PDP For Fleets - 3 Months Free

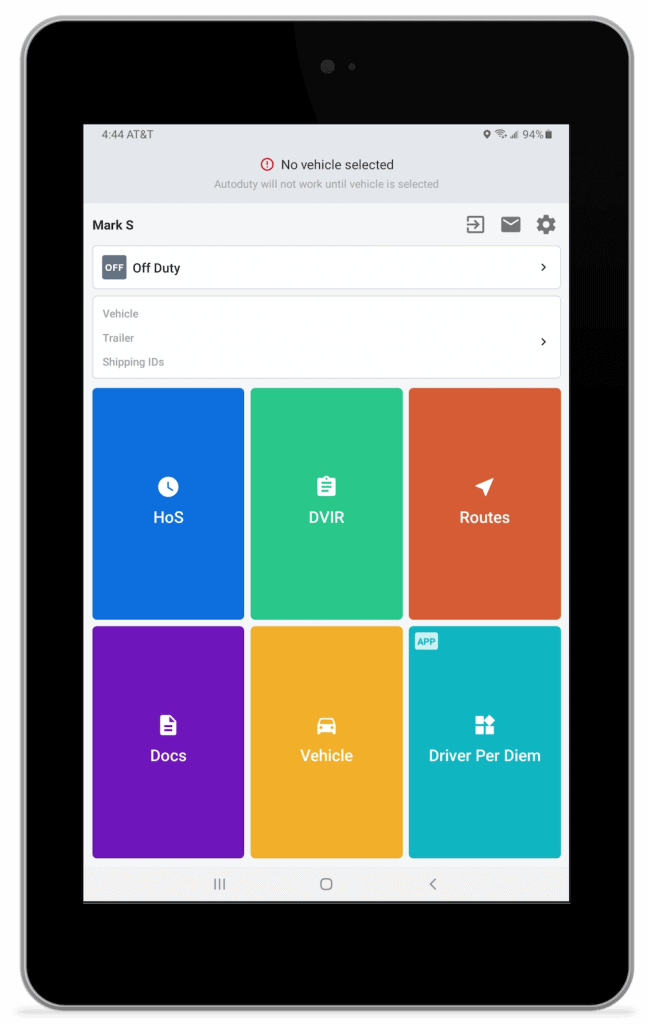

Per Diem Plus® FLEETS, a mobile application platform that automates per diem tax compliance for motor carriers, today announced a new integration with Samsara. The deep link is a configurable integration that enables drivers to navigate between the Samsara ELD dashboard and Per Diem Plus FLEETS app creating an enhanced user experience.

Related Articles

Per Diem Plus Announces New API Integration With Samsara

With over $40 million of per diem claimed and 5 years of reports accepted by the IRS, adding an accountable, substantiated per diem program is a sure-fire way for a motor carrier to increase driver take home pay and save money.

Consider the following:

Our cloud-based platform enables motor carriers to implement an IRS-compliant fleet per diem plan that is:

Case Study: One fleet with 85 company drivers was able to save $255,000 in the first year and increase driver pay by $0.04 per mile by leveraging FLEETS.

[1] The Special Trucker Per Diem rate is established by the Internal Revenue Service in an annual notice. See IRS Notice 20-70

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves more than 20,000 customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing and food and beverage. Learn more about Samsara's mission to increase the efficiency, safety, and sustainability of the operations that power the global economy at www.samsara.com

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to implement an IRS-compliant fleet per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers travelling in the United States and Canada. For more information, visit www.perdiemplus.com

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

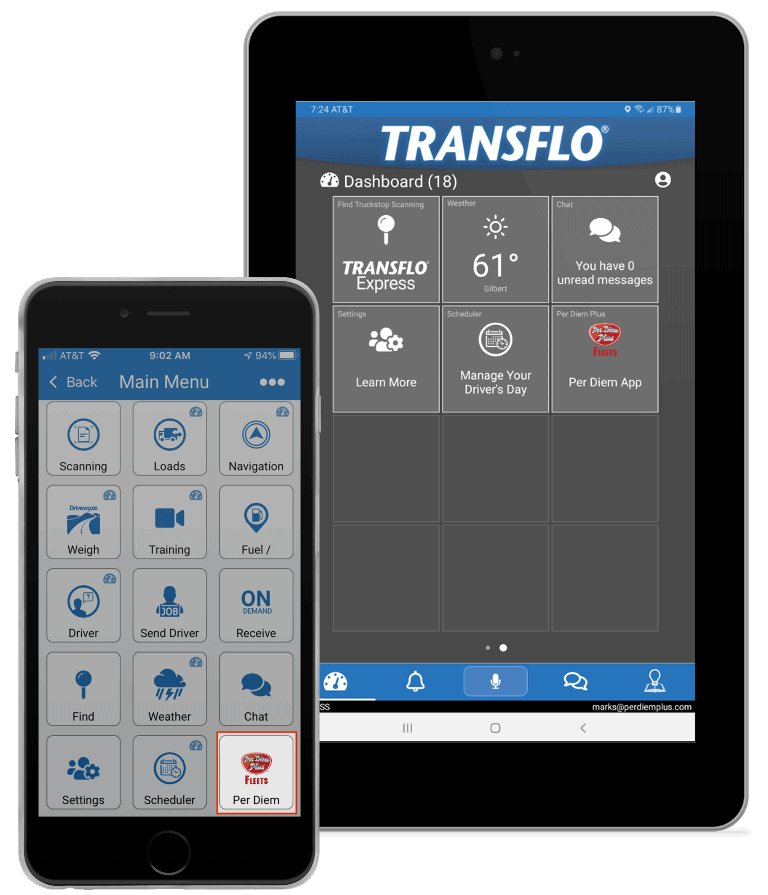

Per Diem Plus® FLEETS, a mobile application platform that automates per diem tax compliance for motor carriers, today announced a new integration with Transflo. The deep link is a configurable integration that enables drivers to navigate between the Transflo Mobile dashboard and Per Diem Plus FLEETS app creating an enhanced user experience.

With over $40 million of per diem claimed and 5 years of reports accepted by the IRS, adding an accountable, substantiated per diem program is a sure-fire way for a motor carrier to increase driver take home pay and save money. Consider the following:

Our cloud-based platform enables motor carriers to implement an IRS-compliant fleet per diem plan that is:

Case Study: One fleet with 85 company drivers was able to save $255,000 in the first year and increase driver pay by $0.04 per mile by leveraging FLEETS.

[1] The Special Trucker Per Diem rate is established by the Internal Revenue Service in an annual notice. See IRS Notice 20-70

Transflo®, a Pegasus TransTech company, is a leading mobile, telematics, and business process automation provider to the transportation industry in the United States and Canada. Transflo’s mobile and cloud-based technologies deliver real-time communications to fleets, brokers, shippers, and commercial vehicle drivers, and digitize 800 million shipping documents a year, representing approximately $84 billion in freight bills. Organizations throughout the Transflo client and partner network use the solution suite and digital platforms to increase efficiency, improve cash flow, and reduce costs. Headquartered in Tampa, Florida, USA, Transflo is setting the pace for innovation in transportation software. For more information, visit www.transflo.com.

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to implement an IRS-compliant fleet per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for travel in the United States and Canada for drivers, motor carriers and owner operators. For more information, visit www.perdiemplus.com

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

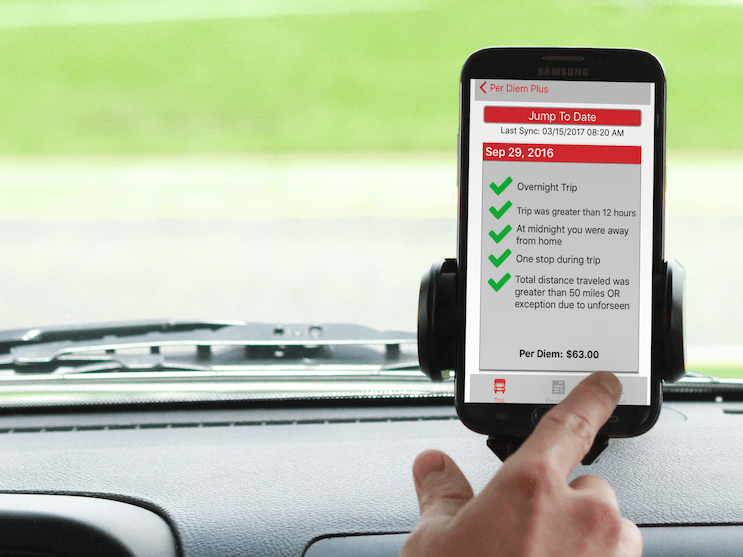

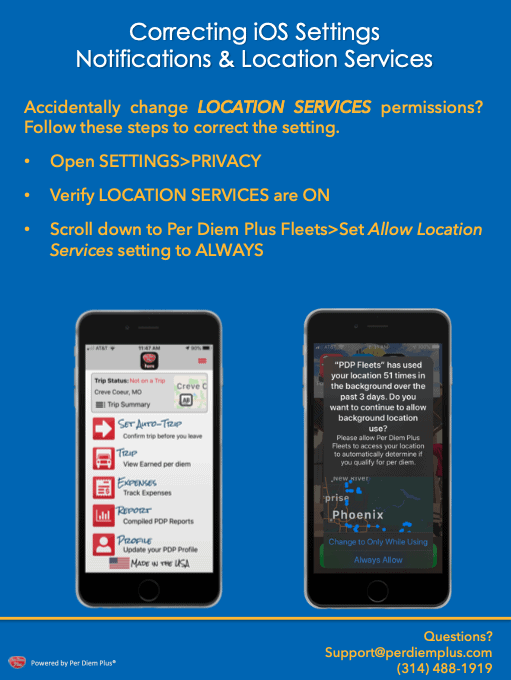

Per Diem Plus Fleets releases Build 56 to resolve location services permission restrictions imposed with OS 14.

What's new? The app will post a notification alerting an iOS user that location services permissions were changed by iOS and instructing the user to reset permissions to "Always Allow".

Why was this needed? Per Diem Plus was designed to run passively in the background to determine IRS-required "time, date and location" for per diem. However, because of abuses by Big Tech, like Facebook, Apple no longer allows apps to lock Location Services with "Always Allow" during initial login and setup. As a result, iOS automatically changes the setting to "Only while using app", which prevents PDP from functioning as designed.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

Use Per Diem To Raise Trucker Pay To Recruit Drivers. A company-sponsored substantiated per diem plan can raise trucker pay to attract new drivers.

Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

"I still think to get new people into the industry, given the 150K-200K driver deficit and robust demand in 2021, pay is going to have to go up a lot more than 20%."

U.S Express CEO Eric Fuller told Yahoo Finance (9/30/20)

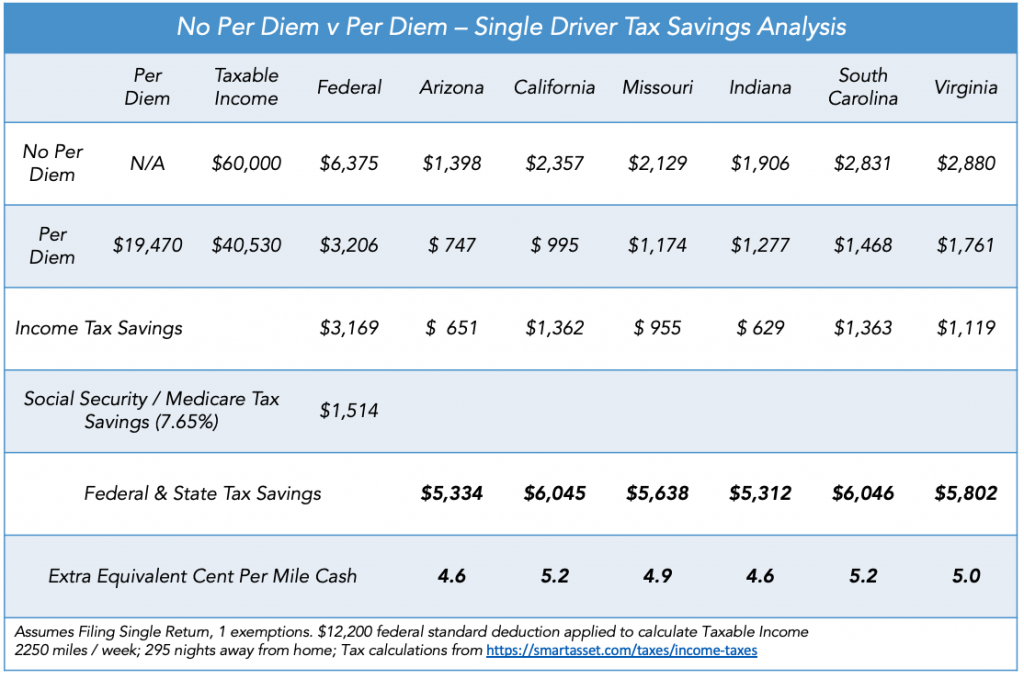

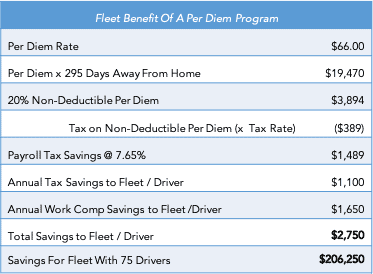

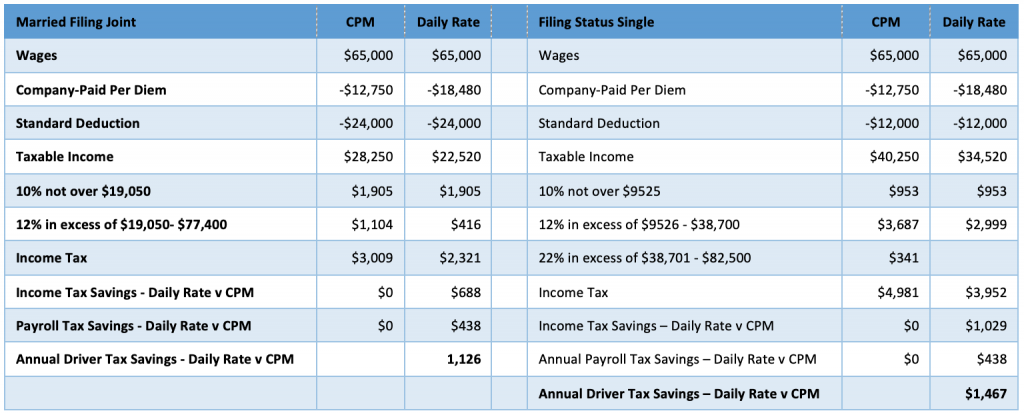

Adding a substantiated per diem program for employee drivers is a sure-fire way raise driver take-home pay by 10% or more while saving the motor carrier money. Consider the following:

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets

TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

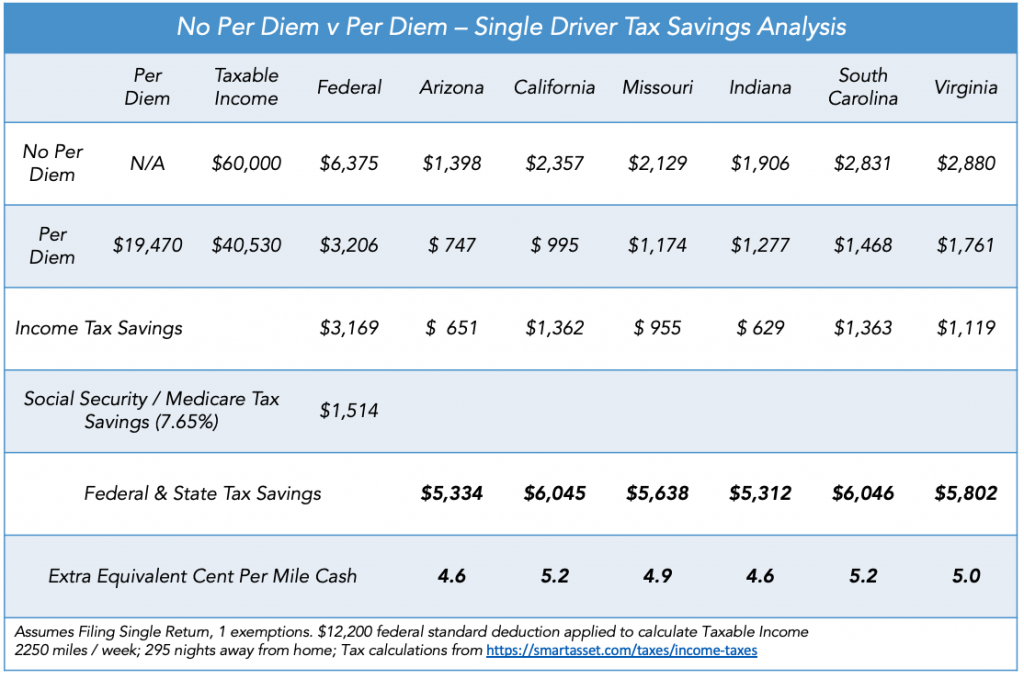

A single driver from South Carolina could save $6,046 in taxes equal to an extra 5.2 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

A fleet with 75 drivers and could raise driver pay by 10% or more and still save $206,250. Do not believe the savings are achievable? Read our Case Study. The motor carrier saved $3,000 per driver within the first year of implementing Per Diem Plus Fleets. In addition, they received a $125,000 workers compensation premium refund.

Our cloud-based FLEETS mobile app platform enables fleets to easily implement an IRS-compliant fleet per diem plan that will raise driver take-home pay by 10% or more while also saving the motor carrier money.

Related Articles:

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

2021 TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

Implementing a fleet per diem solution is something that should be on many fleet managers’ to-do list. They know the benefits to drivers, they know the incredible ROI, and yet it still manages to slip down the list of immediate priorities. One of the main perceived barriers to implementing Per Diem Plus Fleets is the rollout process.

With such a dramatic overhaul of your fleet, surely there will be some bumps along the way — translating to tech overload and a hit to back-office productivity, right? Perhaps you’re worried that there are things you’ve missed, and you’ll suffer teething issue after teething issue before you see the benefits you were promised.

The good news is that this needn’t be the case, no matter the size of your fleet.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Configure your fleet per diem plan in minutes with our simple check-the-box menu.

For example, the platform allows you to select individual, team drivers or both. The geofence tax home radius can be set from 5 - 25 miles and best matches fleet lanes and app installation type. Or to minimize cellular data plan usage for mobile app users you can whitelist the app using our static IP address.

Per Diem Plus was purpose-built to simplify substantiated per diem tax compliance. Have you thought about how you can use the data gathered? There are a few important things to note.

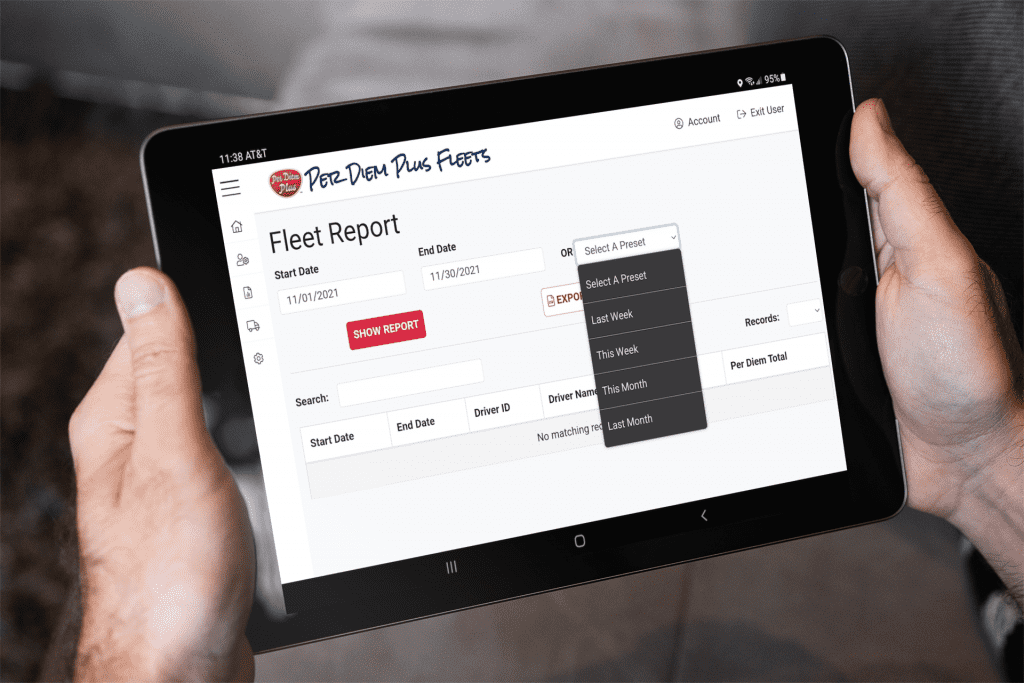

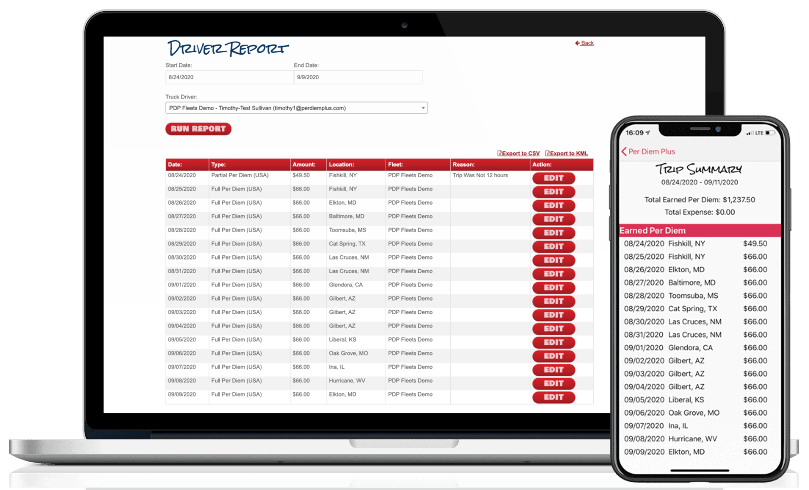

Use your Fleet Reports quickly audit your per diem program or to support the Workers Compensation per diem exemption in addition to or instead of your paper documents.

To run a Fleet Report in the FLEETS Web App:

Generate reports with Per Diem Plus:

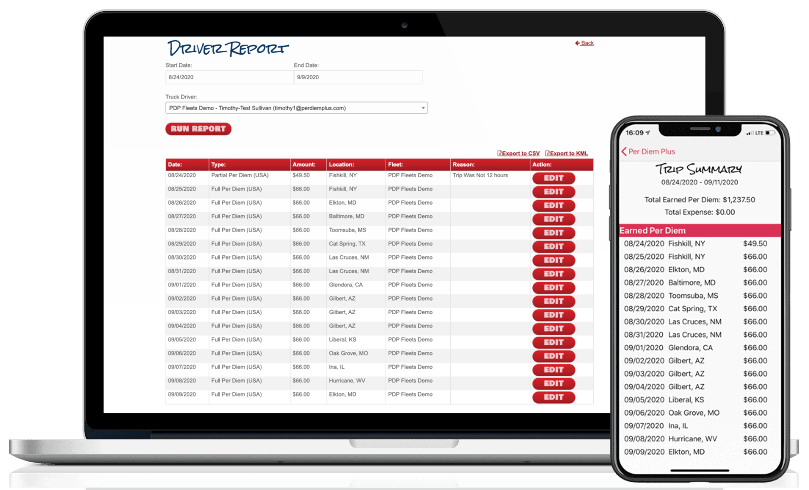

When you use Per Diem Plus Fleets Web App for Premium users, you have access to your fleetwide reporting that you can use to analyze your per diem program. The report tracks per diem totals for each driver for a given period. If you are interested in a map of a trip route to see exactly where a driver traveled, you can access that from a KML export within a Driver Report.

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Related Articles:

Use Per Diem to Raise Trucker Pay to Attract New Drivers

Raise Driver Take-Home Pay with Per Diem

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

Copyright 2022 Per Diem Plus, LLC.

Related Articles

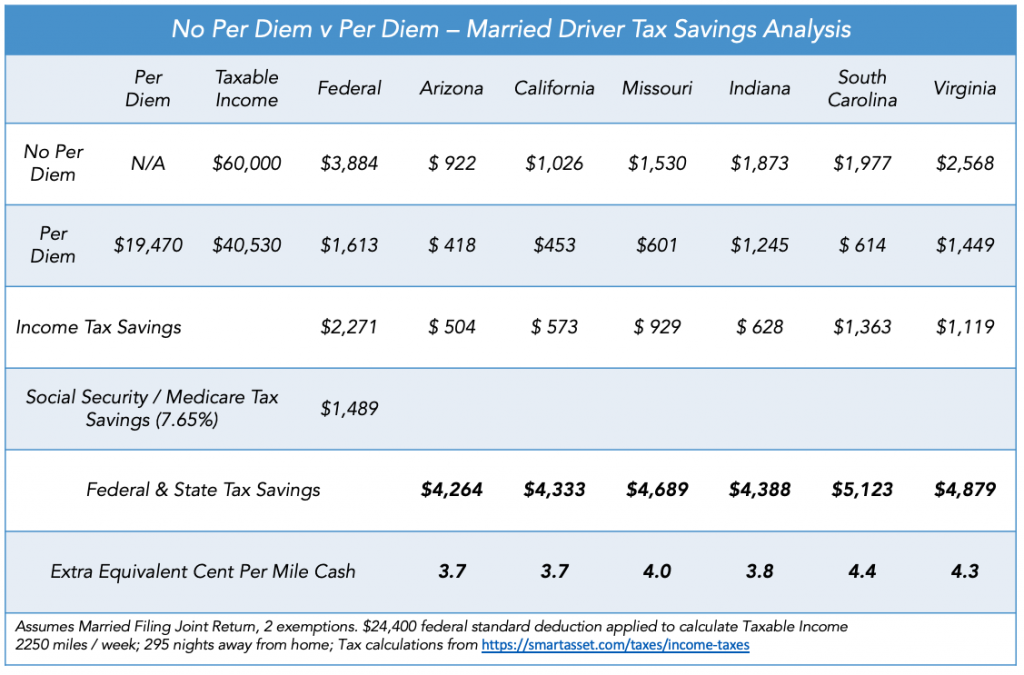

A company-sponsored substantiated per diem plan will save a fleet money and raise driver take-home pay by several cents per mile.

Truckers designed it, tax pros built it, your drivers want it. Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

Adding a substantiated per diem program for employee drivers is a sure-fire way for a motor carrier to save money and raise driver take-home pay. Consider the following:

For example, a married driver from South Carolin could save $5,123 in taxes equal to an extra 4.4 cents per mile.

A single driver from Missouri could save $5,638 in taxes equal to an extra 4.6 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

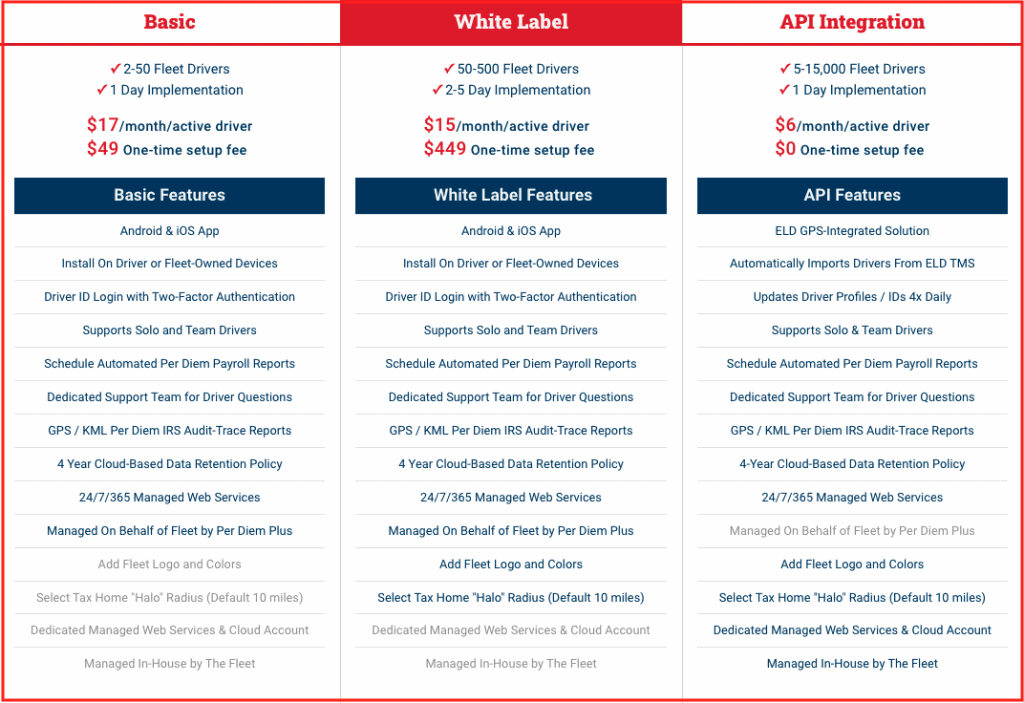

Per Diem Plus® FLEETS introduces new service plan options: BASIC, WHITE LABEL and API.

Our cloud-based Per Diem Plus Fleets platform enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

2021 TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

"We were able to buy three new trucks for our fleet with the savings we achieved by implementing a per diem program for our company drivers using the Per Diem Plus FLEETS platform." said Nick Adamczyk, Controller at Reliable Carriers.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

A trucking company is required to prove 1) drivers were away from home overnight 2) identify the “date, place and amount” of each per diem event, and 3) retain substantiation through the retention of ELD backups or Per Diem Plus FLEETS platform for no less than 3 years.

The burdensome IRS compliance requirements are one reason trucking companies eschew company-paid per diem programs. Although, ELD’s automate driver hours of service compliance, the process of creating an IRS-compliant per diem record is immensely time consuming. Fleets that implement the Per Diem Plus FLEETS platform can obtain IRS-compliant fleet per diem payroll reports for a week, month or even a year in under a minute. Furthermore, per diem records are retained on the secure cloud and instantly accessible to a fleet for four (4) years.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Do you have questions about Per Diem Plus FLEETS? Contact Us

Copyright 2020, 2021, 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

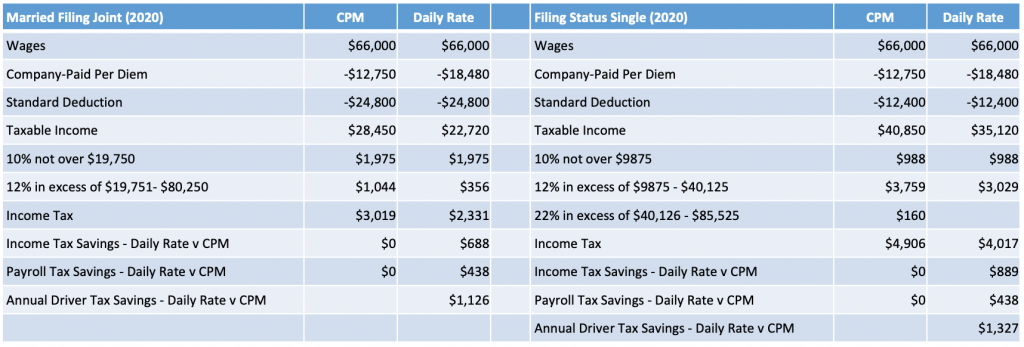

Substantiated per diem provides the largest benefit to both a driver and fleet over the old cent-per-mile method. Decades before the advent of TMS software, telematics and ELD's fleets adopted cent-per-mile per diem. Why? Because it was easy to calculate and substantiate using trip sheets[i]. However, there is no correlation between the miles a driver travels and frequency of meal breaks.

Under the cent-per-mile method a driver is paid only for miles driven and not nights away from home. Although, a driver may travel 500 miles one day they may only clock 200 miles the next. In the end, the distance traveled does not affect the need to eat 3 meals a day.

The IRS introduced the Special Transportation Industry substantiated per diem to simplify tax compliance for fleets by relying on days away from home instead of miles traveled. This method accurately reflects the number of meals a driver eats and resolved the problem that driver’s regularly travel away from home and stop during a single trip at localities with differing federal M&IE rates.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

[i] 1-274-5T(c) Rules of substantiation, Rev. Proc. 2011-47 § 4.02(5)

Both the substantiated and cent-per-mile per diem methods are IRS-compliant. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service.

Questions? Contact Mark W. Sullivan, EA.

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Which per diem method saves a fleet more money? Substantiated per diem saves a motor carrier the most money, since the fleet benefits are directly proportional to total per diem paid to drivers. So how did cent-per-mile per diem become so popular in the trucking industry? Decades before the advent of telematics fleets adopted cent-per-mile per diem for because it was easy to calculate. However, there is no correlation between the miles a driver travels and meal breaks.

Drivers prefer substantiated special trucker per diem. Why? They eat 3 meals a day regardless of whether they drive 200 or 600 miles. The IRS introduced the Special Transportation Industry substantiated per diem to remedy this issue. In addition it simplified tax compliance for fleets by relying on nights away from home instead of miles traveled. It is also a more accurate reflection of anticipated meal expenses for drivers.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Adding an accountable per diem program for employee drivers is a sure-fire way to enhance driver recruiting and retention. Consider the following:

Both substantiated and cent-per-mile per diem must comply with the IRS substantiation by adequate records rules. According to the IRS, "a motor carrier must maintain lrecords to establish "time, place and location" for each per diem event". The Per Diem Plus FLEETS platform satisfies this requirement since it is maintained in such manner that each recording of an element of an expenditure is made at or near the time of the expenditure.

Document retention rules:

The transportation industry has been unique in its treatment of driver per diem for over 30 years. The substantiated per diem method saves a motor carrier more money than cent-per-mile method. While, substantiated and cent-per-mile per diem methods are IRS-compliant, both require a motor carrier to comply with the adequate records and document retention rules.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups to substantiate away-from-home travel.

This article was written by Mark W. Sullivan EA, Tax Counsel for Per Diem Plus, who has over a decade of experience advising trucking companies on per diem issues. Prior to starting a private practice in 1998, Mr. Sullivan was an Internal Revenue Officer with the New York, NY, Saint Louis, MO and Washington, D.C. offices of the Internal Revenue Service. Questions? Contact Mark W. Sullivan, EA.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

"Partnering with Per Diem Plus provided us a turn-key solution configured to meet the needs of our fleet and offer this benefit to our drivers who love our new per diem app."

Nick A., Controller

Per diem saves fleet thousands. With over 400 power units the motor carrier is a leader among specialized companies serving the United States and Canada.

The Controller was looking for a solution to two significant challenges impeding growth. The first involved reducing driver turnover and the second was raising driver pay in a tight labor market to improve driver recruiting.

The only IRS-compliant mobile application platform that automated administration of an accountable trucker per diem plan.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus

Implementing Per Diem Plus FLEETS is a breeze and does not require specially trained professional installers like telematics solutions. No matter how big or small your company is, Per Diem Plus has a solution for you.

Questions? Contact Mark W. Sullivan Program Manager - Per Diem Plus FLEETS

About: Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Copyright 2019-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®