PDP For Fleets - 3 Months Free

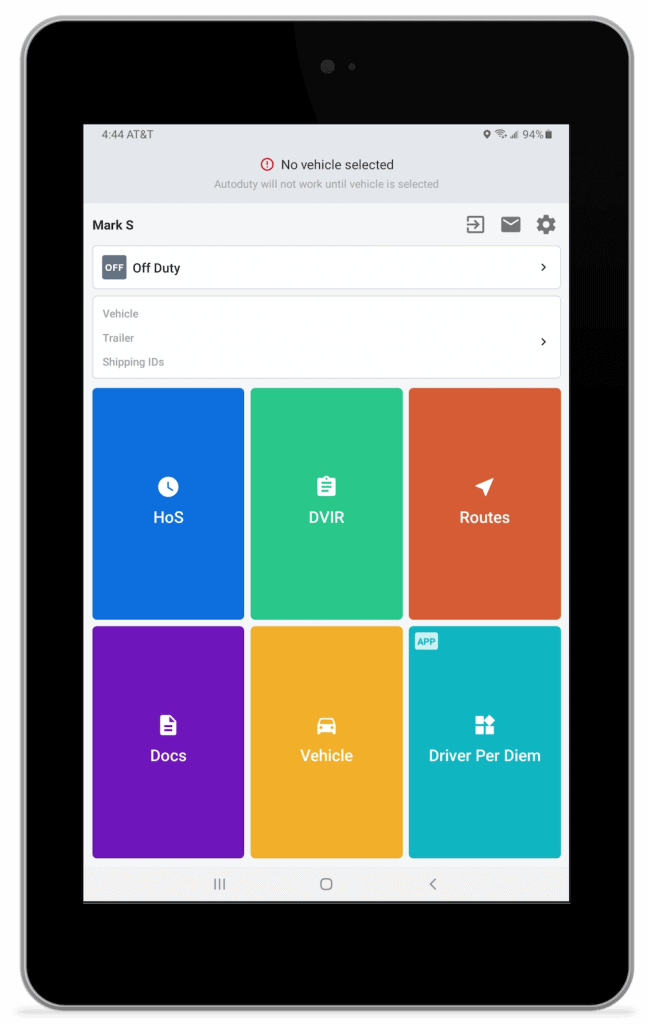

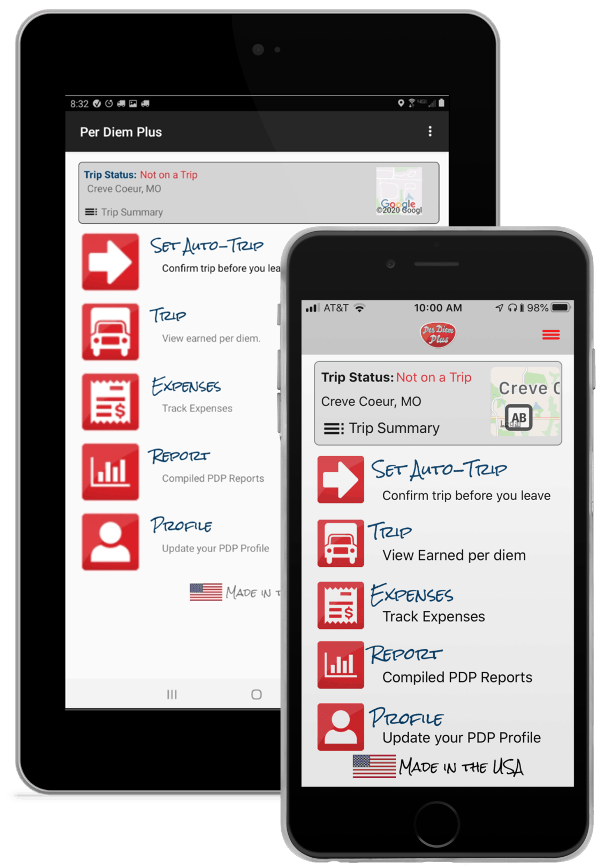

Per Diem Plus® FLEETS, a mobile application platform that automates per diem tax compliance for motor carriers, today announced a new integration with Samsara. The deep link is a configurable integration that enables drivers to navigate between the Samsara ELD dashboard and Per Diem Plus FLEETS app creating an enhanced user experience.

Related Articles

Per Diem Plus Announces New API Integration With Samsara

With over $40 million of per diem claimed and 5 years of reports accepted by the IRS, adding an accountable, substantiated per diem program is a sure-fire way for a motor carrier to increase driver take home pay and save money.

Consider the following:

Our cloud-based platform enables motor carriers to implement an IRS-compliant fleet per diem plan that is:

Case Study: One fleet with 85 company drivers was able to save $255,000 in the first year and increase driver pay by $0.04 per mile by leveraging FLEETS.

[1] The Special Trucker Per Diem rate is established by the Internal Revenue Service in an annual notice. See IRS Notice 20-70

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

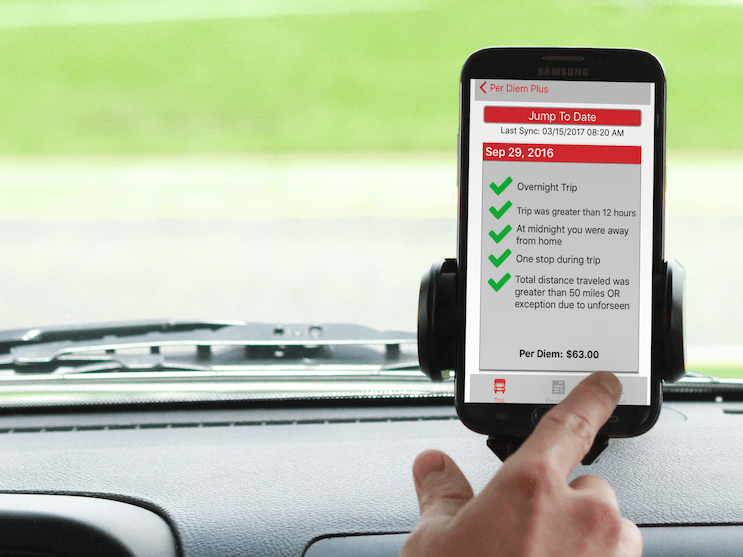

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves more than 20,000 customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing and food and beverage. Learn more about Samsara's mission to increase the efficiency, safety, and sustainability of the operations that power the global economy at www.samsara.com

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to implement an IRS-compliant fleet per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers travelling in the United States and Canada. For more information, visit www.perdiemplus.com

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

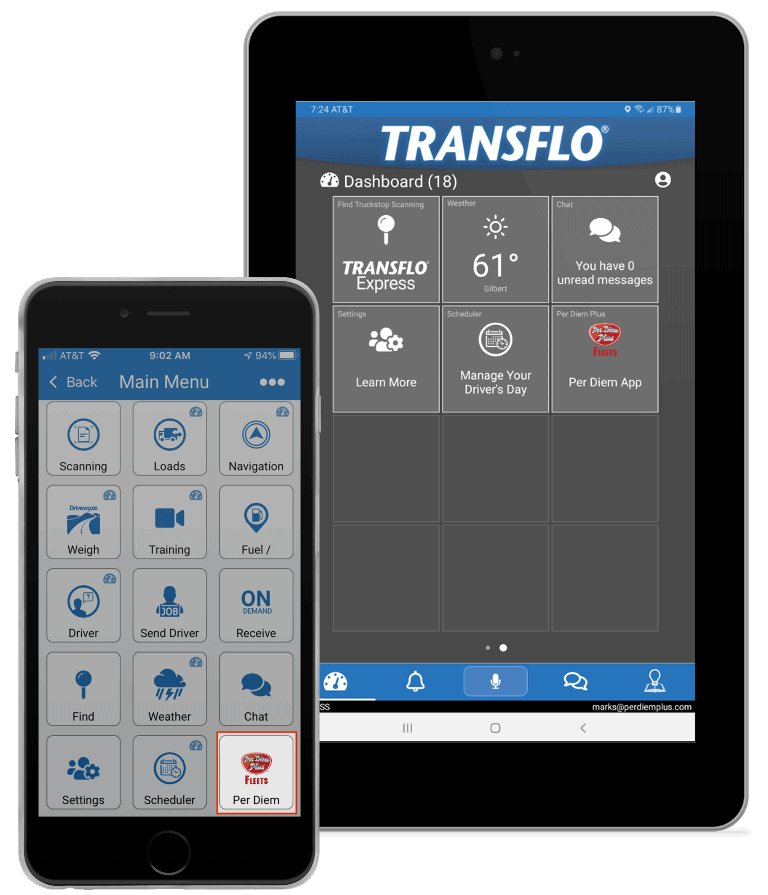

Per Diem Plus® FLEETS, a mobile application platform that automates per diem tax compliance for motor carriers, today announced a new integration with Transflo. The deep link is a configurable integration that enables drivers to navigate between the Transflo Mobile dashboard and Per Diem Plus FLEETS app creating an enhanced user experience.

With over $40 million of per diem claimed and 5 years of reports accepted by the IRS, adding an accountable, substantiated per diem program is a sure-fire way for a motor carrier to increase driver take home pay and save money. Consider the following:

Our cloud-based platform enables motor carriers to implement an IRS-compliant fleet per diem plan that is:

Case Study: One fleet with 85 company drivers was able to save $255,000 in the first year and increase driver pay by $0.04 per mile by leveraging FLEETS.

[1] The Special Trucker Per Diem rate is established by the Internal Revenue Service in an annual notice. See IRS Notice 20-70

Transflo®, a Pegasus TransTech company, is a leading mobile, telematics, and business process automation provider to the transportation industry in the United States and Canada. Transflo’s mobile and cloud-based technologies deliver real-time communications to fleets, brokers, shippers, and commercial vehicle drivers, and digitize 800 million shipping documents a year, representing approximately $84 billion in freight bills. Organizations throughout the Transflo client and partner network use the solution suite and digital platforms to increase efficiency, improve cash flow, and reduce costs. Headquartered in Tampa, Florida, USA, Transflo is setting the pace for innovation in transportation software. For more information, visit www.transflo.com.

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to implement an IRS-compliant fleet per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for travel in the United States and Canada for drivers, motor carriers and owner operators. For more information, visit www.perdiemplus.com

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

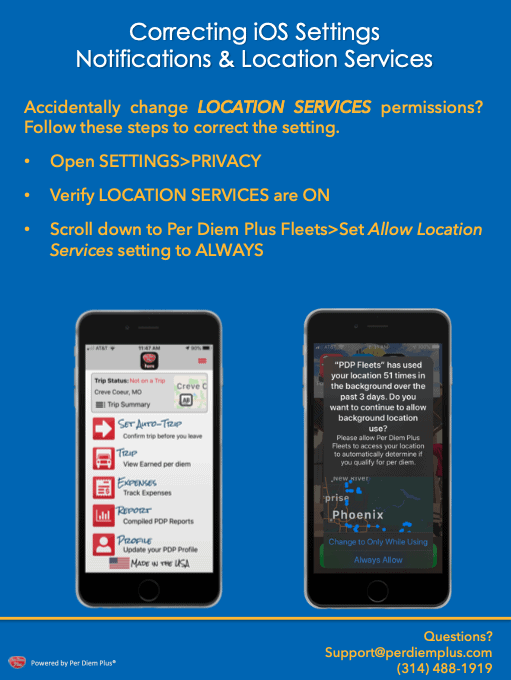

Per Diem Plus Fleets releases Build 56 to resolve location services permission restrictions imposed with OS 14.

What's new? The app will post a notification alerting an iOS user that location services permissions were changed by iOS and instructing the user to reset permissions to "Always Allow".

Why was this needed? Per Diem Plus was designed to run passively in the background to determine IRS-required "time, date and location" for per diem. However, because of abuses by Big Tech, like Facebook, Apple no longer allows apps to lock Location Services with "Always Allow" during initial login and setup. As a result, iOS automatically changes the setting to "Only while using app", which prevents PDP from functioning as designed.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

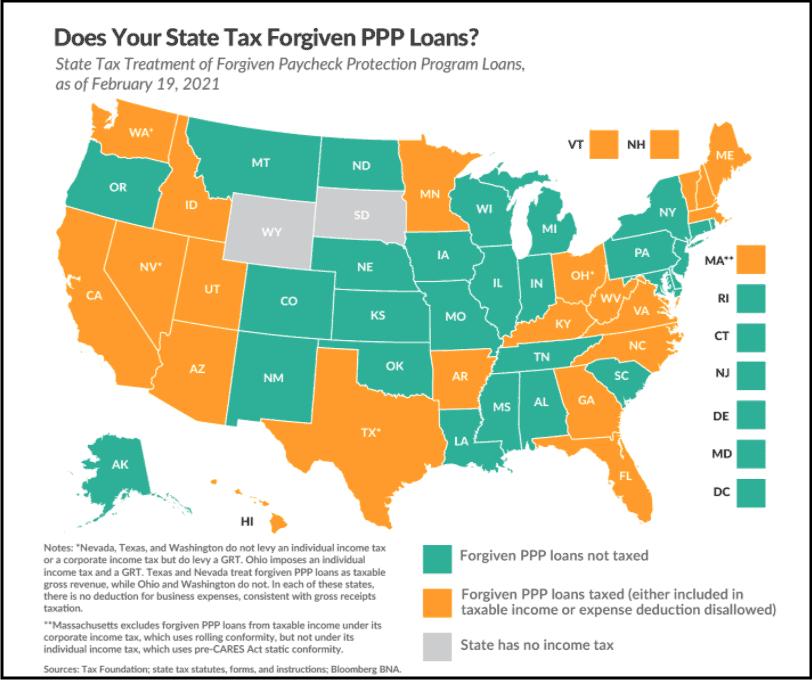

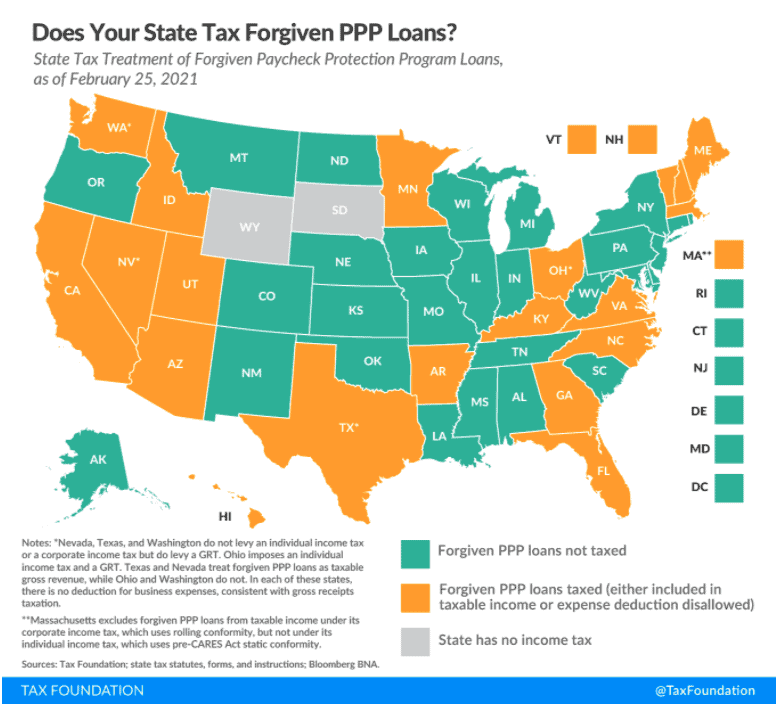

Did you receive a Paycheck Protection Program Loan (PPP) in 2020 to keep your small trucking company from going under? Did you use the loan proceeds for qualifying purposes, like payroll costs, mortgage interest payments, rent, and utilities? The good news is your loan should be forgiven AND it will be exempt from federal taxation. The bad news is that many states do not conform to the federal tax code and will tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both. The Tax Foundation map below and (click HERE to view state-by-state table show states’ tax treatment of forgiven PPP loans.

Fortunately several states that currently tax forgiven PPP loans, including Arizona, Arkansas, Hawaii, Maine, Minnesota, New Hampshire, Virginia, and Wisconsin, bills have been introduced to prevent such taxation.

If you received a PPP loan, and with tax deadlines fast approaching, you should consult with your tax advisor to determine if you will incur a state tax liability for the forgiven loan.

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2021, 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Pros & Cons: Schedule C vs S-Corp for Self-Employed Truckers is from "Making The IRS Work In Your Favor" presented by Mark W. Sullivan, EA at the CMC LIVE hosted by Kevin Rutherford and Let's Truck.

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

Pros & Cons: Schedule C vs S-Corp for Self-Employed Truckers general rule of thumb:

It is important to note that entity classifications like Limited Liability Company (LLC) and Limited Liability Partnership (LLP) are a function of state law and not federal. For federal purposes the entity type is a tax election.

What qualifies as "reasonable wages" has been a matter of debate for more than 100 years. However, in trucking a safe-haven would be to pay yourself a wage equal to that which an employee truck driver would be paid for doing the same job. Hint: Paying yourself $20,000 of wages as an OTR driver clocking 110,000 miles annually and $80,000 of draw would likely be classified as unreasonable.

The procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect. Below are topics that frequently arise when new business owners ask the Internal Revenue Service questions about paying themselves.

An officer of a corporation is generally an employee. However, an officer who performs no services or only minor services and who neither receives nor is entitled to receive any pay is not considered an employee. Refer to "Who Are Employees?" in Publication 15-A, Employer's Supplemental Tax Guide.

Partners are not employees and should not be issued a Form W-2, Wage and Tax Statement, in lieu of Form 1065, Schedule K-1, for distributions or guaranteed payments from the partnership. Refer to Tax Information for Partnerships page for more information.

Any distribution to shareholders from earnings and profits is generally a dividend. However, a distribution is not a taxable dividend if it is a return of capital to the shareholder. Most distributions are in money, but they may also be in stock or other property. For information on shareholder reporting of dividends and other distributions, refer to Publication 550, Investment Income and Expenses.

You cannot designate a worker, including yourself, as an employee or independent contractor solely by the issuance of Form W-2, Wage and Tax Statement or Form 1099-NEC, Nonemployee Compensation. It does not matter whether the person works full time or part time. You use Form 1099-NEC to report payments to others who are not your employees. You use Form W-2 to report wages, car allowance, and other compensation for employees.

You will be liable for social security and Medicare taxes and withheld income tax if you do not deduct and withhold them because you treat an employee as a nonemployee, including yourself if you are a corporate officer, and you may be liable for a trust fund recovery penalty. Refer to Publication 15, Circular E, Employer's Tax Guide for details about the trust fund recovery penalty or Independent Contractor (Self-Employed) or Employee? for more information on employee classification.

A loan by a corporation to a corporate officer should include the characteristics of a loan made at arm's length. That is, there should be a contract with a stated interest rate, a specified length of time for repayment, and a consequence for failure to repay the loan. Collateral would also be an indication of a loan. A below-market loan is a loan which provides for no interest or interest at a rate below the federal rate that applies. If a corporation issues you, as a shareholder or an employee, a below-market loan, then depending on the substance of the transaction the lender's payment to the borrower is treated as a gift, dividend, contribution to capital, payment of wages, or other payment.

See "Below-market interest rate loans" under Employees' Pay / Kinds of Pay / Loans or Advances in Publication 535, Business Expenses for more information.

Because an officer of a corporation is generally an employee with wages subject to withholding, corporate officers may question what is considered reasonable compensation for the efforts they contribute to conducting their trade or business. Wages paid to you as an officer of a corporation should generally be commensurate with your duties. Refer to "Employee's Pay, Tests for Deducting Pay" in Publication 535, Business Expenses for more information. Public libraries may have reference sources that provide averages of compensation paid for various types of services. The Internal Revenue Service may determine that adjustments must be made to the income and expenses of tax returns for both the corporation and an individual shareholder if the officer is underpaid for services provided.

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

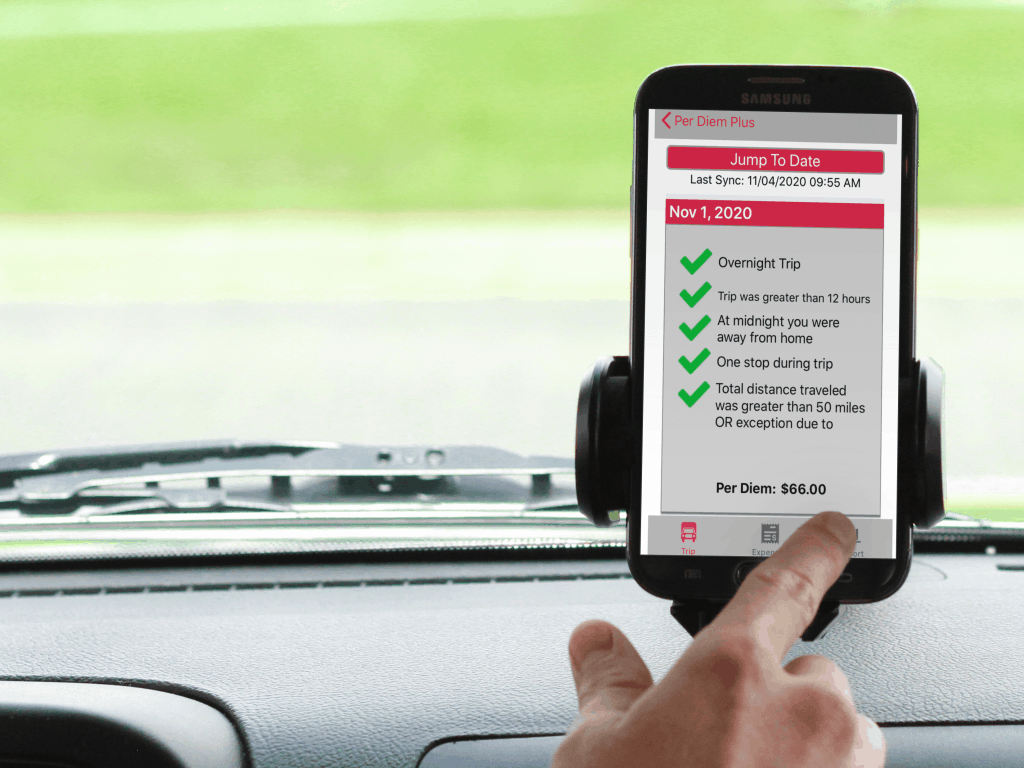

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article includes general tax information, and therefore may not be relied upon as legal authority. This means that the information cannot be used to support a legal argument in a court case. Please consult with a licensed tax professional.

Copyright 2020-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Yes. As a self-employed trucker you cannot do your job via a ZOOM meeting, thus you are eligible for a refundable tax credit under the Families First Act (FFCRA). You may fund the "sick leave" or "family leave" tax credit by using a portion of the 2020 estimated tax payments that were supposed to be paid quarterly. The refundable credit will be claimed on your Form 1040, U.S. Individual Income Tax Return, for the 2020 tax year.

An eligible self-employed individual is defined as an individual who,

Eligible self-employed individuals are allowed an income tax credit to offset their federal self-employment tax for any taxable year equal to their “qualified sick leave equivalent amount” or “qualified family leave equivalent amount.”

The tax credit is calculated by multiplying the number of days you could not work (maximum of 10 days) between April 1 and December 31, 2020 by either:

Average daily self-employment income is an amount equal to the net earnings from self-employment for the taxable year divided by 260. A taxpayer’s net earnings from self-employment are based on the gross income that he or she derives from the taxpayer’s trade or business minus ordinary and necessary trade or business expenses.

Which type of "leave" you qualify for depends on the reason(s) you were unable to work. Those that were prohibited from working can claim up to $511/day but those who were home to care for a family member can only claim up to $200/day.

For an eligible self-employed individual who is unable to work or telework because the individual:

the qualified sick leave equivalent amount is equal to the number of days during the taxable year that the individual cannot perform services in the applicable trade or business for one of the three above reasons, multiplied by the lesser of $511 or 100 percent of the “average daily self-employment income” of the individual for the taxable year.

Example: John was unable to drive due to state-mandated quarantine orders and the absence of loads for 8 days. He had $75,000 or an average of $288/day of self-employment income in 2020.

John can claim the lesser amount of $2,304 as refundable credit under FFCRA on his Form 1040, U.S. Individual Income Tax Return.

For an eligible self-employed individual who is unable to work or telework because the individual:

the qualified family leave equivalent amount is equal to the number of days during the taxable year that the individual cannot perform services in the applicable trade or business for one of the three above reasons, multiplied by the lesser of $200 or 67 percent of the “average daily self-employment income” of the individual for the taxable year.

Example: Mary was unable to drive for 10 days because she was home caring for her husband who had been exposed to COVID. She had $65,000 or an average of $250/day of self-employment income in 2020.

Mary can claim the lesser amount of $1,680 as refundable credit under FFCRA on his Form 1040, U.S. Individual Income Tax Return.

The refundable credits are claimed on the self-employed individual’s Form 1040, U.S. Individual Income Tax Return, tax return for the 2020 tax year. The Families First Act refundable tax credit is not surprisingly complicated, please consult with your tax advisor.

Substantiate the days you were unable to work using either of the following methods:

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Use Per Diem To Raise Trucker Pay To Recruit Drivers. A company-sponsored substantiated per diem plan can raise trucker pay to attract new drivers.

Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

"I still think to get new people into the industry, given the 150K-200K driver deficit and robust demand in 2021, pay is going to have to go up a lot more than 20%."

U.S Express CEO Eric Fuller told Yahoo Finance (9/30/20)

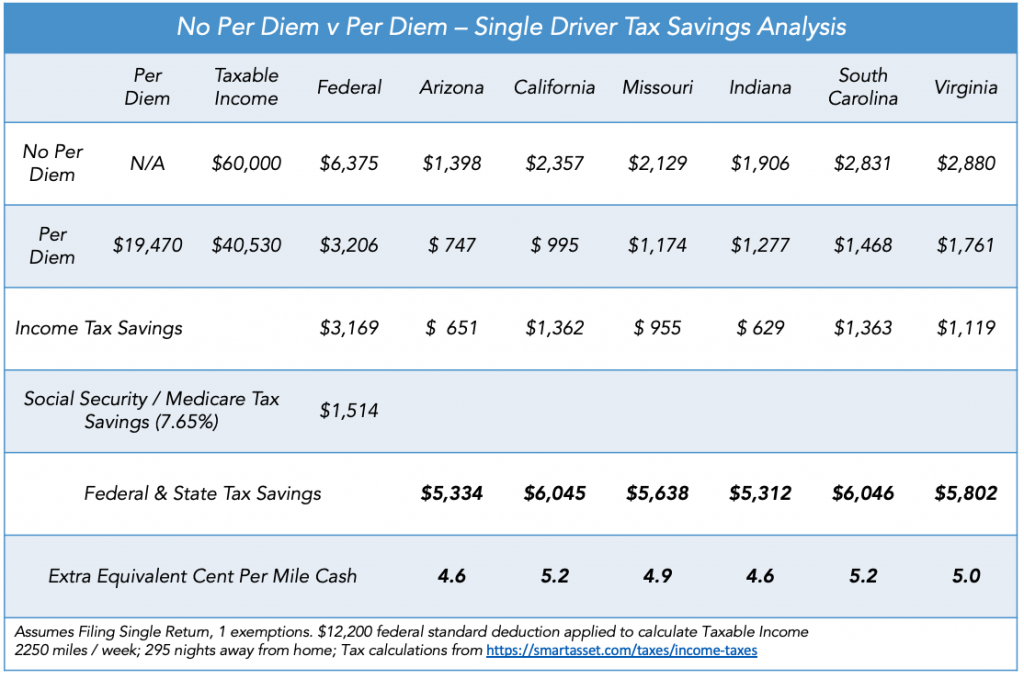

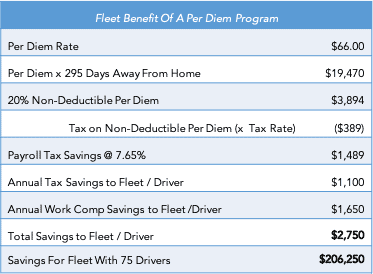

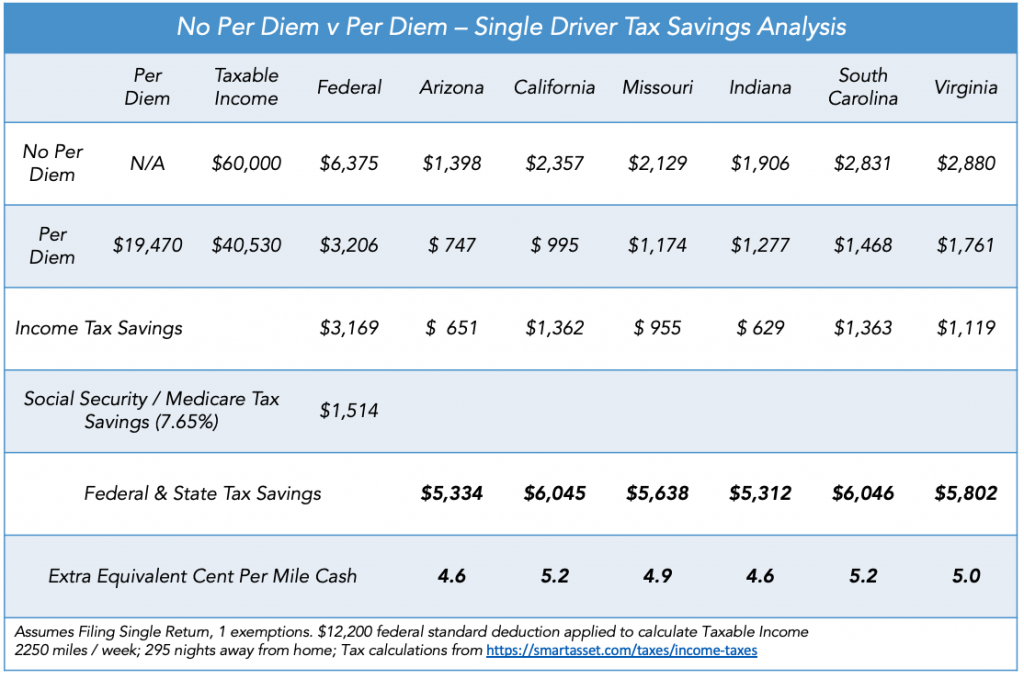

Adding a substantiated per diem program for employee drivers is a sure-fire way raise driver take-home pay by 10% or more while saving the motor carrier money. Consider the following:

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets

TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

A single driver from South Carolina could save $6,046 in taxes equal to an extra 5.2 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

A fleet with 75 drivers and could raise driver pay by 10% or more and still save $206,250. Do not believe the savings are achievable? Read our Case Study. The motor carrier saved $3,000 per driver within the first year of implementing Per Diem Plus Fleets. In addition, they received a $125,000 workers compensation premium refund.

Our cloud-based FLEETS mobile app platform enables fleets to easily implement an IRS-compliant fleet per diem plan that will raise driver take-home pay by 10% or more while also saving the motor carrier money.

Related Articles:

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

2021 TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

Implementing a fleet per diem solution is something that should be on many fleet managers’ to-do list. They know the benefits to drivers, they know the incredible ROI, and yet it still manages to slip down the list of immediate priorities. One of the main perceived barriers to implementing Per Diem Plus Fleets is the rollout process.

With such a dramatic overhaul of your fleet, surely there will be some bumps along the way — translating to tech overload and a hit to back-office productivity, right? Perhaps you’re worried that there are things you’ve missed, and you’ll suffer teething issue after teething issue before you see the benefits you were promised.

The good news is that this needn’t be the case, no matter the size of your fleet.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Configure your fleet per diem plan in minutes with our simple check-the-box menu.

For example, the platform allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 25 miles and best matches fleet lanes and app installation type. Or to minimize cellular data plan usage for mobile app users you can whitelist the app using our static IP address.

Per Diem Plus was purpose-built to simplify substantiated per diem tax compliance. Have you thought about how you can use the data gathered? There are a few important things to note.

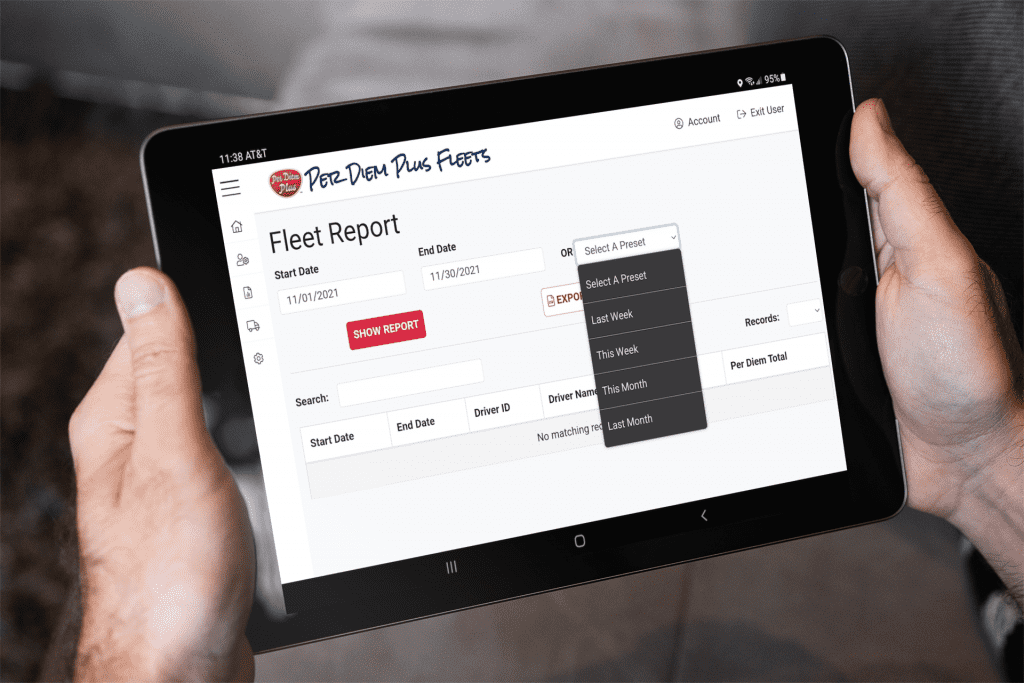

Use your Fleet Reports quickly audit your per diem program or to support the Workers Compensation per diem exemption in addition to or instead of your paper documents.

To run a Fleet Report in the FLEETS Web App:

Generate reports with Per Diem Plus:

When you use Per Diem Plus Fleets Web App for Premium users, you have access to your fleetwide reporting that you can use to analyze your per diem program. The report tracks per diem totals for each driver for a given period. If you are interested in a map of a trip route to see exactly where a driver traveled, you can access that from a KML export within a Driver Report.

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

Copyright 2022 Per Diem Plus, LLC.

The 2021 special trucker per diem rates for taxpayers in the transportation industry remain unchanged from 2019-2020 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

View Notice 2020-71 that includes the 2021 special trucker per diem rates.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Are you unsure what per diem is or which drivers can claim travel-related expenses? Our tax experts answer the most common question in a prior post, Trucker Per Diem Simply Explained

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Related Articles

A company-sponsored substantiated per diem plan will save a fleet money and raise driver take-home pay by several cents per mile.

Truckers designed it, tax pros built it, your drivers want it. Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

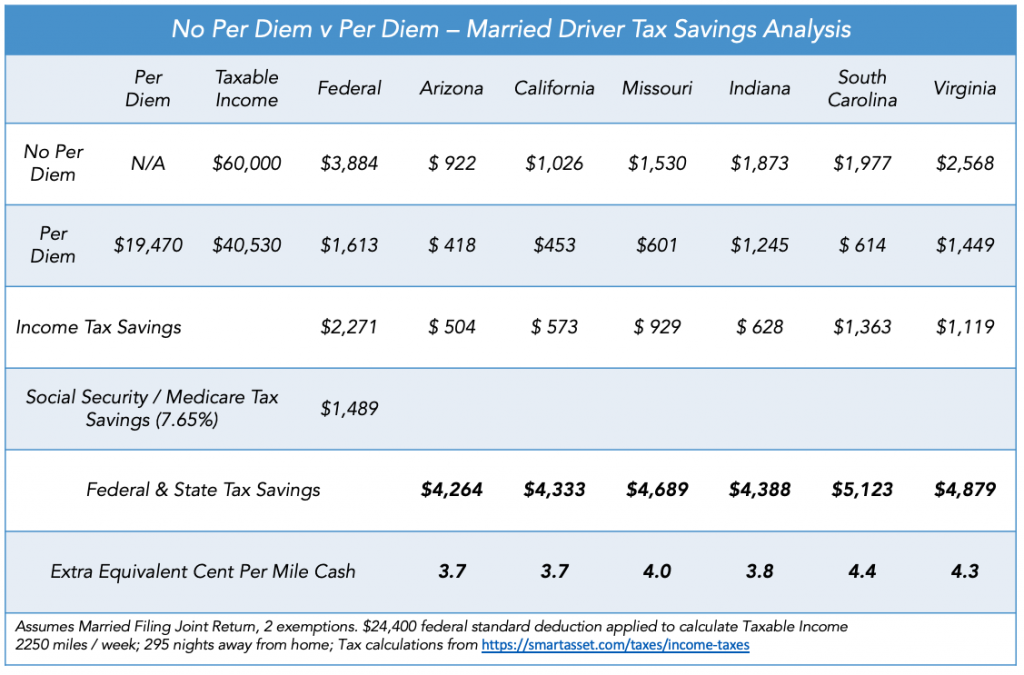

Adding a substantiated per diem program for employee drivers is a sure-fire way for a motor carrier to save money and raise driver take-home pay. Consider the following:

For example, a married driver from South Carolin could save $5,123 in taxes equal to an extra 4.4 cents per mile.

A single driver from Missouri could save $5,638 in taxes equal to an extra 4.6 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®