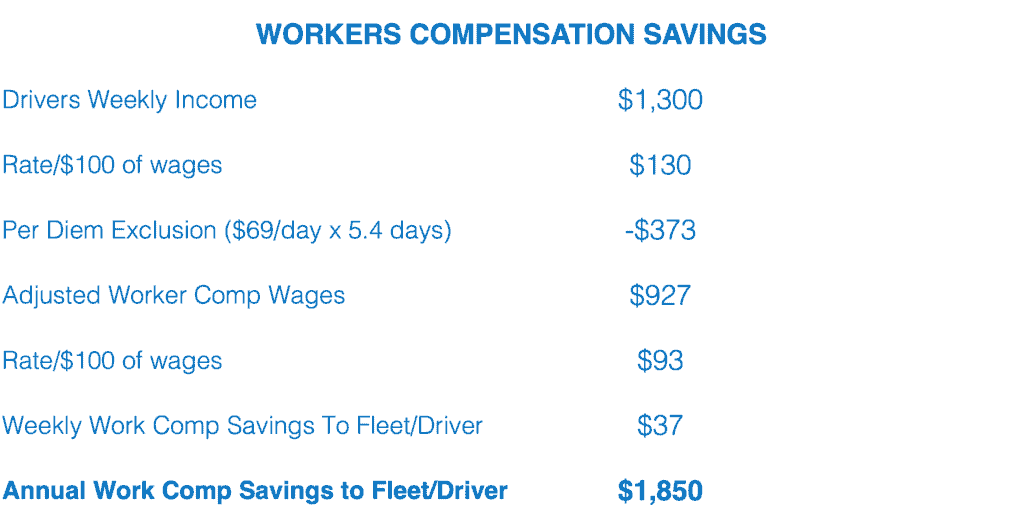

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility per diem will not save a motor carrier money. The below tables prove otherwise.

The following analysis assumes 2,500 average weekly miles / driver; $69 per diem; $75,000 annual driver wages; 255 nights away from home; a 12% effective federal income tax rate, and $10/$100 workers' comp rate.

Motive builds technology to improve the safety, productivity, and profitability of businesses that power the physical economy. The Motive Automated Operations Platform combines IoT hardware with AI-powered applications to automate vehicle and equipment tracking, driver safety, compliance, maintenance, spend management, and more. Motive serves more than 120,000 businesses, across a wide range of industries including trucking and logistics, construction, oil and gas, food and beverages, field services, agriculture, passenger transit, and delivery. Visit gomotive.com to learn more.

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of individual experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

On Monday, November 21, 2022, Mark W. Sullivan, EA, Tax Counsel for Per Diem Plus hosted a webinar for the American Trucking Association titled, "Unlock Fleet Savings With Per Diem Amid Economic Uncertainty". The following are excerpts from that presentation.

The freight market has experienced steady softening over the past few months while the nationwide average price for a gallon of diesel fuel hovering around $5.36 or about $2.02 more than just one-year ago1. So how can fleets mitigate the exploding cost of fuel and softening freight rates2? Use per diem compliance tech to unlock fleet savings amid economic uncertainty and record inflation.

An automated telematic solution, like Per Diem Plus®, allows motor carriers to rapidly deploy a solution to realize immediate savings, offset pain at the pump and boost driver pay. Additionally, our cloud-based mobile-enabled platform offers flexible Service Plan Options allowing motor carriers to easily implement an IRS-compliant fleet per diem plan that:

“We are seeing increased inflationary pressures throughout the business," U.S. Xpress CEO Eric Fuller said during a May 5 call. "Wages, both office and driver, are increasing [and] new equipment prices, insurance, maintenance, and fuel expenses are all up. Taken together, the cost of doing business is increasing across our industry.”1

FleetOwner, May 23, 2022

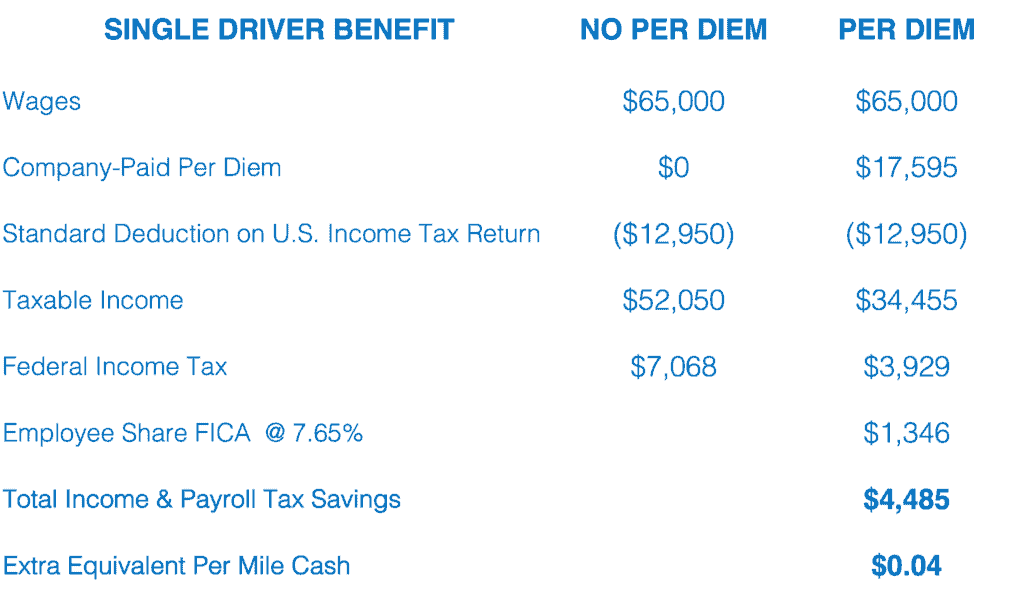

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility per diem will not save a motor carrier money. The below tables prove otherwise.

The following analysis assumes 2,500 average weekly miles / driver; $69 per diem; $65,000 annual driver wages; 255 nights away from home; a 12% effective federal income tax rate, and $10/$100 workers' comp rate.

Twenty-three states are members of the National Council on Compensation Insurance (NCCI), 39 rely on NCCI regulations. Under NCCI rules a motor carrier paying substantiated per diem under an IRS-accountable plan can exclude up to $69/day of per diem from taxable wages, which provides a significant per driver annual savings to a fleet3.

With growing economic uncertainty and recessionary clouds on the horizon it is not known if Congress will extend the 100% deduction for per diem. However, a motor carrier that implements Per Diem Plus will be in a stronger position to weather the economic storm.

As of January 1, 2018, employee drivers can no longer claim per diem as an itemized deduction on their federal income tax return. However, motor carriers can offer per diem to employee drivers to recapture the lost tax savings. The average Married over-the-road driver earning $65,000 annually will save approximately $3,457 in federal income taxes equivalent to $0.03 cents per mile.

The average Single over-the-road driver earning $65,000 annually will save approximately $4,485 in federal income taxes equivalent to $0.04 cents per mile.

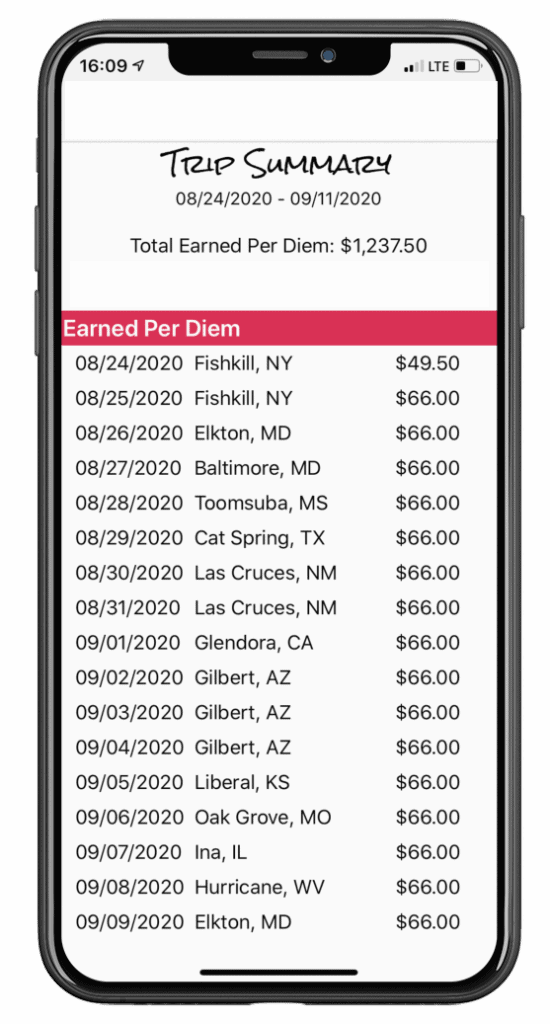

GPS-Based Tracking: Per Diem Plus® utilizes telematics to establish IRS-required “time, date and place” substantiation to prove away-from-home travel.

Proven: Drivers have logged millions of miles using Per Diem Plus! Join those that value their time, love to eliminate inefficient paperwork, and want to simplify tax compliance and save money.

Easy Setup: Our IRS-compliant cloud-based ELD-integrated platform and mobile app solutions allow for rapid deployment with minimal investment in IT resources.

Easy to Use: Web services interface that allows non-technical users to manage individual and team drivers.

Scalable: Whether 5 or 15,000 trucks, our secure cloud-based platform will meet the growing needs of your fleet.

Data Plan Friendly: An average driver using our mobile app solution will use less than 50MB per month.

Per Diem Plus Fleets is also available on the Samsara App Marketplace and Platform Science Marketplace

For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

1 Kingston, John, "Weekly DOE/EIA diesel price decline is biggest since 2008", Freightwaves, July 25, 2022 LINK

2 Achelpohl, Scott, "Survey points to exodus of small operators - and fuel costs as the culprit", FleetOwner, May 23, 2022 LINK

3 North Carolina allows a $75 exemption for per diem Rule 2-B-2 LINK

SAN DIEGO, CA and CLAYTON, MO, June 7, 2022– Per Diem Plus, the leader in mobile-enabled transportation per diem solutions, and Platform Science, a leading connected vehicle platform, today announced a new collaboration making the Per Diem Plus Fleets mobile app available as part of Platform Science’s industry-leading marketplace of solutions. The Per Diem Plus app enables motor carriers to automate trucker per diem tracking, payroll accounting, administration, and auditing. Platform Science's innovative transportation solutions make it easier for fleets to develop, deploy, and manage mobile devices and applications on commercial vehicles.

“Per Diem Plus adds to our growing number of driver-focused apps that give fleets choice and flexibility, and it represents the type of solution that fleet operators are seeking to increase efficiencies and decrease burdensome tasks for drivers,” said Joe Jumayao, VP of Business Development, Platform Science. “This new collaboration with Per Diem Plus offers fleets another solution to boost productivity and meet compliance requirements. Fleet operators can use this app in conjunction with other tools in the Platform Science catalog, providing the flexibility to tailor their in-cab platform to best fit the fleet’s needs.”

Per Diem Plus utilizes GPS to establish IRS-required “time, date and place” substantiation to prove away-from-home travel for over-the-road truck drivers. It is the only IRS-compliant solution for Special Transportation Industry per diem for solo and team drivers traveling in the USA and Canada.

The benefits of the Per Diem Plus app include:

"The Per Diem Plus for Platform Science was developed in response to growing industry demand to build integrations and is a part of our continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions", said Donna Sullivan, CEO at Per Diem Plus.

About Platform Science

Platform Science is transforming transportation technology by empowering enterprise fleets with a unified, user-friendly technology platform. Platform Science makes it easy to develop, deploy and manage mobile devices and applications on commercial vehicles, giving fleets an edge in efficiency, flexibility, visibility and productivity. The customizable platform delivers an unlimited canvas to fleets and developers seeking to innovate and create new solutions as customers' needs, businesses and industries evolve. Platform Science was named by Fast Company as one of the World’s Most Innovative Companies for 2022. In 2021, Platform Science was ranked #2 in the FreightTech 25 Awards by industry news leader, FreightWaves. For more information, please visit www.platformscience.com

About Per Diem Plus

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets, and their accounting professionals. The Per Diem Plus® Fleets enterprise platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed, and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The ability of Per Diem Plus to calculate 8,892 partial per diem days yielded one customer $460,000 of additional per diem

Beware: How inadequate per diem solutions can rob you of savings. A recent New York Post article acutely observed that the Producer Price Index, the most useful measure of general inflation, was up a whopping 16.3% from April 2021, per the Bureau of Labor Statistics. That means that roughly $1 out of every $6 that people earn has been lost to inflation in a single year. Or to put it another way, 80 minutes’ earnings out of every eight-hour day have been eaten up.1 Motor carriers that figure out how to best navigate sky-high inflation and a shrinking U.S. labor force while recruiting and retaining drivers will have a market advantage over lesser fleets when inflation decreases. The keywords: Recruiting and retention.

Introducing a fleet-sponsored driver per diem program, coupled with temporary 100% deduction for per diem in 2022, will immediately reduce a motor carrier's expenses, enhance recruiting and retention and increase driver take-home pay. Per Diem Plus® customers can implement in minutes our IRS-compliant telematics-based substantiated per diem solution, which automates trucker per diem tracking for solo and teams traveling in the USA and Canada. The Per Diem Plus API and mobile apps include the unique ability to calculate full and qualifying partial per diem days, which can substantially increase the tax savings for both fleets and drivers2.

Analyzing real-world fleet per diem data is the best method for quantifying this exceptional feature to project the financial benefit partial per diem days have for both the fleet and drivers.

Based on an automated weekly fleet per diem report, 129 or 36% of 354 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

A motor carrier that offers a $0.11/mile per diem is evaluating switching to a substantiated per diem program using the free trial of Per Diem Plus for Samsara. Based on an automated weekly beta test fleet report, 30 of 100 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

No matter how big or small your company is, Per Diem Plus has a cost-effective solution for you.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

1 - Glenn H. Reynolds, "Why team Biden might be purposely grinding down the middle class", New York Post, May 26, 2022

2 - IRS Rev. Proc. 2011-47 6.04

3 - IRS Rev. Proc. 2011-47 6.04.2

Copyright 2017-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

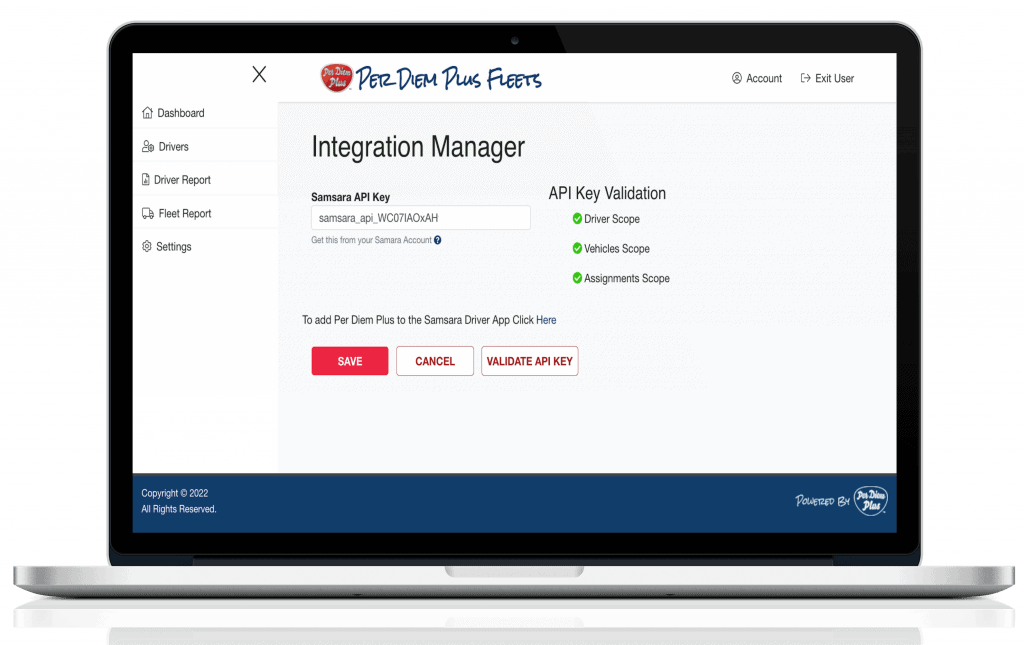

New "Check Configuration" API button added for Samsara. Why is this new feature important? Samsara recently updated their API requirements by incorporating granular scopes to the configuration of integrated solutions, like Per Diem Plus. What was previously a simple 3 step process morphed into 7 specific configuration permissions, which created issues for some motor carriers.

How does the new "Check Configuration" API button added to Samsara work? When an API access token is added to the Integration Manager it will automatically check the API Token configuration.

Our API adapter was developed in response to growing industry demand to build integrations and is a part of PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Per Diem Plus Fleets is available to all fleets on the Samsara App Marketplace.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Patriot Transport selects Per Diem Plus Fleets. The Arkansas-based specialty bulk hauler implemented the Fleets mobile app for Android and iOS to enhance recruiting and retention and raise driver pay for its OTR fleet.

“The Per Diem Plus Fleets implementation was seamless and smooth. Their automated per diem tax compliance solution enabled Patriot staff to avoid the increased administrative burdens commonly associated with traditional trucker per diem programs ”

April Stobbs, HR Manager

Patriot Transport and 3D Corporate Solutions were founded in 2002 as a marketer and logistics provider sourcing specialty, value-added pet food ingredients. Today, they are the leading manufacturer of protein ingredients used to make premium pet food. 3D has earned a reputation as the go-to source for high quality and differentiated ingredients separate themselves from competitors through a portfolio of specialty proteins, specialty flavors, and premium and specialty fats. They operate six manufacturing facilities across the Midwest and Southeast, each with world-class manufacturing capabilities.

The driver per diem program was introduced in 2021. In order to distinguish itself in the industry Patriot adopted a per diem program that does not reclassify a portion of wages as per diem, which has been standard industry practice for over 30 years.

According to April Stobbs, HR Manager at Patriot Transport, “Drivers rave about the $12,750 or so of tax-free per diem they receive annually that has resulted in 100% participation of qualifying drivers. This especially true of veteran drivers who previously received per diem at other motor carriers that utilized the traditional trucker per diem methods. Meanwhile the feedback from drivers about the Per Diem Plus Support team can be summed up as simply amazing.”

“Per Diem Plus has multiple per diem solutions regardless of what ELD you use to track Hours of Service, like their mobile app and API, while others offer a single solution with one partner. This was a significant factor in our choosing Per Diem Plus as it allows Patriot flexibility to switch ELD solution providers without affecting our per diem program should the need arise. They have a great team and allow you to have a trusted partner to handle all your per diems needs” said Stobbs.

Apply at patriottransport.com or Contact April Stobbs at (417) 354-0509 or astobbs@3dsolutions.com

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact us at info@perdiemplus.com

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of transportation industry tax compliance. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA. It is the only IRS-compliant mobile-enabled application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Mido's Trucking selects Per Diem Plus for Samsara. The St. Louis-based truckload carrier is using Per Diem Plus to further streamline operational efficiency and per diem accounting of its 100-vehicle fleet.

“America is truly the land of opportunity. I am living proof that if you dream big, work hard and persevere anything is possible.”

- Mido Selimovic, President

Mido Selimovic came to the US in 1999 as an 18-year-old refugee from Vlasenica, Bosnia-Herzegovina where his family struggled to stay alive in a country destroyed by the Bosnian War. At age 25 Mido entered the transportation industry by purchasing his first truck. In 2008, he opened Mido's Trucking with his sole purpose being to provide a workplace for fellow war refugees who were looking for a reliable carrier they could work for and call their home. Since starting Mido’s 15 years ago the company has grown to 100 trucks serving 48 states with the help of his wife Azra, a fellow refugee who fled Kozarska-Dubic at the outset of the war when she was 12.

As with many small businesses in America, Mido’s is a family affair with many relatives working for the company as drivers, dispatchers and mechanics. Mido’s mission as refugee haven remains unchanged to this day; they employ drivers from Africa, Asia, Bulgaria, Eastern Europe and Thailand looking for an opportunity to make a fresh start in the USA.

The Per Diem Plus API for Samsara allows for rapid deployment with minimal investment in dollars and/or IT resources. Configure your fleet in three simple steps.

Are you attending TCA Truckload 2022 in Las Vegas (March 20-22) and want to learn more about the PDP Fleets integration with Samsara? Schedule a meeting with Mark Sullivan, API Manager HERE

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Arka Express selects Per Diem Plus for Samsara to raise driver pay and enhance operational efficiency for its 400-vehicle "first in excellence" fleet.

“The API was quick and easy to set up and run, which was a significant factor in our choosing Per Diem Plus for Samsara.”

Art Astrauskas, President

Arka Express has evolved from a small 35-unit carrier located out of Markham, IL, to an elite, state-of-the-art fleet of 400 units built by the top transportation professionals in the industry in only 10 years.

In addition to our Markham terminal, they are currently establishing headquarters in Indiana, Atlanta, Georgia and Marlboro Township, New Jersey as they continue to deliver services throughout the Midwest, east coast and Southeast. Drivers typically operate in a 400-mile regional radius in both Chicago and Atlanta. In addition, they have developed an OTR presence from the Dakotas to Florida to New York—and everything in between.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Intercity Lines case study highlights how the specialized automotive transporter improved safety and operational efficiency of its 30-vehicle fleet using Samsara ELD and Per Diem Plus.

"The Per Diem Plus integration was a significant factor in our choosing Samsara over competing ELD solution providers."

Dean Wilson, Vice President

Dave and Linda opened Intercity Lines, Inc. more than 40 years ago, setting out to provide excellence in enclosed automotive transportation. As a driver himself, Dave took great pride in the trust customers gave him when transporting what could be their most prized possession—their classic, historic, or exotic vehicles. Together, Dave and Linda brought attention to detail, dedication, and innovation to the enclosed automotive transportation industry.

Improve safety and operational efficiency for the specialized automotive transporter and its 30-vehicle fleet using Samsara’s complete fleet platform. Intercity deployed VG-series gateways, CM-series dash cams, Galaxy tablets, fuel, maintenance and per diem program. According to Dean Wilson, VP of Intercity Lines, “Per Diem Plus integrating directly into Samsara TMS was a significant factor in our choosing Samsara over competing ELD solution providers. The API was quick and easy to set up and run; it was a no-brainer. ”

“Per Diem Plus has a per diem solution regardless of what you use to track Hours of Service, while others offer limited solutions with limited partners,” said Wilson. Jay Leno's favorite auto transport company is transitioning to the API from the PDP Fleets mobile app. Wilson cited the modern and intuitive web services dashboard, flexible report formats and ability to track per diem in the event the ELD goes down that distinguish Per Diem Plus. “Since introducing our driver per diem program in 2020 Intercity has achieved 85% driver participation, cut driver turnover to 10%, and saved over $3,000 per driver annually that was used to raise driver pay by several cents per mile. PDP’s customer service is top-notch, allowing you to have a trusted partner to handle all your per diems needs. And we prefer the features and benefits of PDP offers,” he said.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus, the leader in mobile-enabled transportation per diem solutions, today announced the release of the Per Diem Plus Fleets application programming interface (API) integration for Samsara, the pioneer of the Connected Operations Cloud. Now, Per Diem Plus Fleets will be available to all fleets on the Samsara App Marketplace.

The Per Diem Plus Fleets API adapter was developed in response to growing industry demand to build integrations and is a part of PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Per Diem Plus completed months of beta testing in December with several motor carriers, including Intercity Lines. Jay Leno's favorite auto transport company is transitioning from the PDP Fleets mobile app to the API. "Setting up the API could not have been easier. It took us less than 5 minutes to configure the PDP Fleets API with our Samsara account," said Dean Wilson, Vice President at Intercity Lines. "Since introducing our driver per diem program in 2020 Intercity has achieved 85% driver participation, cut driver turnover by 10%, and saved over $3,000 per driver annually that was used to raise driver pay by several cents per mile," said Wilson.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®