PDP For Fleets - 3 Months Free

Patriot Transport selects Per Diem Plus Fleets. The Arkansas-based specialty bulk hauler implemented the Fleets mobile app for Android and iOS to enhance recruiting and retention and raise driver pay for its OTR fleet.

“The Per Diem Plus Fleets implementation was seamless and smooth. Their automated per diem tax compliance solution enabled Patriot staff to avoid the increased administrative burdens commonly associated with traditional trucker per diem programs ”

April Stobbs, HR Manager

Patriot Transport and 3D Corporate Solutions were founded in 2002 as a marketer and logistics provider sourcing specialty, value-added pet food ingredients. Today, they are the leading manufacturer of protein ingredients used to make premium pet food. 3D has earned a reputation as the go-to source for high quality and differentiated ingredients separate themselves from competitors through a portfolio of specialty proteins, specialty flavors, and premium and specialty fats. They operate six manufacturing facilities across the Midwest and Southeast, each with world-class manufacturing capabilities.

The driver per diem program was introduced in 2021. In order to distinguish itself in the industry Patriot adopted a per diem program that does not reclassify a portion of wages as per diem, which has been standard industry practice for over 30 years.

According to April Stobbs, HR Manager at Patriot Transport, “Drivers rave about the $12,750 or so of tax-free per diem they receive annually that has resulted in 100% participation of qualifying drivers. This especially true of veteran drivers who previously received per diem at other motor carriers that utilized the traditional trucker per diem methods. Meanwhile the feedback from drivers about the Per Diem Plus Support team can be summed up as simply amazing.”

“Per Diem Plus has multiple per diem solutions regardless of what ELD you use to track Hours of Service, like their mobile app and API, while others offer a single solution with one partner. This was a significant factor in our choosing Per Diem Plus as it allows Patriot flexibility to switch ELD solution providers without affecting our per diem program should the need arise. They have a great team and allow you to have a trusted partner to handle all your per diems needs” said Stobbs.

Apply at patriottransport.com or Contact April Stobbs at (417) 354-0509 or astobbs@3dsolutions.com

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

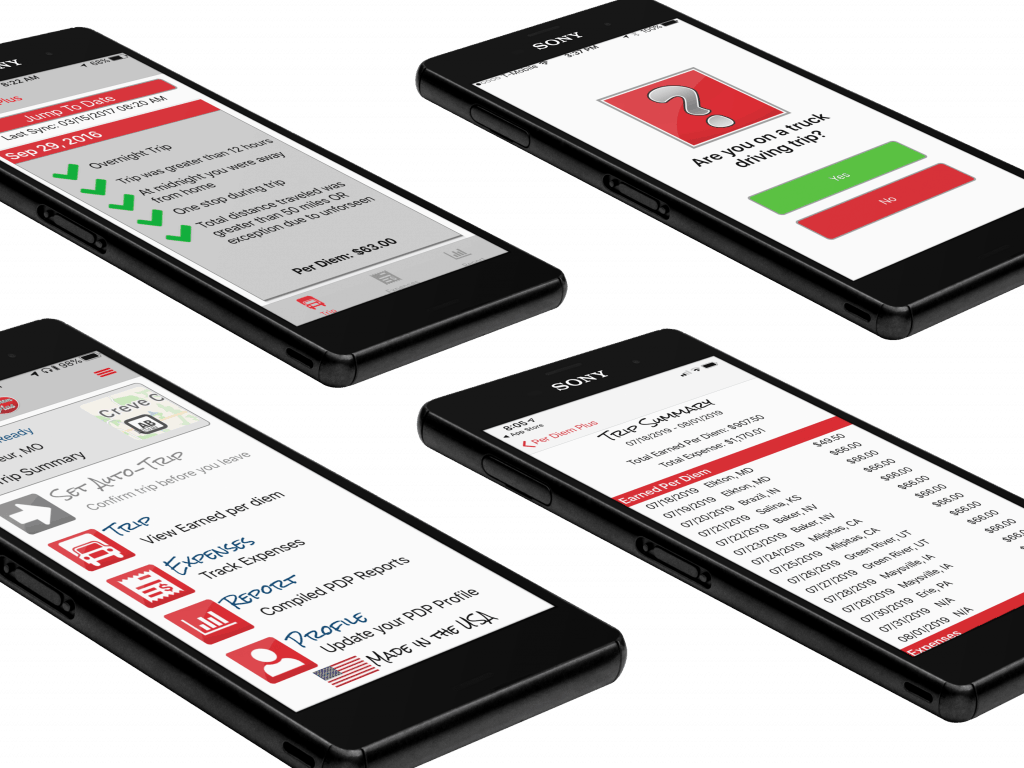

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact us at info@perdiemplus.com

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of transportation industry tax compliance. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA. It is the only IRS-compliant mobile-enabled application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Mido's Trucking selects Per Diem Plus for Samsara. The St. Louis-based truckload carrier is using Per Diem Plus to further streamline operational efficiency and per diem accounting of its 100-vehicle fleet.

“America is truly the land of opportunity. I am living proof that if you dream big, work hard and persevere anything is possible.”

- Mido Selimovic, President

Mido Selimovic came to the US in 1999 as an 18-year-old refugee from Vlasenica, Bosnia-Herzegovina where his family struggled to stay alive in a country destroyed by the Bosnian War. At age 25 Mido entered the transportation industry by purchasing his first truck. In 2008, he opened Mido's Trucking with his sole purpose being to provide a workplace for fellow war refugees who were looking for a reliable carrier they could work for and call their home. Since starting Mido’s 15 years ago the company has grown to 100 trucks serving 48 states with the help of his wife Azra, a fellow refugee who fled Kozarska-Dubic at the outset of the war when she was 12.

As with many small businesses in America, Mido’s is a family affair with many relatives working for the company as drivers, dispatchers and mechanics. Mido’s mission as refugee haven remains unchanged to this day; they employ drivers from Africa, Asia, Bulgaria, Eastern Europe and Thailand looking for an opportunity to make a fresh start in the USA.

The Per Diem Plus API for Samsara allows for rapid deployment with minimal investment in dollars and/or IT resources. Configure your fleet in three simple steps.

Are you attending TCA Truckload 2022 in Las Vegas (March 20-22) and want to learn more about the PDP Fleets integration with Samsara? Schedule a meeting with Mark Sullivan, API Manager HERE

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Arka Express selects Per Diem Plus for Samsara to raise driver pay and enhance operational efficiency for its 400-vehicle "first in excellence" fleet.

“The API was quick and easy to set up and run, which was a significant factor in our choosing Per Diem Plus for Samsara.”

Art Astrauskas, President

Arka Express has evolved from a small 35-unit carrier located out of Markham, IL, to an elite, state-of-the-art fleet of 400 units built by the top transportation professionals in the industry in only 10 years.

In addition to our Markham terminal, they are currently establishing headquarters in Indiana, Atlanta, Georgia and Marlboro Township, New Jersey as they continue to deliver services throughout the Midwest, east coast and Southeast. Drivers typically operate in a 400-mile regional radius in both Chicago and Atlanta. In addition, they have developed an OTR presence from the Dakotas to Florida to New York—and everything in between.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Intercity Lines case study highlights how the specialized automotive transporter improved safety and operational efficiency of its 30-vehicle fleet using Samsara ELD and Per Diem Plus.

"The Per Diem Plus integration was a significant factor in our choosing Samsara over competing ELD solution providers."

Dean Wilson, Vice President

Dave and Linda opened Intercity Lines, Inc. more than 40 years ago, setting out to provide excellence in enclosed automotive transportation. As a driver himself, Dave took great pride in the trust customers gave him when transporting what could be their most prized possession—their classic, historic, or exotic vehicles. Together, Dave and Linda brought attention to detail, dedication, and innovation to the enclosed automotive transportation industry.

Improve safety and operational efficiency for the specialized automotive transporter and its 30-vehicle fleet using Samsara’s complete fleet platform. Intercity deployed VG-series gateways, CM-series dash cams, Galaxy tablets, fuel, maintenance and per diem program. According to Dean Wilson, VP of Intercity Lines, “Per Diem Plus integrating directly into Samsara TMS was a significant factor in our choosing Samsara over competing ELD solution providers. The API was quick and easy to set up and run; it was a no-brainer. ”

“Per Diem Plus has a per diem solution regardless of what you use to track Hours of Service, while others offer limited solutions with limited partners,” said Wilson. Jay Leno's favorite auto transport company is transitioning to the API from the PDP Fleets mobile app. Wilson cited the modern and intuitive web services dashboard, flexible report formats and ability to track per diem in the event the ELD goes down that distinguish Per Diem Plus. “Since introducing our driver per diem program in 2020 Intercity has achieved 85% driver participation, cut driver turnover to 10%, and saved over $3,000 per driver annually that was used to raise driver pay by several cents per mile. PDP’s customer service is top-notch, allowing you to have a trusted partner to handle all your per diems needs. And we prefer the features and benefits of PDP offers,” he said.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Related articles

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Questions? Contact Mark W. Sullivan API Manager - Per Diem Plus Fleets Platform

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The 2022 special trucker per diem rates for taxpayers in the transportation industry have increased $3/day from 2020-2021 and are $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

View Notice 2021-52

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

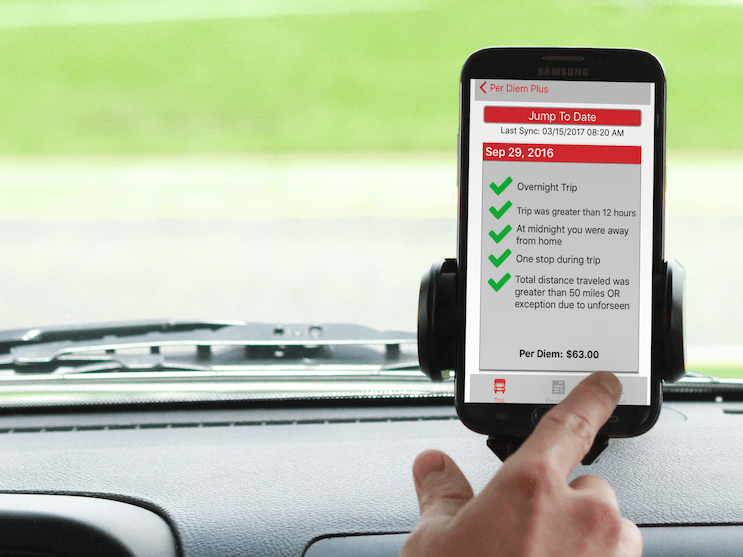

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

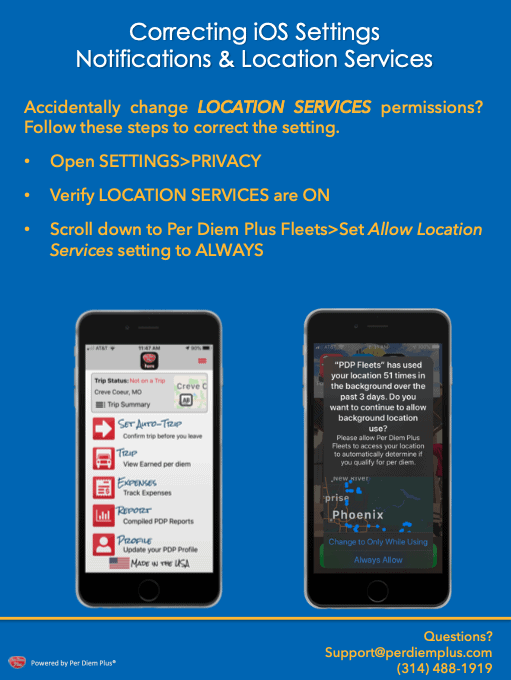

Per Diem Plus Fleets releases Build 56 to resolve location services permission restrictions imposed with OS 14.

What's new? The app will post a notification alerting an iOS user that location services permissions were changed by iOS and instructing the user to reset permissions to "Always Allow".

Why was this needed? Per Diem Plus was designed to run passively in the background to determine IRS-required "time, date and location" for per diem. However, because of abuses by Big Tech, like Facebook, Apple no longer allows apps to lock Location Services with "Always Allow" during initial login and setup. As a result, iOS automatically changes the setting to "Only while using app", which prevents PDP from functioning as designed.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

Use Per Diem To Raise Trucker Pay To Recruit Drivers. A company-sponsored substantiated per diem plan can raise trucker pay to attract new drivers.

Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

"I still think to get new people into the industry, given the 150K-200K driver deficit and robust demand in 2021, pay is going to have to go up a lot more than 20%."

U.S Express CEO Eric Fuller told Yahoo Finance (9/30/20)

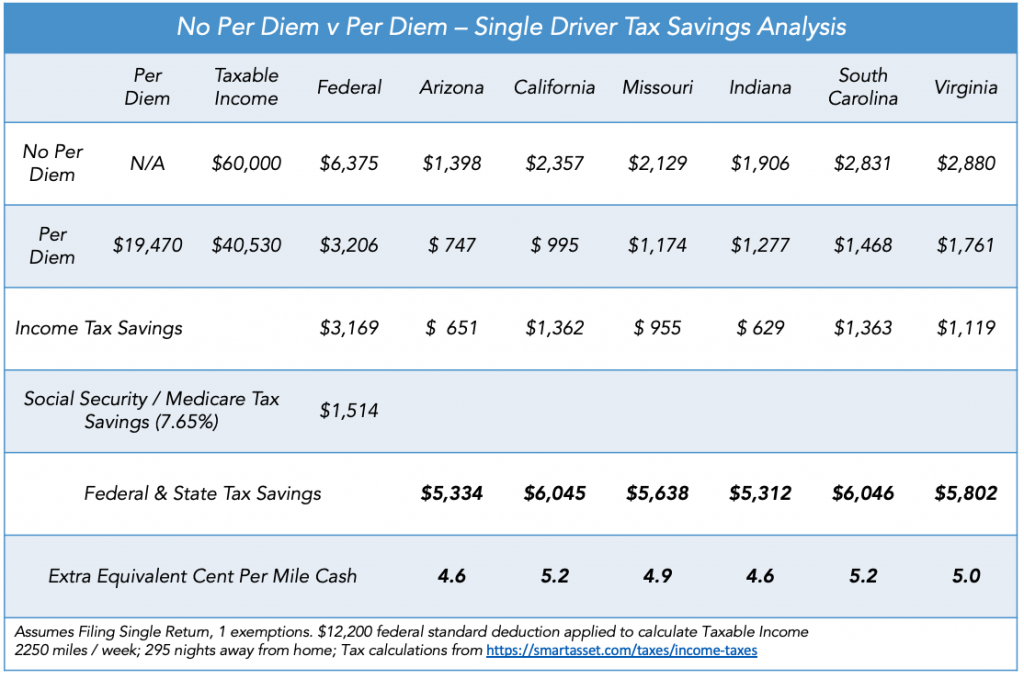

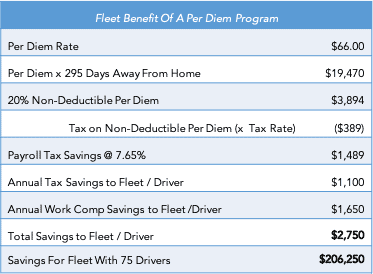

Adding a substantiated per diem program for employee drivers is a sure-fire way raise driver take-home pay by 10% or more while saving the motor carrier money. Consider the following:

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets

TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

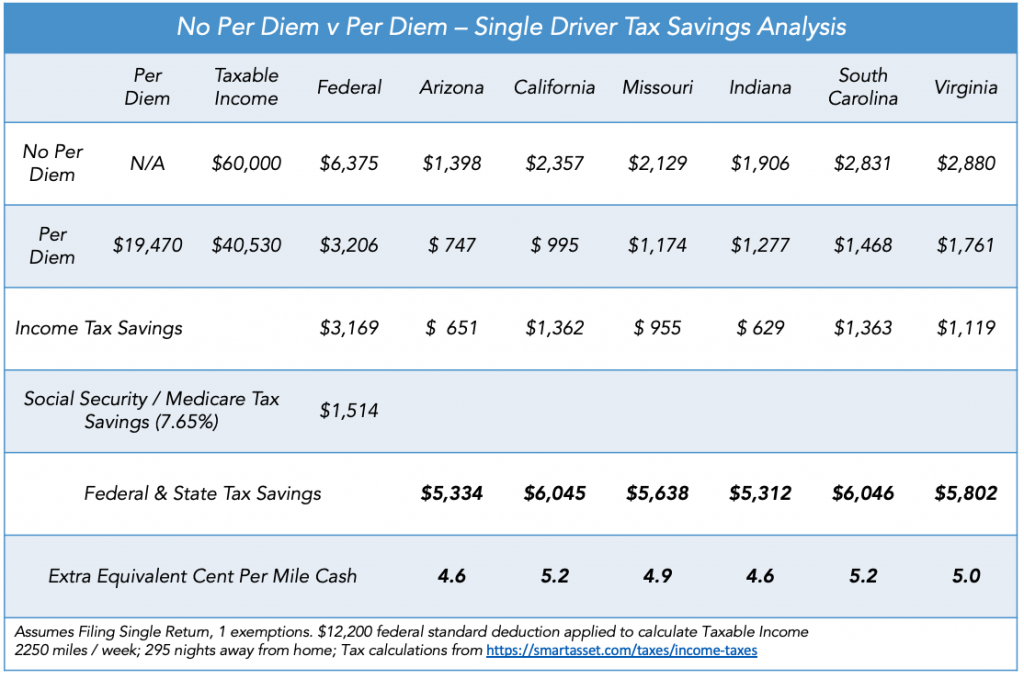

A single driver from South Carolina could save $6,046 in taxes equal to an extra 5.2 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

A fleet with 75 drivers and could raise driver pay by 10% or more and still save $206,250. Do not believe the savings are achievable? Read our Case Study. The motor carrier saved $3,000 per driver within the first year of implementing Per Diem Plus Fleets. In addition, they received a $125,000 workers compensation premium refund.

Our cloud-based FLEETS mobile app platform enables fleets to easily implement an IRS-compliant fleet per diem plan that will raise driver take-home pay by 10% or more while also saving the motor carrier money.

Related Articles:

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

2021 TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

Implementing a fleet per diem solution is something that should be on many fleet managers’ to-do list. They know the benefits to drivers, they know the incredible ROI, and yet it still manages to slip down the list of immediate priorities. One of the main perceived barriers to implementing Per Diem Plus Fleets is the rollout process.

With such a dramatic overhaul of your fleet, surely there will be some bumps along the way — translating to tech overload and a hit to back-office productivity, right? Perhaps you’re worried that there are things you’ve missed, and you’ll suffer teething issue after teething issue before you see the benefits you were promised.

The good news is that this needn’t be the case, no matter the size of your fleet.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Configure your fleet per diem plan in minutes with our simple check-the-box menu.

For example, the platform allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 25 miles and best matches fleet lanes and app installation type. Or to minimize cellular data plan usage for mobile app users you can whitelist the app using our static IP address.

Per Diem Plus was purpose-built to simplify substantiated per diem tax compliance. Have you thought about how you can use the data gathered? There are a few important things to note.

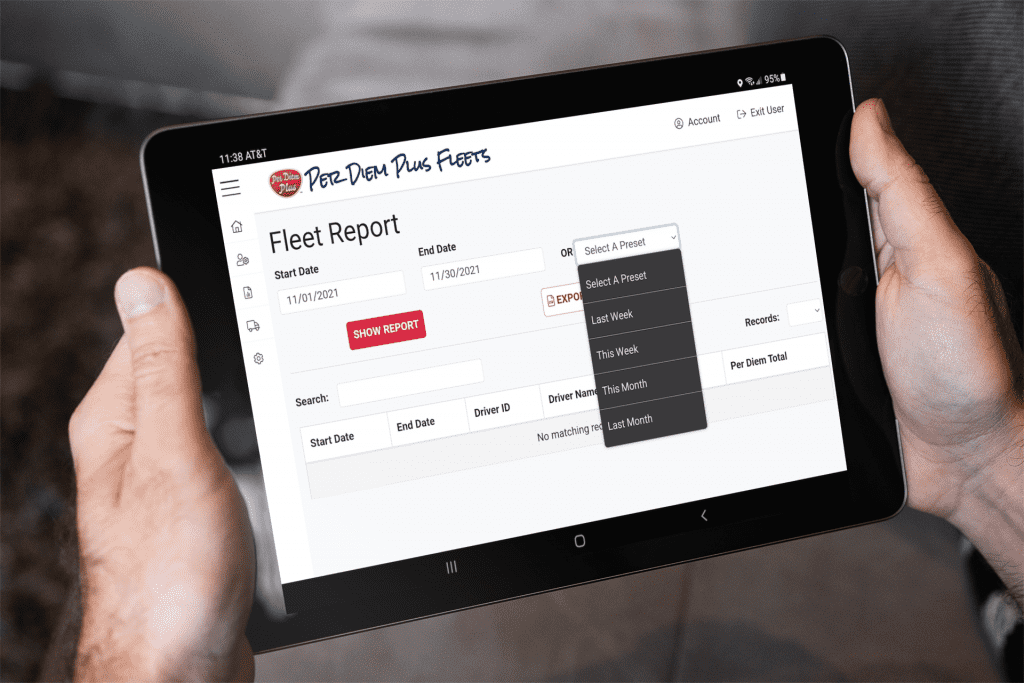

Use your Fleet Reports quickly audit your per diem program or to support the Workers Compensation per diem exemption in addition to or instead of your paper documents.

To run a Fleet Report in the FLEETS Web App:

Generate reports with Per Diem Plus:

When you use Per Diem Plus Fleets Web App for Premium users, you have access to your fleetwide reporting that you can use to analyze your per diem program. The report tracks per diem totals for each driver for a given period. If you are interested in a map of a trip route to see exactly where a driver traveled, you can access that from a KML export within a Driver Report.

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

Copyright 2022 Per Diem Plus, LLC.

The 2021 special trucker per diem rates for taxpayers in the transportation industry remain unchanged from 2019-2020 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

View Notice 2020-71 that includes the 2021 special trucker per diem rates.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Are you unsure what per diem is or which drivers can claim travel-related expenses? Our tax experts answer the most common question in a prior post, Trucker Per Diem Simply Explained

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Related Articles

A company-sponsored substantiated per diem plan will save a fleet money and raise driver take-home pay by several cents per mile.

Truckers designed it, tax pros built it, your drivers want it. Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

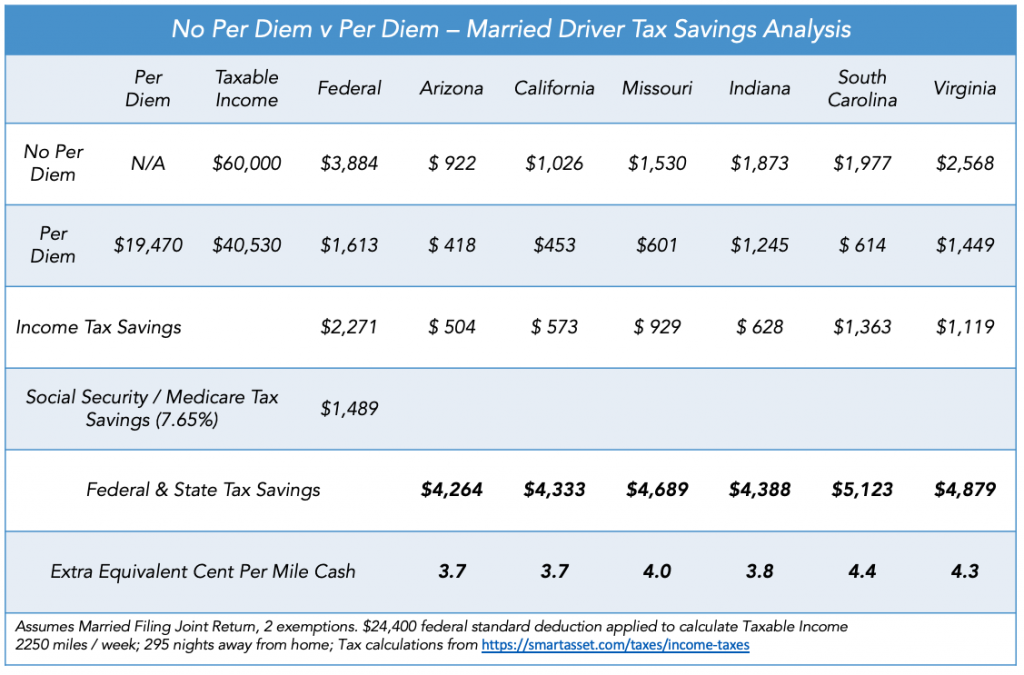

Adding a substantiated per diem program for employee drivers is a sure-fire way for a motor carrier to save money and raise driver take-home pay. Consider the following:

For example, a married driver from South Carolin could save $5,123 in taxes equal to an extra 4.4 cents per mile.

A single driver from Missouri could save $5,638 in taxes equal to an extra 4.6 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®