PDP For Fleets - 3 Months Free

No per diem tax analysis would be complete without addressing the state income tax considerations on driver per diem. In our last blog post, No Driver Per Diem Yields Surprise Tax Bill, we showed you an example of a driver not receiving per diem. In this article, we will show you the negative impact of living in a high-tax state.

Johnny Mills is an over-the-road company driver

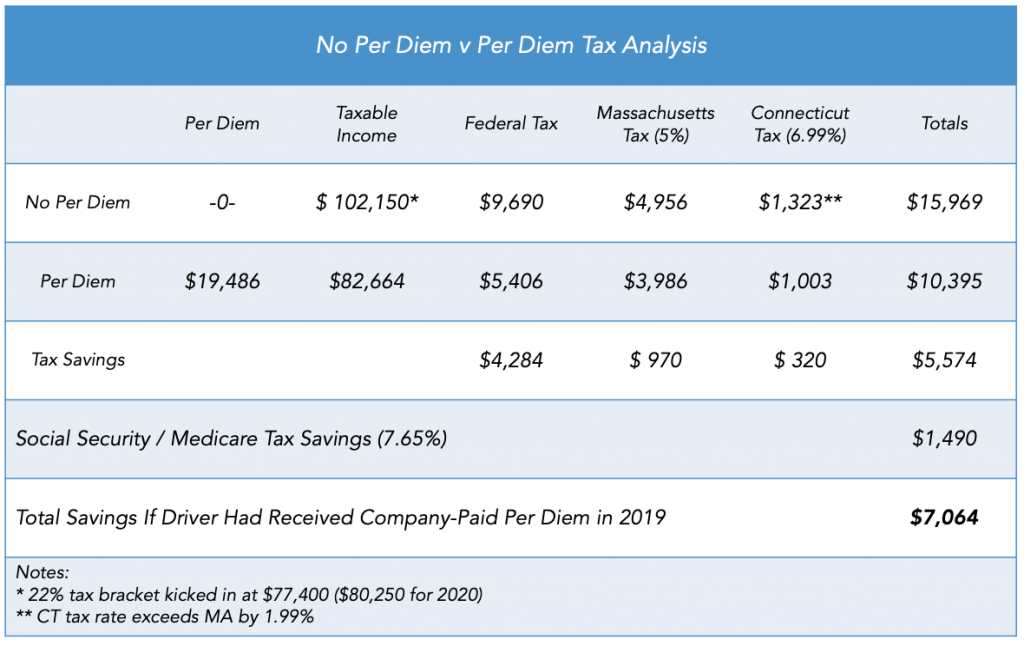

Since, Johnny elected not to enroll in the employer plan when he joined the company, he paid an extra $7,064 in federal income and payroll taxes. But how much extra state income tax did he pay? Would it make financial sense for him to move his family and transfer to one of the company's other terminals, like nearby Arizona?

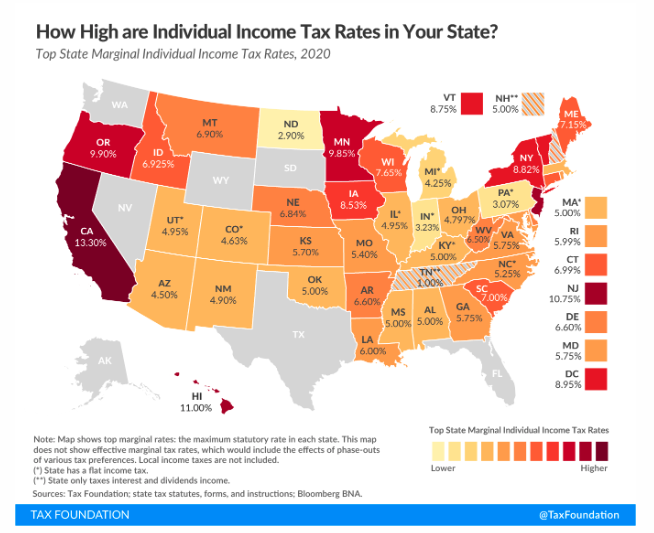

No discussion on the benefits of per diem for truck drivers would be complete without considering state income taxes. State income taxes substantially impact a driver's overall income tax burden. Drivers in high-tax states like California, Connecticut or New York should consider the state tax savings of per diem. These savings are even more pronounced when compared to low-tax states like Arizona.

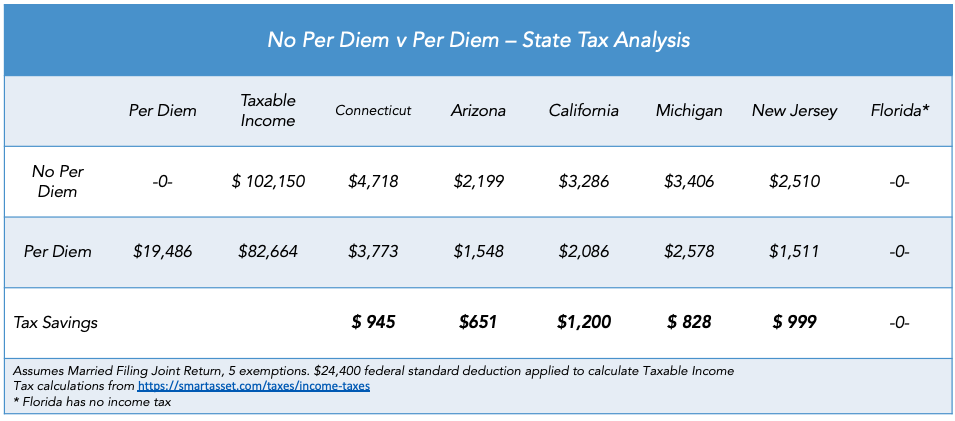

State Tax Savings: Enrolling in the company per diem plan would have saved Johnny $ 945 in Connecticut income tax for 2019.

State vs State Analysis: A Connecticut driver paid $4,718 of state income tax in 2019. An identical Arizona-based driver paid only $2,199 - a $2,519 difference.

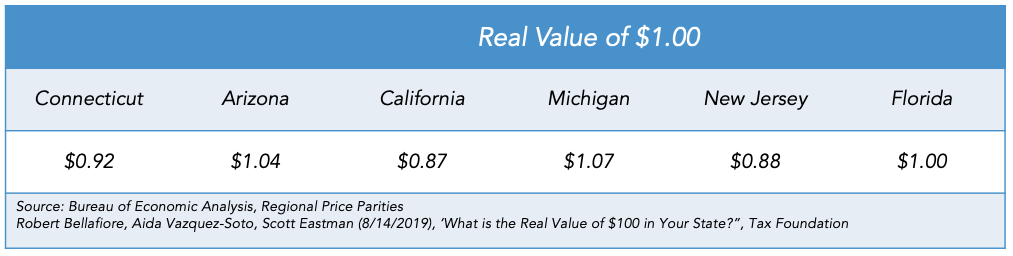

The real value of a dollar (purchasing value) must be taken into consideration in order to make state-to-state comparisons. For example, $1.00 is only worth $0.92 cents in Connecticut but $1.04 in Arizona - a 11.5% difference.

No per diem tax analysis would be complete without addressing the state income tax considerations on driver per diem. Johnny Mills received an unpleasant surprise this tax season because he did not participate in his employer offered per diem plan - an additional $7,064 of federal and $ 945 in state income taxes. Living in high-cost, high-tax Connecticut further reduced the value of his earnings by over $11,136. However, if Johnny enrolls in the company per diem plan and moves his family to a low-cost, low-tax state like Arizona it would generate about $16,198 in real dollar value.

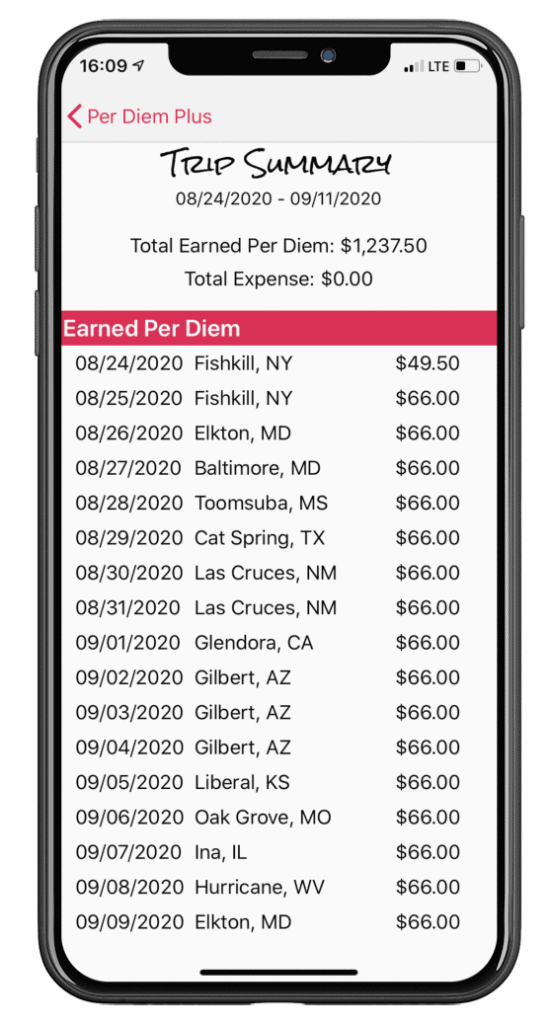

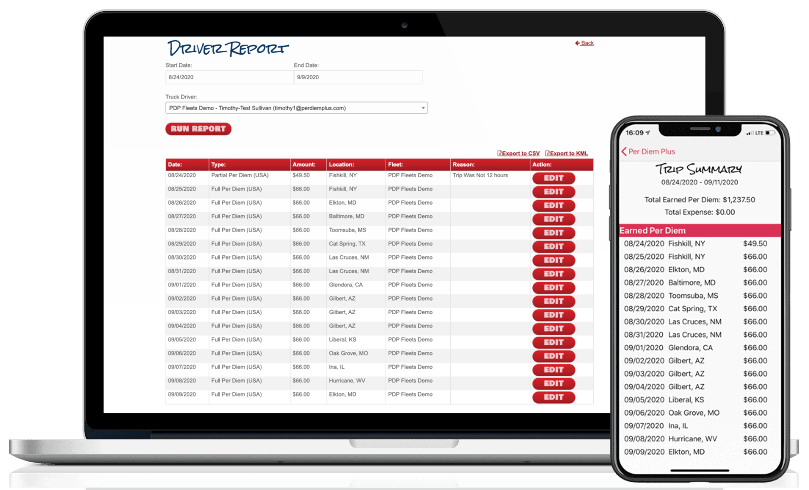

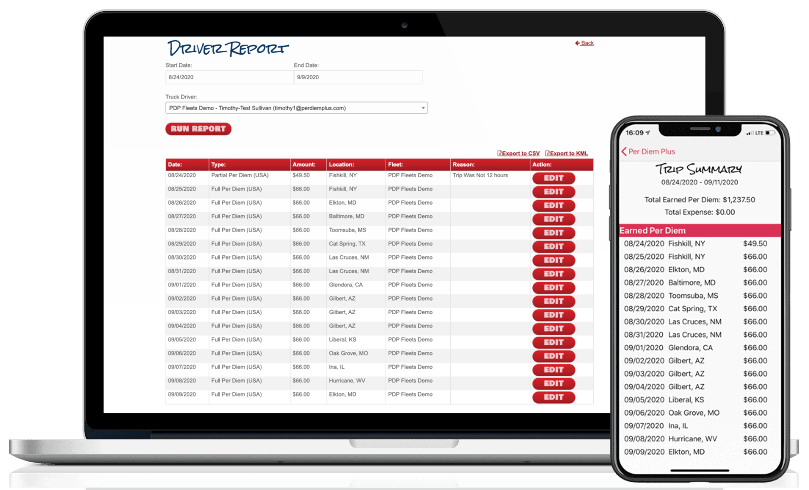

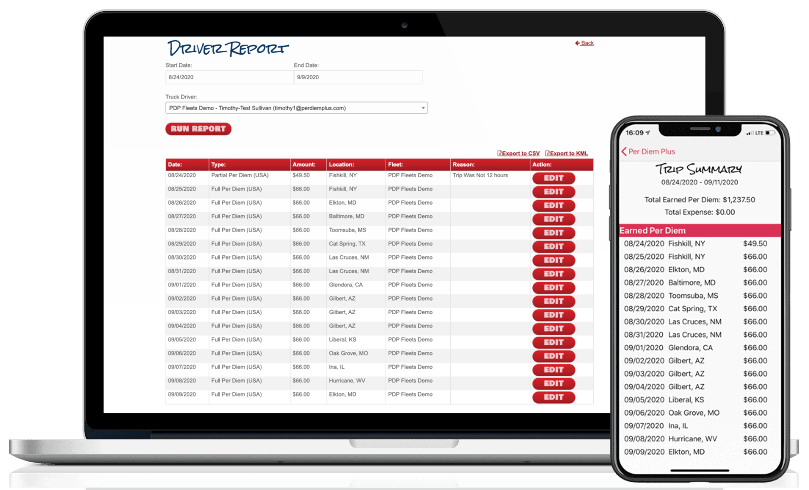

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Reference:

https://taxfoundation.org/real-value-100-state-2019/

https://taxfoundation.org/state-individual-income-tax-rates-and-brackets-for-2020/

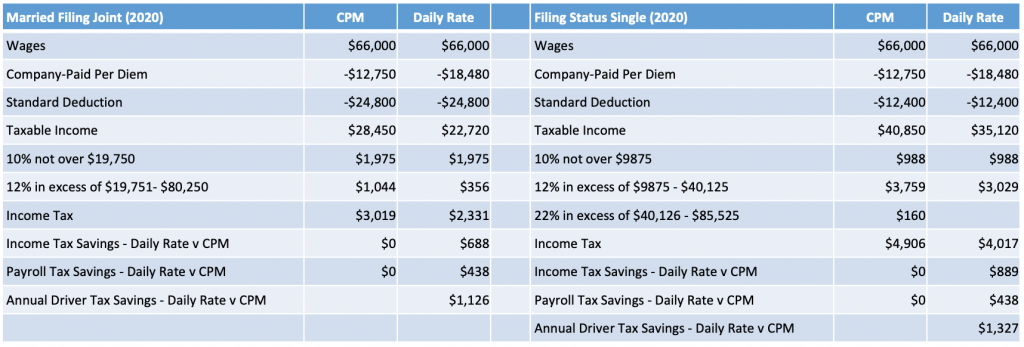

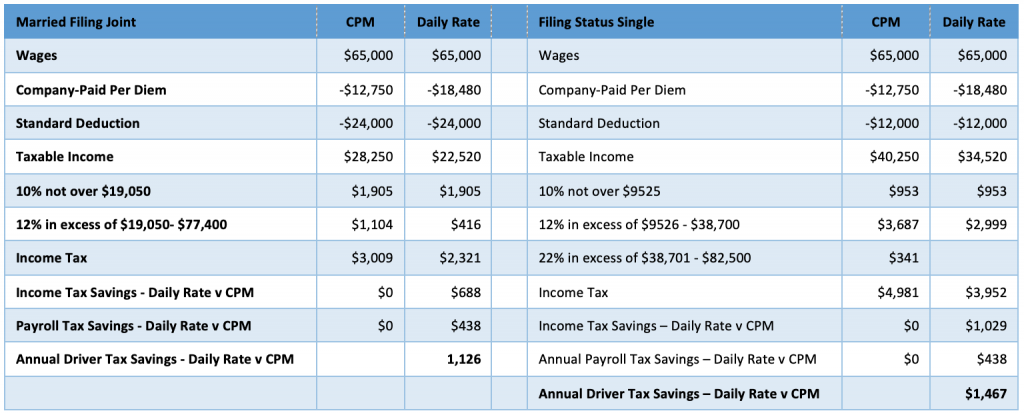

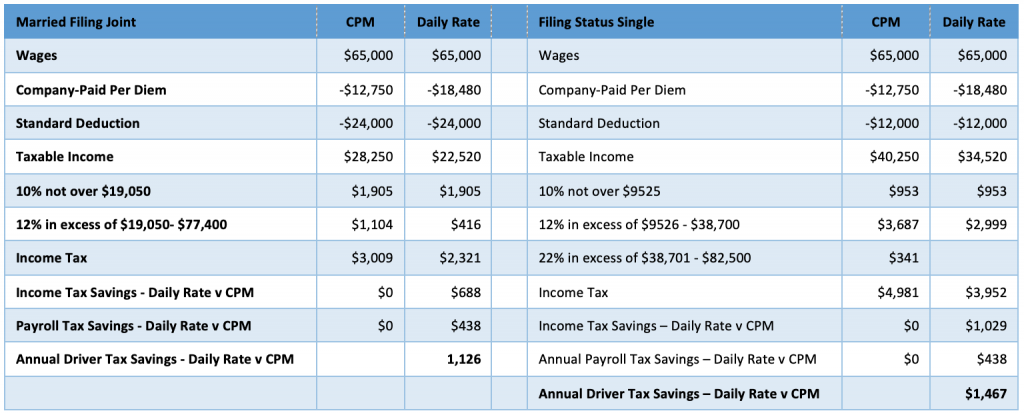

Billy is an over-the-road company driver who lives in a high-tax state with his wife and 3 children. His previous employer administered their plan through Per Diem Plus FLEETS. Unfortunately, his new company doesn't offer per diem. He understood per diem saves a driver significant taxes and worried his tax refund would be much smaller.

After quickly assembling his tax records for his accountant he received an unwelcome surprise:

The table highlights the federal and state tax consequence of Billy's employer not having a driver per diem program.

Billy received an unpleasant surprise this tax season because his employer did not offer per diem

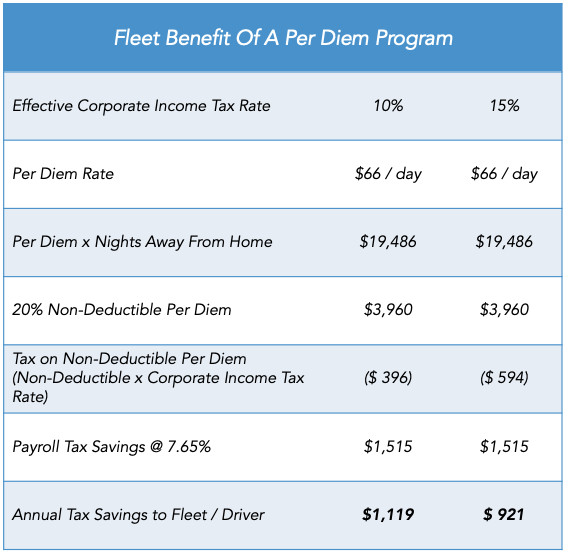

Why does Billy's employer not have a per diem program? Like many trucking companies they incorrectly assume that a company-sponsored per diem program will cost them money. In fact, the table below shows the tax due on the 20% non-deductible portion of per diem is offset by the payroll tax savings. In addition, a CASE STUDY demonstrated a trucking company saved $3,000 per driver by imlementing the Per Diem Plus FLEETS. Billy's employer would actually have saved over a thousand dollars in taxes per driver.

Fleets that adopt the Per Diem Plus FLEETS mobile platform will not only enhance driver retention and recruiting, but save many thousands of dollars in the process.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. Furthrmore, it is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

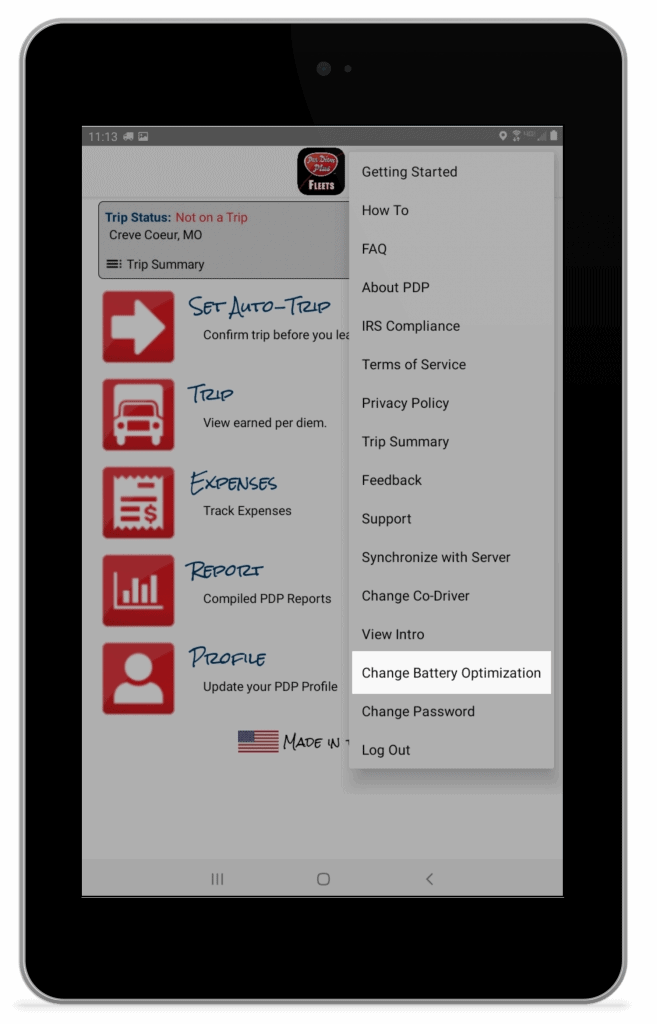

Here is how you fix battery optimization issues when you update to Android 9. It came to our attention that updating a device to Android 9 may automatically optimize the battery settings. Unfortunately, the optimized battery setting prevents the Per Diem Plus FLEETS and Per Diem Plus - Owner Operators app from waking up to establish location.

Follow these steps to adjust the battery optimization setting for Per Diem Plus Fleets on your Android device:

Follow these steps to adjust the battery optimization setting Per Diem Plus - Owner Operators on your Android device:

This setting prevents Android from blocking the app from tracking per diem trips.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Copyright 2020 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

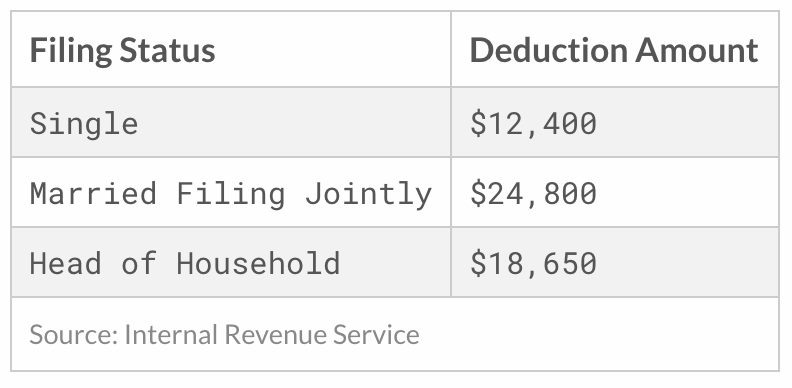

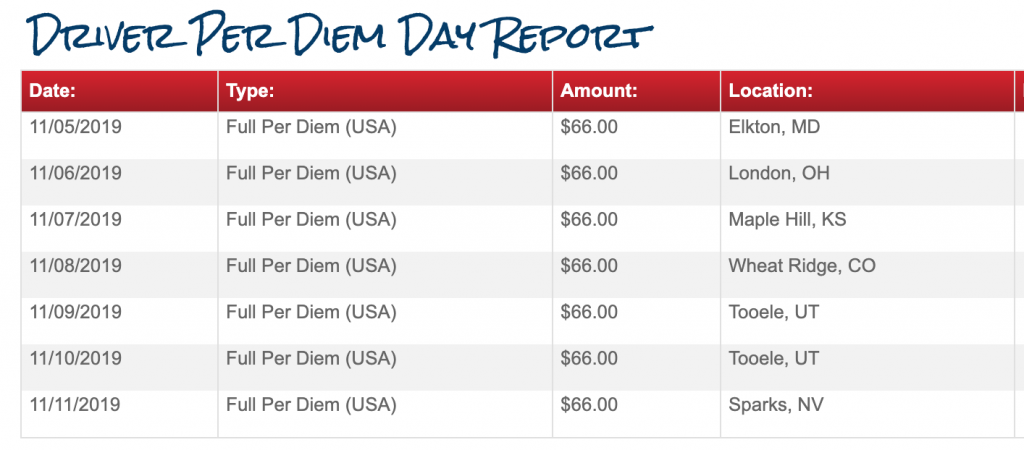

The 2020 trucker per diem rates & tax brackets for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

The standard deduction for single filers will increase by $200, and by $400 for married couples filing jointly.

The personal exemption for 2020 remains eliminated.

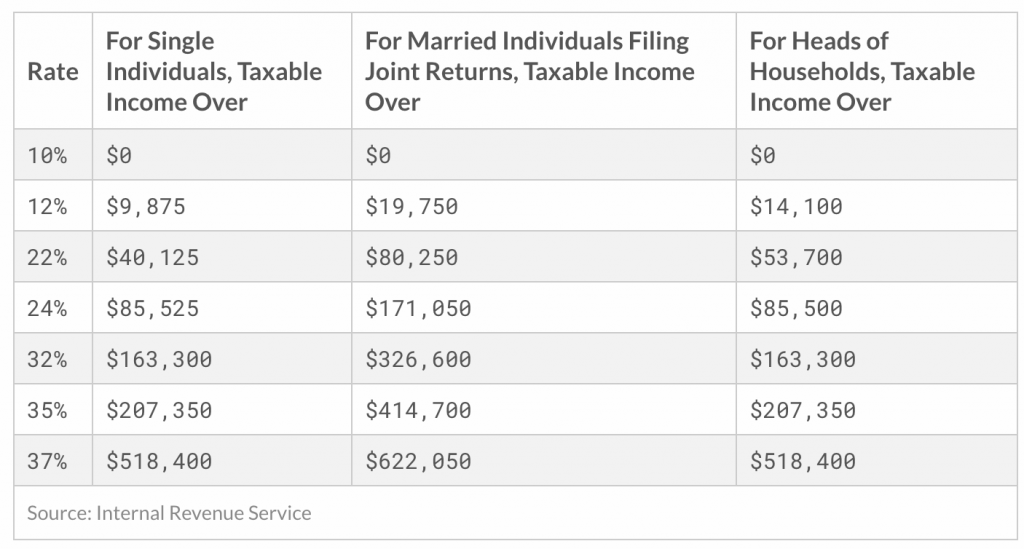

In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly.

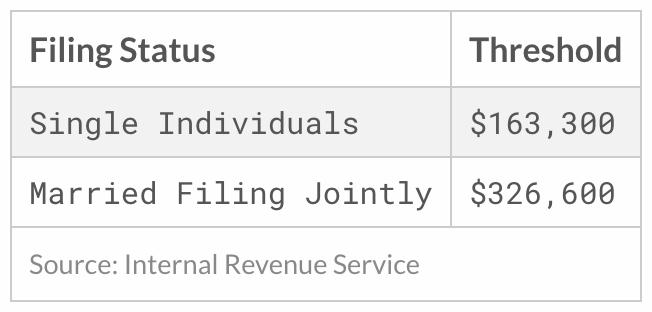

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to $163,300 of qualified business income for single taxpayers and $326,600 for married taxpayers filing jointly.

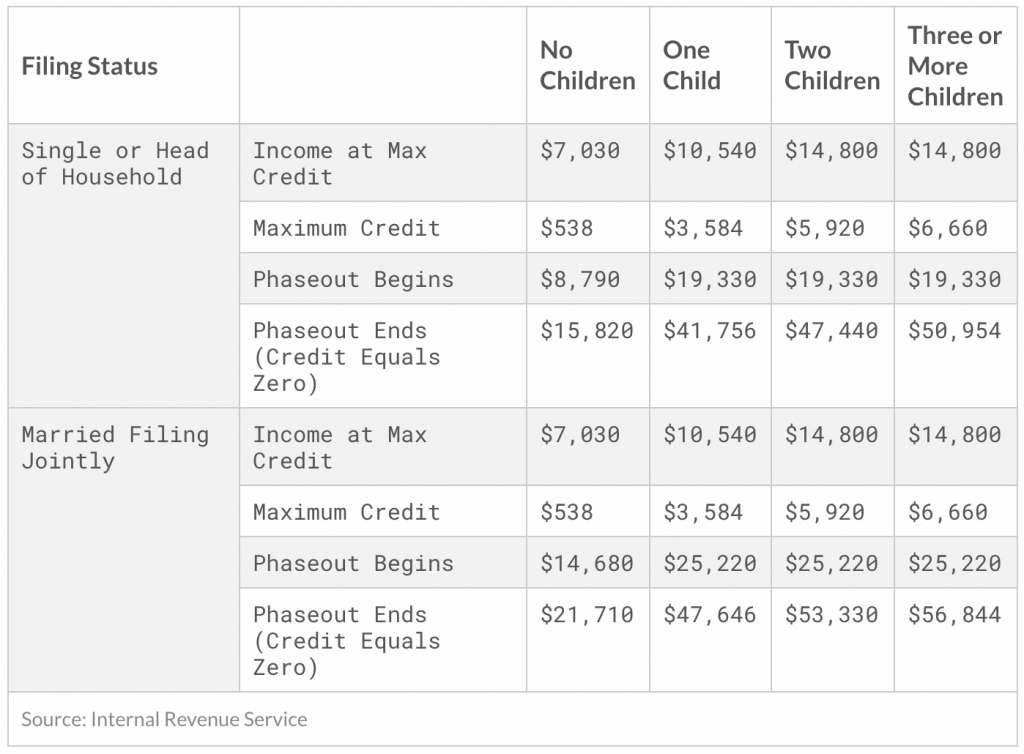

The maximum Earned Income Tax Credit in 2020 for single and joint filers is $538, if there are no children. The maximum credit is $3,584 for one child, $5,920 for two children, and $6,660 for three or more children. All these are relatively small increases from 2019.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2019-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Internal Revenue Service, “Revenue Proc. 2019-44,” https://www.irs.gov/pub/irs-drop/rp-19-44.pdf.

No. The treatment of per diem as a portion of an employee’s wages is not considered an improper “wage reclassification”. The IRS first introduced per day allowances in Revenue Procedure 90-60 as a simplified method of substantiating employee business expenses. However, the first published guidance for the transportation industry was TAM 9146003 issued in 1991. According to the IRS:

The Special Transportation Industry substantiated method was introduced in 2000 to ease the burden on taxpayers, who would otherwise have to meet the extensive substantiation requirements in order to claim deductions for business related travel [See Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48], which among other things:

The Internal Revenue Code gives the IRS Commissioner discretionary authority to issue regulations, such as revenue rulings and procedures. The Revenue Procedures and Notices are updated annually and the relevant per diem provisions have remained substantially the same since 2011 [See Rev. Proc. 2011-47 ].

Biden's IRS Is Coming For Your PayPal & Venmo Payments

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

A substantiated per diem program reimburses drivers a fixed amount per day (i.e. $66) in place of a rate per mile for travel away from home. As a result, it eliminates the need for drivers to turn in receipts for actual meals and incidental expenses. Most importantly, it reduces a fleets administratives burden while providing additional cash to drivers on a pre-tax basis. However, companies must have an accountable plan to qualify, which would include these requirements [See KMS Transport Advisors (NAFC March 2019 newsletter]:

Well-known motor carriers that utilize the substantiated method include Averitt Express, EPES Transport System, TMC Transportation, G&P Trucking, Transport America and Big G Express, Danny Herman Trucking and Oakley Transport.

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event meet the IRS substantiation requirements.

Thirty years of IRS guidance and legislative history specifically reference an employer paying a driver in the transportation industry under the substantiated method and, therefore, contemplate that some portion of a driver’s wages will be treated as per diem. While, both the substantiated and cent-per-mile per diem methods are IRS-compliant, neither method has been considered an improper wage reclassification for over 30 years. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS. Additional information can be found at IRS.gov

[i] The 2019 per diem rate for travel in the USA is $66 and $49.50 for a partial day.

ii] The raised the deductible percentage of employee travel related expenses to 80% in 2008

iii] Federal Register-1989-12-12 Vol 54 Page 51038 pursuant to “Family Support Act of 1988”

[iv] Rev. Ruling 2006-56, 2006-2 CB 274

[i] Updated annually IRS Notice 2019-55, 2018-77, 2017-54, 2016-58, 2015-63, 2014-57, 2013-65, 2012-63, Rev. Proc. 2011-47, 2010-39, 2009-47, 2008-59, 2007-63, 2006-41, 2005-67, 2004-60, 2003-80, 2002-63 and 2001-47.

The 2019-2020 special trucker per diem rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

This annual notice provides the 2019-2020 special per diem rates for taxpayers to use in substantiating the amount of ordinary and necessary business expenses incurred while traveling away from home, specifically (1) the special transportation industry meal and incidental expenses (M&IE) rates.

Information on the 2020-2021 per diem rates can be found HERE

BACKGROUND

Rev. Proc. 2011-47, 2011-42 I.R.B. 520 (or successor), provides rules for using a per diem rate to substantiate, under § 274(d) of the Internal Revenue Code and § 1.274-5 of the Income Tax Regulations, the amount of ordinary and necessary business expenses paid or incurred while traveling away from home.

The special M&IE rates for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

Are you unsure what per diem is or which drivers can claim travel-related expenses? Our tax experts answer the most common question in a prior post, Trucker Per Diem Simply Explained

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Substantiated per diem provides the largest benefit to both a driver and fleet over the old cent-per-mile method. Decades before the advent of TMS software, telematics and ELD's fleets adopted cent-per-mile per diem. Why? Because it was easy to calculate and substantiate using trip sheets[i]. However, there is no correlation between the miles a driver travels and frequency of meal breaks.

Under the cent-per-mile method a driver is paid only for miles driven and not nights away from home. Although, a driver may travel 500 miles one day they may only clock 200 miles the next. In the end, the distance traveled does not affect the need to eat 3 meals a day.

The IRS introduced the Special Transportation Industry substantiated per diem to simplify tax compliance for fleets by relying on days away from home instead of miles traveled. This method accurately reflects the number of meals a driver eats and resolved the problem that driver’s regularly travel away from home and stop during a single trip at localities with differing federal M&IE rates.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

[i] 1-274-5T(c) Rules of substantiation, Rev. Proc. 2011-47 § 4.02(5)

Both the substantiated and cent-per-mile per diem methods are IRS-compliant. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

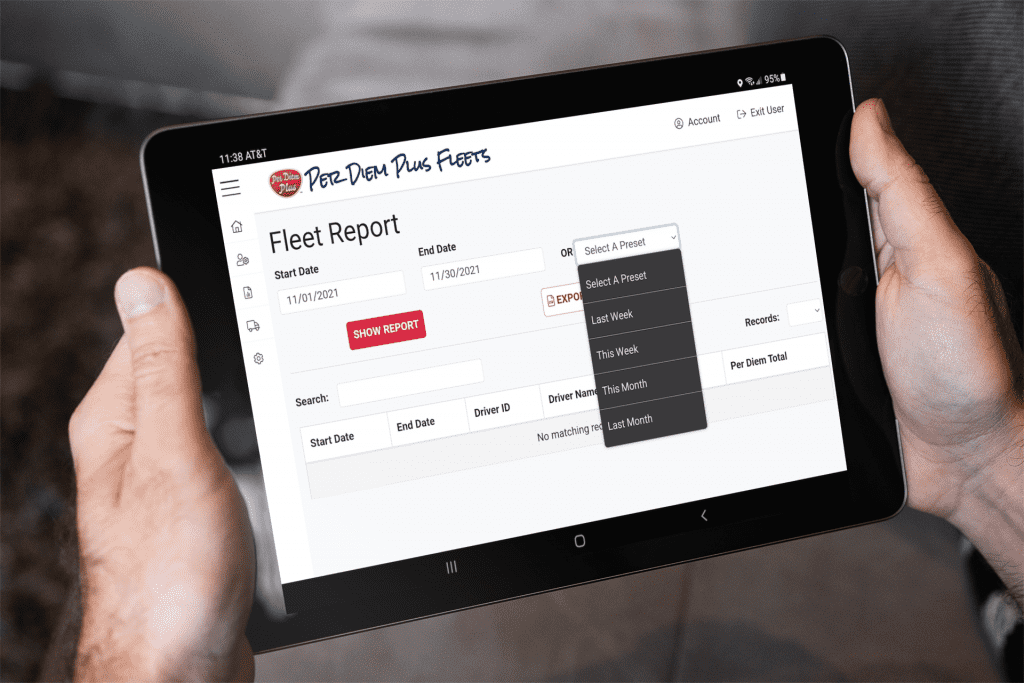

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service.

Questions? Contact Mark W. Sullivan, EA.

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Which per diem method saves a fleet more money? Substantiated per diem saves a motor carrier the most money, since the fleet benefits are directly proportional to total per diem paid to drivers. So how did cent-per-mile per diem become so popular in the trucking industry? Decades before the advent of telematics fleets adopted cent-per-mile per diem for because it was easy to calculate. However, there is no correlation between the miles a driver travels and meal breaks.

Drivers prefer substantiated special trucker per diem. Why? They eat 3 meals a day regardless of whether they drive 200 or 600 miles. The IRS introduced the Special Transportation Industry substantiated per diem to remedy this issue. In addition it simplified tax compliance for fleets by relying on nights away from home instead of miles traveled. It is also a more accurate reflection of anticipated meal expenses for drivers.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Adding an accountable per diem program for employee drivers is a sure-fire way to enhance driver recruiting and retention. Consider the following:

Both substantiated and cent-per-mile per diem must comply with the IRS substantiation by adequate records rules. According to the IRS, "a motor carrier must maintain lrecords to establish "time, place and location" for each per diem event". The Per Diem Plus FLEETS platform satisfies this requirement since it is maintained in such manner that each recording of an element of an expenditure is made at or near the time of the expenditure.

Document retention rules:

The transportation industry has been unique in its treatment of driver per diem for over 30 years. The substantiated per diem method saves a motor carrier more money than cent-per-mile method. While, substantiated and cent-per-mile per diem methods are IRS-compliant, both require a motor carrier to comply with the adequate records and document retention rules.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

Is trucker per diem an improper wage reclassification? No, the treatment of a portion of an employee’s wages as per diem has been unique to the transportation industry for over 30 years and is not considered an improper “wage reclassification”.

The IRS first introduced per diem (per day) allowances in Revenue Procedure 90-60 - a simplified method of substantiating employee business expenses - in accordance with the Family Support Act of 1988. The first published guidance for the transportation industry was issued in 1991 where, according to the IRS, a driver's weekly compensation earned on a cents-per-mile basis may be reclassified by amounts designated as per diem (i.e. $66/day) for meals and incidental expenses after determining how many days a driver was away from home overnight [TAM 9146003].

Related Article: Part II: Is Trucker Per Diem An Improper Wager Reclassification

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

Yes. The IRS introduced the Special Transportation Industry substantiated per diem method 20 years ago in Rev. Proc. 2000-39, 2000-9 Sec. 4.04 [Notice 2000-48], which among other things:

Stay In The Know: Biden's IRS Is Coming For Your PayPal & Venmo Payments

The 2017 Tax Cuts and Jobs Act eliminated per diem as an itemized deduction on drivers individual income tax returns. As a result, interest from employees in company-sponsored per diem plans swelled as drivers sought to offset the lost deduction [about $19,000 for an average OTR driver]. Since, drivers were prohibited from using the decades-old industry standard cent-per-mile per diem method, motor carriers embraced the parity to drivers substantiated per diem provided.

Unfortunately, they discovered the IRS never published a basic instructions for implementing a substantiated per diem program or payroll process for reclassifying a portion of wages to daily rate per diem. In fact, the last comprehensive guidance issued by IRS on substantiated per diem method was Rev. Proc. 2011-47, however, it was silent on wage reclassification for per diem. So too was the last relevant court case, Beech Trucking, Inc. v. IRS (USTC 2002). The only published guidance that referenced "wage recharacterization" could be found in the Rev. Rul. 2012-25.

IRS issued Rev. Rul. 2012-25 in response to an emerging audit trend whereby businesses that did not historically offer per diem were implementing abusive per diem plans that recharacterized taxable wages as nontaxable reimbursements or allowances. Although unrelated to trucking the tax practitioner community, and especially those that offered cent-per-mile per diem audit services, elevated the ruling to misplaced prominence.

No. Based on the foregoing Rev. Rul. 2012-25 is inapplicable to transportation industry:

The employer’s cited in 2012-25 failed to fulfill the business connection requirement of the regulations because they took liberties with IRS published guidance and ignored the limitations set forth in Rev. Proc. 2011-47 Section 3.03(2) which states in part, “An allowance that is computed on a basis similar to that used in computing an employee's wages or other compensation does not meet the business connection requirement unless, as of December 12, 1989, (a) the allowance was identified by the payor either by making a separate payment or by specifically identifying the amount of the allowance, or (b) an allowance computed on that basis was commonly used in the industry in which the employee performed services.” Furthermore, neither cable contractors, nurses, construction workers or house cleaners enjoy industry-specific rules prescribed by the IRS Commissioner like those covering the transportation industry introduced in Rev. Proc. 2000-9 Section 4.04 that established the Special Transportation Industry per diem[i].

1. A truck driver employee travels away from home on business for 24 days during a calendar month. A payor pays him the $66 special trucking daily allowance for meal and incidental expenses only. The amount deemed substantiated is the total per diem allowance paid for the month or $1,584 (24 days away from home at $66 per day). The employer treats $1,584 as a pre-tax deduction; calculated withholdings; adds per diem to payroll as a non-taxable reimbursement.

2. A truck driver is paid 45 cents-per-mile. The employer classifies 10 cents-per-mile to a per diem allowance based on the number of miles driven. He travels away from home for 24 days but only drives for 20. Driver’s employer pays an allowance of $1,000 for the month based on 2500 miles per week. The amount deemed substantiated is the full $1,000 because that amount does not exceed $1,584 (24 days away from home at $66 per day). The employer calculates taxable wages at 35 cents-per-mile and per diem at 10 cents-per-mile as a non-taxable reimbursement.

Although, a driver may travel 600 miles one day but only 100 miles the next, the distance traveled does not affect the need to eat 3 meals a day. As a result, substantiated per diem accurately reflects the definition of per diem in Rev. Proc. 2011-47 section 3.01: "Paid for ordinary and necessary business expenses the payor reasonably anticipates will be incurred, by an employee for meal and incidental expenses, for travel away from home performing services as an employee of the employer." Thus, the IRS introduced the Special Transportation Industry substantiated per diem to enhance and simplify tax compliance for fleets by relying on nights away from home instead of miles traveled.

The most beneficial aspect to a driver is that:

The Internal Revenue Code gives the IRS Commissioner discretionary authority to issue regulations, such as revenue rulings and procedures, to ease the burden on taxpayers, who would otherwise have to meet the extensive substantiation requirements in order to claim deductions for business related travel. The Commissioner updates these Revenue Procedures annually, but the relevant per diem provisions have remained substantially the same since 2011.

Thirty years of IRS guidance and legislative history specifically reference an employer paying a driver in the transportation industry under the substantiated method and, therefore, contemplate that some portion of a driver’s wages will be treated as per diem. While, both the substantiated and cent-per-mile per diem methods are IRS-compliant, neither method has been considered a wage reclassification for over 30 years. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

[i] The 2019 per diem rate for travel in the USA is $66 and $49.50 for a partial day.

ii] The IRS raised the deductible percentage of employee travel related expenses to 80% in 2008

iii] Federal Register-1989-12-12 Vol 54 Page 51038 pursuant to “Family Support Act of 1988”

[iv] Rev. Ruling 2006-56, 2006-2 CB 274

[i] Updated annually IRS Notice 2019-55, 2018-77, 2017-54, 2016-58, 2015-63, 2014-57, 2013-65, 2012-63, Rev. Proc. 2011-47, 2010-39, 2009-47, 2008-59, 2007-63, 2006-41, 2005-67, 2004-60, 2003-80, 2002-63 and 2001-47.

"Partnering with Per Diem Plus provided us a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers who love our new per diem app."

Nick A., Controller

Per diem saves fleet thousands. With over 400 power units the motor carrier is a leader among specialized companies serving the United States and Canada.

The Controller was looking for a solution to two significant challenges impeding growth. The first involved reducing driver turnover and the second was raising driver pay in a tight labor market to improve driver recruiting.

The only IRS-compliant mobile application platform that automated administration of an accountable trucker per diem plan.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Questions? Contact Mark W. Sullivan Program Manager - Per Diem Plus FLEETS

About: Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®